How Oil Prices Impact the UAE’s Fiscal Health and Debt Clock

UAE — August 2025:

Oil prices are once again in the spotlight, and in the United Arab Emirates, the stakes are high. Economists and debt market analysts say fluctuations in global crude markets this year could directly determine whether the country’s debt clock ticks slower or faster in the coming quarters.

The UAE, one of the world’s most influential oil exporters, has long enjoyed the fiscal rewards of high oil prices — from budget surpluses to rapid debt repayments. But in 2025, with energy markets swinging on geopolitical tensions and shifting global demand, policymakers face a delicate balancing act: protecting fiscal stability while advancing long-term diversification goals.

UAE Oil Prices Still Call the Shots

Oil and gas revenues remain the backbone of the UAE’s fiscal model. When crude prices climb above budgeted levels, the government gains the flexibility to increase spending, invest in infrastructure, and bolster sovereign wealth funds.

“When oil prices are high, the UAE can almost entirely sidestep borrowing,” said a Dubai-based macroeconomist. “It’s one of the reasons investors view its fiscal profile as exceptionally strong.”

But the country is not immune to downturns. A sustained drop in prices, such as the 2014–2016 slump or the brief but severe crash of April 2020, can quickly narrow fiscal space. In such periods, the government must either draw down reserves, issue bonds, or reduce expenditure — all of which influence the national debt clock.

Despite accelerated diversification in tourism, real estate, finance, and advanced manufacturing, oil revenues remain a critical driver of fiscal health.

The Debt Clock Reading

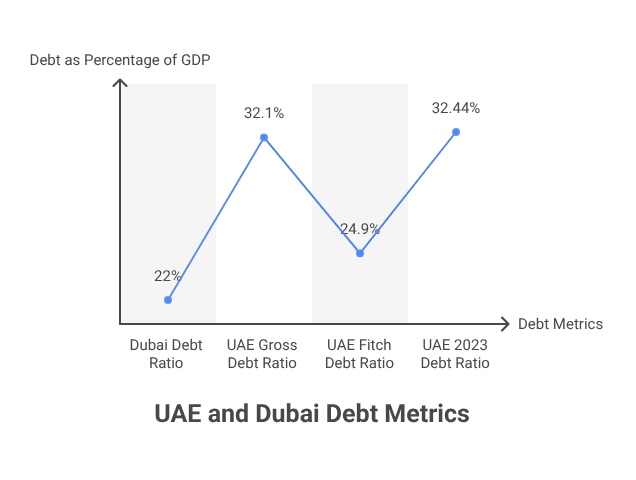

As of mid-2025, Dubai’s public debt stands at AED 112.4 billion, down 3.9% from a year earlier, with a debt-to-GDP ratio of 22%. At the national level, the UAE’s general government gross debt is estimated at 32.1% of GDP for 2024. Fitch Ratings offers a slightly lower figure of 24.9% of GDP for consolidated debt.

In US dollar terms, the UAE’s public debt for 2023 was about $166.8 billion, equal to roughly 32.44% of GDP.

Key figures at a glance:

- Dubai (June 2025): AED 112.4 billion (22% of GDP)

- UAE (2024/2025): 32.1% of GDP (gross), 24.9% (Fitch consolidated)

- Total 2023 debt: ~$166.8 billion (32.44% of GDP)

These figures remain healthy by both regional and global standards. But they are sensitive to oil prices — a sharp downturn could raise debt ratios within a single budget cycle.

2025: A Year of Price Swings

Oil prices this year have been shaped by a mix of bullish and bearish forces:

- Geopolitical risks in the Middle East and Eastern Europe have triggered periodic spikes.

- Sluggish global growth in major economies like China and the EU has dampened demand.

- OPEC+ output policies have kept supply relatively tight, supporting prices.

For the UAE, which bases its federal budget on conservative oil price assumptions, this volatility cuts both ways.

If prices remain above forecast:

- Surpluses can be directed to infrastructure, clean energy investments, and accelerated debt repayments.

- Extra funds can support Vision 2031 goals, including diversification and sustainability projects.

If prices fall below forecast:

- The government may tap sovereign reserves to maintain capital projects.

- Debt issuance could increase, raising the debt clock and potentially the cost of borrowing.

Fiscal Buffers in Action

The UAE’s sovereign wealth funds, led by the Abu Dhabi Investment Authority and Mubadala, manage assets worth hundreds of billions of dollars. These funds act as fiscal shock absorbers — when oil revenues surge, excess income is invested; when revenues decline, investment returns help plug budget gaps.

“Those funds are the UAE’s insurance policy,” said an Abu Dhabi-based financial strategist. “But even the largest reserves have limits if a low-price environment drags on for years.”

During the 2020 pandemic crash, these funds provided liquidity without requiring sharp spending cuts, a move that helped the UAE maintain investor confidence.

Historical Lessons

The UAE’s fiscal history shows how quickly oil cycles can affect debt trends.

- 2014–2016 downturn: Brent crude fell from $110 to below $30 a barrel, prompting spending reviews and the introduction of value-added tax (VAT) in 2018.

- 2020 oil crash: Prices briefly turned negative in global markets. The UAE weathered the storm by drawing on reserves, issuing targeted debt, and accelerating non-oil investments.

In both cases, the debt clock ticked faster during downturns — but slowed again when oil prices recovered.

Regional Debt Comparisons

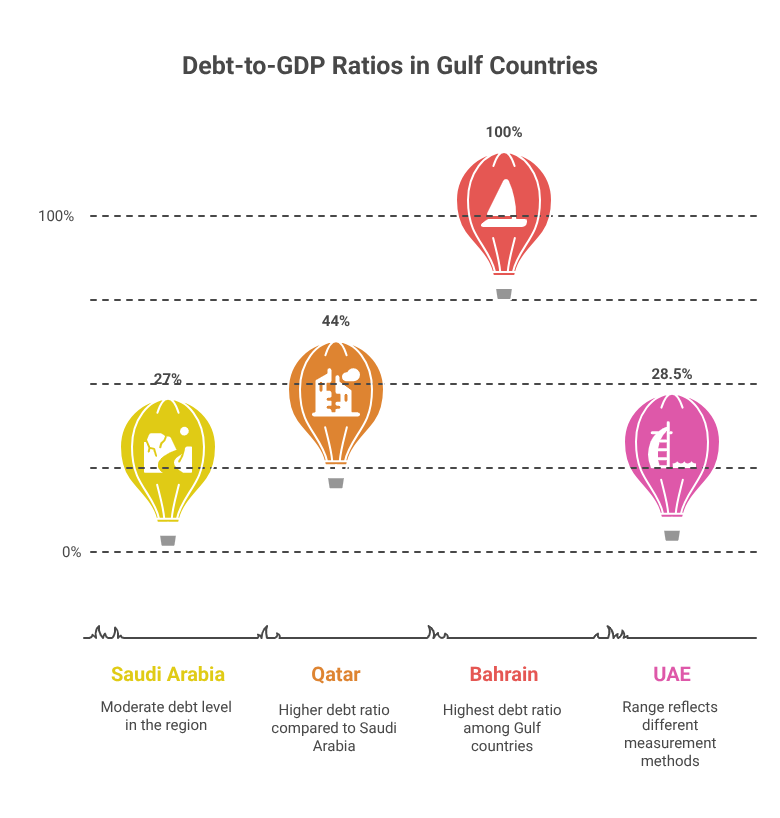

In the Gulf, debt-to-GDP ratios vary widely:

- Saudi Arabia: ~27%

- Qatar: ~44%

- Bahrain: Over 100%

- UAE: 24.9%–32.1%, depending on measurement

The UAE’s low ratio strengthens its credit profile, but analysts stress it cannot be taken for granted. Sustained low oil prices, rising global interest rates, or unexpected fiscal shocks could narrow that lead.

The Fiscal Discipline Test

Over the last decade, the UAE has implemented fiscal reforms that include:

- VAT introduction in 2018

- Energy subsidy reforms to reduce budget burdens

- Medium-term budget planning to smooth spending over oil cycles

However, high oil revenues can tempt governments into long-term spending commitments that are difficult to reverse when prices fall. “The real test of fiscal discipline is not during downturns, but during booms,” said a Gulf-based debt analyst.

The Diversification Drive

The UAE is pushing to expand non-oil revenue streams through:

- Tourism and events (Dubai Expo legacy projects, Abu Dhabi Grand Prix, cultural festivals)

- Manufacturing and logistics hubs in free zones

- Technology and renewable energy investments

- Financial services are attracting global capital flows

While progress is visible — non-oil GDP has grown steadily — oil still underpins fiscal strength. Full decoupling will take time.

Renewable Energy as a Hedge

Projects like the Mohammed bin Rashid Al Maktoum Solar Park and Masdar’s renewable energy initiatives are part of the UAE’s strategy to lead in clean energy while creating alternative revenue streams.

“Renewable investments won’t replace oil revenue overnight,” said an energy transition researcher. “But they will make fiscal planning less vulnerable to oil price shocks.”

Looking Ahead: The Debt Clock’s Future

Most analysts expect the UAE’s debt clock to remain stable in the short term. The country’s combination of low debt, high reserves, and diversified investments gives it a cushion few nations can match.

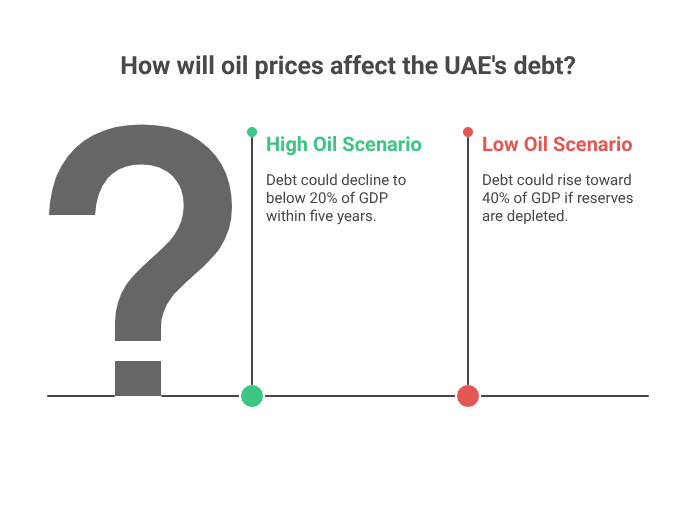

Still, the direct correlation between oil prices and fiscal health means vigilance is essential.

- High oil scenario: Debt could decline to below 20% of GDP within five years.

- Low oil scenario: Debt could rise toward 40% of GDP if reserves are depleted and borrowing needs increase.

Global trends such as the energy transition, geopolitical risk, and climate policies will also shape future fiscal outcomes.

In the UAE, oil prices don’t just influence markets — they influence the pace of the debt clock. The country’s ability to manage this dependency through disciplined budgeting, strategic investment, and continued diversification will determine whether the clock slows or speeds up in the years ahead.

For now, the numbers look favourable, but 2025’s volatile oil market is a reminder that in the Gulf’s fiscal landscape, every dollar on the barrel counts.