Saudi Student Loan Crisis: 40% of Scholarship Recipients Can’t Repay – Government Clawback Demands Intensify

Riyadh, Saudi Arabia – A wave of financial pressure is sweeping across the Kingdom as a startling 40% of Saudi Arabia’s government-sponsored scholarship recipients are unable to repay their student loans, sparking heated debates about loan forgiveness, repayment structures, and the future of the nation’s educational financing policies.

This deepening student loan crisis is pushing both policymakers and graduates into uncharted territory. Once hailed as a model of government-backed investment in youth and education, Saudi Arabia’s scholarship program now faces mounting scrutiny as thousands of young Saudis default, forcing government institutions to initiate aggressive clawback measures.

A Saudi Student Loan Crisis Years in the Making

Saudi Arabia’s international scholarship program, introduced as part of a broader national development plan, aimed to empower young Saudis with global education opportunities. Students were sent to top universities in the U.S., U.K., Australia, and Europe under the promise of state sponsorship, with an understanding that they would contribute back to the Kingdom’s workforce after graduation.

But a mismatch between academic qualifications and domestic job opportunities has left thousands stranded. Graduates returning home with degrees in niche or saturated fields are finding limited employment options, with many unable to meet the financial obligations tied to their scholarships.

Government data obtained by a Riyadh-based education watchdog reveals that of the last five years’ graduating classes, 40% are currently in default or delinquent on repayment agreements. Many of these individuals are now facing clawback orders, where the government demands full or partial reimbursement of tuition, living expenses, and travel costs.

Millennials and Gen Z Leading the Charge

This crisis has disproportionately affected younger generations. Millennials and Gen Z scholarship holders—who make up the bulk of those funded in the last decade—are voicing growing frustration over what they call a “promise broken.”

“I did everything right—graduated with Honors, applied to dozens of jobs, even accepted internships without pay,” said Areej, a 28-year-old engineering graduate. “Now I’m jobless, and the government is asking me to repay nearly 600,000 riyals. It’s not fair.”

Social media platforms like X (formerly Twitter) and TikTok have become hotbeds of discussion. Hashtags such as #LoanBurdenYouth and #ScholarshipTrap have trended repeatedly over the past six months, as thousands of graduates share their stories, grievances, and mounting mental health struggles.

Mental health professionals in Riyadh report a noticeable uptick in anxiety and depression among unemployed or underemployed scholarship recipients. “We’re witnessing the psychological toll of financial insecurity among highly educated youth,” said Dr. Hana Al-Qahtani, a clinical psychologist in Jeddah. “The burden of debt, combined with unmet career expectations, is deeply affecting this generation’s outlook.”

Government Response and Clawback Mechanism

The Ministry of Education, which oversees the scholarship program, has acknowledged the rising default rates but maintains that repayment obligations are legally binding and necessary for the sustainability of the system.

In a recent press conference, a Ministry spokesperson confirmed the implementation of a clawback enforcement campaign, targeting graduates who failed to meet work obligations or did not return to the Kingdom after graduation.

“Government scholarships are public funds intended to build national capacity,” the spokesperson said. “When students do not fulfill the terms—such as completing employment service within Saudi Arabia—the state is entitled to recoup the investment.”

The clawback mechanism includes:

- Wage garnishments for employed graduates

- Travel bans for defaulters within the Kingdom

- Legal notices demanding lump sum repayments

- Suspension of public services like government grant eligibility or passport renewal for chronic defaulters

These harsh measures have drawn criticism from both legal experts and economic analysts, who argue they are counterproductive.

Federal and Provincial Policy Lag

Policy reform has struggled to keep pace with the evolving economic landscape. While Vision 2030 has made strides in diversifying the economy, many industries still face oversaturation in certain professions, especially those tied to social sciences, humanities, and international relations.

Analysts argue that the scholarship program has not been adequately aligned with labour market needs. Moreover, decentralized regulation among provinces has led to inconsistent enforcement and support mechanisms.

“There’s no uniform guidance on how graduates in default should be treated,” said Faisal Al-Shammari, a legal policy researcher. “Some regions are more lenient, offering deferments or grace periods. Others push for repayment immediately, regardless of employment status.”

Furthermore, observers point out that the repayment policy doesn’t account for inflation or cost-of-living changes over the last decade, making original debt figures even more unaffordable today.

Female Graduates Hit Especially Hard

The crisis has taken a sharper toll on female scholarship recipients, many of whom face additional cultural and societal barriers when seeking employment. In more conservative provinces, job opportunities for women remain limited, especially in male-dominated fields like engineering, law, and technology.

Noura, a 31-year-old graduate in biomedical sciences, explained: “I returned from the U.S. with a Ph.D. but had to relocate to three cities just to find part-time lab work. Now I’m behind on my loan, and I fear being blacklisted.”

Female graduates also report higher rates of family pressure to prioritize marriage or caregiving responsibilities over employment, leaving them with little support when default occurs.

International Repercussions and Diplomatic Strain

The student loan default crisis is also creating diplomatic ripples. Several foreign universities have raised concerns over unpaid fees when students fail to complete their programs or drop out early due to financial stress.

There are also cases where students remain abroad illegally, fearing repercussions back home if they return without employment or repayment plans.

An education attaché at the Saudi embassy in Canada, speaking anonymously, said: “We’ve seen a surge in students overstaying visas, turning down embassy contact, or seeking asylum. It’s a real reputational concern for Saudi Arabia’s scholarship image.”

Some Western institutions are now demanding advance guarantees or higher insurance deposits before accepting Saudi government-sponsored students, citing “high financial risk.”

Calls for Reform Grow Louder

With pressure mounting, think tanks, student groups, and members of the Shura Council are calling for sweeping reforms. Among the proposed changes:

- Capping scholarship amounts based on field and employability

- Introducing income-based repayment (IBR) plans

- Offering loan forgiveness for high-performing or underserved region graduates

- Developing internship-to-employment pipelines in partnership with major Saudi companies

- Creating a national job matching portal for returning graduates

A recent policy brief by the Centre for Gulf Education suggests implementing a five-year grace period after graduation before enforcing clawbacks, to give students time to secure meaningful employment.

“We must remember these young people are not criminals,” said council member Dr. Fahd Al-Mutairi. “They are victims of an outdated system. We must evolve it, not punish them for its failures.”

The Bigger Picture: Debt and Vision 2030

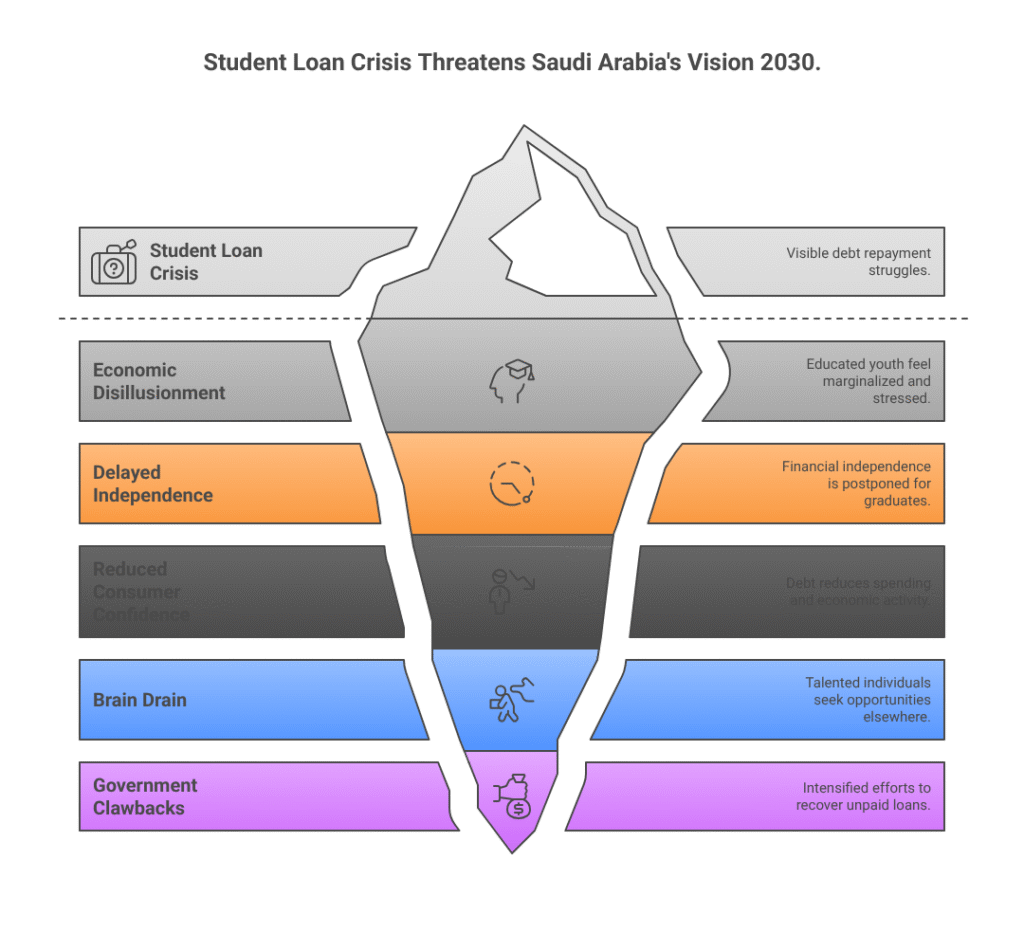

The student loan crisis poses a potential threat to the goals of Vision 2030, the Kingdom’s long-term strategic plan to diversify its economy and foster innovation. Educated youth are expected to drive future growth, yet many now feel disillusioned and marginalized.

Economic experts warn that placing young citizens under crushing debt may backfire, reducing consumer confidence, increasing brain drain, and delaying major life milestones such as homeownership or family planning.

A July 2025 report by the Gulf Economic Monitor found that student loan-related stress is delaying financial independence for nearly 1 in 3 Saudi graduates.

As pressure builds, observers believe the government must strike a delicate balance between fiscal responsibility and social equity. “This is not just about recovering riyals,” said economic strategist Laila Al-Dabbagh. “It’s about preserving human capital—and the future of a generation.”

The Road Forward

The unfolding student loan crisis in Saudi Arabia underscores the complexity of public education investment in a transforming economy. With 40% of scholarship recipients unable to repay, and government clawbacks intensifying, the challenge now lies in crafting a fair, humane, and future-ready repayment model.

Until then, thousands of young Saudis—once symbols of national pride—are stuck in limbo, fighting both debt and disillusionment. And the nation must decide whether to penalize or protect the very generation it sought to empower.