Debt Collection Best Practices & Playbooks: Ethical Approaches to Debt Recovery

for Modern Agencies

The Imperative of Best Practices in a Changing World

Debt collection, long perceived as a confrontational and purely transactional process, is undergoing a profound transformation. In today’s interconnected and reputation-driven economy, it’s no longer just about recovering money; it’s about sustaining long-term customer relationships, ensuring stringent regulatory compliance, and optimizing operational efficiency. For any entity handling receivables—be it a debt collection agency, a financial institution, or a business of any size—adhering to a robust set of best practices isn’t a competitive advantage; it’s a fundamental necessity for survival and growth.

The stakes are higher than ever. A single misstep can lead to severe financial penalties, significant reputational damage, and the erosion of consumer trust that takes years to rebuild. Conversely, a well-structured, ethical, and technology-driven approach can lead to remarkable outcomes:

- Higher recovery rates without compromising brand reputation.

- Flawless regulatory compliance across a patchwork of global jurisdictions.

- Reduced operational costs through streamlined, automated workflows.

- Improved consumer experiences, which in turn lead to fewer disputes and complaints, foster a more cooperative environment for resolution.

As a testament to this, data from ACA International highlights a compelling correlation: agencies that implement structured compliance frameworks and invest in comprehensive training programs report 15–20% higher recovery rates than those that do not. This isn’t a coincidence; it’s a direct result of building trust, reducing friction, and operating within a clear, ethical framework.

Part 1: Compliance-First Collection: The Unshakeable Foundation

At the heart of any successful debt collection operation is an unwavering commitment to compliance. The legal and ethical landscape of debt collection is fraught with complexity, and ignorance of the law is never an excuse. A single violation, regardless of intent, can trigger fines, costly lawsuits, and irreversible reputational harm.

Key Global Regulations and Their Implications

Understanding and integrating a “compliance-first” mindset requires a deep dive into the specific rules governing collection activities in different parts of the world.

- United States: The regulatory framework is largely defined by the Fair Debt Collection Practices Act (FDCPA). This landmark legislation restricts aggressive and deceptive practices, dictating specific rules around communication, such as time of contact, prohibition of harassment, and the requirement to validate a debt. The Consumer Financial Protection Bureau (CFPB) provides a layer of oversight, issuing guidelines that further define what constitutes fair practices, with a strong focus on protecting consumer rights and ensuring clear, accurate disclosures. For example, the CFPB’s Regulation F (part of the FDCPA) has updated rules for email and text message communications, requiring opt-out options and specific disclosures.

- European Union: The EU’s regulations are heavily influenced by the General Data Protection Regulation (GDPR). This law governs how personal data, including debt information, is collected, stored, and used. Collectors must have a lawful basis for processing data, provide clear privacy notices, and respect a consumer’s right to access or rectify their information. Furthermore, directives on Unfair Commercial Practices prevent misleading or aggressive collection tactics, such as making false claims about legal status or impersonating officials.

- Asia-Pacific: This region presents a diverse landscape of regulations. In India, the Reserve Bank of India (RBI) Debt Collection Guidelines set clear boundaries on the conduct of collection agents, emphasizing respectful behavior and prohibiting harassment. Australia’s ASIC Debt Collection Regulations focus on fairness, with a strong emphasis on a consumer’s ability to pay and a prohibition on undue pressure. Each country has its own set of rules, requiring a localized approach to compliance.

- Middle East & Africa: Consumer protection is a growing focus. In the UAE, for instance, laws are tightening to require clear documentation and communication standards, moving away from past, less-regulated practices. South Africa’s National Credit Act provides a robust framework that regulates credit providers and collection practices, mandating ethical behavior and fairness.

The High-Stakes Risks of Non-Compliance

Ignoring these rules is a perilous gamble. The consequences can be catastrophic:

- Financial Penalties: Regulatory bodies can impose crippling fines. In the US, FDCPA violations can lead to statutory damages of up to $1,000 per violation, plus actual damages. The GDPR, meanwhile, can impose fines of up to 4% of a company’s global annual revenue for serious breaches.

- Reputation Loss: In the age of social media and online reviews, a single negative customer experience or news of a lawsuit can spread like wildfire, causing immense reputational damage that can deter new customers and harm existing relationships.

- Operational Setbacks: Legal disputes and regulatory investigations are time-consuming and resource-intensive, diverting attention and capital from core business activities. This can paralyze an organization and significantly increase its cost-to-collect.

Part 2: Data-Driven Excellence: Measuring What Matters

The adage, “You can’t improve what you don’t measure,” holds particularly true in debt collection. A successful strategy is not built on guesswork but on a foundation of clear, quantifiable metrics. Tracking the right Key Performance Indicators (KPIs) allows an organization to identify strengths, pinpoint weaknesses, and make informed decisions that drive efficiency and profitability.

Essential Metrics for Success

- Recovery Rate: The most fundamental metric, representing the percentage of total debt successfully collected. This can be broken down by portfolio age, debt type, or agent performance to provide deeper insights.

- Days Sales Outstanding (DSO): Measures the average time it takes to collect payments after a sale. Lowering DSO improves cash flow and reduces the risk of accounts becoming uncollectible.

- Right-Party Contact Rate (RPC): The percentage of successful connections with the actual debtor. A high RPC indicates effective skip-tracing and contact strategies, reducing wasted agent time.

- Promise-to-Pay (PTP) Rate: The percentage of debtors who commit to a payment plan. This metric is often followed by the PTP Kept Rate, which measures how many of those promises are actually honored, serving as a powerful indicator of both the quality of the promise and the effectiveness of follow-up.

- Dispute Rate: The frequency of disputes raised by consumers. A high dispute rate can signal underlying issues with data accuracy, communication clarity, or compliance, highlighting areas that need immediate attention.

- Cost-to-Collect Ratio: The total cost incurred in collection efforts (including salaries, technology, and legal fees) versus the total amount recovered. A lower ratio indicates greater operational efficiency.

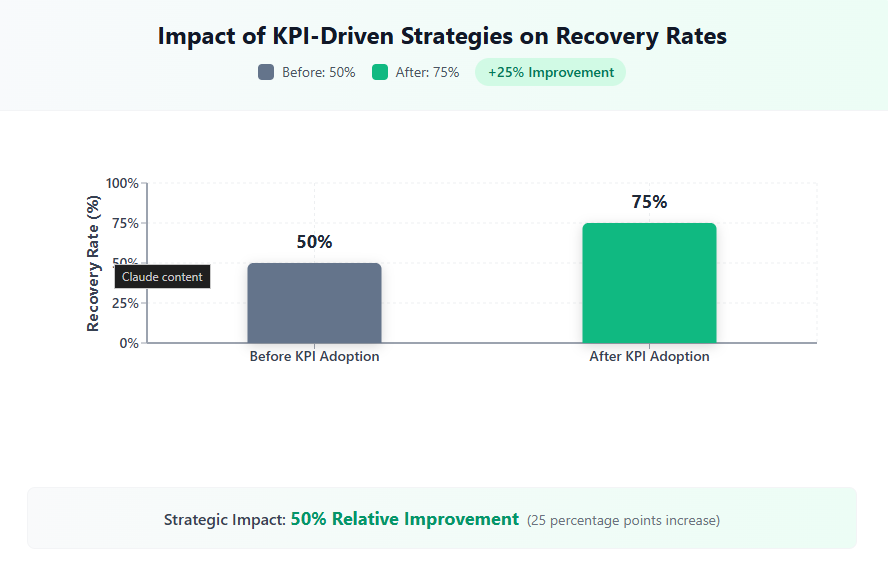

By regularly tracking and analyzing these metrics, organizations can move from a reactive to a proactive model. For instance, a comparison of recovery rates before and after implementing a KPI-driven strategy almost always reveals a significant positive shift, demonstrating the power of data in optimizing performance.

Part 3: Strategic Scaling: Balancing Cost and Recovery

One of the most significant challenges for growing collections operations is scaling sustainably without letting costs spiral out of control. The key lies in the strategic allocation of resources and the smart integration of technology.

Smart Strategies for Affordability

- Automation & AI:

- Predictive dialers are a classic example, using algorithms to reduce agent idle time by connecting them only to answered calls.

- Chatbots and automated self-service portals can handle routine queries (e.g., “What’s my balance?”), freeing up human agents to focus on more complex, high-value conversations.

- AI-driven risk scoring uses machine learning to analyze data points and predict the likelihood of an account being recovered. This allows agents to prioritize high-potential accounts, significantly increasing efficiency.

- Outsourcing vs. In-House:

- Outsourcing offers a flexible way to achieve scale without the significant overhead of hiring, training, and managing large in-house teams. It’s particularly useful for handling high volumes of low-value accounts or for managing portfolios in different geographic regions.

- In-house teams provide greater control over compliance, quality, and brand image. They are ideal for managing sensitive accounts or for organizations that prioritize a very specific customer experience.

- Hybrid models combine the best of both worlds, using a small, specialized in-house team for strategic accounts while leveraging outsourced partners for scale and cost-effectiveness.

- Digital-First Collections:

- Self-service portals empower consumers to view their balance, set up payment plans, and make payments 24/7 without needing to speak to an agent.

- SMS and email reminders offer a non-intrusive way to prompt payments and provide links to these portals, drastically reducing the workload on human agents.

- An integrated CRM (Customer Relationship Management) system is a non-negotiable component of a digital-first strategy. It centralizes all communication history, payment information, and notes, ensuring every interaction is informed and efficient.

Part 4: Empathy and Training: The Human Element of Collection

The debt collection industry has historically been associated with aggressive and even harassing behavior. Modern, successful agencies are proving that this approach is outdated and counterproductive. The future of collections is built on empathy-driven communication and a highly trained workforce.

Best Practices for Training and Communication

- Scripts with Flexibility: Instead of rigid, robotic scripts, provide agents with flexible guidelines. These guidelines should ensure that all compliance-related disclosures are made, but they should also empower agents to adapt their tone and approach to the specific needs of the consumer.

- Empathy-Driven Communication: Agents must be trained to recognize and acknowledge the financial hardship a consumer may be facing. This involves active listening and using non-judgmental language. The goal is to be a partner in problem-solving, not an adversary. Offering flexible solutions, such as payment restructuring or hardship plans, can turn a potential dispute into a successful resolution.

- Continuous Learning: Training should not be a one-time event. It should be an ongoing process that includes:

- Role-playing difficult scenarios to prepare agents for real-world challenges.

- Regular compliance refreshers to keep teams updated on evolving regulations.

- Soft-skill development, including negotiation, de-escalation, and conflict resolution techniques.

Part 5: Playbooks & Checklists: Standardizing Excellence

To ensure consistency and minimize errors across a team, it is crucial to provide a standardized set of tools. Playbooks and checklists serve as the backbone of a well-organized collection operation.

Examples of Actionable Tools

- Early-Stage Collections Playbook: Focuses on a soft, friendly approach. This playbook would outline the use of gentle reminders via text or email, and offer self-service payment options to make the process as easy as possible.

- Mid-Stage Collections Playbook: This guide would introduce a more structured approach, outlining specific payment plan options and compliance-driven follow-up procedures. The tone remains professional but more direct.

- Late-Stage Collections Playbook: This is the playbook for accounts nearing legal action. It outlines escalation procedures, legal involvement protocols, and detailed settlement negotiation strategies, all while maintaining strict compliance.

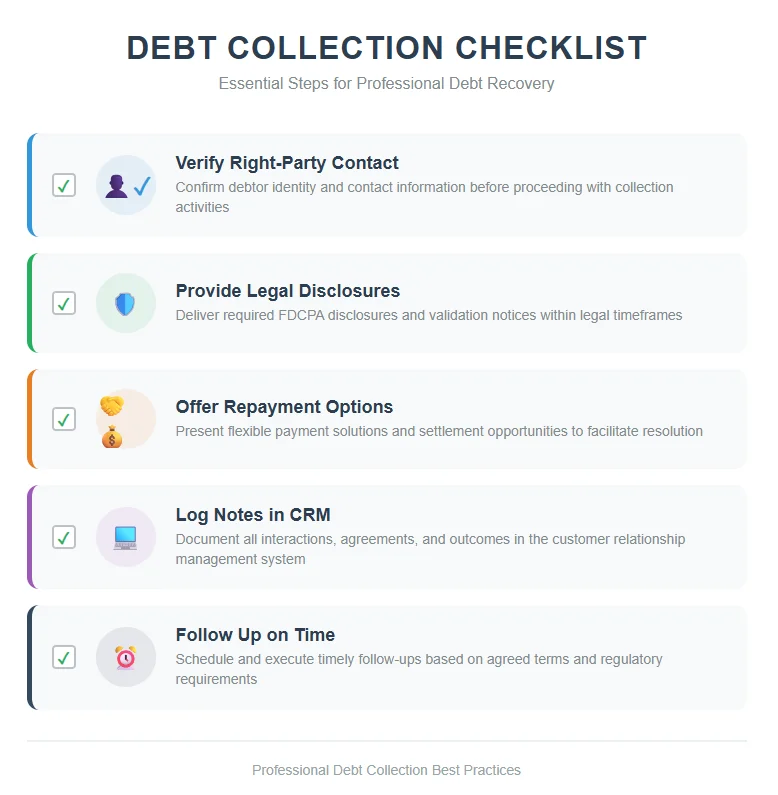

Sample Checklist for Every Interaction

To prevent oversights, a simple, concise checklist can be a powerful tool for agents to use on every call:

- ✅ Have I verified the right-party contact to ensure I’m speaking with the correct person?

- ✅ Have I provided all disclosures required by law (e.g., “This is an attempt to collect a debt…”)?

- ✅ Have I offered at least one flexible repayment option tailored to the consumer’s situation?

- ✅ Have I accurately logged all call notes, promises, and follow-up dates in the CRM?

- ✅ Have I scheduled the next follow-up within the agreed-upon timeframe?

The Future of Collections is Sustainable and Ethical

The debt collection landscape is in a constant state of flux, shaped by evolving regulations, rapid digital transformation, and shifting consumer expectations. The organizations that will not only survive but thrive are those that recognize this evolution and embrace a new set of best practices.

By building a framework founded on compliance-first principles, driven by KPI-based decision-making, optimized through cost-effective scaling, and powered by an empathy-driven workforce, organizations can create a sustainable, scalable, and consumer-friendly collection system. This isn’t just about making the process more efficient; it’s about rebuilding trust and proving that ethical debt collection is not only possible but also the most profitable and responsible path forward.