The Global Debt Clock: Real-Time World Debt Statistics

Track real-time global debt with our interactive Global Debt Clock

What Is a National Debt Clock?

A national debt clock is a dynamic visual tool that tracks a country’s government debt in real time, presenting the figure in a format that’s both accessible and alarming. These clocks, whether displayed on digital billboards in urban centres or hosted on websites, update continuously to reflect new borrowing, interest accrual, and debt repayments. By showcasing the scale and pace of debt accumulation, they serve as a wake-up call for policymakers and citizens alike.

The concept was born in 1989 when real estate developer Seymour Durst installed the first U.S. National Debt Clock in New York City’s Times Square. At the time, the U.S. debt stood at $2.7 trillion—a figure that has since skyrocketed to over $33 trillion by 2025. The U.S. clock’s success inspired other nations, including Japan, Germany, and Australia, to adopt similar tools, either as physical installations or online dashboards. These clocks not only highlight fiscal realities but also spark debates about government spending, taxation, and economic priorities.

Beyond their symbolic impact, debt clocks play a practical role. They translate complex fiscal data into a digestible format, making it easier for the public to grasp the magnitude of national borrowing. In Japan, for instance, the Tokyo debt clock has become a focal point for discussions on the country’s 260% debt-to-GDP ratio, while Australia’s online debt tracker informs citizens about the per capita debt burden of $46,000.

1. Why Is Monitoring National Debt Important?

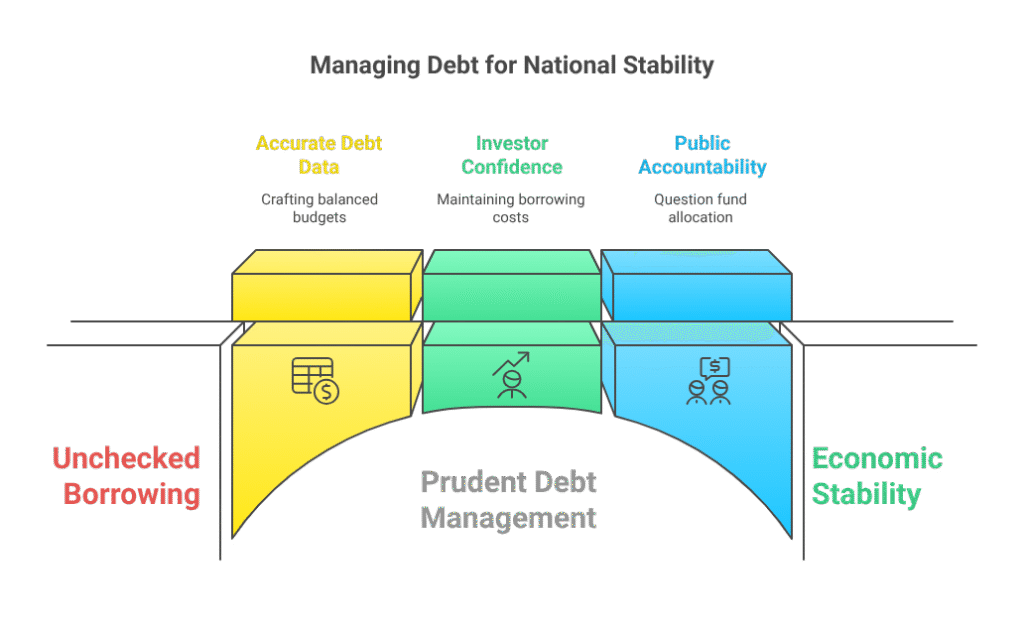

Monitoring national debt is critical for maintaining economic stability and ensuring sustainable governance. Here are the key reasons why it matters:

- Policy Planning: Accurate debt data enables governments to craft budgets that balance immediate needs, such as infrastructure or healthcare, with long-term fiscal health. Missteps in debt management can limit future policy options, as seen in Argentina’s repeated defaults.

- Economic Stability: Excessive debt can destabilize economies by fuelling inflation, devaluing currencies, or triggering defaults. The 2012 Greek debt crisis, which led to severe austerity measures, and Sri Lanka’s 2022 default, which caused widespread shortages, illustrate the risks of unchecked borrowing.

- Investor Confidence: A nation’s debt level and debt-to-GDP ratio directly influence its credit rating, affecting borrowing costs and foreign investment. For example, Japan’s high debt is offset by its domestic borrowing model, maintaining investor trust, while Argentina’s history of defaults has eroded confidence.

- Public Accountability: Debt clocks empower citizens to question how borrowed funds are allocated, whether for productive investments like education or wasteful expenditure. In the UK, public scrutiny of debt levels led to debates over post-Brexit fiscal policies.

Unmanaged debt can have catastrophic consequences. In Greece, the 2012 crisis slashed pensions and public services, sparking protests and economic contraction. Similarly, Sri Lanka’s 2022 default led to fuel and food shortages, political instability, and a humanitarian crisis affecting millions. These cases underscore the urgency of vigilant debt monitoring.

Purpose of This Article

This article provides a comprehensive exploration of the global debt landscape in 2025, with the following objectives:

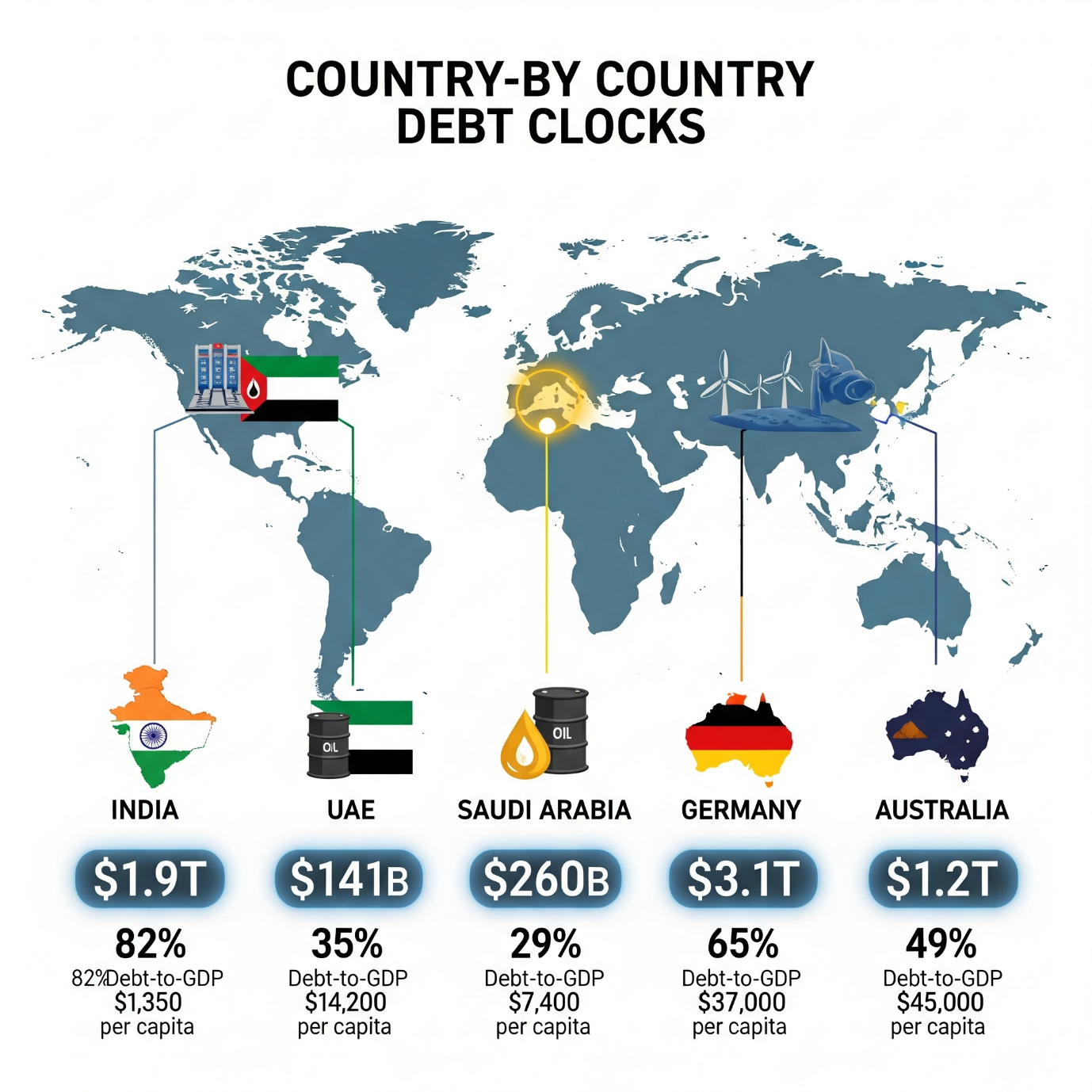

- Present real-time government debt figures for key nations, including India, the UAE, Saudi Arabia, Germany, and Australia.

- Analyse the economic, social, and political implications of rising national debt.

- Explore regional debt trends and the diverse strategies countries employ to manage borrowing.

- Offer practical tools and resources for readers to track and understand global debt dynamics.

By delving into these areas, we aim to demystify national debt and highlight its significance for policymakers, investors, and citizens navigating an increasingly complex economic environment.

2. Global Debt Overview

Current Global Debt Levels

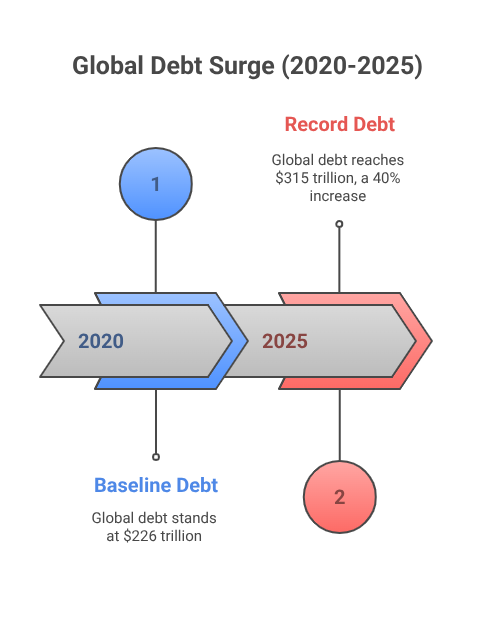

As of 2025, global debt has surged to an unprecedented $315 trillion, according to the International Monetary Fund (IMF) Global Debt Database. This represents a 40% increase from $226 trillion in 2020, driven by a combination of structural and crisis-driven factors. The debt is split between the public and private sectors:

| Debt Type | Amount (USD) | % of Global Debt |

| Public (Government) Debt | ~$95 trillion | ~30% |

| Private Debt | ~$220 trillion | ~70% |

Source: IMF Global Debt Database, 2025

Public debt, the focus of national debt clocks, encompasses government borrowing to fund budgets, infrastructure, and emergency measures. Private debt, including household and corporate borrowing, amplifies economic risks when combined with high public debt. For instance, Australia’s high household debt (120% of GDP) poses risks to financial stability, even as its public debt remains manageable.

Key Drivers of Rising Debt

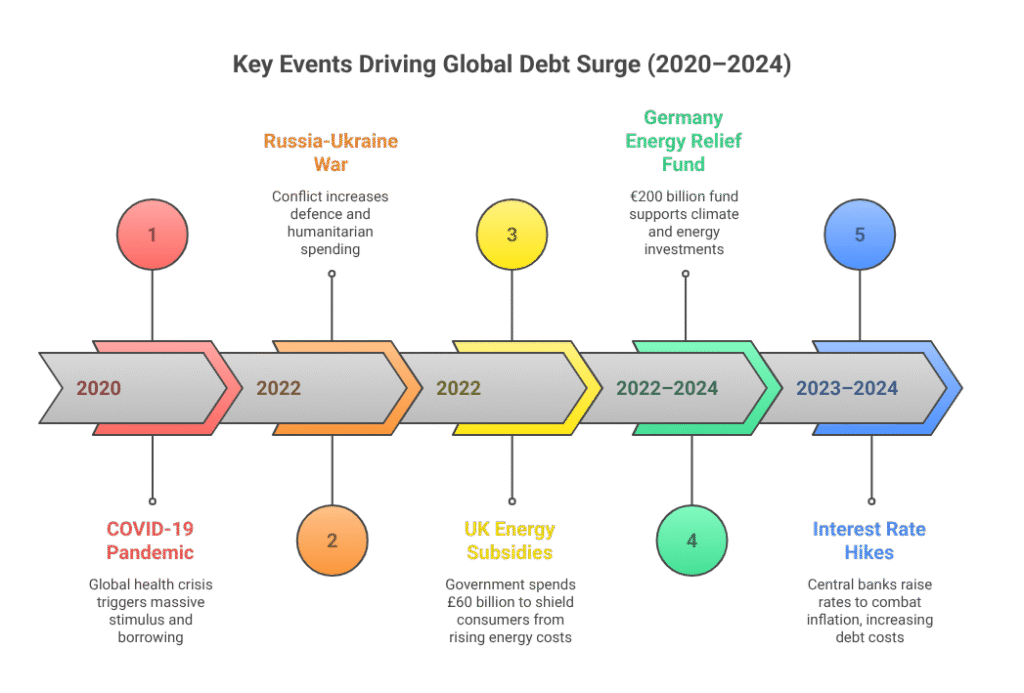

Several factors have fuelled the global debt surge:

- Post-Pandemic Recovery: The COVID-19 pandemic prompted unprecedented borrowing to finance healthcare, economic stimulus, and social safety nets. The U.S. CARES Act ($2.2 trillion) and India’s $266 billion stimulus package are notable examples. These measures, while necessary, added trillions to global debt.

- Geopolitical Instability: Conflicts like the Russia-Ukraine war and Middle East tensions have increased defence and humanitarian spending. Poland, for instance, has boosted its defence budget to 4% of GDP, while Jordan’s refugee support costs have strained its finances.

- Climate Change: Governments are investing heavily in green infrastructure, renewable energy, and disaster preparedness. Germany’s €200 billion energy relief fund (2022–2024) includes significant climate investments, while Pacific Island nations borrow to build climate-resilient infrastructure.

- Aging Populations: In developed nations like Japan, Germany, and Italy, rising healthcare and pension costs for aging populations drive borrowing. Japan’s elderly population (28% over 65) consumes over 40% of its budget in social spending.

- Global Supply Chain Disruptions: Post-2020 supply chain issues and energy price spikes have forced governments to subsidize fuel, food, and utilities. In 2022, the UK spent £60 billion on energy subsidies to shield consumers from rising costs.

- Interest Rate Hikes: Central banks, including the U.S. Federal Reserve and Reserve Bank of Australia, raised interest rates in 2023–2024 to combat inflation, increasing debt servicing costs for governments and households alike.

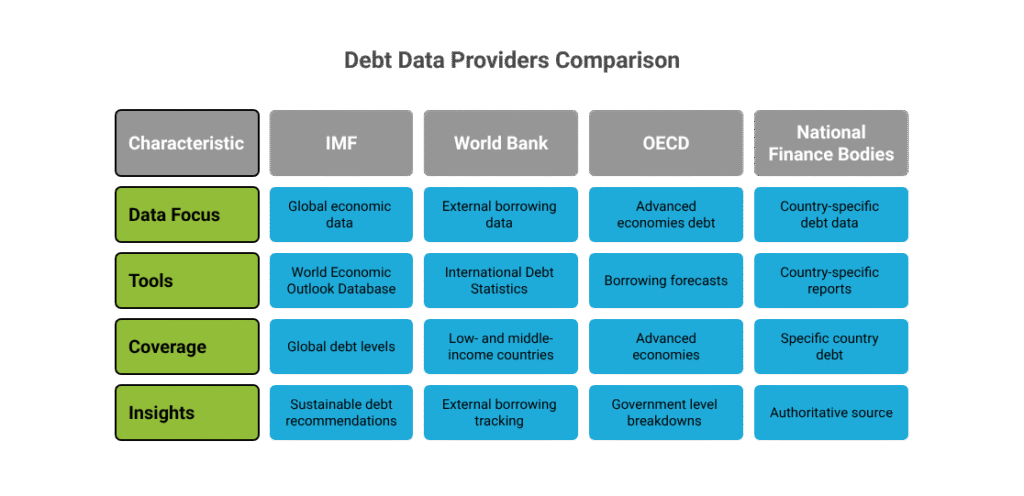

Who Tracks Global Debt?

Several organizations provide authoritative data on global debt:

- International Monetary Fund (IMF): The IMF’s Global Debt Database tracks public and private debt across 190 countries, offering biannual updates and analytical reports.

- World Bank: Focuses on debt sustainability in low- and middle-income countries, providing tools like the Debt Sustainability Framework and country-specific analyses.

- Organisation for Economic Co-operation and Development (OECD): Analyses debt trends in advanced economies, emphasizing fiscal policy and economic resilience.

Visual Suggestion: A global heatmap of debt-to-GDP ratios would visually contrast high-debt nations like Japan (260%) and Greece (185%) with low-debt ones like Saudi Arabia (30%) and the UAE (36%), providing a clear snapshot of relative debt burdens.

3. Country-by-Country Debt Clocks

3.1 India

- Real-Time Debt: ~$1.95 trillion (2025)

- Debt-to-GDP Ratio: ~83%

- Per Capita Debt: ~$1,400

Key Economic Factors: India’s national debt has grown steadily due to its ambitious $1.4 trillion National Infrastructure Pipeline, which funds highways, metro systems, and smart cities. Social welfare programs, such as food subsidies for 800 million citizens and the Mahatma Gandhi National Rural Employment Guarantee Scheme, account for significant spending. The $266 billion pandemic stimulus package, rolled out in 2020–2021, further increased borrowing. Additionally, India’s defence budget, at $75 billion in 2024, reflects rising geopolitical tensions in the Indo-Pacific.

Impact on Economy & Citizens:

- Debt Servicing: Interest payments consume 25% of India’s annual revenue, crowding out investments in education and healthcare (Reserve Bank of India, 2025).

- Currency Risks: Heavy borrowing has weakened the Indian rupee, contributing to inflation rates of 5–6%, which raises living costs for millions.

- Fiscal Constraints: Limited fiscal space could hinder India’s ability to respond to future crises, such as monsoon-related floods or economic slowdowns.

- Social Impact: Rising debt has sparked debates over subsidy reforms, with critics arguing that inefficient subsidies strain public finances without addressing structural poverty.

Recent Fiscal Efforts:

- Fiscal Deficit Target: India aims to reduce its fiscal deficit to below 4.5% of GDP by FY 2025–26, signalling a commitment to fiscal discipline.

- Disinvestment: The government has raised $20 billion by divesting stakes in public sector enterprises like Air India and BPCL since 2021.

- National Monetization Pipeline (NMP): Launched in 2021, the NMP aims to monetize $81 billion in public assets, including roads, railways, and airports, to reduce borrowing needs.

- Digital Economy: India’s push for digital infrastructure, such as 5G networks and UPI, has attracted private investment, easing fiscal pressures.

3.2 United Arab Emirates (UAE)

- Real-Time Debt: ~$145 billion

- Debt-to-GDP Ratio: ~36%

- Per Capita Debt: ~$14,500

Key Economic Factors: The UAE’s economy remains anchored by oil exports, which contribute 30% of GDP. However, the nation is diversifying through tourism, renewable energy, and technology. Mega-projects like Expo 2020 (held in 2021–2022), the $3.5 billion Dubai Creek Harbour, and the Mars Hope Mission have driven public spending. Investments in AI, such as the UAE’s National AI Strategy 2031, and green tech, like the Mohammed bin Rashid Al Maktoum Solar Park, further increase borrowing.

Impact on Economy & Citizens:

- Sovereign Wealth Funds: The Abu Dhabi Investment Authority (ADIA), valued at $1 trillion, provides a financial buffer, reducing debt reliance.

- Low Taxes: The UAE’s minimal tax burden supports consumer spending but limits non-oil revenue, making diversification critical.

- Asset Bubbles: Rapid real estate development in Dubai and Abu Dhabi raises concerns about speculative bubbles, as seen in the 2008 Dubai property crash.

- Social Stability: The UAE’s debt levels are low, but rising living costs due to global inflation affect expatriate workers, who comprise 80% of the population.

Recent Fiscal Efforts:

- Corporate Tax: A 9% federal corporate tax, introduced in 2023, aims to diversify revenue and reduce oil dependency.

- Green Bonds: The UAE issued $4 billion in green bonds in 2024 to fund sustainable projects like solar farms and desalination plants.

- Public-Private Partnerships (PPPs): Expanded PPPs in healthcare, education, and infrastructure reduce direct government borrowing.

- Vision 2021–2030: The UAE’s long-term plan emphasizes economic diversification, with a goal to increase non-oil GDP to 80% by 2030.

3.3 Saudi Arabia

- Real-Time Debt: ~$270 billion

- Debt-to-GDP Ratio: ~30%

- Per Capita Debt: ~$7,600

Key Economic Factors: Saudi Arabia’s debt is tied to global oil price volatility, which funds 70% of its budget. The Vision 2030 initiative, launched in 2016, drives massive investments in non-oil sectors, including tourism (e.g., the $20 billion Red Sea Project), entertainment, and futuristic cities like NEOM ($500 billion). Defence spending, at $70 billion in 2024, reflects regional security concerns, including tensions with Iran and Yemen.

Impact on Economy & Citizens:

- Job Creation: Vision 2030 has created 1.5 million jobs in non-oil sectors since 2016, but at the cost of rising debt.

- Fiscal Risks: A prolonged dip in oil prices below $60 per barrel could strain debt sustainability, as seen in the 2014–2016 oil slump.

- Social Impact: Subsidy cuts and a 15% VAT, introduced in 2020, have increased living costs, prompting public discontent among middle-class households.

- Youth Empowerment: Investments in education and technology aim to address youth unemployment, which remains at 15% for those under 30.

Recent Fiscal Efforts:

- Non-Oil Revenue: The share of non-oil revenue has risen from 10% to 35% of GDP since 2016, driven by taxes and fees.

- Sukuk Bonds: Saudi Arabia issued $12 billion in Islamic bonds in 2024 to attract global investors.

- Public Investment Fund (PIF): The PIF, valued at $700 billion, reinvests oil wealth into sectors like tech and tourism.

- Fiscal Reforms: The government aims to balance its budget by 2030, reducing reliance on oil revenue.

3.4 Germany

- Real-Time Debt: ~$3.2 trillion

- Debt-to-GDP Ratio: ~66%

- Per Capita Debt: ~$38,000

Key Economic Factors: Germany, Europe’s economic powerhouse, faces rising debt due to an aging population, with 22% of citizens over 65, driving pension and healthcare costs. The 2022 energy crisis, triggered by Russia’s gas supply cuts, prompted a €200 billion relief fund. Germany’s push for carbon neutrality by 2045 requires massive investments in renewable energy, hydrogen, and digital infrastructure, such as 5G and Industry 4.0.

Impact on Economy & Citizens:

- Stability: Low unemployment (3.5%) and stable interest rates bolster economic resilience, despite rising debt.

- Fiscal Rules: The “debt brake” limits annual deficits to 0.35% of GDP, ensuring fiscal discipline.

- Taxation: Rising taxes to fund social safety nets and energy transitions may burden middle-income households, with income tax rates reaching 42% for high earners.

- Social Cohesion: Germany’s debt policies balance growth with social welfare, but rising energy costs have sparked protests among low-income groups.

Recent Fiscal Efforts:

- Debt Brake: Reinstated in 2024, this constitutional rule curbs excessive borrowing post-COVID.

- Energy Relief: The €200 billion fund supports households and businesses amid high energy costs.

- Green Investments: Germany allocated €50 billion in 2024 for renewable energy, hydrogen, and electric vehicle infrastructure.

- Digital Transformation: Investments in 5G and AI aim to maintain Germany’s competitive edge in manufacturing.

3.5 Australia

- Real-Time Debt: ~$1.25 trillion

- Debt-to-GDP Ratio: ~50%

- Per Capita Debt: ~$46,000

Key Economic Factors: Australia’s debt is driven by high household debt (120% of GDP), reliance on commodity exports (iron ore, coal, gas), and rising healthcare and aged care costs. The 2022–2023 floods and bushfires necessitated emergency borrowing for recovery and climate adaptation, with costs exceeding $10 billion. Defence spending, at $35 billion in 2024, reflects tensions in the Indo-Pacific.

Impact on Economy & Citizens:

- Manageable Debt: Public debt remains sustainable, supported by 2.5% GDP growth in 2024.

- Housing Crisis: Loose lending practices have fuelled a housing affordability crisis, with median home prices in Sydney exceeding $1 million.

- Interest Rates: The Reserve Bank of Australia’s rate hikes to 4.35% in 2024 strain household budgets, particularly for mortgage holders.

- Climate Vulnerability: Australia’s exposure to climate-related disasters increases borrowing needs for adaptation and recovery.

Recent Fiscal Efforts:

- Surplus Budgeting: Australia achieved a $15 billion budget surplus in 2023, the first in 15 years, reducing borrowing needs.

- National Housing Accord: A $10 billion initiative aims to build 1 million homes by 2029 to address affordability.

- Tax Reforms: Proposals to balance income and corporate taxes aim to fund social programs without increasing debt.

- Climate Investments: Australia allocated $2 billion in 2024 for renewable energy and disaster resilience.

4. Regional Debt Trends

Europe: High Debt and Aging Populations

Europe faces complex debt challenges:

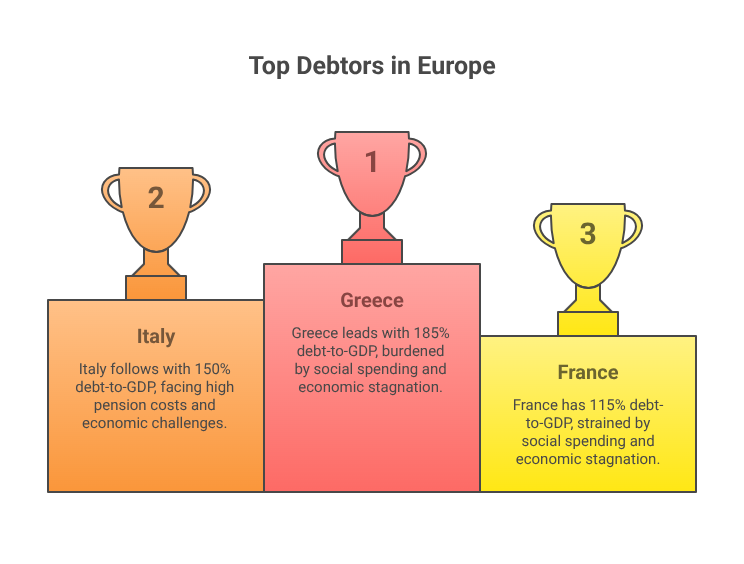

- Top Debtors: Greece (185% debt-to-GDP), Italy (150%), and France (115%) lead in debt burdens, driven by social spending and economic stagnation.

- Policy Constraints: The EU’s Stability and Growth Pact caps deficits at 3% of GDP, limiting fiscal flexibility for high-debt nations.

- Challenges: Aging populations, rising energy costs, and migration pressures strain budgets. For example, Italy’s pension costs consume 16% of GDP, while Germany’s migration costs reached €20 billion in 2023.

Middle East: Oil vs. Diversification

- GCC Economies: The UAE and Saudi Arabia maintain low debt-to-GDP ratios (30–36%) but face risks from oil price volatility. A 2020 oil price crash forced Saudi Arabia to triple its VAT to 15%.

- Levant and North Africa: Egypt and Lebanon face severe debt crises. Lebanon defaulted in 2020, with inflation exceeding 200%, while Egypt relies on $8 billion in IMF bailouts to stabilize its economy.

Oceania: Mixed Fortunes

- Australia: Strong fundamentals, with 2.5% GDP growth, but high household debt and housing affordability are concerns.

- Pacific Islands: Small nations like Fiji and Vanuatu borrow heavily for climate adaptation, with debt-to-GDP ratios exceeding 80% in some cases, increasing vulnerability to external shocks.

5. Understanding National Debt

Types of Government Debt

- Internal Debt: Borrowed from domestic sources, such as bonds sold to citizens or pension funds. Japan’s debt, 90% domestically held, reduces external risks.

- External Debt: Owed to foreign creditors, such as international banks or governments. Argentina’s $100 billion external debt fuelled its 2020 default.

Deficit vs. Surplus

- Deficit: When spending exceeds revenue, it requires borrowing. Pakistan’s 7% deficit in 2024 is among the highest globally, driven by debt servicing and subsidies.

- Surplus: When revenue exceeds spending, it allows for debt repayment. Norway’s oil-funded surplus, averaging 10% of GDP, is a rare example.

Debt Servicing Costs

Interest payments consume significant budget portions:

- Pakistan: ~50% of revenue goes to interest payments, limiting development spending (IMF, 2025).

- Italy: €75 billion annually, equivalent to 4% of GDP, strains public finances.

- Brazil: High interest rates in 2024 pushed debt servicing costs to 8% of GDP, prompting fiscal reforms.

6. Why National Debt Matters

Short-Term and Long-Term Effects

- Short-Term: Borrowing can stimulate economies during crises, as seen with COVID-19 stimulus packages. The U.S. added $7 trillion to its debt in 2020–2021, averting a deeper recession.

- Long-Term: High debt can crowd out private investment, raise interest rates, and force austerity. Greece’s post-2012 austerity cut GDP by 25%, triggering social unrest.

Global Case Studies

- Japan: With a 260% debt-to-GDP ratio, Japan remains stable due to domestic borrowing and low interest rates, but faces risks from an aging population.

- Argentina: Nine defaults since independence, driven by inflation and capital flight, highlight the perils of mismanaged debt.

- Iceland (2008): A banking collapse tripled Iceland’s debt-to-GDP ratio to 120%, but prudent reforms restored stability by 2015.

7. Tools & Resources

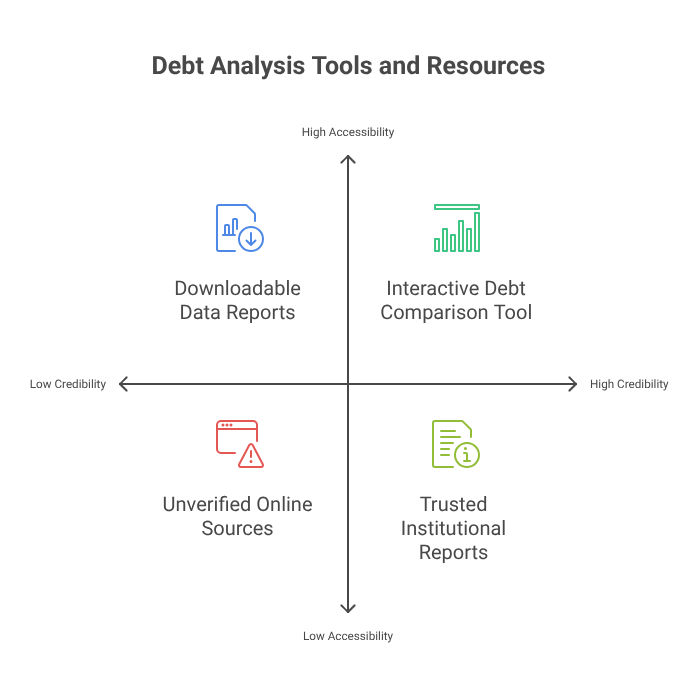

In a world of complex financial data, having the right tools and credible sources is essential to analyse and understand national and global debt trends. This section offers readers access to interactive tools, downloadable data, and trusted institutions that specialize in debt monitoring and analysis.

Interactive Global Debt Comparison

To make data meaningful and accessible, an interactive global debt comparison tool can be an invaluable feature. This widget or dashboard would allow users to:

- Compare national debts side by side across countries.

- View real-time figures including total debt, debt per capita, and debt-to-GDP ratios.

- Track debt trends over time using historical charts and projections.

- Apply filters for public vs. private debt, regional groupings (e.g., G7, BRICS), and income categories (developed vs. emerging markets).

- Toggle between different currencies for a clearer international understanding.

Downloadable Reports & Datasets

For researchers, analysts, and policymakers, access to structured and up-to-date datasets is critical. This section should offer direct downloads or links to:

- Debt Sustainability Analyses (DSAs): Evaluate a country’s ability to service its debt without external support.

- Historical Debt Data: Time-series datasets showing how debt evolved since the 1980s or earlier.

- Regional Debt Breakdowns: Specialized reports for Africa, Latin America, Asia, and Europe.

- Excel/CSV Files: For easy import into analysis tools like Excel, R, or Python.

Recommended Links: Trusted Sources for Debt Data

When it comes to financial information, credibility is non-negotiable. The following organizations are globally recognized for their debt statistics, fiscal research, and policy insights:

- International Monetary Fund (IMF):

- Offers tools like the World Economic Outlook Database and Fiscal Monitor.

- Tracks global debt levels, country reports, and lending arrangements.

- Provides projections and recommendations for sustainable debt.

- World Bank – Debt Statistics:

- Hosts the “International Debt Statistics” (IDS) platform, which includes long-term public and publicly guaranteed (PPG) debt data.

- Useful for tracking external borrowing, especially in low- and middle-income countries.

- OECD Debt Statistics:

- Covers debt levels of advanced economies, including breakdowns by level of government (federal, regional, municipal).

- Also includes borrowing forecasts and debt instruments issued.

- National Finance Bodies:

These are authoritative sources for country-specific debt data.

Examples include:- U.S. Treasury Department – Debt to the Penny

- India’s Ministry of Finance – Public Debt Management Cell

- UK Debt Management Office

- Japan’s Ministry of Finance

Why It Matters: Relying on verified and regularly updated data ensures accuracy and helps avoid misinformation, especially in economic journalism or policy debates.

Bonus Suggestions for Site Enhancement

If you’re planning to host this content as a webpage or digital report, consider integrating:

- Debt Calculator Tools: Allow users to see how debt per capita is calculated.

- Interactive Timelines: Show major fiscal events and their impact on national debt.

- Custom Alerts or Widgets: Enable users to receive notifications when a country crosses a certain debt threshold.

Conclusion

The Global Debt Clock is more than a numerical ticker—it’s a reflection of a nation’s fiscal choices, economic priorities, and vulnerabilities. For countries like Germany and the UAE, prudent policies and diversified economies provide resilience against rising debt. In contrast, nations like Sri Lanka and Argentina serve as cautionary tales of fiscal mismanagement, where defaults led to economic collapse and social hardship.

In an era of geopolitical tensions, climate challenges, and demographic shifts, managing national debt requires balancing growth with sustainability. Debt clocks and global datasets, such as those from the IMF and World Bank, empower citizens to hold governments accountable. By leveraging these tools and adopting forward-thinking fiscal strategies, nations can navigate the complex debt landscape and secure a stable economic future for their citizens.

Track real-time global debt with our interactive Global Debt Clock