Global Debt Clock Signals Rising Sovereign Stress in Europe and Emerging Markets

The world debt clock is accelerating at a pace that is increasingly difficult for governments to ignore. As global public debt reaches unprecedented levels, signs of sovereign stress are re-emerging across Europe and intensifying in emerging markets. What was once a distant macroeconomic concern has now become a central policy challenge, with rising interest costs, slower growth, and fragile fiscal balances reshaping national economic strategies.

From Southern Europe’s heavily indebted economies to emerging nations struggling with currency volatility, the national debt clock has become a real-time indicator of fiscal strain. For policymakers, investors, and citizens, these rising numbers signal a narrowing margin for error.

World Debt Clock Shows Structural Imbalances Deepening

According to global debt tracking indicators, total sovereign debt has expanded faster than economic output for several consecutive years. The world debt clock reflects the cumulative effect of crisis-era borrowing, pandemic stimulus, energy price shocks, and prolonged fiscal support measures.

While aggressive borrowing helped stabilize economies during periods of stress, it also locked many governments into high-debt trajectories. As global interest rates rose, debt servicing costs surged, exposing structural weaknesses in public finances. The result is a growing divide between countries with fiscal buffers and those operating under persistent budget pressure.

Europe Faces Renewed Sovereign Pressure

Europe is once again under scrutiny as debt ratios climb and fiscal flexibility tightens. Several euro-area economies entered the current cycle with elevated public debt, aging populations, and modest productivity growth. The national debt clock in these countries shows liabilities rising faster than revenues, even as governments attempt to balance social spending with fiscal discipline.

Higher borrowing costs have added urgency to long-delayed reforms. Governments are now forced to make difficult choices between funding welfare systems, investing in infrastructure, and servicing debt. Political fragmentation and election cycles further complicate efforts to implement long-term fiscal consolidation plans.

Although institutional safeguards exist to prevent sudden debt crises, markets are increasingly sensitive to policy credibility. Small deviations from fiscal targets can lead to rapid increases in bond yields, reinforcing debt sustainability concerns.

Emerging Markets Confront Dual Debt Risks

In emerging markets, sovereign stress is often magnified by external vulnerabilities. Many countries borrowed heavily in foreign currencies during the years of low global interest rates. As financial conditions tightened, debt repayment became more expensive, while local currencies weakened against major global currencies.

The world debt clock highlights the aggregate rise in emerging market debt, but the national debt clock at the country level reveals sharp disparities. Commodity exporters benefited from favorable price cycles, while import-dependent economies struggled with trade imbalances and inflationary pressures.

Shorter debt maturities have increased rollover risk, forcing governments to refinance frequently in volatile markets. For lower-rated sovereigns, access to capital markets has become more fragile, increasing reliance on multilateral support or domestic borrowing at higher costs.

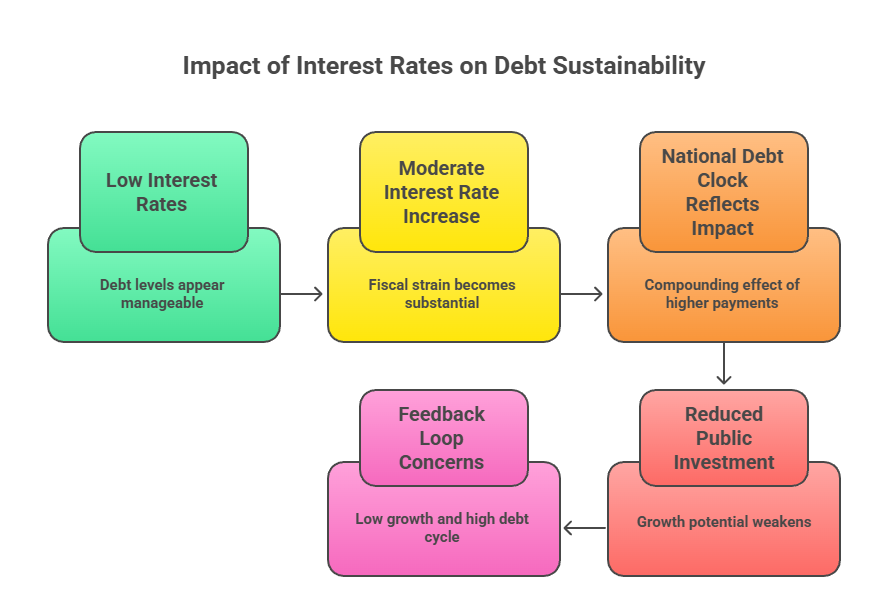

Interest Rates Transform Debt Sustainability

Interest rates are the most critical variable shaping the current debt landscape. When rates were low, high debt levels appeared manageable. Today, even moderate increases translate into substantial fiscal strain.

Across Europe and emerging markets, the national debt clock reflects the compounding effect of higher interest payments. Governments are allocating a growing share of revenue to debt servicing, leaving less room for development spending, social protection, and economic stimulus.

This shift has long-term consequences. Reduced public investment can weaken growth potential, making it even harder to stabilize debt ratios. The feedback loop between low growth and high debt is once again becoming a central concern for policymakers.

Fiscal Policy Under Pressure

Governments now face a delicate balancing act. Rapid fiscal tightening risks slowing already weak growth, while delayed adjustment undermines credibility and increases borrowing costs. The challenge lies in designing credible medium-term strategies that restore confidence without triggering economic contraction.

Transparency and consistency have become essential. Countries that clearly communicate fiscal plans and demonstrate commitment to reform tend to face less market volatility, even when debt levels are high. In contrast, policy uncertainty can quickly amplify sovereign risk.

Tax reform, expenditure rationalization, and productivity-enhancing investments are increasingly viewed as necessary components of sustainable debt management.

Global Institutions Warn of Spillover Risks

International financial institutions have warned that rising sovereign stress could spill across borders. Debt distress in one region can quickly affect investor sentiment globally, tightening financial conditions for multiple economies simultaneously.

Support mechanisms, debt restructuring frameworks, and liquidity facilities are expected to play a larger role as fiscal pressures intensify. Coordination between governments and global institutions is becoming more critical as synchronized debt challenges emerge.

Social Impact of Rising Sovereign Debt

Behind the numbers on the world debt clock lies a broader social reality. As governments devote more resources to interest payments, funding for public services comes under pressure. Healthcare systems, education budgets, and social safety nets face increasing scrutiny.

Public frustration is growing in countries where austerity measures limit wage growth or reduce benefits. This has fueled political volatility, with voters demanding both economic stability and social protection—often without clear funding pathways.

The social dimension of sovereign debt is now inseparable from the economic debate, shaping electoral outcomes and policy priorities.

Markets Become More Selective

Financial markets are responding with increased discrimination. Investors are closely monitoring fiscal data, reform progress, and political stability. Countries with credible debt management strategies continue to access funding, while those perceived as high risk face widening yield spreads.

In Europe, deeper financial integration and capital market reforms could help mitigate fragmentation risks. In emerging markets, expanding local currency debt markets and diversifying funding sources are seen as key resilience strategies.

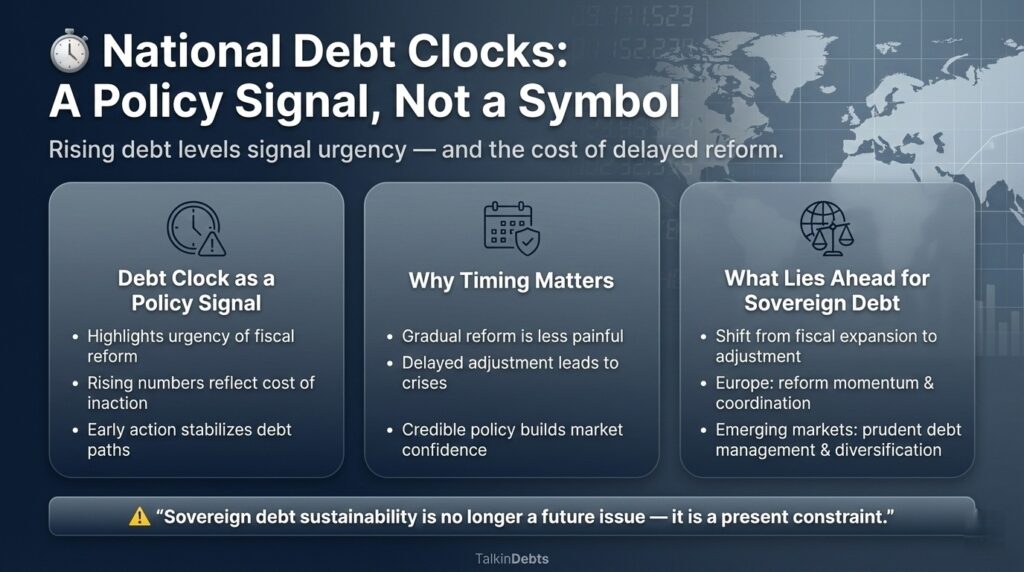

National Debt Clock as a Policy Signal

The national debt clock is no longer a symbolic counter—it has become a policy signal. Rising numbers highlight the urgency of reform and the cost of inaction. Countries that act early by improving fiscal efficiency and supporting growth are better positioned to stabilize their debt paths.

History shows that delaying adjustment often leads to harsher outcomes. Gradual, credible reform is less painful than crisis-driven correction.

What Lies Ahead for Sovereign Debt

The coming years are likely to be defined by fiscal adjustment rather than expansion. Governments must rebuild balance sheets while navigating demographic shifts, climate investment needs, and geopolitical uncertainty.

Europe’s path will depend on reform momentum and institutional coordination. Emerging markets will rely on prudent debt management, diversified growth strategies, and access to international support when needed.

As the world debt clock continues to rise, the message is increasingly clear: sovereign debt sustainability is not a future problem—it is a present constraint shaping economic policy worldwide.