Student Loan Forgiveness in 2026: What Changed After the 2025 Deadlines?

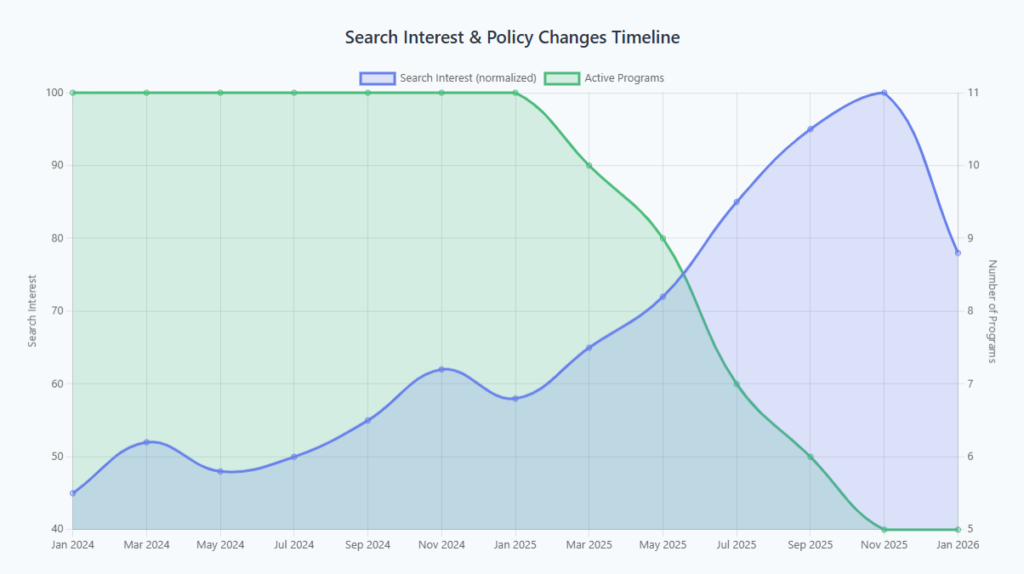

Student loan forgiveness entered a new phase in 2026. After a year marked by missed deadlines, partial relief programs, court challenges, and last-minute extensions, borrowers are now facing a very different forgiveness landscape than they expected just a year ago. Many programs that dominated headlines in 2024 and early 2025 have either expired, been modified, or replaced with stricter eligibility rules, leaving millions of borrowers searching for clarity.

Search interest around student loan forgiveness 2025 surged toward the end of last year as deadlines approached, yet confusion remains high in early 2026. Borrowers want to know what actually changed, which programs still exist, and whether any forgiveness opportunities remain. The answers depend heavily on loan type, repayment history, and whether borrowers acted before the 2025 cutoff dates.

This article breaks down exactly what changed after the 2025 deadlines, what forgiveness options are still available in 2026, and what borrowers must do now to avoid costly mistakes.

Why the 2025 Student Loan Forgiveness Deadlines Were So Important

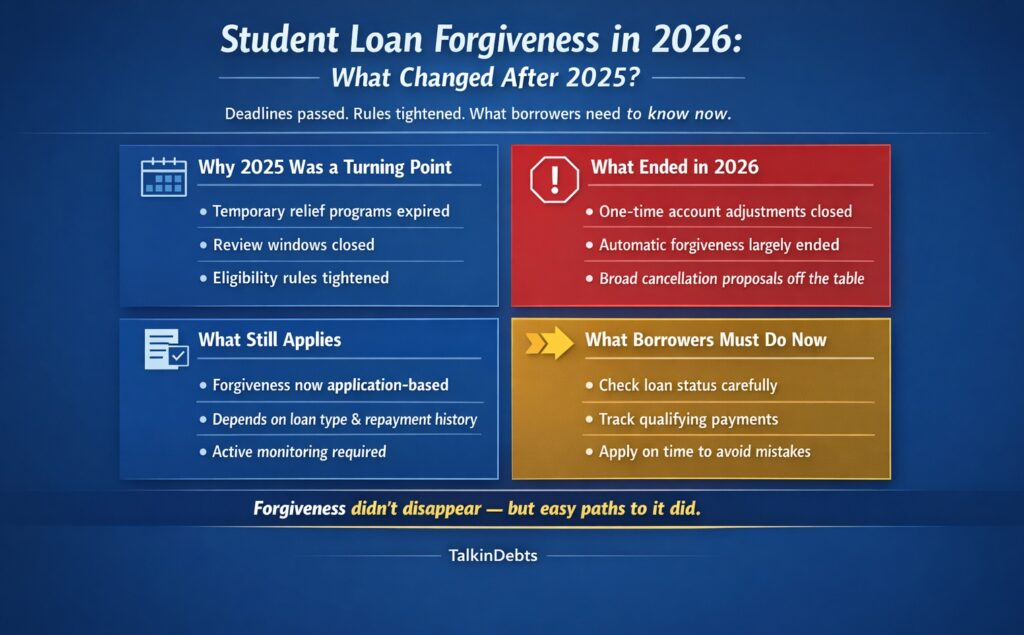

The year 2025 served as a turning point for federal student loan policy. Several temporary relief measures introduced after the pandemic were designed with firm sunset clauses. These programs were never meant to last indefinitely, yet many borrowers assumed extensions would continue.

By late 2025, the federal government finalized multiple deadline-driven transitions:

- Temporary payment count adjustments ended

- One-time forgiveness review windows closed

- Expanded eligibility rules reverted to narrower standards

- Automatic forgiveness pathways became application-based again

Borrowers who failed to act before these deadlines did not necessarily lose all forgiveness opportunities, but they often lost faster or easier routes to relief.

What Ended After 2025 and No Longer Applies in 2026

Understanding what ended is just as important as knowing what remains.

One-Time Account Adjustment Programs Are Closed

Several borrower-friendly initiatives allowed past repayment periods, deferments, and forbearances to count toward forgiveness—even when they normally would not. These adjustments dramatically accelerated forgiveness timelines for many borrowers.

As of 2026, those one-time reviews are complete. New borrowers can no longer retroactively fix decades-old repayment records using those temporary rules.

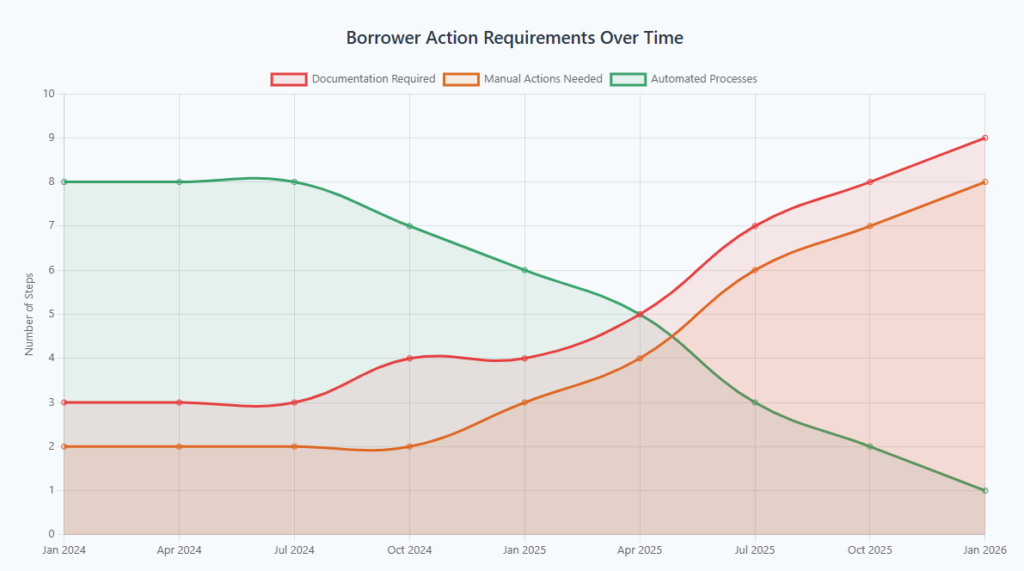

Automatic Forgiveness Reviews Are Largely Over

In 2024 and 2025, many borrowers received forgiveness notices without filing new applications, as servicers conducted large-scale reviews. In 2026, forgiveness is no longer automatic for most borrowers. Active monitoring, accurate documentation, and timely applications are now essential.

Broad-Based Cancellation Proposals Are Off the Table

While large-scale forgiveness proposals generated headlines in earlier years, policy direction in 2026 is far more targeted. Relief efforts now focus on specific borrower categories rather than sweeping cancellation initiatives.

Student Loan Forgiveness Programs Still Available in 2026

Despite the end of several deadline-driven programs, student loan forgiveness has not disappeared. Instead, it has become more structured, more conditional, and more paperwork-heavy.

Income-Driven Repayment Forgiveness Still Exists

Borrowers enrolled in income-driven repayment plans can still qualify for forgiveness after meeting long-term payment requirements. However, the rules are now strictly enforced.

Key changes borrowers notice in 2026 include:

- Payment counts are no longer automatically corrected

- Documentation errors can delay forgiveness by years

- Missed annual income certifications can reset progress

Borrowers who did not lock in adjusted payment counts before the 2025 deadline may now need significantly more qualifying payments to reach forgiveness.

Public Service Loan Forgiveness Continues—With Tighter Oversight

Public Service Loan Forgiveness remains available in 2026, but it operates under much stricter compliance standards than during the temporary expansion years.

Borrowers must now ensure:

- Employer certification forms are filed consistently

- Employment qualifies under current definitions, not past interpretations

- Repayment plans remain eligible at all times

The relaxed rules that allowed previously ineligible payments to count ended in 2025, making precision essential going forward.

Disability-Based Forgiveness Still Applies

Borrowers who qualify for total and permanent disability discharge can still receive forgiveness in 2026. However, monitoring periods and verification requirements are more rigid than before.

Automatic discharge processes tied to external data matching are less common, meaning more borrowers must initiate the process themselves.

Why So Many Borrowers Are Confused in 2026

Search data shows that confusion did not decline after deadlines passed—it increased. Several factors explain why.

Deadline Communications Were Poorly Understood

Many borrowers misunderstood what the 2025 deadlines actually meant. Some believed forgiveness itself was ending, rather than temporary eligibility expansions. Others assumed they had more time than they did.

Loan Servicing Transitions Added Complexity

Servicer changes in recent years created gaps in communication, lost records, and inconsistent payment histories. In 2026, borrowers are still discovering discrepancies that could impact forgiveness eligibility.

Repayment Restart Fatigue Is Real

After multiple years of policy shifts, repayment pauses, and reversals, borrower attention has dropped. Many are only now re-engaging—after key opportunities passed.

What Borrowers Must Do Differently in 2026

Student loan forgiveness is no longer passive. Borrowers who want relief must take an active, strategic approach.

Audit Your Loan History Immediately

Borrowers should review:

- Total qualifying payments recorded

- Periods of deferment or forbearance

- Employer certification records

- Repayment plan enrollment history

Errors that went unnoticed in 2025 can still be corrected, but delays can be costly.

Stay on an Eligible Repayment Plan

Being on the wrong repayment plan in 2026 can silently disqualify months—or years—of payments from forgiveness consideration. Borrowers should confirm eligibility annually, not just once.

Keep Documentation Organized

Forgiveness programs now place greater responsibility on borrowers to prove eligibility. Missing forms or inconsistent employment records can stall forgiveness indefinitely.

How Student Loan Forgiveness in 2026 Differs From 2024–2025

The biggest shift is philosophical. Earlier programs focused on speed and correction. In 2026, the focus is on compliance and sustainability.

Key differences include:

- Less retroactive generosity

- More upfront verification

- Slower processing timelines

- Fewer blanket exceptions

Borrowers who benefited from transitional policies in 2025 are often in a stronger position than those entering forgiveness pathways for the first time in 2026.

Are New Student Loan Forgiveness Programs Coming?

As of early 2026, there is no confirmed replacement for the large-scale deadline-driven programs that ended in 2025. Policy discussions continue, but current relief strategies emphasize affordability rather than cancellation.

This means:

- Lower monthly payments matter more than forgiveness expectations

- Long-term planning is essential

- Borrowers should not delay action based on speculative future programs

Waiting for a new forgiveness announcement has become a risky strategy.

The Real Cost of Missing the 2025 Deadlines

For many borrowers, missing the 2025 deadlines did not eliminate forgiveness—but it extended timelines by years.

Examples include:

- Borrowers who lost retroactive payment credits

- Public service workers who must now complete full payment terms

- Income-driven repayment participants whose clocks effectively reset

Understanding these consequences helps borrowers make better decisions in 2026.

Student Loan Forgiveness in 2026: A More Demanding Reality

Student loan forgiveness still exists, but it now rewards accuracy, consistency, and engagement rather than timing alone. The era of mass adjustments and automatic corrections has ended. Borrowers who succeed in 2026 are those who actively manage their repayment strategies, track eligibility requirements, and respond quickly to servicer communications.

For anyone searching for student loan forgiveness 2025 in early 2026, the answer is clear: the deadlines mattered, the rules changed, and the path forward is narrower—but not closed. Acting now, with a clear understanding of the updated system, is the difference between eventual relief and years of unnecessary repayment.