Buying & Selling Consumer Debt: The Complete Guide

What Is Debt Buying & Why It Matters

Consumer debt isn’t just about people borrowing money; it’s also about what happens when borrowers stop paying. At that point, a huge secondary market comes into play where lenders sell delinquent accounts to investors and collection agencies, who then attempt to collect. This practice is known as debt buying.

Debt buying serves two key functions:

- For lenders: It reduces losses by converting “bad debt” into immediate cash, even if at a discount.

- For buyers: It provides an investment opportunity where profit comes from collecting more than the purchase price.

📊 The Size of the Market: A Deeper Dive

The scale of the consumer debt market is staggering. In the United States, consumer debt reached a monumental $17.5 trillion in the second quarter of 2025, according to the Federal Reserve. Within this figure, credit card debt alone surpassed $1.4 trillion, highlighting the immense volume of revolving credit.

Of this massive total, a significant portion—around $80–100 billion in consumer debt—is sold annually on the secondary market. This consistent flow of debt portfolios from originators to buyers underpins a vibrant, albeit complex, ecosystem.

💡 Why It Matters: Liquidity, Efficiency, and Ethical Concerns

Without this market, lenders would be forced to hold onto mountains of uncollected debt, tying up their balance sheets and restricting their ability to issue new credit. Debt buyers create liquidity, allowing lenders to quickly recover some value from non-performing assets and reinvest that capital. This process is crucial for the health of the financial system.

However, the system also raises significant consumer protection and ethical collection concerns. When a debt is sold, the new owner may not have the same level of documentation as the original lender, potentially leading to disputes and errors. This makes compliance and professionalism not just good business practice but an essential requirement for avoiding legal and reputational damage. The entire framework operates on a delicate balance between financial efficiency and the rights of consumers.

How Debt Leads Work: Flow from Lender to Buyer

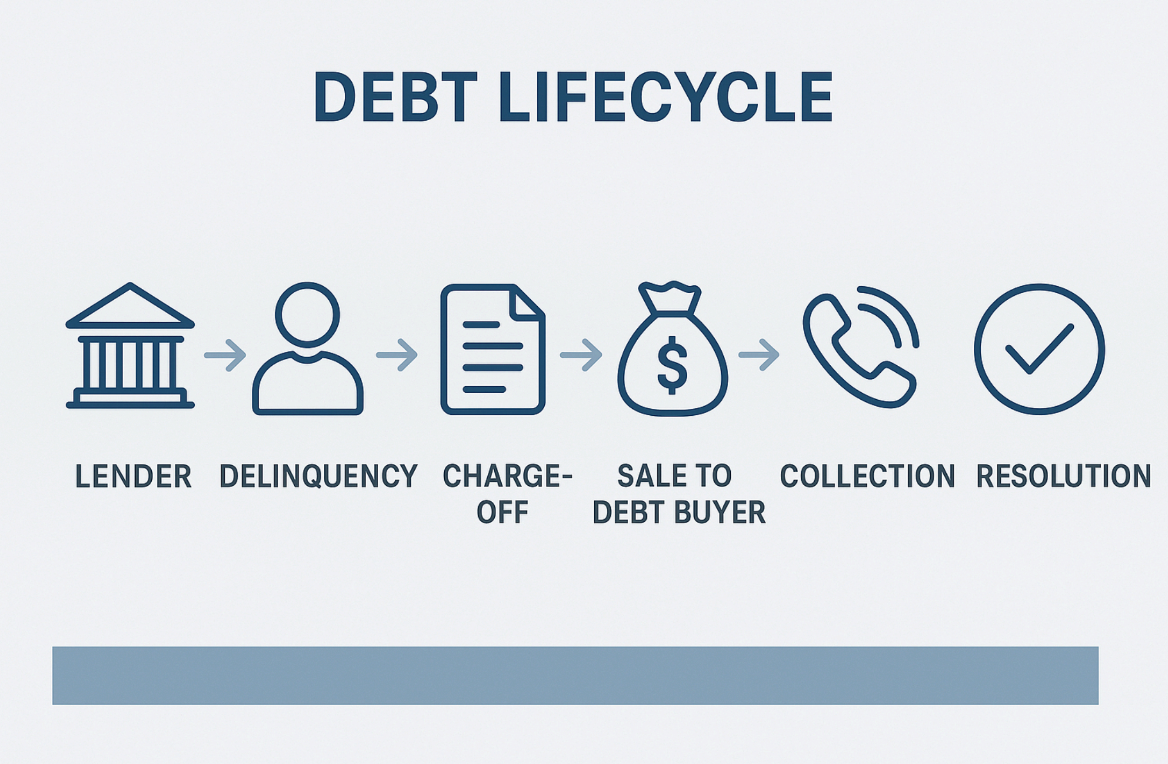

Debt doesn’t jump directly from a consumer to a collection agency; it goes through a meticulously defined lifecycle. This journey, from a simple transaction to a charged-off asset, is crucial for understanding the debt buying process.

🔄 The Debt Lifecycle: A Step-by-Step Breakdown

- Step 1: Origination: This is the beginning. A consumer signs up for a credit card, takes out a personal loan, finances a car, or receives a medical service. The account is considered “performing” as long as payments are made on time.

- Step 2: Delinquency: If payments are missed for a period, typically 90 to 180 days, lenders categorize the account as “delinquent.” During this phase, the original lender’s internal collection teams will attempt to contact the borrower to resolve the issue.

- Step 3: Charge-Off: After approximately six months (180 days) of nonpayment, U.S. banks are legally required to “charge off” the account. This is an accounting measure where the lender writes the debt off as a loss for tax and regulatory purposes. It’s important to note that a charge-off does not erase the debt; the consumer still legally owes the money. This is the point at which the debt becomes a prime candidate for sale.

- Step 4: Debt Sale: The lender may sell a large portfolio of charged-off accounts to a debt buyer—usually at a fraction of its face value. The price is determined by the age and quality of the debt.

- Fresh portfolios (less than 1 year old) are more likely to be collected and, thus, sell at a higher price, often 10–15 cents per dollar.

- Stale portfolios (over 3 years old) have a lower probability of collection and may sell for just 1–3 cents per dollar.

- Step 5: Collection Efforts: Once the debt is purchased, the new owner, the debt buyer, begins collection efforts. They will either:

- Use their in-house collection team, which requires significant operational overhead and expertise.

- Outsource the accounts to a third-party collection agency, paying a percentage of any money collected.

- Step 6: Resolution: The ultimate goal of the debt buyer is resolution. This happens when the consumer:

- Pays in full, satisfying the original balance.

- Negotiates a settlement for a reduced amount, which is a common outcome.

- Declares bankruptcy, in which case the debt may be discharged, and recovery may be minimal or non-existent.

👉 A Practical Example of the Business Model:

Let’s illustrate the financial mechanics with a simple scenario.

- Portfolio Face Value: The total amount of money owed across all accounts is $5,000,000.

- Purchase Price: The debt buyer acquires this portfolio for $500,000.

- Total Recovery: Over time, the buyer successfully collects $1,500,000 from consumers in the portfolio.

- Return on Investment (ROI): The profit is the recovered amount minus the purchase price ($1,500,000 – $500,000 = $1,000,000). The ROI is calculated as (Profit / Purchase Price) x 100, which is ($1,000,000 / $500,000) x 100 = 200%.

This simplified model explains why investors are so attracted to debt buying despite the inherent risks. The potential for high returns on a relatively low initial investment is a powerful motivator.

Types of Debt Portfolios

Debt portfolios are not monolithic; they vary widely in terms of risk, collectability, and pricing. A successful debt buyer understands these nuances and specializes in the types of debt that align with their operational strengths.

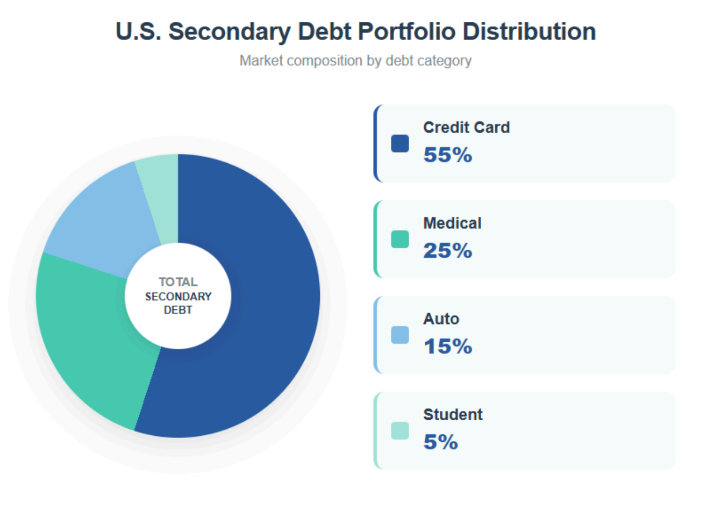

1. Credit Card Debt

This is the largest and most traded category in the secondary debt market. Sold in bulk by major banks and credit card issuers, these portfolios are attractive due to their high volume and the relative ease of tracing consumers. The average sale price for credit card debt ranges from 3–15 cents per dollar owed, depending on the age and quality of the accounts. Some buyers specialize in “fresh” credit card portfolios, while others prefer older, cheaper accounts, demonstrating the diversity within this single category.

2. Medical Debt

Hospitals, clinics, and other healthcare providers frequently sell unpaid medical bills. This type of debt often has a lower ROI because many of the debts are a result of unexpected hardship or are disputed by patients due to billing errors or insurance issues. In a significant shift, the three major U.S. credit bureaus (Experian, TransUnion, Equifax) announced limits in 2022 on how medical debt appears on credit reports, making it a more difficult and controversial portfolio type to collect on.

3. Auto Loan Debt

This category includes deficiency balances left over after a vehicle has been repossessed and sold. Collection efforts can be more complex, but the debt may be secured by a repossessed asset (the car itself), which can provide some recovery value. The ROI can be higher if the collateral can be resold for a good price, but it’s riskier if the borrower is insolvent and the vehicle’s value has depreciated significantly.

4. Student Loan Debt

Federal student loans are rarely sold due to government protections and various repayment programs. However, private student loans may be sold on the secondary market. They are often harder to collect due to their longer repayment terms and the frequency of deferments or forbearances, which can make a borrower’s payment history less reliable.

5. Other Debt Types (Emerging Markets)

- Buy-Now-Pay-Later (BNPL) loans, from services like Affirm or Klarna, are becoming a hot new portfolio type as their popularity explodes.

- Utility bills and telecom debts from companies like Comcast or Verizon are also frequently packaged and sold, especially in markets outside the U.S. like Europe and Asia.

Compliance Factors: Avoiding Legal Pitfalls in Debt Purchasing

Debt buying isn’t just about crunching numbers; it’s about staying compliant with a complex web of regulations that protect consumers. The legal landscape is constantly evolving, and a single mistake can lead to massive fines and lawsuits.

U.S. Federal Laws

- FDCPA (Fair Debt Collection Practices Act): This is the cornerstone of consumer protection in debt collection. It prohibits debt buyers and collectors from using harassment, misrepresentation (like pretending to be a lawyer), or unfair practices (like adding excessive fees) in their collection attempts.

- FCRA (Fair Credit Reporting Act): This law governs how debt can be reported to credit bureaus. It requires that all information reported is accurate and verifiable. Consumers have the right to dispute any inaccuracies on their credit report.

- CFPB (Consumer Financial Protection Bureau) Rules: The CFPB enforces strict documentation and disclosure requirements. Its rules, often referred to as Regulation F, mandate what information must be provided to a consumer in the initial collection notice and place limits on communication methods, such as phone calls and emails.

State and Global Regulations

- State Regulations: Beyond federal laws, many states have their own, often stricter, rules. States like New York, California, and Massachusetts require special debt buyer licenses and have specific statutes of limitations on how long a debt can legally be collected.

- Global Regulations: The U.S. is not unique. The EU’s Consumer Credit Directive regulates debt transfers, while in India, the RBI has strict guidelines for how non-banking financial companies (NBFCs) can sell and collect debt. Australia also has its own regulatory body, ASIC, that governs consumer credit and debt purchasing.

Compliance Checklist for Buyers

A smart debt buyer has a robust compliance program. They will:

- ✔ Ensure a clear chain of title. This is paramount. They must be able to prove they legally own the debt by tracing its sale from the original lender.

- ✔ Validate debt documentation. They must have access to the original loan agreement, payment history, and other documents to prove the debt is valid and the amount owed is correct.

- ✔ Maintain call recordings and audit logs. These records are essential for proving compliance in the event of a consumer complaint or a regulatory audit.

- ✔ Train staff in consumer rights compliance. Regular and comprehensive training is a non-negotiable part of running a legitimate debt buying business.

Conversely, they must ❌ Avoid:

- “Zombie debt”: This refers to debt that is too old to be legally collected or has already been paid off. Reselling or attempting to collect on such debt is a serious legal violation.

- Fake portfolios: Unscrupulous sellers sometimes attempt to sell portfolios with no legal enforceability. Due diligence is critical to prevent this.

ROI & Valuation Models: Profitability, Pricing, and Risks

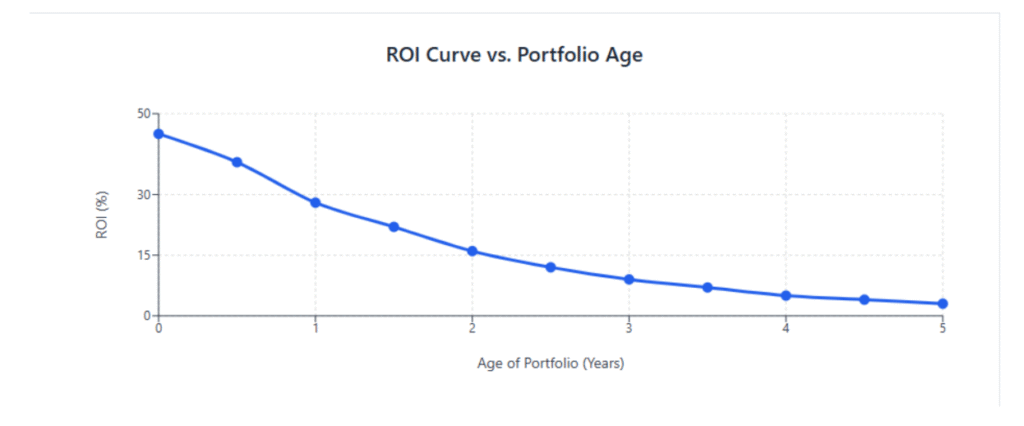

Debt buying can be extremely profitable, but success hinges entirely on accurate valuation. Overpaying for a portfolio is the most common reason for failure in this industry.

Common Valuation Models

Debt buyers use a variety of models to determine what a portfolio is worth.

- Face Value Percentage: This is the simplest model, where portfolios are priced as a small percentage of the total original balance. While easy, it’s a rough estimate and doesn’t account for individual account quality.

- Expected Recovery Rate (ERR): This is a more sophisticated model. It’s a forecast of how much can realistically be collected from a portfolio, often based on historical data from similar debt types.

- Net ROI: This model calculates the ultimate profitability by taking all costs into account. The formula is: (Collections – Costs – Purchase Price) ÷ Purchase Price.

A Deeper Look at the ROI Calculation:

Let’s expand on the previous example to include operational costs.

- Portfolio Value: $10M

- Purchase Price: $1.2M (12% of face value)

- Collection Yield: The amount successfully collected from consumers is $3.5M.

- Collection Costs: This includes staff salaries, technology, legal fees, etc., totalling $800K.

- Net Profit: $3.5M (Yield) – $1.2M (Purchase) – $800K (Costs) = $1.5M

- Net ROI: ($1.5M / $1.2M) x 100 = 125%.

Key Risks

- Overpaying: The biggest risk is a miscalculation that leads to an inflated purchase price.

- Economic Downturns: A recession or job losses can significantly reduce a consumer’s ability to repay, plummeting collection rates.

- Legal Challenges: Disputes over ownership or collection tactics can lead to lawsuits and loss of collection rights.

- High Compliance Costs: Keeping up with regulations requires a significant investment in technology, training, and legal expertise.

Best Practices in Debt Buying: Avoiding Scams & Vetting Sellers

The debt buying market can be profitable—but also riddled with scams. To succeed, buyers must be diligent and professional.

Avoiding Scams

- Purchase from Reputable Sources: Only deal with banks, credit unions, or licensed and well-known debt brokers.

- Demand Chain-of-Title Documentation: A legitimate seller will provide a clear, documented history of the debt from its origination. If they can’t, walk away.

- Use Escrow Accounts: For large purchases, use a third-party escrow service to ensure funds are not released until the debt portfolio is properly transferred and verified.

- Beware of “Too Good to Be True” Pricing: If a portfolio is being sold for an unbelievably low price, it’s a major red flag that the debt is likely uncollectible, improperly documented, or even fake.

Vetting Sellers

Before making a purchase, a thorough vetting process is essential.

- Verify their track record with other buyers in the industry.

- Request sample account audits to examine the quality of the data and documentation for a representative sample of accounts.

- Confirm state licensing in all jurisdictions where the seller operates.

Operational Best Practices

The most successful debt buyers are not just good at buying; they are experts at collecting efficiently and ethically.

- Invest in AI-driven skip tracing to find debtors who have moved or changed their contact information.

- Use predictive analytics to prioritize accounts with the highest probability of repayment.

- Maintain a consumer-first compliance culture where staff are trained to be respectful, transparent, and helpful, as this leads to higher repayment rates and fewer complaints.

Case Study: ROI for a U.S. Lender

Let’s look at a real-world scenario from the perspective of a lender.

- Lender: A mid-size U.S. regional bank.

- Portfolio: Charged-off credit card debt that has been on their books for over a year.

- Face Value: $50 million. The bank has already written this off as a loss.

- Sale Price: A debt buyer offers the bank $6 million for the portfolio (12% of face value).

- Lender’s Gain: The bank gains immediate liquidity. Instead of having a useless $50 million asset on its books, it has $6 million in cash that it can reinvest or use to offset losses.

- Buyer’s Collections: The debt buyer successfully collects $18 million from the portfolio. After accounting for costs, their net ROI is over 200%.

👉 Key Takeaways:

- Lenders gain immediate liquidity and can clean up their balance sheets.

- Buyers gain multi-fold ROI and a viable business model.

- Success relies on accurate valuation and compliant recovery practices, ensuring the system works for all parties involved while protecting consumers.

Future Outlook: The Evolution of Debt Buying

The industry is entering a new phase shaped by technology and evolving regulation.

1. AI & Machine Learning

- Predictive Analytics: AI will become even more sophisticated, predicting repayment probability with greater accuracy and automating which accounts to prioritize.

- Automated Workflows: Machine learning will automate large parts of the collection process, from sending initial notices to managing payment plans.

2. Blockchain for Debt Ownership

Blockchain technology could revolutionize the industry by creating a secure, transparent, and immutable record of debt ownership. This would prevent disputes over who owns a portfolio and create a transparent audit trail for regulators.

3. Stricter Consumer Protections

Governments worldwide are tightening rules to combat predatory collection practices. Buyers who ignore compliance will face higher penalties, making professionalism and ethical conduct a competitive advantage.

4. Global Market Growth

As consumer credit becomes more widespread in emerging markets like India, Southeast Asia, and Latin America, the need for a secondary debt market will grow, offering new opportunities for buyers who can navigate these new regulatory landscapes.

Conclusion

Buying and selling consumer debt is a multi-billion-dollar industry that balances immense opportunity with significant risk. For lenders, it provides a crucial mechanism for gaining liquidity from non-performing assets. For buyers, it creates high-ROI opportunities that, if executed properly, can be extremely lucrative.

However, success is not guaranteed. It requires an intricate understanding of valuation models, a deep commitment to regulatory compliance, and a strategic approach to collections. The future of this industry is shaped by technology that will increase efficiency and transparency, while stricter regulations will demand a higher level of ethical conduct. Ultimately, the debt buying ecosystem is a vital, and increasingly complex, part of the global financial system.

Buying & Selling Consumer Debt Debt Collection Technology & SaaS Solutions Fintech Compliance & Regulatory Rules