The Ramadan Debt Trap: How Holiday Spending Crushes Low-Income Workers

Post-Festival Insolvency Surge Raises Red Flags in 2025

As Ramadan 2025 concluded with grand Eid al-Fitr celebrations, a darker financial reality has emerged. A growing number of low-income households across South Asia, the Middle East, and parts of Africa are now grappling with severe financial distress brought on by overspending during the holy month. The phenomenon, now termed the “Ramadan Debt Trap,” has resulted in a sharp surge in loan defaults, payday borrowing, and informal debt disputes in the weeks following the festival.

While Ramadan is widely regarded as a period of spiritual reflection and generosity, the commercialization of Eid spending—fuelled by societal expectations and aggressive marketing—has turned the celebration into a significant financial burden for the working poor.

Holiday Spending Soars Among Low-Income Households

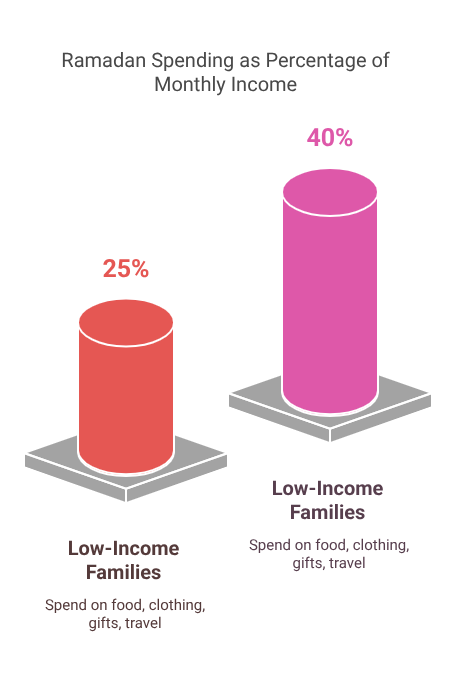

Multiple economic surveys conducted across developing economies indicate that household expenditures during Ramadan and Eid have risen sharply over the past five years. In 2025, low-income families reportedly spent 25% to 40% of their total monthly income on festival-related expenses, including food, clothing, gifts, and travel.

Despite stagnant wages in many regions, spending behaviour remained unaffected by income constraints. Analysts attribute this to deep-rooted cultural norms, social obligations, and the desire to avoid shame or exclusion during Eid celebrations. Families who cannot afford festive goods often turn to credit cards, payday lenders, or informal borrowing from acquaintances.

The Rise of BNPL and Digital Credit During Ramadan

The increased penetration of mobile financial services has contributed to a dangerous cycle of seasonal debt. During Ramadan 2025, Buy Now Pay Later (BNPL) apps and instant microcredit platforms saw a significant uptick in new users, particularly among low-income and migrant populations.

Promotional campaigns during the festive season heavily marketed these services as “interest-free” or “Eid-ready,” encouraging users to defer payments until after Eid. However, most of these loans carried hidden processing fees, late penalties, or rolling interest charges after a brief grace period.

Regulatory bodies in several countries have warned that BNPL schemes lack robust consumer protection frameworks and are being misused by unregulated lenders to target financially vulnerable populations.

Post-Eid Insolvency Spike Now a Recurring Pattern

Financial institutions and credit bureaus across multiple regions have confirmed a 20–35% increase in payment delinquencies and new debt restructuring applications within four weeks of Eid al-Fitr. This trend, observed consistently over the past three years, has now been formalized into a seasonal economic risk by analysts.

In May and June 2025, debt helplines and financial counselling centres in urban areas reported an unprecedented number of first-time callers seeking assistance with high-interest payday loans or maxed-out credit cards, directly linked to Ramadan-related borrowing.

In many cases, borrowers are unable to meet even minimum repayment obligations, forcing them into deeper debt cycles or leading to defaults with long-term financial consequences.

Emotional and Cultural Pressures Drive Spending Behaviour

Economists note that the drivers behind Eid overspending are not purely economic. The psychological burden of not participating in Eid rituals—such as gifting clothes to children, preparing communal meals, or contributing to charity—creates intense emotional and societal pressure.

For many families, Eid is not just a religious occasion, but a social statement. Not participating visibly in the celebration can be seen as shameful or isolating. In tightly knit communities, appearances matter, and those unable to “show up” financially are often viewed as irresponsible or neglectful.

This mindset leads to high borrowing rates, often without a repayment plan, as people prioritize social acceptance over financial prudence during the holiday period.

Digital Lenders Criticized for Exploiting Festive Season

Consumer rights groups have voiced concerns about the surge in unregulated digital lending apps that target working-class users with quick approvals and minimal background checks. These platforms often obscure actual loan terms and repayment schedules, especially in languages or formats not easily understood by first-time borrowers.

During Ramadan, targeted ads flooded social media platforms and mobile devices, offering “Eid loans” or “fast cash for gifts.” These campaigns, while legal in many jurisdictions, are increasingly viewed as predatory due to the lack of financial literacy among the intended users.

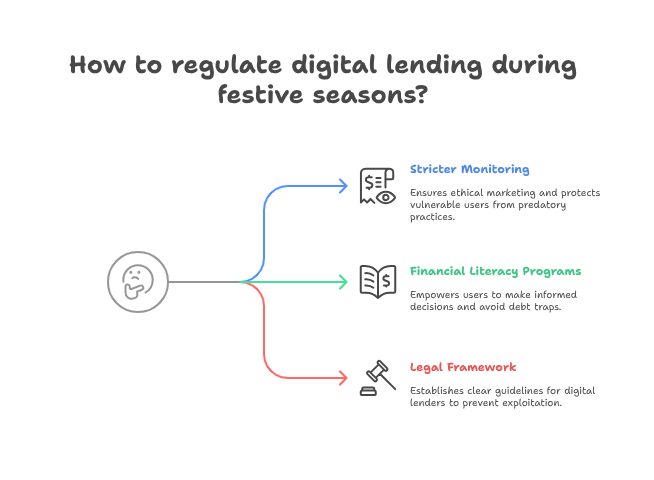

Regulatory agencies have called for stricter monitoring of digital credit products during religious or festive seasons, arguing that ethical marketing should not exploit cultural vulnerabilities.

Financial Literacy Remains Critically Low

A major contributor to the Ramadan Debt Trap is the widespread lack of basic financial education. Studies in 2025 show that more than 70% of individuals who took out short-term loans for Eid expenses did not fully understand the interest rates, repayment terms, or long-term impact on their credit scores.

Public and private sector efforts to improve financial literacy have largely failed to reach low-income groups, especially in rural areas or among migrant populations. Experts say that unless awareness programs are specifically tailored to coincide with Ramadan and delivered in a culturally sensitive format, their impact will remain negligible.

Calls for Community-Led Financial Education Before Ramadan

In response to the growing crisis, several civil society organizations are advocating for Ramadan-specific financial planning campaigns. These would include budgeting workshops, savings tools, and guidelines on managing debt responsibly during the holiday period.

Some communities have begun organizing pre-Ramadan awareness drives through mosques, schools, and local associations to promote responsible spending. The goal is to shift the focus from lavish celebrations to meaningful, manageable observance without falling into financial ruin.

However, without broader institutional support, these grassroots efforts struggle to reach the scale needed to significantly reduce post-Ramadan insolvencies.

Employers and Governments Taking Small Steps

In some regions, governments have advised employers to release salaries and bonuses early before Eid to allow workers to plan their finances more effectively. Others have launched subsidized Ramadan bazaars or price controls on staple goods to limit the financial burden.

Digital lenders in a few countries have been instructed to pause promotions for high-interest products during the last ten days of Ramadan, though compliance remains inconsistent.

Policymakers in several countries are also considering proposals to integrate financial education into pre-Eid media programming, including religious broadcasts, to reach a broader audience.

The Migrant Worker Dilemma: Remittances and Unpaid Debts

Among the hardest hit are migrant workers in the Middle East and Southeast Asia, many of whom sent large portions of their income back home for Eid celebrations. Often paid low wages and lacking access to formal credit, these workers relied on informal loans or salary advances to fulfill remittance expectations.

Many now face harsh repayment demands, late penalties, or even job loss due to unpaid obligations. The lack of legal protections for migrant workers further exacerbates their vulnerability during these periods.

International Labor organizations have flagged this issue in their post-Ramadan briefings, calling for urgent protections and ethical employer practices.

Suggested Interventions to Prevent Future Debt Traps

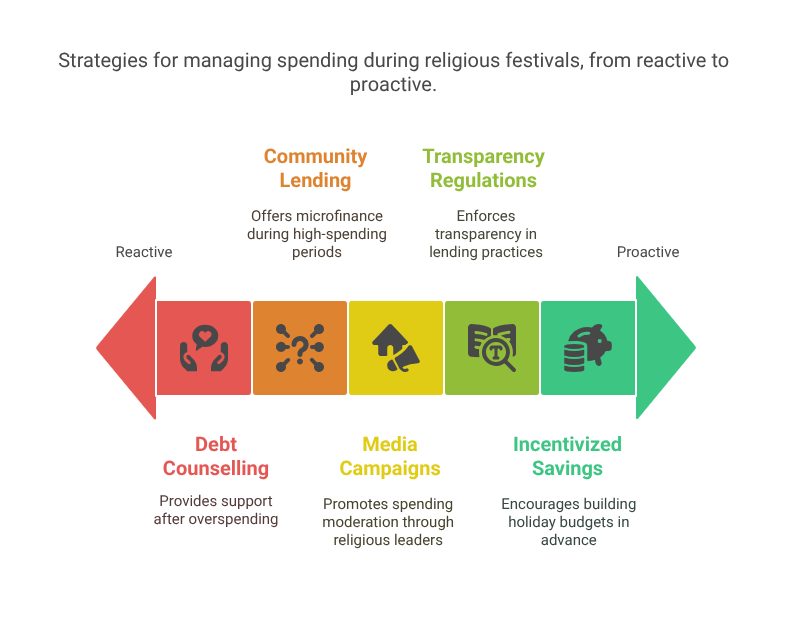

Experts and advocacy groups are proposing a set of interventions aimed at breaking the recurring cycle of Ramadan-related debt:

- Mandatory Transparency Regulations for BNPL and digital loan providers, especially during religious festivals.

- Community-Based Lending Programs that offer interest-free or low-interest microfinance during high-spending periods.

- Incentivized Savings Schemes run by employers or NGOs to help workers build holiday budgets in advance.

- Media Campaigns Featuring Religious Leaders to promote moderation in spending during Ramadan.

- Debt Counselling Services are made available before and after Ramadan in high-risk areas.

These interventions aim to balance the cultural importance of Eid celebrations with the need for financial sustainability among low-income populations.

Festivity Must Not Lead to Financial Ruin

Ramadan and Eid al-Fitr are meant to be times of joy, generosity, and spiritual growth. However, for millions in 2025, these holy days ended with financial anxiety, repayment notices, and mounting debt.

The Ramadan Debt Trap is now a pressing socio-economic issue that extends beyond individual households. It represents a systemic failure to protect vulnerable communities from seasonal financial exploitation. If left unaddressed, it risks deepening cycles of poverty in already fragile economies.

Urgent action is needed—from regulators, employers, fintech companies, and religious leaders—to reshape how societies engage with holiday economics. Celebration should never come at the cost of stability, and no worker should face insolvency for simply trying to share in the joy of Eid.