Global Debt Distress in 2025: Key Takeaways for Agencies

The global economic landscape in 2025 is marked by unprecedented debt levels, creating significant challenges for governments, financial institutions, and agencies involved in debt management and collection. Global debt distress is no longer a theoretical concern—it is a reality impacting both developed and emerging markets. Agencies must understand these dynamics to effectively navigate the complexities of debt recovery, risk management, and financial consulting in this high-stakes environment.

Understanding Global Debt Distress

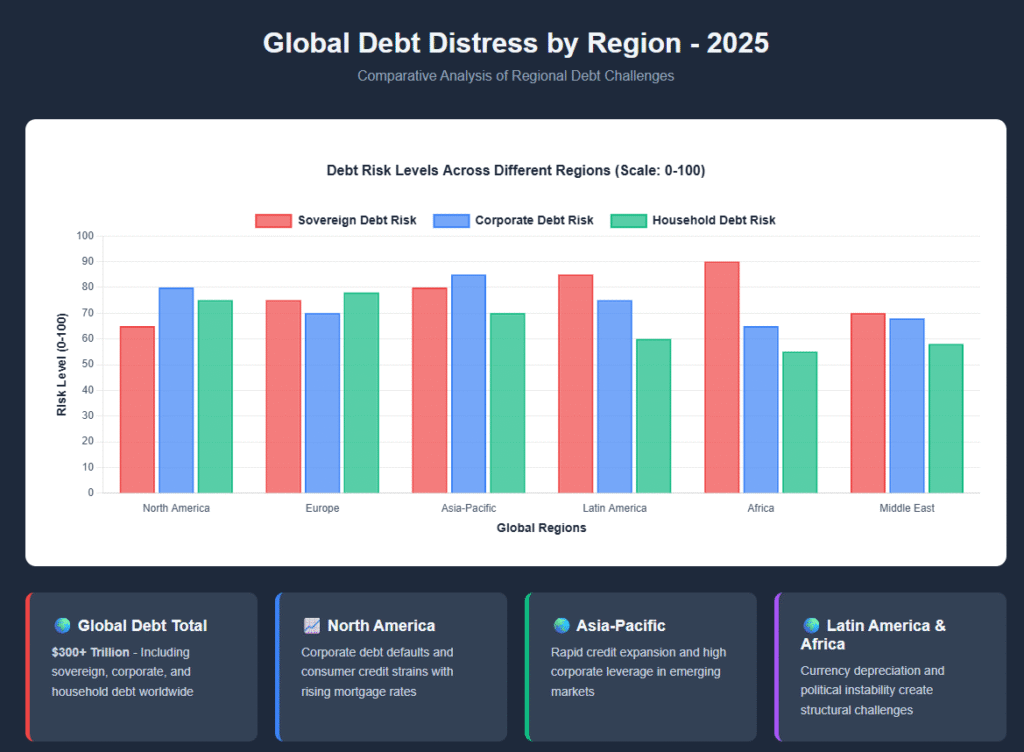

Global debt distress refers to situations where countries, corporations, or individuals struggle to service their debt obligations, leading to defaults or restructuring. According to recent data, the total global debt has surpassed $300 trillion in 2025, a figure that includes sovereign, corporate, and household debt. This massive accumulation poses systemic risks and threatens economic stability worldwide.

Debt distress is not uniform—it manifests differently depending on the economic, political, and social context. While developed nations face corporate and household debt challenges, emerging markets often deal with sovereign and currency-related debt crises. Understanding these nuances is critical for agencies seeking to position themselves as leaders in debt recovery and risk management.

Key Drivers of Debt Distress

- Rising Interest Rates: Central banks worldwide, responding to inflationary pressures, have raised interest rates. This increases the cost of borrowing, making it harder for debtors to meet repayment obligations. Agencies must monitor these rate changes to anticipate default risks and adjust collection strategies proactively.

- Economic Slowdowns: Global GDP growth has slowed, particularly in emerging markets. Sluggish economic activity reduces revenue for businesses and individuals, intensifying repayment difficulties. Industries such as retail, manufacturing, and hospitality are particularly vulnerable, leading to higher default rates on corporate loans.

- Geopolitical Tensions: Trade disputes, sanctions, and conflicts disrupt markets, reduce liquidity, and increase the likelihood of default, creating additional burdens for debt collection agencies. Agencies need to be aware of cross-border legal implications, currency risks, and the political environment affecting debt repayment.

- Climate-related Events: Natural disasters and climate crises have forced governments and corporations to divert funds toward recovery efforts, increasing fiscal deficits and debt pressure. Insurance claims, infrastructure damage, and disrupted supply chains have direct and indirect impacts on debt repayment patterns.

- Technological Disruption: Rapid technological adoption can impact industries unevenly. Agencies must account for sectors under stress due to automation, digital transformation, and evolving consumer behaviors, which can influence the likelihood of debt default.

Impact on Financial Agencies

Debt distress impacts agencies in multiple ways, from operational challenges to strategic opportunities. Understanding these impacts is essential for agencies to optimize their services and protect their interests.

Operational Challenges

- Increased Default Rates: Agencies face higher non-performing accounts, requiring advanced strategies to recover debts efficiently. Standard collection methods are often insufficient in distressed economic environments, demanding innovative approaches.

- Regulatory Pressures: Governments often implement stricter regulations during periods of high debt distress, affecting collection practices. Agencies must stay informed about changing legislation, compliance requirements, and consumer protection laws in every operational territory.

- Resource Allocation: Managing distressed portfolios demands more manpower and technological investment, increasing operational costs. Agencies must balance operational efficiency with the need for skilled personnel and technology solutions.

- Psychological Impact: Working with distressed debtors can be challenging. Agencies must train staff to manage sensitive situations ethically while maintaining high recovery rates.

Strategic Opportunities

- Debt Restructuring Services: Agencies can expand services by offering debt restructuring, refinancing, and advisory support to struggling clients. This approach builds trust, strengthens relationships, and positions the agency as a strategic partner rather than just a debt collector.

- Technological Integration: Leveraging AI, predictive analytics, and digital communication tools helps agencies streamline collection processes and enhance recovery rates. Automated reminders, chatbots, and personalized communication increase efficiency and improve debtor engagement.

- Market Expansion: Distress situations create opportunities to offer specialized services in emerging economies and sectors under stress. Agencies can develop localized strategies and partnerships with financial institutions to capture new business.

- Financial Consulting: Agencies can provide insights on cash flow management, credit risk assessment, and debt restructuring strategies. These services allow agencies to diversify revenue streams beyond traditional collections.

Global Debt Distress Regional Insights 2025

North America

Despite strong economic fundamentals, North American agencies face challenges from corporate debt defaults and consumer credit strains. Rising mortgage rates and high consumer debt levels contribute to growing delinquency rates. Agencies must adopt data-driven strategies to manage collections while complying with strict consumer protection laws. Additionally, the rise of fintech platforms presents both competition and partnership opportunities for agencies seeking innovative debt management solutions.

Europe

Europe faces a mixed debt landscape. While countries like Germany and France maintain stable sovereign debt levels, Southern European nations grapple with high government and household debt. Agencies need to navigate complex legal frameworks, including the EU’s debt recovery regulations, to ensure efficient operations. Moreover, agencies should consider cross-border collaboration to address transnational debt portfolios effectively.

Asia-Pacific

Emerging markets in the Asia-Pacific region are particularly vulnerable due to rapid credit expansion and high corporate leverage. Agencies can benefit from proactive risk assessment and early intervention strategies to minimize losses. Innovative fintech solutions, mobile banking, and digital payment platforms can aid debt collection while maintaining compliance with local regulations.

Latin America and Africa

These regions face structural economic challenges, including currency depreciation and political instability. Debt recovery agencies need localized expertise, flexible repayment solutions, and partnerships with local financial institutions to succeed. Agencies should also focus on community engagement and educational initiatives to improve financial literacy and responsible borrowing.

Best Practices for Agencies in 2025

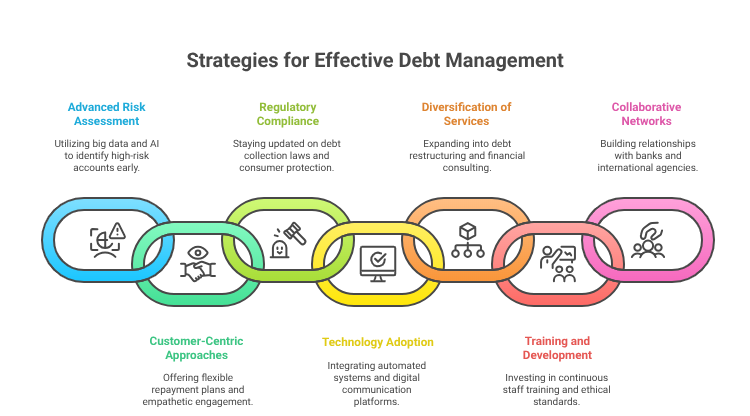

- Advanced Risk Assessment: Utilize big data and AI models to identify high-risk accounts early and prioritize resources effectively. Predictive analytics can help agencies forecast default probabilities and allocate resources efficiently.

- Customer-Centric Approaches: Offer flexible repayment plans and advisory services to maintain client relationships and improve recovery rates. Empathetic engagement with debtors can increase compliance and reduce litigation costs.

- Regulatory Compliance: Stay updated on changing debt collection laws, cross-border regulations, and consumer protection policies to avoid legal complications. Establishing internal compliance teams and automated audit systems is recommended.

- Technology Adoption: Integrate automated collection systems, predictive analytics, and digital communication platforms to enhance efficiency. Cloud-based platforms can facilitate secure and scalable debt management operations.

- Diversification of Services: Agencies should expand into debt restructuring, financial consulting, and risk management to remain competitive. Offering a holistic suite of services positions agencies as trusted partners in financial stability.

- Training and Development: Invest in continuous training for staff to handle complex debt situations, improve negotiation skills, and maintain ethical standards.

- Collaborative Networks: Build relationships with banks, fintech companies, and international agencies to share intelligence and streamline cross-border debt recovery.

Lessons from Past Debt Crises

Historical debt crises, such as the 2008 financial crash and the European sovereign debt crisis, provide valuable lessons for agencies:

- Early Intervention Matters: Agencies that act swiftly to manage distressed accounts minimize losses. Timely communication and proactive restructuring can prevent defaults from escalating.

- Collaboration with Stakeholders: Cooperation with banks, regulators, and clients ensures smoother debt recovery processes. Joint strategies can reduce litigation costs and improve recovery rates.

- Flexibility and Innovation: Customizing solutions based on debtor profiles leads to better outcomes than rigid, one-size-fits-all approaches. Agencies should leverage data insights to design personalized repayment plans.

- Communication Transparency: Clear communication with debtors, creditors, and regulators enhances trust and reduces disputes. Transparency is particularly important in high-risk economic environments.

Predictive Outlook for 2025 and Beyond

While global debt levels remain high, agencies can adopt proactive measures to mitigate risks:

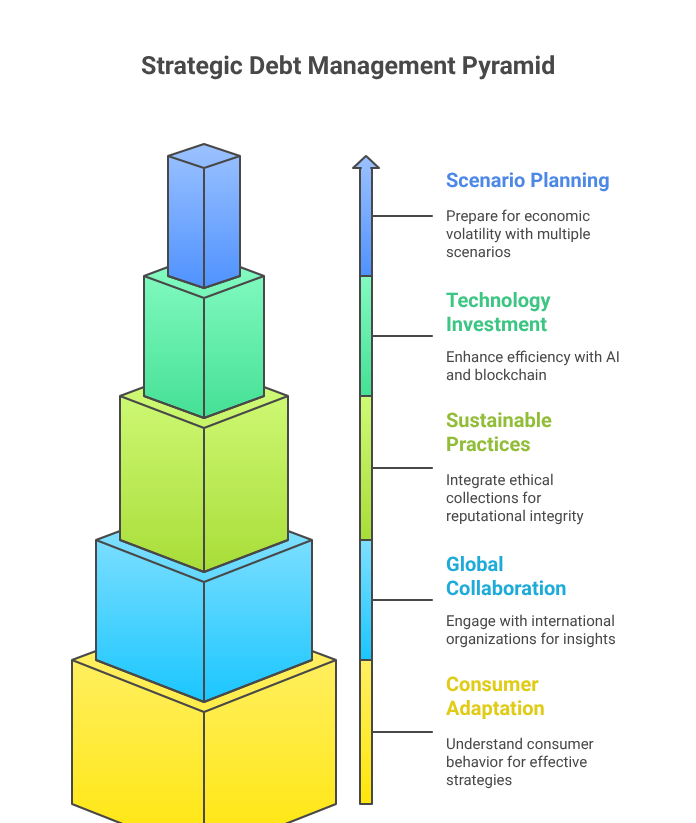

- Scenario Planning: Developing multiple debt recovery scenarios helps agencies prepare for economic volatility. Stress-testing portfolios under different macroeconomic assumptions can guide strategic decisions.

- Investment in Technology: Continued adoption of AI, machine learning, and blockchain can improve transparency and efficiency in debt recovery. Digital platforms can also enhance reporting and compliance capabilities.

- Focus on Sustainable Practices: Agencies must consider the social impact of collections and integrate ethical practices to maintain reputational integrity. Socially responsible collections can improve debtor engagement and reduce negative publicity.

- Global Collaboration: Agencies should engage with international organizations, industry associations, and regulatory bodies to stay informed about trends and best practices.

- Adapting to Consumer Behaviour: Understanding shifts in consumer borrowing, spending, and repayment patterns is crucial for developing effective collection strategies. Agencies should analyze demographic and behavioral data to anticipate trends.

Conclusion: Strategic Takeaways

In 2025, global debt distress presents both challenges and opportunities for agencies. By understanding the macroeconomic environment, leveraging technology, adopting customer-centric strategies, and staying compliant with regulations, agencies can not only survive but thrive in this complex landscape. Strategic foresight, operational agility, and innovative solutions will define the most successful agencies in the years ahead.

Agencies that invest in technology, diversify services, and build strong stakeholder networks will be best positioned to navigate the evolving debt landscape. The integration of AI, predictive analytics, and ethical debt recovery practices will become industry standards, shaping the future of debt management worldwide.