UAE’s New AI Ethics Law: Collections Bots Face Voice Stress Analysis Bans — Compliance Fallout Forces 80% Agent Retraining

Dubai, UAE – October 2025:

The United Arab Emirates has introduced a landmark AI Ethics Law prohibiting the use of voice stress analysis and emotion-detection technology in automated collection systems. The decision marks a significant turning point in how artificial intelligence is deployed across the country’s financial and outsourcing sectors.

The new law directly affects companies that use AI-driven call analytics, particularly those in debt recovery, customer engagement, and financial services. Under the regulation, any automated system that analyzes, records, or reacts to a caller’s emotional tone or stress level will now be considered non-compliant.

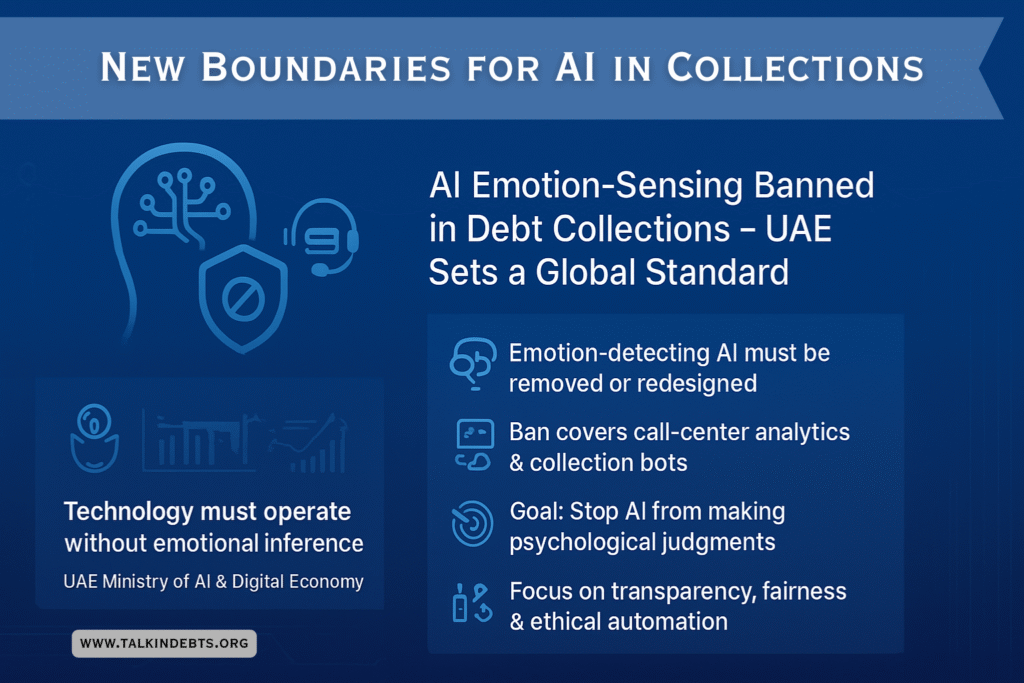

New Boundaries for AI in Collections

The legislation introduces a clear ethical boundary for AI tools operating in sensitive financial communication. Systems that detect or interpret human emotion during phone interactions—commonly used in collections bots, customer verification systems, and call-center analytics—must now be withdrawn or re-engineered.

The Ministry of Artificial Intelligence and Digital Economy stated that the measure aims to prevent AI systems from making psychological judgments about individuals, reinforcing that technology must operate transparently and without emotional inference.

This move positions the UAE as one of the first nations globally to formally prohibit emotion-sensing technologies in consumer-facing financial interactions, signaling a broader shift toward responsible AI governance.

Operational Shock Across Outsourcing Networks

The regulation has created widespread disruption among offshore outsourcing firms handling UAE portfolios, especially those based in India, the Philippines, and South Africa. These centers have long depended on AI-powered voice analysis platforms to optimize collection performance and improve response strategies.

With the new ban in force, UAE-based institutions are now responsible for ensuring that all third-party vendors comply with the country’s ethical AI requirements. That includes disabling non-compliant software features, retraining staff, and updating compliance protocols to meet local standards.

Industry estimates suggest that around 80% of offshore agents working on UAE contracts will require new training programs to align with the updated regulations. Retraining modules will focus on manual communication assessment, privacy protection, and empathy-based conversation management instead of automated tone detection.

Compliance Over Automation

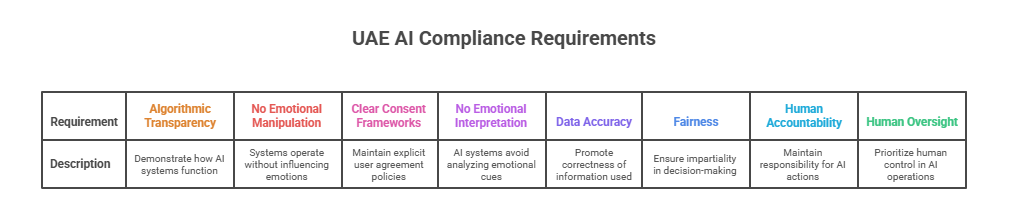

The UAE’s stance reflects a wider transition from automation-driven efficiency to ethics-driven compliance. Financial institutions and collection agencies are expected to prioritize human oversight in all AI-supported operations.

Under the new law, every organization using artificial intelligence in customer communications must demonstrate algorithmic transparency, ensure that systems operate without emotional manipulation, and maintain clear consent frameworks.

Audits will verify that no AI system interprets or acts upon emotional indicators such as stress, hesitation, or tone. The emphasis now lies on promoting data accuracy, fairness, and human accountability in decision-making.

Financial Impact on Outsourcing Providers

The compliance overhaul will involve a substantial financial commitment. Analysts project that system modifications, retraining programs, and compliance documentation could collectively exceed AED 2.4 billion over the next 12 months.

Companies using popular customer interaction platforms will need to deactivate or remove emotion-recognition components, modify data processing protocols, and seek independent audits to confirm adherence. Some firms have already paused AI collection initiatives pending certification under the new ethical guidelines.

Despite the cost, industry experts suggest that the regulation may ultimately reduce legal and reputational risks, fostering stronger consumer trust in AI-assisted financial communication.

Data Sovereignty and Voice Analytics Control

The AI Ethics Law also reinforces data sovereignty principles, restricting how voice data linked to UAE citizens can be stored or analyzed. The legislation mandates that voice datasets used for AI training or analytics must remain within the country or undergo strict anonymization before any international transfer.

This provision affects offshore data pipelines previously used to optimize AI collection models through cross-border analytics. Organizations handling UAE accounts must now restructure data flows, relocate storage, and implement localized AI processing infrastructure.

Non-compliance can attract heavy penalties, including fines of up to AED 5 million per incident, suspension of licenses, and public disclosure of violations.

Ethical Governance as a Global Signal

Observers view the UAE’s move as part of a global trend toward ethical AI governance. Several other economies, including regions in the European Union and Asia-Pacific, are reportedly evaluating similar restrictions on emotion-detection systems used in finance and law enforcement.

By codifying ethical standards ahead of many jurisdictions, the UAE positions itself as a model for responsible digital transformation. The framework aligns with national strategies that emphasize transparency, accountability, and respect for individual privacy within all AI applications.

The law is expected to influence cross-border compliance policies, prompting multinational outsourcing providers to standardize their AI models according to UAE-style ethical parameters.

Industry Response and Adaptation

Debt collection and business process outsourcing (BPO) providers have started adopting new operational models to maintain service continuity under the regulation. Companies are moving away from emotion-driven analytics and introducing behavior-based performance systems focused purely on objective customer data such as payment timelines, call duration, and response frequency.

Software vendors are also updating their platforms. Several providers are now offering AI-neutral modes or ethical compliance switches that disable prohibited features within call-center software. This allows firms to maintain AI efficiency while remaining compliant with the UAE’s ethical code.

Industry insiders believe this adaptation phase will pave the way for hybrid AI systems that combine automation with ethical oversight, emphasizing informed consent and transparent interaction protocols.

Retraining the Workforce

The most significant operational impact lies in workforce transformation. With 80% of offshore agents requiring retraining, companies are rolling out compliance-centric training programs that replace automated sentiment analysis with human interpretation skills.

The new training modules emphasize empathetic communication, tone neutrality, and privacy-first engagement. Agents are being equipped to handle customer interactions without relying on AI cues, ensuring that emotional influence remains entirely human-regulated.

Over time, this shift is expected to produce a more skilled, ethically aligned workforce capable of sustaining regulatory compliance while maintaining service quality.

A Redefined AI Ecosystem

The introduction of the AI Ethics Law is expected to reshape the UAE’s digital compliance landscape over the next year. Financial institutions will likely revise vendor contracts, update AI policy documentation, and increase internal compliance auditing.

Meanwhile, AI developers and fintech firms are expected to accelerate innovation around transparent and explainable models. Emerging tools will focus on data accuracy, language processing, and adaptive communication without drawing emotional inferences.

In the long run, analysts predict that the law will raise operational standards, reduce misuse of emotional AI, and strengthen international confidence in the UAE’s regulatory integrity.

The Broader Economic Outlook

Although the compliance burden may appear heavy in the short term, the long-term benefits could include enhanced data credibility, consumer protection, and international recognition for the UAE as a safe jurisdiction for AI investment.

The regulation aligns with broader government objectives under Vision 2031, which aims to develop a sustainable, innovation-led economy supported by ethical technology frameworks.

Industry forecasts suggest that while some smaller outsourcing firms may struggle with compliance costs, larger providers are expected to emerge as more competitive, offering ethically certified services that meet growing global demand for responsible AI solutions.

End of Emotion-Based Automation

The ban on voice stress analysis closes a chapter in the evolution of AI-driven customer engagement. What began as a tool for improving efficiency has now reached ethical limits where privacy and fairness outweigh predictive accuracy.

By prohibiting emotional analysis in collection systems, the UAE has reaffirmed that technology must serve human interest, not exploit human response. The transition now underway marks the start of a new era in which ethical intelligence replaces emotional manipulation as the foundation of AI-assisted communication.

For the collections and financial outsourcing industries, the message is clear:

Compliance, transparency, and respect for human boundaries are now the true measures of intelligent innovation.