Fintech Compliance & Regulatory Rules: The Complete guide to fintech regulatory compliance

Why Compliance is the Backbone of Fintech

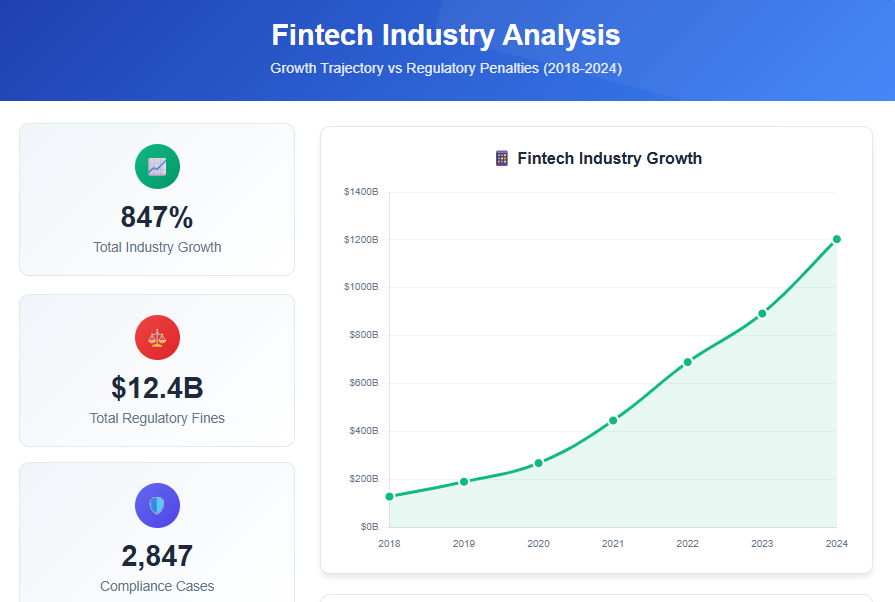

The financial technology (fintech) industry has revolutionized the way people manage their money, from mobile payment apps to AI-driven lending platforms. This sector is disrupting traditional banking and financial services on an unprecedented scale by offering more accessible, convenient, and efficient solutions. However, this rapid innovation comes with an equally rapid increase in regulatory scrutiny. For any fintech company, compliance is not a mere “box to tick”—it is the fundamental pillar of trust and a prerequisite for sustainable growth.

Ignoring or failing to prioritize compliance can lead to severe consequences, including:

- Multi-million-dollar fines: Regulatory bodies impose substantial financial penalties for violations, which can cripple a startup or significantly harm a large company’s bottom line.

- Suspension or revocation of licenses: The ability to operate is dependent on regulatory licenses. Non-compliance can lead to their suspension, effectively shutting down the business.

- Data breaches and reputational damage: Inadequate data protection measures can result in breaches, leading to financial losses and a catastrophic loss of customer confidence.

- Loss of customer trust: Trust is the most valuable currency in finance. A single compliance failure can erode years of trust and send customers to competitors.

Example: In 2020, a prominent European neobank faced a €15 million fine for failing to comply with Anti-Money Laundering (AML) monitoring standards. This case highlights how a seemingly technical oversight can result in a significant financial penalty.

Key Laws and Regulatory Frameworks by Region

Fintechs operating globally must navigate a complex, often fragmented, patchwork of regulations. Understanding the major compliance frameworks in key markets is crucial.

United States: A Multi-Layered Regulatory Landscape

The U.S. financial system is regulated by a mix of federal and state laws, creating a complex environment.

- Fair Debt Collection Practices Act (FDCPA): This federal law restricts the abusive and deceptive practices of third-party debt collectors. For fintechs involved in lending, credit platforms, and debt purchasing, the FDCPA imposes strict rules on communication. Collectors are prohibited from harassing debtors, making false statements, or contacting them at inconvenient times, such as before 8 a.m. or after 9 p.m., without consent.

- Consumer Financial Protection Bureau (CFPB): The CFPB oversees a broad range of financial products and services. It focuses on ensuring fair lending practices and requires fintechs to provide clear, transparent disclosures on loans, interest rates, and fees. Fintech lenders and payment processors must adhere to the CFPB’s rules to ensure consumer protection and prevent predatory practices.

- Securities and Exchange Commission (SEC): The SEC regulates fintechs that operate in the securities market. This includes robo-advisors, which use algorithms to provide automated investment advice, and cryptocurrency exchanges that list and trade digital assets classified as securities. Fintechs under SEC jurisdiction must comply with rules regarding investor protection, anti-fraud measures, and transparent reporting.

European Union: Data Privacy and Open Banking

The EU is known for its stringent data privacy and financial services regulations.

- General Data Protection Regulation (GDPR): The GDPR is one of the most comprehensive data privacy laws in the world. It mandates strict rules on the collection, processing, and storage of personal data of EU citizens. Key provisions include:

- Explicit consent: Companies must obtain clear and unambiguous consent from users before processing their data.

- Right to be forgotten: Users have the right to request the deletion of their personal data.

- Data portability: Users can request their data in a machine-readable format to transfer it to another service provider.

- Breach reporting: Organizations must report data breaches to regulators within 72 hours.

- Payment Services Directive 2 (PSD2): This directive promotes open banking by requiring banks to provide third-party providers, including fintechs, with secure access to customer account data through Application Programming Interfaces (APIs). PSD2 also enforces Strong Customer Authentication (SCA), which requires multi-factor authentication for most electronic payments, significantly increasing security for online transactions.

Case in Point: In 2022, a UK-based payment processor was fined £20 million for GDPR violations, demonstrating the significant financial penalties associated with data privacy non-compliance.

Middle East: The Rise of Islamic Finance

Fintechs operating in the Middle East must navigate a unique regulatory environment, particularly one shaped by Islamic financial principles.

- Shariah-Compliant Finance: This framework is based on the principles of Islamic law. It prohibits key practices common in conventional finance:

- Prohibition of interest (riba): Interest on loans is forbidden. Instead, financial transactions are structured around profit-and-loss or risk-sharing models.

- Prohibition of financing prohibited industries: Investments in businesses dealing with alcohol, gambling, or pork are forbidden.

- Local Regulators: Each country has its own regulatory bodies that enforce these rules:

- United Arab Emirates (UAE): The Central Bank of UAE, the Dubai International Financial Centre (DIFC), and the Abu Dhabi Global Market (ADGM) oversee fintech activities.

- Saudi Arabia: The Saudi Central Bank (SAMA) is the primary regulator.

- Bahrain: The Central Bank of Bahrain (CBB) has been a pioneer in creating a fintech-friendly regulatory environment.

Common Compliance Mistakes in Fintech

Even with robust frameworks, many fintechs make avoidable errors that can have serious repercussions.

- Weak Data Privacy Controls: A common mistake is collecting more user data than is necessary without a clear, stated purpose. Furthermore, failing to use strong encryption for sensitive customer information is a major security and compliance risk, making companies vulnerable to breaches.

- Poor Know Your Customer (KYC) / Anti-Money Laundering (AML) Processes: Inadequate identity verification during the onboarding process and a failure to implement robust transaction monitoring systems are significant compliance failures. This can lead to the platform being used for illicit activities like money laundering or terrorist financing.

- Misleading Marketing: The pressure to acquire customers can lead to marketing that overstates potential returns or “guarantees” profits. This non-transparent advertising and failure to clearly disclose loan terms can lead to fines and legal action from regulators like the CFPB.

- Neglecting Cross-Border Laws: A fintech expanding into a new market must not assume its home country’s compliance framework applies everywhere. Ignoring GDPR while serving EU users or overlooking Shariah compliance in the Middle East are common, costly mistakes.

- Lack of Continuous Monitoring: Compliance is not a one-time project. Regulations are constantly evolving, and a static compliance program will quickly become obsolete. A failure to update internal policies and technology to match new rules is a frequent source of penalties.

Cross-Border Challenges: Managing Compliance Globally

Operating in multiple regions adds layers of complexity that require a sophisticated compliance strategy.

- Diverse Regulations: What is legal and acceptable in one jurisdiction may be a serious violation in another. For example, a fintech’s data transfer policies must comply with both U.S. and EU laws, which often conflict.

- Currency & Taxation Rules: Managing multi-currency transactions requires adherence to different VAT, GST, and withholding tax laws in each country of operation.

- Cross-Border Data Transfers: The GDPR has strict rules on transferring personal data outside the EU. Fintechs must use approved mechanisms, such as Standard Contractual Clauses (SCCs), to ensure data transferred to the U.S. or other non-EU countries remains protected.

- Localization of Shariah Compliance: For fintechs entering the Middle East, compliance isn’t just a matter of law—it’s a matter of religious and cultural adherence. This often requires consulting with local Shariah scholars or regulatory bodies to ensure products are compliant.

Best Practices for Global Compliance:

- Appoint a Global Chief Compliance Officer (CCO): A single, dedicated leader to oversee all compliance efforts and ensure consistency across jurisdictions.

- Maintain a Compliance Matrix: A detailed, living document that maps all relevant regulations to each country of operation, providing a clear overview of requirements.

- Leverage RegTech Tools: Using technology to automate and streamline compliance processes is no longer optional but essential.

Technology Solutions for Compliance (RegTech)

The rise of RegTech (Regulatory Technology) has transformed how fintechs manage compliance.

- FDCPA Tools (US): For U.S. fintech lenders, automated dialers with built-in call-time restrictions prevent violations of the FDCPA. AI-driven communication monitoring can flag potentially harassing language or deceptive practices in real-time.

- GDPR Audit Checklists (EU): Automated data encryption dashboards and consent management platforms ensure that a company’s data practices align with GDPR rules. Automated breach reporting tools can also help meet the 72-hour notification requirement.

- AI & Machine Learning: These technologies are now central to modern compliance. They power real-time fraud detection by analyzing transaction patterns and behavior. AI-driven transaction monitoring systems for AML can detect suspicious activities with greater accuracy than traditional rule-based systems.

- Blockchain-Based Compliance: Blockchain’s inherent characteristics—immutability and decentralization—offer a new approach to compliance. It can create immutable records of all transactions, making audits faster and more transparent. Smart contracts can also be programmed to automatically enforce regulatory rules, such as releasing funds only after specific KYC requirements are met.

Case Insights: Real-World Compliance Failures & Lessons

Studying past failures offers critical lessons for the future.

- Case 1: Robinhood (US, 2021): The online trading app was fined $70 million by the Financial Industry Regulatory Authority (FINRA) for misleading customers about the true costs of its services and for system outages.

- Lesson: Transparent disclosures are not just a legal requirement but a fundamental aspect of building trust with users.

- Case 2: Revolut (EU, 2022): The neobank faced a €5 million fine from Irish regulators for weak AML controls. Auditors found that the company’s anti-money laundering systems were inadequate and that a significant number of suspicious transactions were not properly flagged.

- Lesson: Robust KYC and continuous transaction monitoring are not negotiable; they are the front line of defense against financial crime.

- Case 3: Wirecard (Germany, 2020): This German payment processor collapsed after an accounting fraud scandal involving €1.9 billion in missing cash. The scandal revealed major oversight failures and a lack of independent internal audits.

- Lesson: Internal audits must be truly independent and rigorous to prevent catastrophic fraud. A strong internal control environment is as important as external regulatory compliance.

Conclusion: Building Trust Through Compliance

In the fintech world, compliance is not a bottleneck—it is a competitive advantage. It’s not just about avoiding penalties; it’s about building long-term trust with customers, investors, and regulators. By embedding a culture of compliance into the very fabric of the organization, fintechs can not only mitigate risk but also unlock new opportunities for growth.

Embrace RegTech automation to stay ahead of the curve. The regulatory environment is dynamic, and manual processes cannot keep up. Using technology to automate monitoring, reporting, and data management is key to maintaining a proactive and effective compliance posture.

Treat compliance as a strategic investment, not a burden. Companies that invest in robust compliance systems from the start are better positioned to scale securely and attract more partners.

Build cross-functional teams that include legal, tech, and business experts. This ensures that compliance is integrated into every product and process, from the initial design phase to launch.