Debt Collection Technology & SaaS Solutions: “From Calls to Code” Tech Evolution of the Debt Collection

Introduction: The Tech-Driven Evolution of Collections

The debt collection industry has undergone a radical and rapid transformation over the past two decades. What was once defined by relentless phone calls, cumbersome paper trails, and manual record-keeping is now a sophisticated ecosystem powered by advanced digital platforms, artificial intelligence (AI), and data-driven strategies. This paradigm shift isn’t merely about adopting new tools; it’s a fundamental change in how agencies operate, driven by a confluence of powerful forces that have reshaped the financial landscape.

The evolution from a reactive, brute-force model to a proactive, empathetic one has been essential for survival. Modern agencies that ignore these technological advancements risk being left behind, struggling with inefficiency, high costs, and a constant battle to maintain compliance in an increasingly regulated environment.

Key Drivers Behind This Evolution

- Digitization of Financial Services: As consumers have embraced digital banking, online credit applications, and mobile payment platforms, their expectations for how financial services are delivered have changed. To be effective, collection agencies must now meet debtors on the same digital turf, offering seamless interactions through secure online portals, mobile apps, and instant messaging. This shift is no longer a luxury but a necessity for reaching and engaging a digitally native population.

- Regulatory Pressure: The legal and ethical landscape of debt collection has become significantly more complex. Stringent regulations such as the General Data Protection Regulation (GDPR) in Europe and the Fair Debt Collection Practices Act (FDCPA) in the United States demand meticulous record-keeping, non-harassing communication protocols, and robust data security. These rules are nearly impossible to manage manually. Technology provides the necessary framework to automate compliance checks, maintain a verifiable audit trail, and ensure all communications adhere to legal standards.

- Customer-Centric Models: The old, adversarial approach to collections is no longer sustainable. Modern systems emphasize empathy, negotiation, and providing debtors with convenient, self-service options. This approach not only improves recovery rates but also protects the agency’s and its clients’ reputations. It’s about empowering debtors to resolve their financial obligations on their own terms, which leads to better outcomes for everyone involved.

- Scalability Needs: As agencies grow and manage portfolios of hundreds of thousands, or even millions, of accounts, legacy systems simply cannot keep up. The need for a robust, scalable infrastructure has made SaaS (Software-as-a-Service) platforms an indispensable tool for efficient workload management and operational excellence. These cloud-based solutions can handle immense data volumes and user traffic without the need for significant capital investment in on-premise hardware.

SaaS Tools for Agencies: The Pillars of Modern Collections

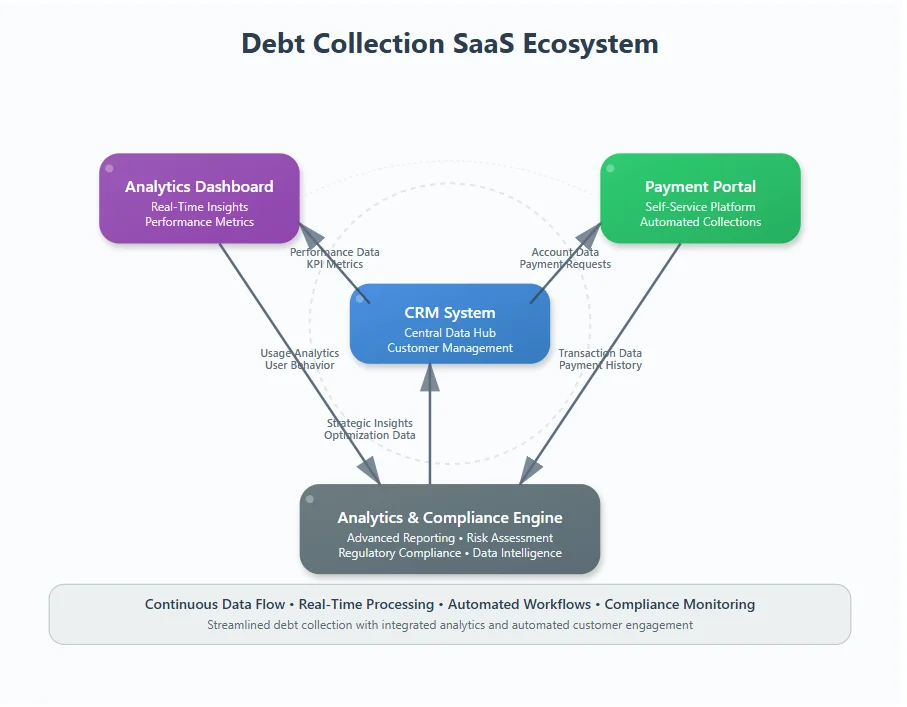

Modern debt collection agencies no longer build their IT infrastructure from the ground up. Instead, they rely on cloud-based SaaS platforms to unify their operations. These solutions offer a host of advantages over traditional systems, including rapid deployment, automatic updates, and cost-effectiveness. The core components of this SaaS ecosystem are the Customer Relationship Management (CRM) system, Payment Portals, and Real-Time Dashboards.

1. Customer Relationship Management (CRM)

A CRM is the central nervous system of a modern collection agency. It is a specialized database designed to track and manage all interactions with debtors. A CRM tailored for collections goes far beyond a generic sales tool; it provides a comprehensive, centralized record for every single account.

- Unified Debtor Profiles: Each account is a complete profile, including the debtor’s credit history, a detailed log of all communication (calls, emails, SMS), and the specifics of any payment plans or settlements. This single source of truth ensures that every agent has access to the same, up-to-date information, preventing confusion and enhancing efficiency.

- Automated Reminders and Workflows: The system can be programmed to send automated reminders for follow-ups, ensuring that no account falls through the cracks. It can also route specific accounts to specialized agents based on predefined rules, optimizing the collection process.

- Integration with Communication Platforms: A good CRM seamlessly integrates with call systems, email, and SMS platforms. Agents can make calls and send messages directly from the system, and all interactions are automatically logged. This saves time and provides a complete audit trail.

- Compliance Monitoring: Crucially, a collections CRM can be configured with compliance monitoring rules that automatically flag risky communication patterns or actions that could violate regulations. This provides an essential layer of protection and accountability.

2. Payment Portals

Digital payment portals are a cornerstone of a customer-centric strategy, empowering debtors with a convenient, self-service option to resolve their dues. This model significantly shifts the responsibility of making a payment from the agency’s call center to the debtor.

- 24/7 Accessibility: Debtors can access the portal at any time, on any device (web or mobile), allowing them to make payments on their own schedule without the pressure of a live agent.

- Multiple Payment Options: The portals support a wide range of payment methods, from traditional credit cards and net banking to modern digital wallets and UPI, catering to diverse consumer preferences and increasing the likelihood of a successful transaction.

- Automated Installment Scheduling: Debtors can view their balance, set up a new payment plan, or schedule future instalments directly through the portal, reducing the need for agent assistance.

- Reduced Dependency on Agents: By handling routine payment tasks, these portals free up call-center agents to focus on more complex, high-value cases that require negotiation and human intervention.

3. Real-Time Dashboards

In an industry where every second and every dollar counts, real-time dashboards provide invaluable data visibility. They are the cockpit of the collection operation, presenting key performance indicators (KPIs) in an easy-to-digest format.

- Performance Metrics: Managers can track key metrics such as recovery rates broken down by agent, team, or portfolio, providing a clear picture of performance and identifying areas for improvement.

- Debtor Engagement Statistics: Dashboards show how debtors are interacting with the agency’s outreach, including response rates by channel (SMS, email, phone call). This data helps refine outreach strategies for better engagement.

- Compliance Monitoring: They can instantly highlight compliance violations or flagged cases, allowing managers to take immediate corrective action and mitigate legal risk.

- Forecasting: Advanced dashboards can provide forecasts of expected recoveries, helping agencies plan their financial strategy and resource allocation with greater accuracy.

AI in Collections: Shifting from Reactive to Predictive

Artificial intelligence has fundamentally changed the collections strategy from a reactive, brute-force approach to a sophisticated, predictive model. By leveraging machine learning, agencies can now analyze vast datasets to identify the likelihood of repayment, prioritize accounts, and personalize their outreach in ways that were previously unimaginable.

1. Skip Tracing with AI

Skip tracing, the process of locating debtors who have changed their contact information, has long been a manual and time-consuming task. AI has revolutionized this process.

- Scanning Multiple Databases: AI-powered skip tracing tools can scan a multitude of public and private databases—including credit bureaus, utility bills, and public records—at lightning speed.

- Matching Fragmented Data: They are designed to match fragmented or incomplete data points (e.g., a partial address with an old phone number) and to cross-reference information to build a complete profile.

- Reducing False Positives: By validating data accuracy, AI reduces false positives, saving agents from chasing dead ends and significantly increasing their efficiency.

- Speed and Efficiency: The entire process, which could take a human agent hours, is completed in seconds, allowing the agency to move on to the next step of collection much faster.

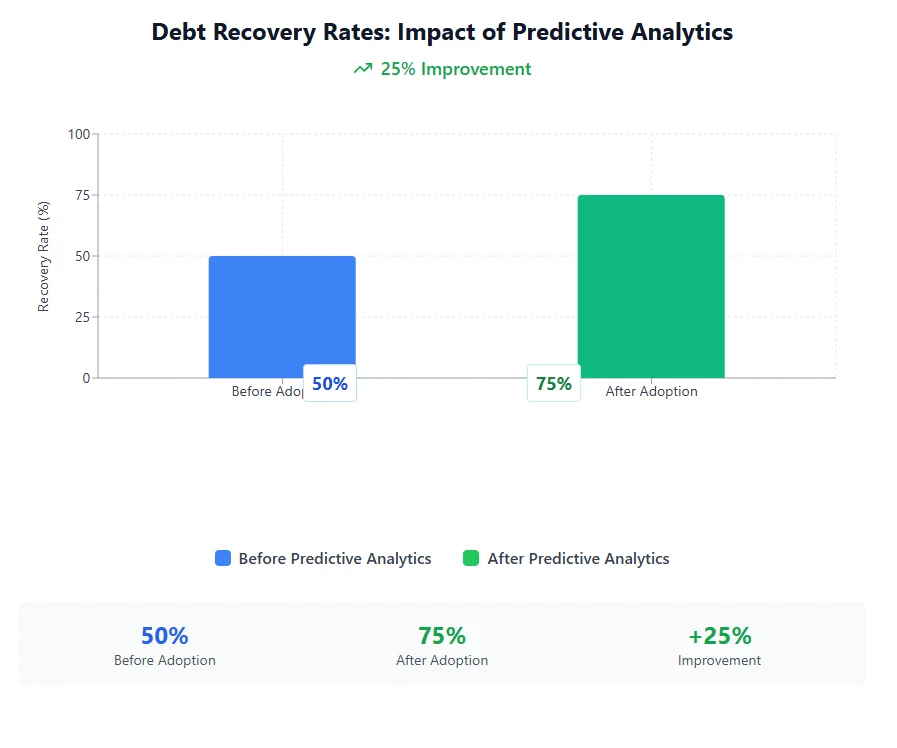

2. Predictive Analytics

The core of AI in collections is predictive analytics. These models analyze historical data to assess the probability of repayment for each debtor.

- Debtor Segmentation: Predictive models can segment debtors into categories like “high-likelihood payers” who may only need a gentle nudge, versus “low-priority accounts” that are unlikely to respond to standard outreach. This allows agencies to allocate their human resources more efficiently.

- Optimizing Outreach: The models can determine the best time and channel for contact, for example, predicting that a specific debtor is more likely to respond to a text message on a Saturday morning than a phone call on a Monday afternoon.

- Forecasting and Planning: Advanced models help in forecasting monthly recovery amounts with greater accuracy, aiding in financial planning and resource allocation.

- Personalized Repayment Plans: By understanding a debtor’s profile and history, the AI can suggest tailored repayment plans that are more likely to be successful, such as a flexible installment schedule instead of a lump sum payment.

Omnichannel Communication: Engaging Debtors on Their Terms

In the past, debt collection was synonymous with the ringing of a telephone. Today, that approach is outdated and often ineffective. Omnichannel communication ensures that agencies can reach debtors on their preferred platforms while maintaining strict compliance. This approach respects the debtor’s privacy and offers a less confrontational means of communication.

1. SMS & WhatsApp Messaging

Text-based communication offers a non-intrusive and highly efficient way to engage debtors.

- Automated Reminders: Automated payment reminders can be sent via SMS, often with a direct link to a secure payment portal. This is a cost-effective and low-friction method.

- Two-Way Communication: Platforms like WhatsApp also allow for quick, two-way communication for simple queries or to provide a less intimidating way for debtors to initiate contact.

2. Chatbots & Virtual Assistants

For a generation that prefers texting over talking, chatbots and virtual assistants are the perfect solution.

- 24/7 Availability: Chatbots are available around the clock to answer frequently asked questions like, “How can I set up an installment plan?” or “What is my outstanding balance?”

- Cost Reduction: By handling these common, routine queries, chatbots can reduce call center costs by up to 40% and free up human agents to focus on complex negotiations.

- Personalization: When integrated with the CRM, chatbots can provide personalized, context-aware responses, making the interaction feel more tailored and less robotic.

3. Interactive Voice Response (IVR)

While live calls remain important, Interactive Voice Response (IVR) systems have modernized the process.

- Automated Payments: These automated phone systems allow debtors to make payments directly, without the need to speak to an agent.

- Multilingual Support: With multilingual support, IVR systems can cater to a broader audience, breaking down language barriers.

- Call Routing: IVR systems are also crucial for routing calls to specialized agents for cases that require a human touch, such as hardship discussions or complex disputes.

Case Study: A UK Agency’s Digital Transformation

To truly understand the impact of this technology, consider the case of a mid-sized UK debt collection agency that embarked on a complete digital overhaul.

Background and Challenges

The agency managed a portfolio of 250,000 active debtor accounts and relied heavily on outdated methods like phone calls and mailed letters. They faced significant challenges in complying with the stringent regulations of the Financial Conduct Authority (FCA). Key issues included:

- High Operational Costs: Due to manual processes and a large call center staff.

- Low Recovery Rates: Their recovery rates were stagnant, often below 35%.

- Inconsistent Data: A lack of consistent, centralized debtor communication logs made compliance audits a nightmare.

The Transformation Journey

The agency made a strategic decision to invest in a comprehensive SaaS ecosystem. Their journey involved:

- Adopting a specialized SaaS CRM for centralized debtor management and a single source of truth.

- Launching a secure payment portal with a variety of self-service options.

- Integrating an AI-powered skip tracing solution to efficiently locate unresponsive debtors.

- Implementing a full omnichannel communication strategy, including SMS, chatbots, and IVR.

- Building custom dashboards for real-time compliance monitoring and performance reporting.

Results After 12 Months

The transformation yielded remarkable results:

- Recovery Rates Increased from 35% to 52%, a significant improvement that directly impacted their bottom line.

- Operational Costs Reduced by 28% as automation replaced manual tasks.

- Customer Satisfaction Scores Improved by 40%, reflecting the shift to a more convenient and empathetic approach.

- They passed multiple FCA audits with zero compliance issues, securing their license and reputation for the long term.

Future Outlook: Beyond Today’s Technology

The evolution of debt collection technology is far from over. Future innovations will likely be driven by decentralized systems, advanced identity verification, and novel payment methods.

1. Blockchain in Debt Collection

Blockchain, with its principles of transparency and immutability, holds immense promise for the industry.

- Smart Contracts: These could be used for automated repayment agreements, ensuring that payments are released only when conditions are met, creating a trustless and efficient system.

- Immutable Audit Trails: Blockchain’s distributed ledger would provide an unalterable record of all transactions and communications, offering an irrefutable audit trail for compliance reporting.

2. Digital Identity Verification

As fraud risks rise, digital identity tools will become a critical component.

- Biometric Authentication: This could be used for secure debtor logins to payment portals, ensuring that only the authorized individual can access the account.

- e-KYC Systems: Integration with government-verified e-KYC systems will help reduce cases of mistaken identity and ensure the right person is being contacted.

3. Integration with Central Bank Digital Currencies (CBDCs)

Future payment portals may directly integrate with Central Bank Digital Currencies (CBDCs), a new form of digital money. This could lead to:

- Faster Settlement: Payments would settle in real-time, eliminating delays and processing fees.

- Real-Time Traceability: All transactions would be instantly traceable, providing an added layer of transparency and security.

A New Era of Efficiency and Empathy

Debt collection is no longer a world of repetitive phone calls and legal threats. With the rise of SaaS solutions, AI, omnichannel engagement, and the nascent potential of technologies like blockchain, the industry is entering a new era of efficiency, compliance, and customer-centricity.

Agencies that embrace these technologies will not only recover more debt but also build stronger reputations and long-term client trust. The ultimate takeaway is that the future of debt collection belongs to those who leverage data, automation, and innovation to strike a crucial balance between achieving recovery goals and treating debtors with dignity and respect. The technological tools are no longer just an option; they are a necessity for survival and success in the modern financial landscape.