Global Corporate Debt Hits Record Levels — IMF and BIS Sound the Alarm

November 2025

Global corporate debt has climbed to an all-time high, prompting fresh warnings from the International Monetary Fund (IMF) and the Bank for International Settlements (BIS) about the growing risks to global financial stability. Both institutions, in their latest reports, cautioned that high leverage, tighter credit conditions, and an approaching refinancing surge could strain companies and banks in advanced economies through 2026 and 2027.

The warnings come amid a world economy still adjusting to a new era of higher interest rates. After more than a decade of cheap money, corporate borrowing costs have reset sharply upward, exposing the vulnerabilities of firms that accumulated record debt during the low-rate years following the pandemic.

Record Leverage Meets Persistent High Rates

According to the IMF’s most recent Global Financial Stability Report, global non-financial corporate debt has reached unprecedented levels. The report highlights that a significant share of companies, particularly in advanced economies, now face interest coverage ratios—a key measure of a firm’s ability to service debt—falling below one.

That means many companies are no longer earning enough to cover their interest payments, a signal of mounting financial stress. The IMF noted that, under even mild economic shocks, the proportion of such firms could rise sharply, potentially triggering defaults and layoffs in vulnerable industries.

While inflation has eased across most major economies, central banks have maintained policy rates well above their pre-2022 levels to ensure price stability. For businesses, that means borrowing remains expensive even as global growth slows. The IMF has warned that the combination of high leverage and higher-for-longer interest rates is becoming one of the biggest threats to financial stability going into 2026.

The Refinancing Wall Ahead

Both the IMF and BIS are increasingly concerned about what they describe as a “refinancing wall”—a surge of corporate debt maturing in the next two years.

Trillions of dollars of corporate bonds and loans issued during the pandemic are set to come due between 2026 and 2027. Companies that secured financing at record-low interest rates are now facing refinancing at yields two or three times higher.

The BIS warned in its quarterly review that this looming maturity wall could “test the resilience of corporate balance sheets” and strain sectors that are already operating with slim margins. Firms with weaker cash flows, particularly in real estate, manufacturing, and consumer services, are likely to face the harshest impact.

According to estimates, more than $5 trillion in corporate debt globally will need to be refinanced by the end of 2026. For many borrowers, especially those in advanced economies where central banks have maintained elevated policy rates, this will mean a steep rise in debt-servicing costs.

Tight Credit Despite Market Calm

Despite relatively stable financial markets in recent months, both institutions warned that credit conditions have quietly tightened across advanced economies.

In the United States and Europe, bank lending standards have grown stricter for six consecutive quarters. Banks are demanding higher collateral, shorter maturities, and tighter covenants, reflecting their own cost pressures and cautious outlooks.

Even though corporate bond spreads have narrowed at times this year, the overall cost of capital remains elevated. The BIS noted that “compressed spreads do not imply easy credit,” as the underlying base rates remain significantly higher than those seen over the past decade.

Small and medium-sized enterprises (SMEs) are bearing the brunt of this credit tightening. Unlike large corporates, which can access bond markets or private credit, smaller firms rely heavily on traditional bank loans. As banks pull back, these companies face a double challenge—shrinking credit availability and higher interest expenses.

Non-Bank Lenders Step In

As traditional banks retreat from riskier lending, non-bank financial institutions—such as private credit funds, hedge funds, and insurers—have stepped in to fill the gap. The private credit market has grown rapidly, surpassing $2 trillion globally, and is now a major source of corporate financing.

While this shift has helped many companies refinance or restructure their obligations, the IMF and BIS caution that it also introduces new forms of systemic risk.

Private lenders often operate with less regulatory oversight, and their funding structures can be opaque. In times of stress, these funds may face sudden redemption requests, forcing them to liquidate assets quickly—potentially transmitting shocks across the financial system.

The IMF urged policymakers to strengthen data collection and transparency around non-bank exposures, emphasizing that the growing linkages between banks and non-bank entities could magnify the impact of future market disruptions.

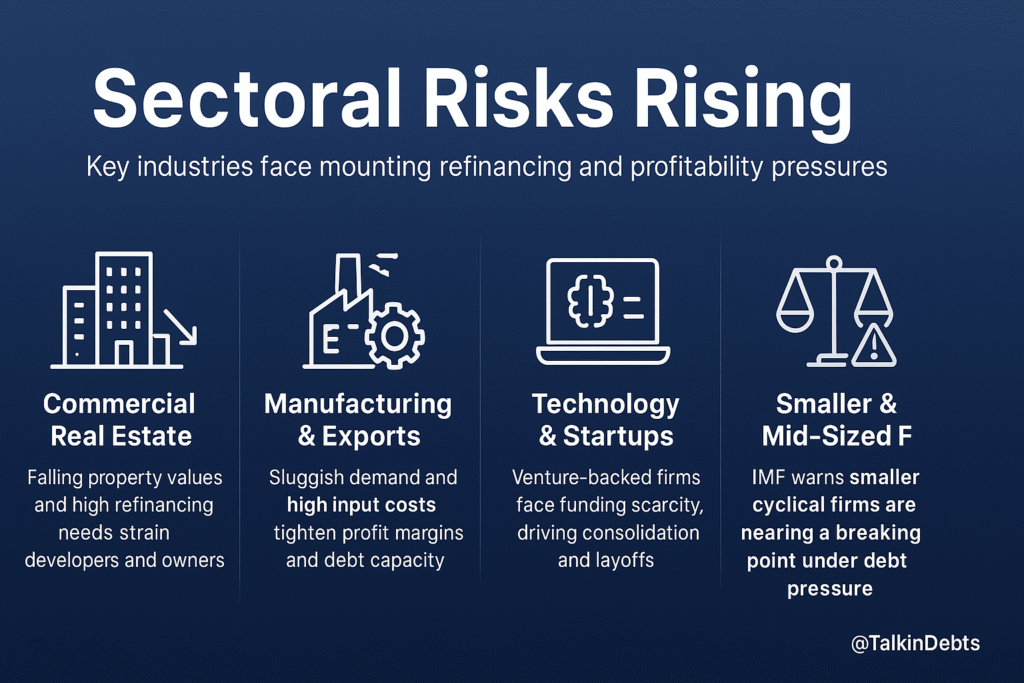

Sectoral Risks Rising

Certain industries are emerging as pressure points in the current environment.

- Commercial real estate remains one of the most heavily exposed sectors. Property valuations in major cities have fallen as demand for office space weakens, while many developers and owners face large refinancing needs at sharply higher rates.

- Manufacturing and export-driven sectors in advanced economies are also under strain. Sluggish global demand and high input costs have limited profit margins, reducing firms’ ability to absorb higher debt servicing costs.

- Technology and venture-backed firms that relied heavily on cheap capital during the 2020–2022 boom are finding it harder to attract funding, leading to consolidation and layoffs across the industry.

The IMF noted that while large multinationals are generally well-positioned, smaller and mid-sized firms are approaching a “breaking point”, especially those operating in cyclical industries.

A Shift in Policy Focus

The persistence of high corporate debt has created a policy dilemma for central banks. While inflation has moderated, it remains above target in several economies, limiting the scope for rapid rate cuts. Yet keeping rates too high for too long could fuel a corporate credit crunch that risks undermining growth.

The IMF recommends that monetary policy remain data-dependent but urges authorities to strengthen financial safety nets. This includes enhancing macroprudential supervision, monitoring corporate refinancing exposures, and preparing targeted support mechanisms for distressed but viable firms.

The BIS echoed those views, stressing the importance of resilience over reaction. It called on regulators to improve visibility into debt structures, especially in the non-bank sector, and to coordinate across jurisdictions to prevent “hidden leverage” from building unnoticed.

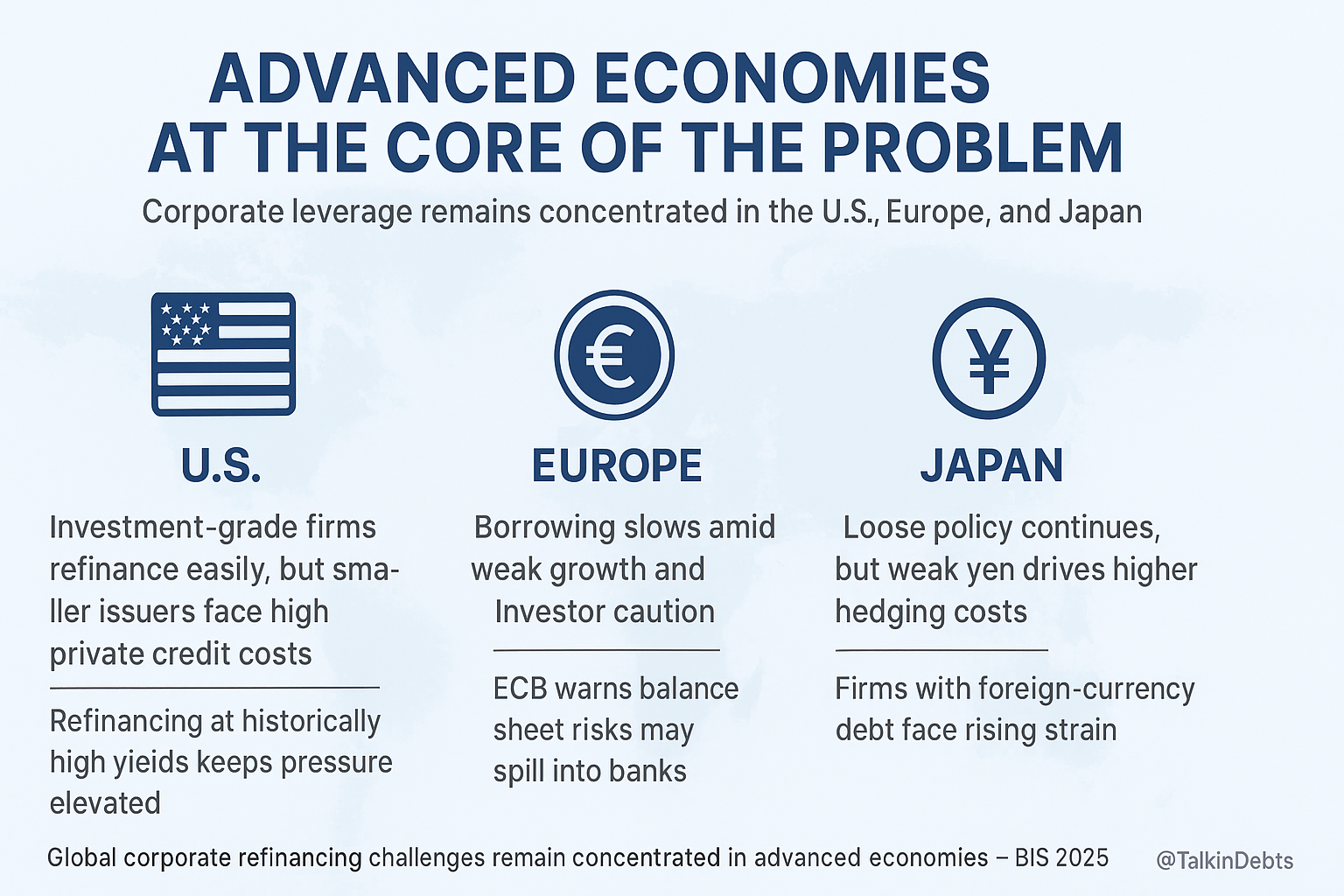

Advanced Economies at the Core of the Problem

The concentration of corporate leverage is highest in advanced economies, particularly the United States, the euro area, and the United Kingdom.

In the U.S., large investment-grade firms continue to refinance with relative ease, but smaller high-yield issuers are increasingly dependent on private credit markets. The BIS noted that while market access has improved in 2025, “borrowers are refinancing at yields that remain historically high, keeping financial pressure elevated.”

In Europe, corporate borrowing has slowed sharply amid weak growth and subdued investor appetite. Banks have been especially cautious with real estate and leveraged lending exposures. The European Central Bank has warned that “balance sheet vulnerabilities could spill over into the banking sector” if defaults rise.

Japan, though still operating under relatively loose monetary conditions, is seeing its own challenges. Companies with large foreign-currency debts are grappling with higher hedging costs as the yen remains weak.

What Comes Next

Analysts say that while a widespread corporate debt crisis is not yet imminent, the combination of high leverage, tighter credit, and an uncertain economic outlook warrants close attention.

If global growth slows faster than expected, or if policy rates remain elevated through 2026, the strain on weaker corporate borrowers could become severe. Rising defaults in riskier credit segments could, in turn, tighten financing further, creating a feedback loop that amplifies stress across the economy.

For now, both the IMF and BIS believe the global financial system remains resilient, supported by strong bank capital buffers and healthy liquidity. But they warn that the buffer of resilience is narrowing, and that complacency could be costly.

The IMF summarized the situation in blunt terms:

“Global corporate debt has reached levels that leave many firms exposed to refinancing and profitability shocks. The next phase of adjustment will test the balance sheets of both borrowers and lenders.”

As 2026 approaches, that test may well determine whether the global economy experiences a controlled landing or a sudden stop in credit flows.