Private Credit Funds Expand Rapidly Across Europe and the US

Private credit funds are accelerating their expansion across Europe and the United States, driven by a surge in investor demand, a wave of new fund launches, and a sharp rise in deal volumes. As traditional banks reduce their lending exposure due to regulatory tightening and economic uncertainty, private lenders are stepping in to fill the financing gaps for businesses of all sizes. The result is one of the strongest growth phases the private credit market has ever seen, reshaping how companies access capital and redefining the global lending landscape.

Over the past year, private credit has evolved from a specialist segment of alternative investments to a mainstream financial powerhouse. The industry is now drawing unprecedented levels of institutional capital and capturing opportunities once dominated by commercial banks. From direct lending to distressed debt and real estate financing, private credit funds are rapidly becoming the preferred source of liquidity for borrowers across major economies.

New Fund Launches Hit Record Levels Across Major Financial Markets

The surge in private credit activity is being propelled by a wave of new fund launches in both Europe and the US. Asset managers, private equity firms, pension funds, and sovereign wealth funds are pouring billions into the sector, attracted by its yield potential and resilience during market cycles.

US Leads the Charge with Multi-Billion-Dollar Direct Lending Funds

In the United States, leading alternative investment firms have rolled out some of the largest private credit funds in history. Managers such as Blackstone, Apollo, KKR, and Ares have all closed new vehicles aimed at middle-market direct lending, structured credit, and opportunistic credit strategies. Many of these funds exceeded their initial fundraising targets, reflecting strong investor appetite for floating-rate, high-yield debt investments.

Middle-market companies—traditionally dependent on banks for long-term loans—are increasingly turning to private credit funds for faster approvals, more flexible terms, and certainty of execution. This dynamic has strengthened private credit’s reputation as a reliable, scalable alternative to bank lending.

Europe Witnesses Unprecedented Growth in Mid-Market Credit Funds

Across Europe, private credit has become one of the fastest-evolving segments of the financial system. With European banks constrained by post-crisis regulations and stricter capital requirements, private lenders are stepping in to meet borrower demand.

Countries such as the UK, Germany, France, and the Nordics have all seen a sharp rise in new fund launches targeting senior secured loans, unitranche facilities, and growth financing. European mid-market companies increasingly prefer private lenders due to faster deal execution, relationship-driven decision-making, and bespoke financing structures.

Industry analysts report that Europe’s private credit AUM has doubled over the past several years, making it the second-largest private credit market globally after the US.

Deal Volumes Increase as Borrowers Shift Away from Banks

A defining feature of the private credit expansion is the dramatic rise in deal volumes. Borrowers are proactively seeking financing from non-bank lenders due to tightening credit standards at banks and rising loan rejection rates.

Direct Lending Deals Surge in the US

In the US, direct lending activity has risen sharply, with private credit funds participating in everything from small corporate refinancings to billion-dollar leveraged buyouts. Many private credit firms are providing entire loan packages—known as “club deals” or “one-stop loans”—that streamline the financing process for corporate borrowers.

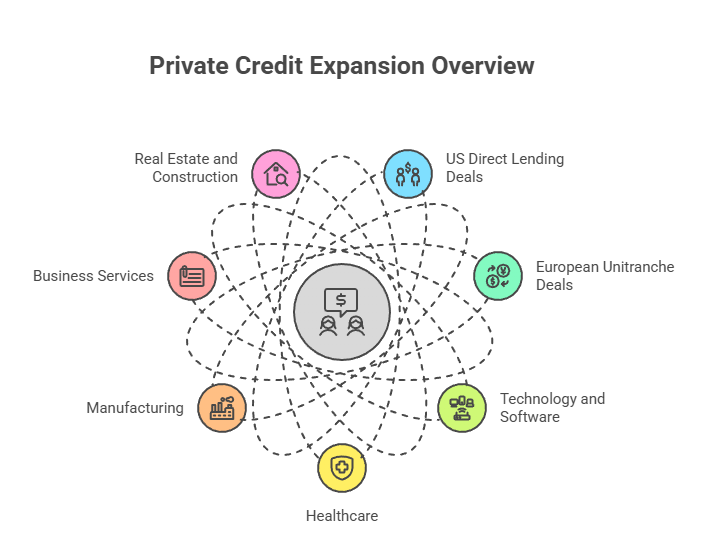

Industries driving the highest private credit deal flow include:

- Technology and software

- Healthcare

- Manufacturing

- Business services

- Real estate and construction

These sectors benefit from the speed and flexibility private lenders provide, especially in complex transactions where bank underwriting may take months.

European Unitranche Deals Reach New Highs

European markets have witnessed significant growth in unitranche lending, where a single loan combines senior and mezzanine debt into one streamlined structure. This product has become especially attractive to private equity firms seeking certainty of financing for acquisitions.

Private credit funds are increasingly syndicating loans to smaller funds or institutional investors, allowing them to execute larger and more competitive deals.

Private Lenders Fill Critical Gaps Left by Banks

One of the driving forces behind the private credit boom is the retreat of traditional banks from various lending segments. Regulatory requirements, higher capital buffers, and risk-weighted asset constraints are pushing banks to limit exposure to corporate and leveraged loans.

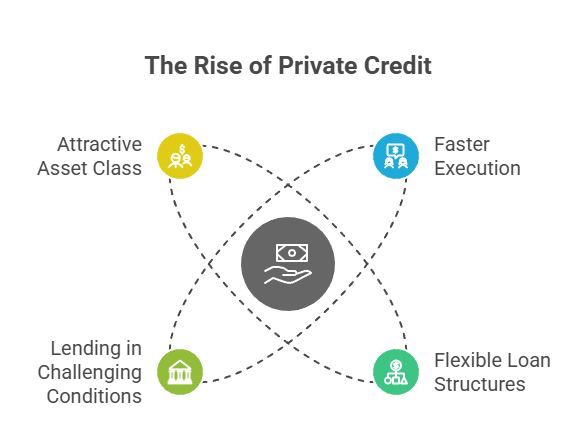

Private credit funds have stepped in to fill these gaps for several key reasons:

1. Faster Execution and Limited Bureaucracy

Borrowers value private credit firms for their quick decision-making and ability to structure deals without layers of approval committees. This agility is particularly beneficial for:

- Time-sensitive acquisitions

- Turnaround financing

- Growth capital

- Refinancing distressed or maturing obligations

2. Flexible Loan Structures

Private lenders can tailor loan terms to fit unique borrower circumstances. This includes:

- Covenant-lite structures

- Interest-only repayment periods

- Customized leverage levels

- Performance-based pricing

Such flexibility is rarely available through major banks.

3. Willingness to Lend in Challenging Conditions

Private credit firms often step in when banks exit sectors considered risky, such as commercial real estate, retail, or distressed industries. This has positioned private credit as a counter-cyclical source of liquidity.

4. An Attractive Asset Class for Investors

With yields higher than traditional fixed-income instruments, private credit is attracting large volumes of institutional capital. Investors appreciate:

- Floating-rate interest payments

- Strong collateral protection

- Direct exposure to cash-flow-generating companies

The growing pipeline of investor commitments is enabling private credit funds to aggressively expand lending offerings.

Growth in Distressed and Special Situations Funds

As economic pressures affect certain sectors, distressed debt and special situations strategies are gaining momentum. Private credit managers are raising new funds specifically focused on recapitalizations, rescue financing, and distressed buyouts.

Distressed opportunities are emerging in:

- Office and commercial real estate

- Retail and hospitality

- Highly leveraged corporations

- Companies with maturing debt and limited bank refinancing options

Private credit firms view this segment as a significant opportunity to generate outsized returns while providing essential capital to struggling businesses.

Real Estate Private Credit Gains Traction

Real estate credit has become another major driver of growth, particularly as banks tighten exposure to commercial property loans.

Private lenders are actively funding:

- Multifamily housing

- Industrial and logistics developments

- Mixed-use projects

- Construction financing

- Bridge loans for property acquisitions

The ability to provide quick bridge financing has made private lenders a preferred partner for property developers facing delayed traditional financing.

Institutional Investors Increase Allocations to Private Credit

Pension funds, sovereign wealth funds, insurance companies, and endowments are all increasing their exposure to private credit as part of long-term investment strategies.

Key factors driving institutional demand include:

- Attractive risk-adjusted returns

- Portfolio diversification

- Lower correlation with public markets

- Consistent cash yield

- Strong performance during periods of volatility

Many institutions now view private credit as a core portfolio component rather than a niche alternative investment.

Regulatory and Market Trends Support Continued Expansion

Both Europe and the US are experiencing structural shifts that favor the long-term growth of private credit.

Regulatory Changes

Post-crisis banking regulations continue to limit bank balance sheets, creating sustained opportunities for private lenders.

Market Trends

- Companies require more flexible financing options

- Aging debt markets are driving refinancing demand

- Private equity sponsors are relying heavily on direct lenders for buyouts

- Investors are seeking alternatives to volatile public debt markets

These trends are expected to support ongoing growth in private credit activity.

Outlook: Private Credit Positioned for Continued Dominance

The rapid expansion of private credit across Europe and the US marks a fundamental transformation in global lending. With billions in fresh capital entering the market, a robust pipeline of deals, and continued retrenchment from traditional banks, private lenders are positioned to play an even more influential role in corporate financing.

The accelerated pace of fund launches, rising deal volumes, and flexible lending structures all point to a sustained period of growth. As borrowers increasingly seek alternatives to bank financing, private credit will continue to bridge the financing gap and emerge as a dominant force in capital markets.