Vision 2030 Debt Hangover: Extravagant Neom Lifestyle Loans Fuel Consumer Debt Crisis

The vision of a new Saudi Arabia in the future has trapped many in a cruel economic reality.

Riyadh, Saudi Arabia — June 2025

As Saudi Arabia hurtles toward its Vision 2030 objectives, a new crisis is unfolding—not one of infrastructure, but of household budgets. The ambitious initiatives designed to transform the country’s economy and society have unwittingly unleashed a consumer debt backlash, particularly among those who chased high-end lifestyles promoted in tandem with developments such as Neom.

Behind the spectre of gigantic building schemes and digital revolution, numerous Saudi nationals are today burdened by increasing debt, the consequence of borrowing to keep up with a vision of contemporary living—gizmo homes, high-end vehicles, health club memberships, and property in the Kingdom’s most modern areas. But the cost is now driving resentment, for the harsh reality of repayment runs into stagnant salaries and accelerating living expenses.

The Price of an Upgrade in the Saudi Arabian Lifestyle

When Vision 2030 was announced, it was described as a new era—a diversification and technology-driven economic renaissance and social reform. The showpiece, Neom, offered a high-tech, sustainable, and high-end lifestyle. Markets lapped it up, and consumers did the same.

Banks and other financial institutions started extending appealing loan products that were specifically for personal enhancements: home automation systems, electric cars, luxury fitness programs, and new units in mega projects. These loans were seen by lenders as not liabilities but as progress tools—means to “future-proof” one’s lifestyle in accordance with the national evolution.

The subsequent consumer activity was as expected. Thousands borrowed recklessly, believing that economic expansion and professional development would keep up. Often, they didn’t.

Soaring Consumer Debt

Consumer debt is at an all-time high, passing SAR 580 billion by early 2025, says the Saudi Central Bank. Estimating a large chunk of this is related to discretionary and aspirational consumption associated with the “Vision lifestyle,” analysts say.

Non-essential borrowing has skyrocketed, including loans for luxury furnishings, smart appliances, imported electric SUVs, and advance payments on real estate in areas still under construction. Credit cards are maxed out, and digital lending apps report a sharp rise in small, high-interest borrowings meant to cover existing debt obligations.

For consumers, it has created a cycle of debt with earnings too low to cover monthly payments, resulting in rolling over their payments, charges for late fees, and, in extreme cases, defaults.

A Vision Misinterpreted?

Public discourse regarding Vision 2030 has always highlighted innovation, entrepreneurship, and individual progress. But for consumers, this communicated itself through material symbols of modernity, frequently through loans.

Financial experts observe that there is a disconnect between the inspirational story and real financial literacy. As the government spent lavishly on megaprojects and startup ecosystems, initiatives promoting responsible personal finance were left behind. This generated an environment in which lending seemed like being part of the country’s vision—until it became unaffordable.

Smart city developments like Neom were expected to generate economic returns and opportunities, yet delays in construction, cost overruns, and unclear timelines have left early adopters, especially those who borrowed to invest, exposed to risk.

Voices of Regret

Throughout the Kingdom, conversations are changing. Where high-end consumption was previously defined belonging to progress, it is now seen more and more as a financial error. Families indicate reducing discretionary spending. Social networking sites overflow with messages from consumers posting tales of remorse and urging prudence.

Surveys in early 2025 indicate that more than 60% of the Saudis who borrowed personal loans over the past three years now feel they stretched too far. The feeling is most pronounced among those below 40 years old, most of whom are new borrowers with little or no prior financial education.

The newfound awareness has created a clamour for change, both in the public messaging and the lending policies.

Institutional Response Under Scrutiny

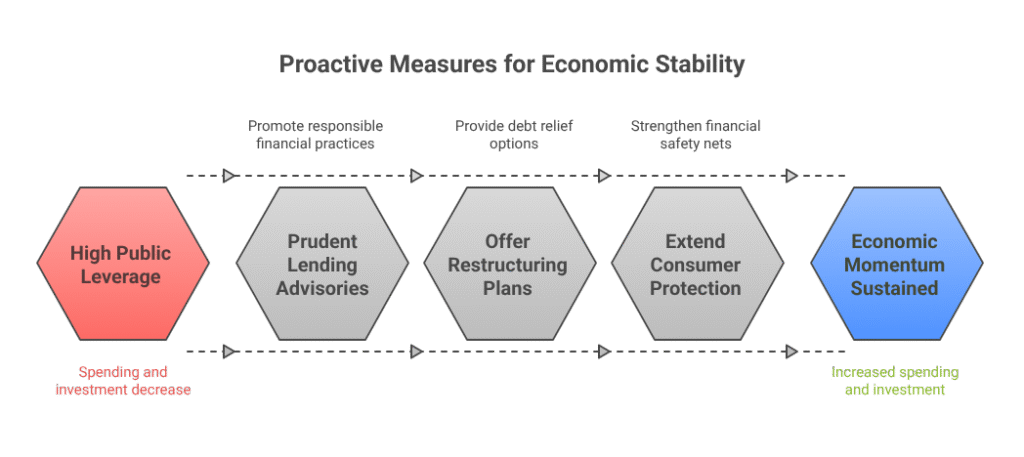

Thus far, there has been a measured official response. Although the Saudi Central Bank has published advisories promoting prudent lending and borrowing, regulatory changes have lagged behind the issue. Voluntarily, some financial institutions have started offering restructuring plans, but consumer protection has yet to be substantially extended.

Economists say that if left unchecked, the situation may have widespread implications. A highly leveraged public is less likely to spend, invest, or get involved in new business initiatives—ironically depriving the very economic momentum Vision 2030 is trying to create.

Suggested measures are:

- Tighter regulation of lifestyle and personal loans

- Financial literacy as a requirement in schools and universities

- Limiting interest rates and charges on non-essential loans

- Government-guaranteed repayment assistance for over-leveraged homes

- National debt-reduction campaigns

A Cultural Turning Point

What’s occurring is more than an economic correction—it’s a cultural reboot. More and more citizens are rethinking what “modernization” really is. They’re moving toward minimalism, green living, and traditional values to deal with increasing financial stress.

Online sites are now saturated with budget tips, debt payoff plans, and consumerism criticism. Financial health influencers and academics alike are now calling for a wholesome existence based on money independence, not image.

Conversations among the public are now moving toward transparency, accountability, and value over the long term. What was once a dash to seem contemporary has transformed into a movement to live intentionally within one’s budget.

Neom: Still a Symbol—But with Caution

Neom is still a symbol of change, and the government is still convinced of its success. It’s now, however, as much a cautionary example as an icon.

The promotion of futuristic urban living raised aspirations that were, in most instances, premature. Early adopters who invested money hoping to reap returns quickly now have the responsibility of those actions without the anticipated reward.

With the Kingdom’s ongoing investment in innovation and infrastructure, there is a focus once again on sustainable growth, both for the economy and the individual. Future growth will likely be marked by more robust risk disclosures and more realistic timetables, enabling citizens to make informed decisions.

Course Correction for a Shared Future

Vision 2030 is still a necessary and ambitious undertaking for Saudi Arabia’s future, but the consumer debt crisis signifies an imperative need for balance. Economic advancement has to be inclusive, not only in opportunity but in economic welfare.

To be successful, citizens need to be empowered, not crushed. That implies putting financial education first, curbing abusive lending tactics, and redefining what it looks like to “live the future.

What started out as a national dream has to now become an individual reality that each Saudi can maintain—not by credit, but by clarity, discipline, and collective responsibility.