PSD3’s Open Banking Rules: Game-Changer for B2B Debt Lead Scoring in Germany and France

Berlin/Paris, October 2025 – Europe’s financial sector is on the cusp of a transformative shift as the Payment Services Directive 3 (PSD3) begins rolling out across the continent. While most headlines focus on consumer-facing banking innovations, the real disruption could be in B2B debt management, particularly in Germany and France, where businesses stand to gain from unprecedented real-time cash flow visibility.

Debt collection agencies, credit risk managers, and B2B lenders are eyeing PSD3’s open banking framework as a breakthrough for debt lead scoring. By accessing live financial data through regulated APIs, firms can dramatically enhance recovery predictions, improve lead qualification, and ultimately reduce bad debt losses in one of Europe’s most debt-burdened business environments.

Why PSD3 Matters for Debt Lead Scoring

The PSD3 directive, a successor to the widely implemented PSD2, is designed to strengthen the EU’s payments and open banking ecosystem. Beyond consumer convenience, it addresses longstanding barriers in cross-border data sharing, fraud prevention, and transparency.

For the B2B debt collection sector, the real headline is mandatory real-time access to standardized financial data. This means debt scoring will no longer depend on outdated balance sheets or delayed payment histories. Instead, agencies and lenders can analyze:

- Current cash flow positions of debtor businesses.

- Ongoing payment obligations and commitments in near real time.

- Liquidity buffers and short-term solvency signals.

This immediate access gives collection agencies in Germany and France the ability to predict defaults with greater accuracy, personalize repayment plans, and even identify high-recovery potential accounts before they spiral into insolvency.

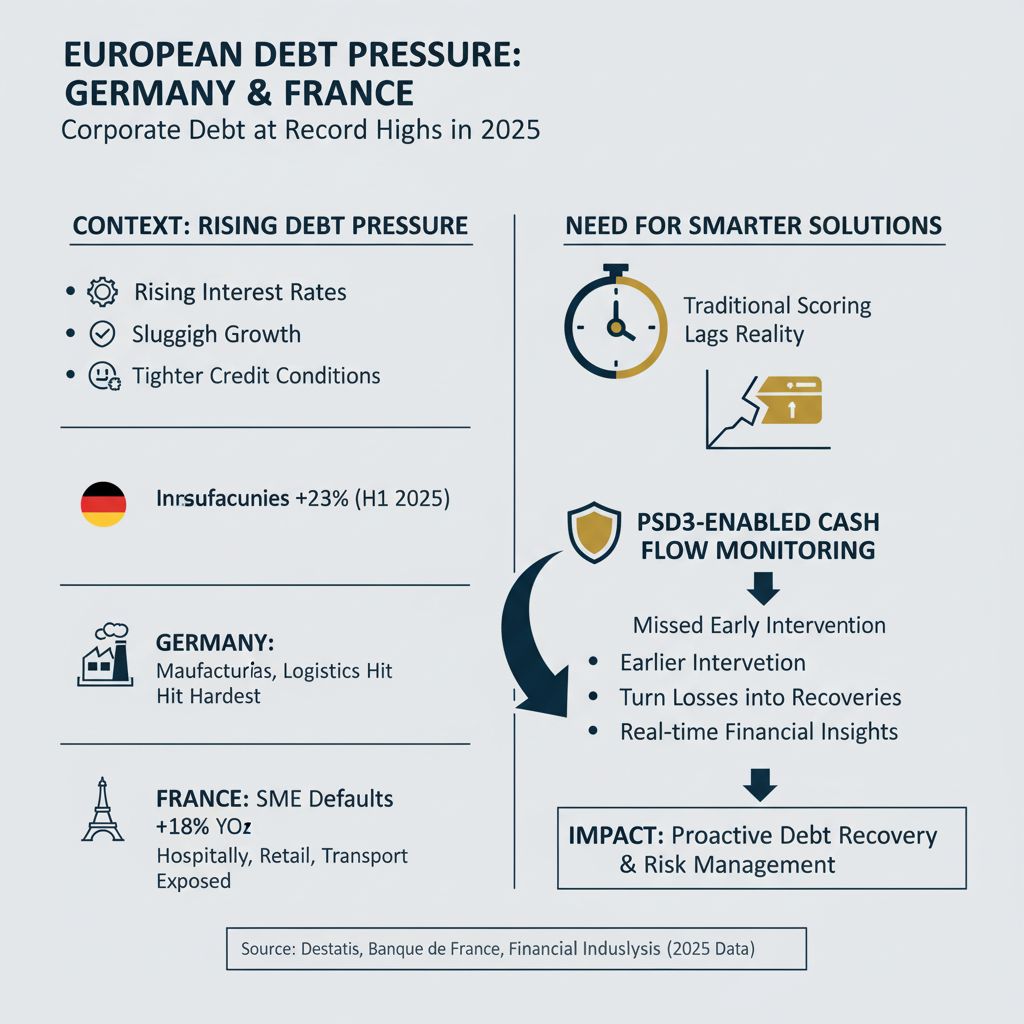

The German and French Context: Debt Pressure at Record Highs

Both Germany and France are facing heightened corporate debt pressures in 2025. Rising interest rates, sluggish growth, and tighter credit conditions have pushed many small and mid-sized businesses (SMEs) into risky debt positions.

- Germany: Business insolvencies rose by 23% in the first half of 2025, according to Destatis, Germany’s federal statistics office. Manufacturing and logistics firms have been hit hardest by rising energy and input costs.

- France: The Banque de France reports that SME defaults jumped 18% year-on-year, with hospitality, retail, and transport sectors most exposed.

This backdrop has created an urgent need for smarter debt recovery tools. Traditional scoring methods often lag reality by months, leaving agencies chasing debtors who have already collapsed. With PSD3-enabled cash flow monitoring, German and French agencies could intervene earlier—turning potential losses into recoveries.

Open Banking Data: The New Fuel for Predictive Lead Scoring

Under PSD3, authorized entities can request structured financial data from debtor banks, provided customer consent is granted. For B2B lead scoring, this creates three game-changing opportunities:

1. Real-Time Risk Assessment

Instead of relying on outdated credit bureau reports, agencies can now access live liquidity indicators. If a French SME shows rapidly declining daily balances, an agency can flag the account as high-risk before invoices go unpaid.

2. Segmented Recovery Strategy

German collection firms can categorize debtors into high, medium, and low recovery potential using open banking analytics. For example:

- High liquidity, temporary arrears → soft recovery tactics.

- Chronic negative cash flow → legal escalation.

- Stable inflows but late payers → restructuring plans.

3. Cross-Border Uniformity

One major frustration for European agencies has been inconsistent banking data formats. PSD3 mandates standardized APIs across the EU, meaning a debt collection agency in Berlin can assess a French debtor with the same clarity as a domestic client.

Industry Voices: A Turning Point for Collections

“This is a watershed moment for our industry,” says Claudia Richter, Head of Strategy at a Berlin-based collections firm. “With PSD3, we can finally move beyond historical data and guesswork. Real-time cash flow access allows us to predict recoverability with precision and offer clients stronger assurances.”

In Paris, debt collection consultant Marc Duval echoes the sentiment:

“France’s SMEs often juggle multiple credit lines, making it difficult to track their true exposure. PSD3 changes that by offering a transparent window into daily liquidity. It’s a game-changer for both lenders and recovery agencies.”

Technology Meets Regulation: New Tools Emerging

Fintech startups in Germany and France are racing to develop platforms that merge open banking APIs with debt analytics engines. Several prototypes already showcase features like:

- Automated lead scoring dashboards pulling data directly from debtor accounts.

- Machine-learning models predicting repayment probability within 30, 60, or 90 days.

- Early-warning systems alert collectors to sudden liquidity drops.

These tools not only support collections but also enable credit risk officers to prevent overexposure in the first place.

Challenges Ahead: Consent, Privacy, and Compliance

Despite the promise, PSD3 adoption for debt scoring won’t be frictionless. Key hurdles include:

- Consent Management – Debtor businesses must grant permission for data access. Convincing distressed SMEs to share sensitive financial data may require legal or contractual leverage.

- Data Protection – Both Germany and France have strict GDPR enforcement regimes. Agencies must demonstrate airtight compliance to avoid reputational and financial risks.

- Integration Costs – Smaller collection agencies may struggle with the technology investments needed to tap into open banking APIs effectively.

Experts warn that while large pan-European firms may gain first-mover advantage, smaller domestic agencies risk being left behind without strategic partnerships.

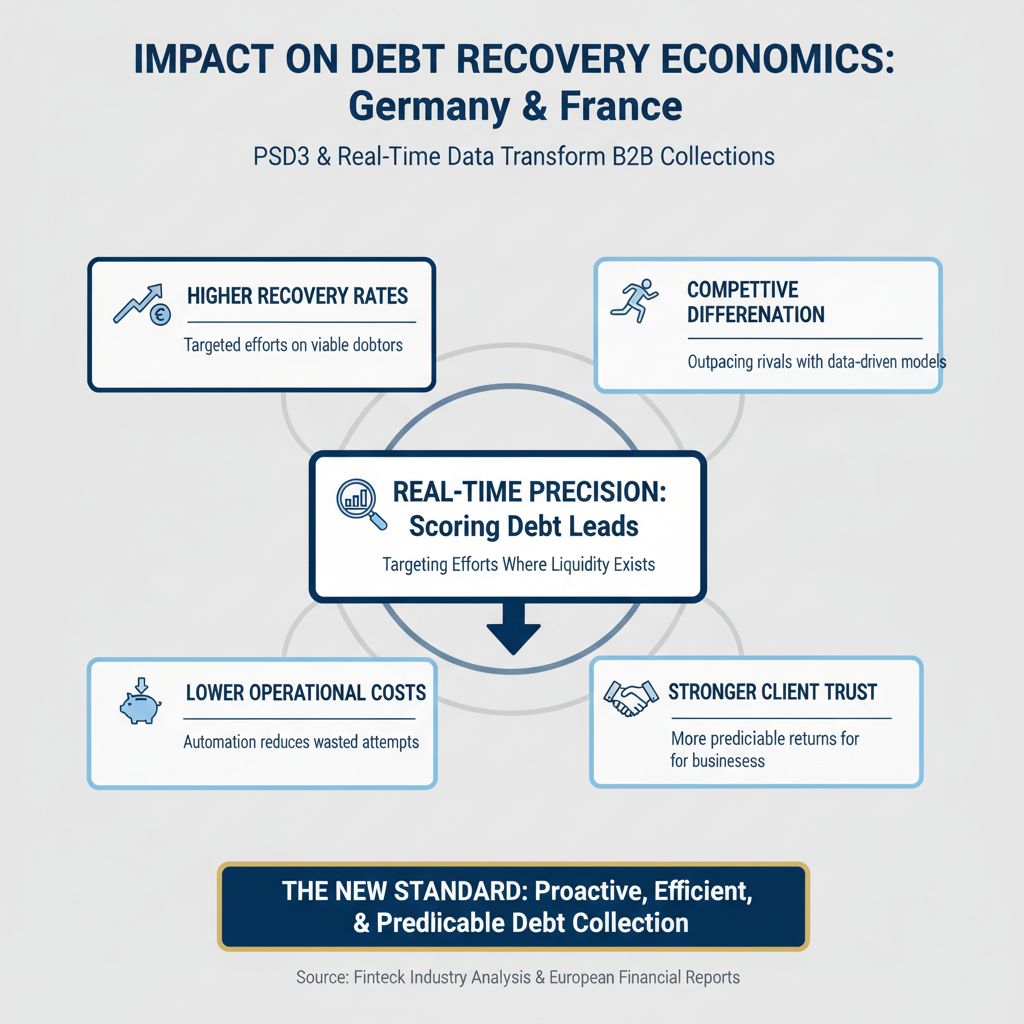

Impact on Debt Recovery Economics

The ability to score debt leads with real-time precision could radically alter the economics of B2B collections in Germany and France:

- Higher recovery rates: Agencies can target efforts where liquidity still exists.

- Lower operational costs: Automation reduces wasted recovery attempts on bankrupt entities.

- Stronger client trust: Businesses hiring collection agencies can expect more predictable returns.

- Competitive differentiation: Agencies leveraging PSD3 data will outpace rivals still dependent on outdated models.

Germany vs. France: Who Adopts Faster?

While both countries stand to benefit, early indications suggest Germany may outpace France in deploying PSD3-enabled debt scoring. German fintech ecosystems are tightly integrated with the banking sector, and regulators have been proactive in fostering open banking innovation since PSD2.

France, meanwhile, has a more fragmented SME landscape, where convincing smaller firms to opt into data sharing could prove more challenging. However, once adoption scales, French agencies may find cross-sector debt visibility especially valuable given the country’s diversified economy.

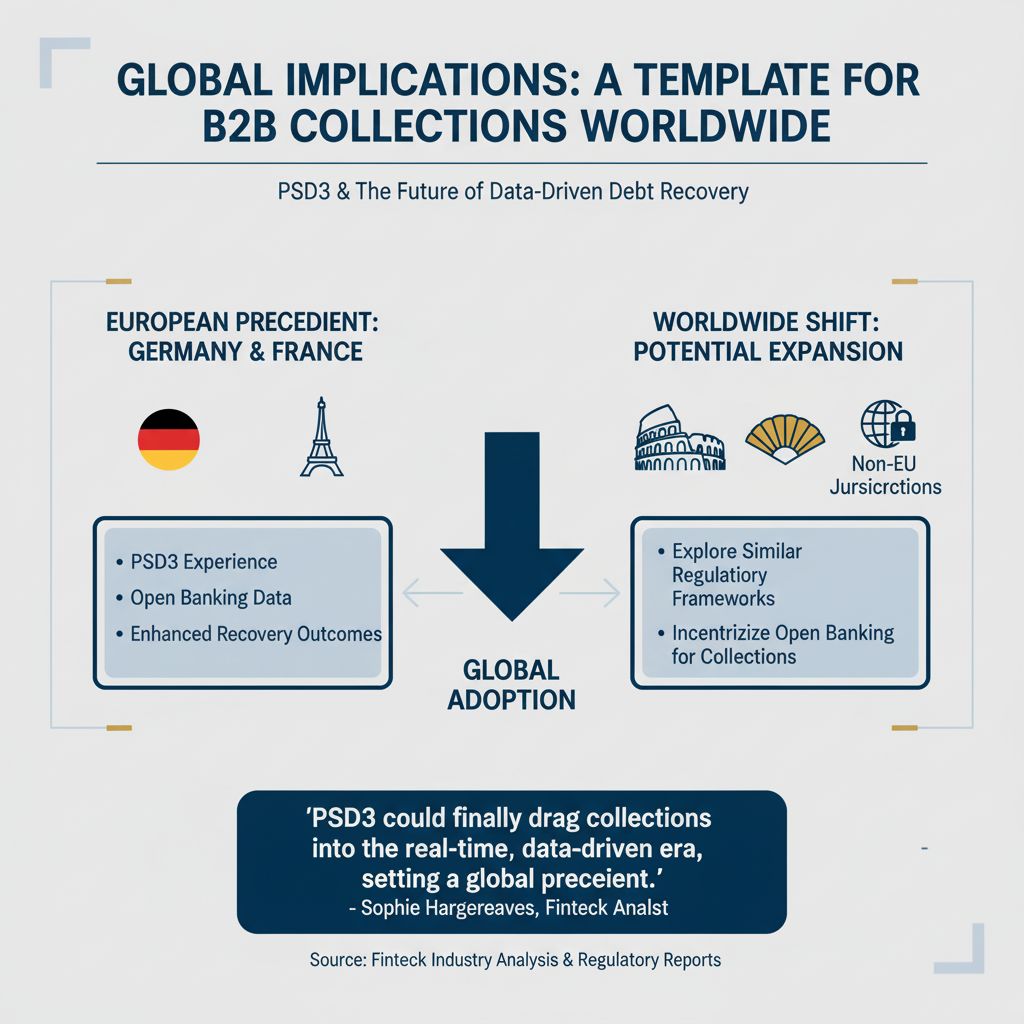

Global Implications: A Template for B2B Collections Worldwide

The German and French experiences under PSD3 could serve as a template for other debt-heavy economies. If open banking data proves to enhance recovery outcomes, markets such as Italy, Spain, and even non-EU jurisdictions may explore similar regulatory frameworks.

“Debt collection has long lagged behind other financial services in digital transformation,” notes London-based fintech analyst Sophie Hargreaves. “PSD3 could finally drag collections into the real-time, data-driven era, setting a global precedent.”

A New Era for B2B Debt Lead Scoring

As PSD3 reshapes Europe’s financial infrastructure, Germany and France are positioned at the forefront of a debt recovery revolution. Real-time cash flow access promises not only to strengthen debt lead scoring but also to improve recovery economics across the board.

For collection agencies, lenders, and B2B credit managers, the message is clear: adapt to PSD3’s open banking era or risk being left behind.

The next 12–18 months will determine which players harness the opportunity—and which remain stuck in the old, opaque world of delayed financial insights.