Top KPIs Every Debt Collection Agency Should Track

In the competitive world of debt recovery, performance tracking is everything. Debt collection agencies rely on measurable results to assess their effectiveness, maintain client trust, and improve recovery strategies. This is where Key Performance Indicators (KPIs) come into play. The right KPIs help agencies understand what’s working, what’s not, and how to optimize collection efforts for better outcomes.

This article explores the most critical KPIs every debt collection agency should track, explaining why they matter, how to measure them, and how they directly impact operational success.

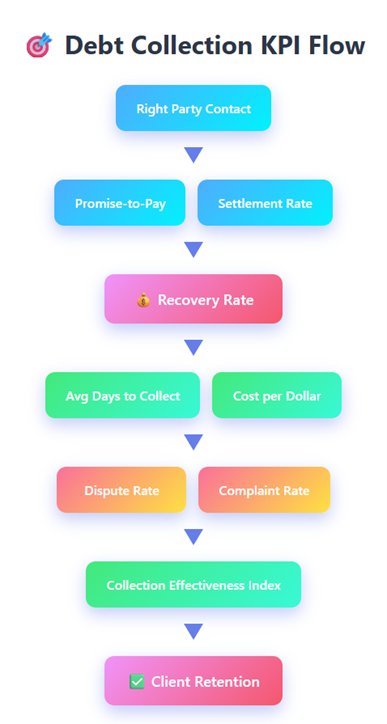

Top Key Performance Indicators (KPIs) for Debt Collection Agencies

1. Recovery Rate

The Recovery Rate is the cornerstone KPI for any debt collection agency. It measures the percentage of total debt recovered compared to the total debt assigned for collection.

Formula:

Recovery Rate = (Amount Collected ÷ Total Debt Assigned) × 100

A high recovery rate indicates successful collection strategies, while a low rate may signal inefficiencies in the process or issues with debtor engagement. Tracking this metric by client, region, or portfolio age helps identify performance trends and improvement areas.

2. Right Party Contact (RPC) Rate

The Right Party Contact Rate measures how often collectors reach the actual debtor or responsible contact. It’s a key operational metric that reflects data accuracy and call strategy effectiveness.

Why it matters:

- Low RPC means wasted time and resources.

- High RPC rates show effective data verification and skip tracing.

Improving RPC can often lead to a direct boost in recovery rates, as reaching the right person increases the likelihood of resolving the account.

3. Promise-to-Pay (PTP) Rate

The Promise-to-Pay Rate measures the percentage of debtors who commit to making a payment after being contacted. It’s an important indicator of negotiation success and communication skills.

Formula:

PTP Rate = (Number of Promises to Pay ÷ Number of Right Party Contacts) × 100

Monitoring PTP helps managers identify top-performing agents and refine negotiation scripts or training programs to improve outcomes.

4. Broken Promise Rate

While PTP measures intent, the Broken Promise Rate tracks the percentage of payment commitments that were not fulfilled. It highlights gaps between debtor intent and actual behavior.

Why it’s important:

- A high broken promise rate signals poor follow-up or ineffective payment reminders.

- It helps agencies refine follow-up strategies and improve collector accountability.

Combining PTP and Broken Promise Rates gives a realistic view of collection performance beyond initial calls.

5. Average Days to Collect

This KPI tracks the average number of days taken to recover a debt. It helps agencies evaluate efficiency and cash flow timing.

Formula:

Average Days to Collect = Total Days Taken to Recover Debts ÷ Number of Accounts Collected

Shorter collection cycles indicate better processes and faster cash turnover, which is essential for client satisfaction and operational profitability.

6. Collector Efficiency Ratio

The Collector Efficiency Ratio measures how much debt a collector recovers compared to the cost of collection. It’s a direct indicator of productivity and cost-effectiveness.

Formula:

Efficiency Ratio = (Total Collected Amount ÷ Total Collection Cost)

This KPI allows managers to identify high-performing collectors and spot areas where automation or training could enhance results.

7. Dispute Rate

In debt recovery, not every claim goes smoothly. The Dispute Rate tracks the percentage of accounts that debtors challenge due to errors, fraud, or misunderstanding.

Formula:

Dispute Rate = (Number of Disputed Accounts ÷ Total Accounts) × 100

A rising dispute rate may point to issues in data accuracy, client account documentation, or communication quality. Reducing disputes strengthens compliance and client trust.

8. Call-to-Contact Ratio

This KPI measures how many calls it takes to reach a debtor successfully. A low Call-to-Contact Ratio indicates efficient outreach strategies and accurate contact data.

Why it matters:

- Reduces wasted collector time.

- Improves call list prioritization.

- Helps optimize dialer or CRM automation tools.

In high-volume operations, this KPI is often paired with RPC and PTP rates for a complete communication performance analysis.

9. Cost per Dollar Collected

The Cost per Dollar Collected measures the overall expense incurred to recover each dollar of debt. It helps agencies assess their operational efficiency and profitability.

Formula:

Cost per Dollar = (Total Collection Expenses ÷ Total Amount Collected)

Agencies with advanced automation, digital payment tools, and AI-driven workflows often achieve significantly lower costs per dollar collected—giving them a strong competitive edge.

10. Collection Effectiveness Index (CEI)

The Collection Effectiveness Index provides a holistic measure of how much debt was collected relative to what could have been collected over a specific period.

Formula:

CEI = [(Beginning Receivables + Credit Sales – Ending Receivables – Write-offs) ÷ (Beginning Receivables + Credit Sales – Ending Receivables)] × 100

A CEI close to 100% means that the agency is effectively converting receivables into recovered payments.

11. Roll Rate

The Roll Rate measures how many accounts move from one delinquency bucket to the next—e.g., from 30 days past due to 60 days past due.

Why it matters:

It identifies early warning signs in the portfolio and helps agencies focus on early intervention strategies before accounts become uncollectible.

12. Net Back Percentage

The Net Back Percentage is the amount of money that goes back to the client after deducting agency fees. It shows the real value delivered to clients and helps evaluate pricing models.

Formula:

Net Back % = (Client Payout ÷ Total Amount Collected) × 100

Agencies often use this KPI in sales discussions to showcase transparency and efficiency to potential clients.

13. Complaint Rate

In a regulated industry like debt collection, maintaining professionalism and compliance is vital. The Complaint Rate measures customer or debtor grievances related to collector conduct or process issues.

Formula:

Complaint Rate = (Number of Complaints ÷ Total Accounts Handled) × 100

A low complaint rate reflects good training, ethical conduct, and compliance with legal standards like the Fair Debt Collection Practices Act (FDCPA) or local regulations.

14. Liquidation Rate

The Liquidation Rate measures how much of the total assigned debt has been successfully collected or “liquidated.” It’s particularly useful for tracking performance across different client portfolios or asset classes.

Formula:

Liquidation Rate = (Total Amount Collected ÷ Total Amount Assigned) × 100

This KPI offers insight into how effectively a team converts delinquent accounts into recovered payments.

15. Agent Utilization Rate

The Agent Utilization Rate tracks how efficiently collectors spend their working hours. It measures the ratio of productive time (calls, follow-ups, negotiations) to total logged-in time.

Why it matters:

It ensures optimal workforce productivity and identifies areas where process automation can reduce idle time or manual effort.

16. Promise Fulfillment Rate

While similar to PTP, the Promise Fulfillment Rate zeroes in on promises that were actually honored. It’s a practical indicator of debtor reliability and collector effectiveness in follow-up.

Improving this KPI often requires stronger reminder systems, digital payment options, and consistent communication cadence.

17. Digital Payment Rate

With digital collections becoming mainstream, the Digital Payment Rate measures what percentage of all payments come through online channels—such as portals, links, or self-service apps.

Why it matters:

- Indicates adoption of modern technology.

- Reduces collection costs.

- Improves debtor convenience and speed of resolution.

Agencies investing in self-service digital platforms often report higher payment compliance and customer satisfaction.

18. Settlement Rate

The Settlement Rate measures the percentage of cases where a mutually agreed payment arrangement or settlement was reached. It shows negotiation strength and client flexibility.

Formula:

Settlement Rate = (Settled Accounts ÷ Total Accounts Handled) × 100

A good settlement rate, combined with a low broken promise rate, reflects a mature and professional collection operation.

19. Skip Trace Success Rate

Skip tracing is crucial for locating debtors who have changed their contact details. The Skip Trace Success Rate measures how effectively the agency finds accurate information to reconnect with them.

Formula:

Skip Trace Success Rate = (Successful Trace Accounts ÷ Total Skip Trace Attempts) × 100

A strong success rate shows the agency’s capability to manage hard-to-locate debtors—especially valuable for aged or written-off accounts.

20. Client Retention Rate

Ultimately, every KPI feeds into one overarching goal—client satisfaction. The Client Retention Rate measures how many clients continue using the agency’s services over time.

Formula:

Client Retention Rate = [(Total Clients – Lost Clients) ÷ Total Clients] × 100

High retention rates mean clients are satisfied with recovery performance, communication, and transparency—key factors that sustain long-term growth.

Conclusion

Tracking the right KPIs is not just about numbers—it’s about insight. For a debt collection agency, performance data drives improvement, compliance, and client confidence.

By focusing on essential metrics like Recovery Rate, CEI, PTP Rate, and Client Retention, agencies can build a data-driven foundation for sustainable success.

In an industry where results define reputation, these KPIs are more than performance indicators—they’re the roadmap to growth, efficiency, and client trust.