Global Debt Industry Insights Hub: 2025 Trends & Analysis

Introduction: The State of Global Debt in 2025

The global debt landscape in 2025 presents a complex picture of both resilience and fragility. Debt has always been a double-edged sword—it’s a powerful engine for economic growth, enabling investment, infrastructure development, and consumption, yet it simultaneously creates significant vulnerabilities when repayment conditions change. We’re now witnessing the full force of this duality.

As of early 2025, global debt stands at a staggering $315 trillion, a record high that represents more than 340% of global GDP. This monumental figure is not the result of a single event but the culmination of several converging, long-term trends:

- Pandemic Aftershocks: In response to the COVID-19 pandemic, governments worldwide borrowed unprecedented amounts to fund emergency healthcare, social safety nets, and economic stimulus packages. This necessary fiscal intervention led to ballooning government deficits and a massive increase in sovereign debt.

- Inflation and Interest Rates: The era of “cheap money,” characterized by years of near-zero interest rates, came to an abrupt end between 2022 and 2024. Central banks, grappling with persistent inflation, embarked on one of the most aggressive tightening cycles in decades. This has fundamentally altered the cost of borrowing for everyone, squeezing households, companies, and governments with higher debt-servicing costs.

- Slow Growth: The post-pandemic economic recovery has been uneven and anemic. With global GDP growth hovering at just 2.5%, the ability of economies to “outgrow” their debt burdens has significantly diminished. This slow-growth environment makes it increasingly difficult for debtors to generate the income or revenue needed to service their obligations.

The result is an era where borrowing remains essential for financing new projects and sustaining economic activity, but it’s also becoming increasingly unsustainable for many sectors. This insights hub brings together the latest statistics, regional deep dives, and expert analysis to offer a comprehensive and authoritative overview of where the global debt industry stands in 2025.

Global Debt Statistics (2025 Overview)

Global debt can be broadly categorized into three primary sectors: household debt, corporate debt, and sovereign (government) debt. Each category is driven by distinct factors, carries unique risks, and has different implications for the global financial system.

Household Debt

Household debt has surged over the past decade, especially in advanced economies where home prices, education costs, and consumer credit have grown sharply. It reflects the financial health and stress of the average citizen.

- Global Household Debt-to-GDP Ratio: Approximately 65%. This figure, while a global average, masks significant variations between countries.

- Key Drivers: The main components of household debt include mortgages (the largest portion in most developed nations), auto loans, credit card balances, and student loans. The rise of Buy Now, Pay Later (BNPL) services has also added to consumer credit exposure.

- Trend in 2025: We are seeing a worrying trend of rising defaults in credit card and mortgage categories, particularly among younger generations and low-income borrowers. The pressure from higher interest rates is making minimum payments more difficult to meet, eroding disposable income, and increasing the risk of widespread consumer stress.

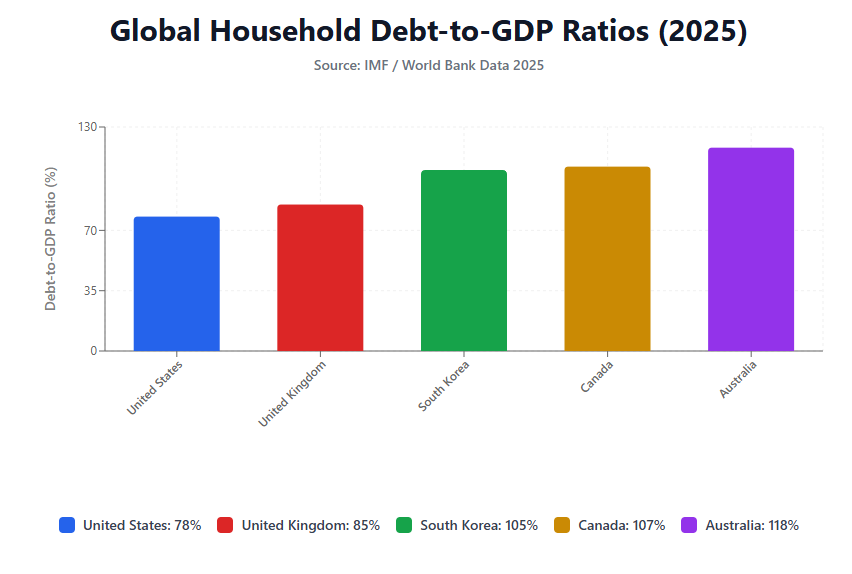

Top Economies by Household Debt-to-GDP (2025)

- South Korea: 105%

- Australia: 118%

- United States: 78%

- United Kingdom: 85%

- Canada: 107%

This data highlights economies most at risk from consumer stress, showing just how high the leverage of households has become. A slight economic shock in these regions could trigger a significant rise in defaults, impacting the banking sector and consumer spending.

Corporate Debt

Corporations worldwide borrowed heavily during the “cheap money era” from 2010 to 2021, taking advantage of low interest rates to fund expansion, mergers, and share buybacks. Now, much of that debt is maturing into a far less favorable environment.

- Total Corporate Debt Outstanding (2025): Approximately $95 trillion.

- Main Vulnerabilities:

- Real estate developers in China and India, many of whom are struggling to service massive debt piles amid a property market downturn.

- Tech start-ups in the US, which relied on venture debt and now face higher refinancing costs as venture capital funding slows.

- Energy companies are exposed to commodity price volatility. A sudden drop in oil or gas prices could jeopardize their ability to repay debt.

- Shift to Private Credit: With traditional banks tightening their lending standards, private credit funds are stepping in to fill the gap. While this provides a new source of capital, it often comes at much higher interest rates, which could further increase financial stress for borrowers.

Sovereign Debt

Governments remain the largest debtors globally, having borrowed to finance everything from economic stimulus and infrastructure projects to social welfare programs. The sustainability of this debt is a key concern for global financial stability.

- Global Sovereign Debt: Approximately $97 trillion.

- Debt-to-GDP Ratios Above 100%: Countries like Japan, the US, the UK, Italy, and France carry heavy fiscal burdens, making them sensitive to interest rate changes.

- Debt Distress: A growing number of emerging markets, including Ghana, Sri Lanka, and Lebanon, are struggling with or have defaulted on their sovereign debt. These crises are often triggered by a combination of unsustainable borrowing, high debt servicing costs, and a lack of access to new financing.

Regional Insights

The debt picture varies sharply across regions, influenced by local economic conditions, political stability, and financial regulations. Some countries manage elevated debt with stable institutions, while others face mounting crises.

United States

The US debt landscape is a microcosm of the global situation, with debt exceeding $100 trillion across all sectors.

- Household: The US household debt is a significant concern. Credit card balances have reached a record $1.2 trillion, with delinquency rates rising fastest among millennials and Gen Z borrowers who entered the workforce during a period of easy credit.

- Corporate: The US corporate sector faces unique challenges. The office real estate market is under immense pressure, with defaults climbing as a result of high vacancy rates fueled by the sustained shift to remote work.

- Sovereign: The US government’s debt-to-GDP ratio is above 120%, with ongoing political battles over the debt ceiling creating periodic market volatility and raising long-term questions about fiscal sustainability.

United Kingdom

- Household: Total UK household debt stands at a formidable £1.9 trillion, with mortgages dominating. A major risk is the wave of homeowners whose fixed-rate mortgage terms are expiring. These individuals are facing payment shocks as they refinance at significantly higher interest rates, putting a strain on household budgets and increasing the risk of mortgage defaults.

- Corporate: Small and medium-sized enterprises (SMEs) in sectors like manufacturing and retail are under severe refinancing pressure. Many took on debt during the pandemic and are now struggling to service it in an environment of high costs and weak demand.

- Sovereign: The UK’s debt has surpassed 100% of GDP. The government also faces fiscal risks from its issuance of inflation-linked bonds, where debt-servicing costs rise in tandem with inflation, creating a feedback loop of financial stress.

United Arab Emirates (UAE)

The UAE’s debt profile is unique due to its large expatriate population and reliance on specific sectors.

- Corporate: Real estate and infrastructure projects continue to drive corporate borrowing. Megaprojects in Dubai and Abu Dhabi rely on significant, long-term financing, making the sector sensitive to global investor sentiment.

- Household: The high reliance on credit cards and personal loans among the large expatriate workforce is a unique feature. Expatriate debt is a key vulnerability, as a loss of employment could lead to immediate default and departure from the country.

- Sovereign: Supported by substantial oil revenues, the UAE’s sovereign debt levels remain relatively stable and low compared to many of its peers, providing a strong buffer against external shocks.

India

India’s debt landscape is characterized by rapid growth in certain sectors and significant domestic financing.

- Household: Household debt is relatively low at approximately 15% of GDP, but consumer lending is growing at a rapid pace. This expansion is driven by a young, aspiring population and the increased accessibility of digital lending platforms.

- Corporate: Non-banking financial companies (NBFCs) play a crucial role in financing both small businesses and consumer loans. However, they face a rising tide of non-performing loans (NPLs), which could destabilize the sector if not managed effectively.

- Sovereign: India’s debt-to-GDP ratio is near 85%. The government often misses its fiscal deficit targets, raising concerns about its long-term debt trajectory and its ability to fund future development.

Australia

- Household: Australia has one of the world’s highest household debt ratios at 118% of GDP, driven almost entirely by the country’s booming, and now potentially vulnerable, housing market.

- Corporate: The mining sector remains a stable, low-debt driver of the economy, but other sectors like retail and services are under stress from rising living costs and weakened consumer spending.

- Sovereign: Australia’s sovereign debt-to-GDP ratio is near 60%, which is moderate compared to other advanced economies, but it has been on a rising trend since the pandemic.

NPL Trends: The Rise of Non-Performing Loans

Non-performing loans (NPLs)—loans where borrowers are no longer making payments—are emerging as one of the most pressing risks in 2025. The full impact of rising interest rates is now beginning to manifest in higher default rates.

Drivers of Rising NPLs

- Higher Borrowing Costs: After years of cheap credit, the cost of servicing both old and new debt has skyrocketed, making it difficult for borrowers to keep up.

- Inflationary Pressure: High inflation erodes the purchasing power of households and the profit margins of businesses. With disposable incomes squeezed and operating costs rising, the ability to repay loans is severely diminished.

- Economic Slowdown: A general cooling of the global economy means lower corporate revenues and higher unemployment, which directly translates to a reduced capacity for both companies and individuals to service their debts.

Regional Outlook for NPLs

- Europe: Small and medium-sized enterprises (SMEs), particularly in Southern Europe, are the most vulnerable. Many took out loans under favorable terms and now face a difficult refinancing environment.

- Asia-Pacific: Indian NBFCs and Chinese real estate firms are the primary hotspots for rising NPLs, reflecting deep-seated structural issues in their respective financial systems.

- Middle East: A potential threat lies in oil price volatility. While stable for now, a sudden drop in prices could threaten the debt repayment capacity of energy-reliant economies.

Global Debt Distress in 2025

2025 is shaping up to be a watershed year for debt distress, with simultaneous stress in multiple sectors and geographies. The cascading effects of high interest rates and slow growth are creating a domino effect of financial vulnerability.

Key Indicators of Distress

- Sovereign Defaults: Several emerging markets are in a precarious position. Argentina and Ghana are in advanced restructuring talks, while Pakistan faces a tightrope situation with its debt obligations. The risk of more defaults is high.

- Corporate Bankruptcies: An uptick in bankruptcies is being observed across the retail, real estate, and technology sectors, signaling a shakeout in industries that are highly sensitive to economic cycles and credit conditions.

- Household Strain: Mortgage and credit card delinquencies are rising in advanced economies, particularly the US and UK, which could foreshadow a slowdown in consumer spending and a broader economic downturn.

Emerging Risks 2025–2026

- Geopolitics: The ongoing risk of conflict escalation could disrupt global markets, supply chains, and investor confidence, adding a layer of unpredictable risk to the debt landscape.

- Inflation Stickiness: If inflation proves to be more persistent than anticipated, central banks may be forced to keep interest rates elevated for longer. This would exacerbate debt-servicing challenges for all borrowers.

- Debt Rollover Challenges: Emerging markets, in particular, face higher refinancing costs on their dollar-denominated debt. With the US dollar remaining strong, their debt burdens become even heavier, making it difficult to find new lenders.

Opportunities

Despite the risks, the current environment also presents opportunities for those who can navigate it effectively.

- Debt Restructuring: The growing number of debt-distressed companies and sovereigns is creating a significant business for specialized advisory firms and law practices that focus on debt restructuring and bankruptcy.

- Private Credit Growth: As banks retreat from riskier lending, private credit funds are stepping in. For investors with a high-risk tolerance, this can be a lucrative market with higher yields.

- Digital Recovery: The crisis is accelerating innovation in the debt collections and recovery space. AI and fintech platforms are improving efficiency in collections, using data analytics to better manage and predict defaults.

Download the Full Global Debt Report (2025 Edition)

This hub provides a glimpse into the complex world of global debt. For a deeper, more granular analysis, we invite you to download our full Global Debt Report (2025 Edition).

This 80-page flagship report, updated annually, is an essential benchmark resource for professionals tracking debt markets globally. It provides:

- Detailed statistics for over 40 countries, with breakdowns by sector and borrower type.

- In-depth case studies of both debt crises and successful recoveries, offering valuable lessons.

- Forecasts for debt sustainability and the outlook for key sectors.

- Actionable insights for lenders, investors, and policymakers to help them navigate this era of heightened debt risk.

Final Notes

This hub offers a comprehensive, authoritative, and updated view of global debt in 2025. By combining data-driven insights, regional case studies, and visual representations, it aims to serve as a cornerstone resource for financial institutions, researchers, and decision-makers. The next few years will be a crucial test of the global financial system’s resilience, and understanding the nuances of the debt crisis is the first step toward effective mitigation.