The Future of Debt Resolution: Digital Platforms, Self-Service Portals & Omni-Channel Engagement

Debt resolution is undergoing a structural shift. What was once a process driven by manual follow-ups, phone-based negotiations, and fragmented systems is rapidly evolving into a technology-led, customer-centric operation. For B2B lenders, financial institutions, utilities, fintech firms, and service providers, this change is not optional. Rising operational costs, increased account volumes, and heightened expectations around customer experience are forcing organizations to rethink how debt is managed and resolved.

Digital platforms, self-service portals, and omni-channel engagement models are now defining the future of debt resolution. These tools are not just improving recovery outcomes—they are reshaping cost structures, compliance readiness, and long-term customer relationships.

Why Traditional Debt Resolution Models Are No Longer Sustainable

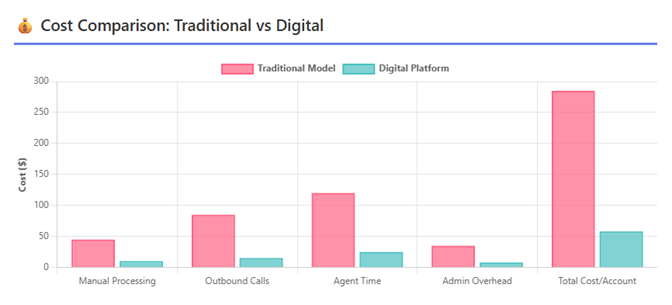

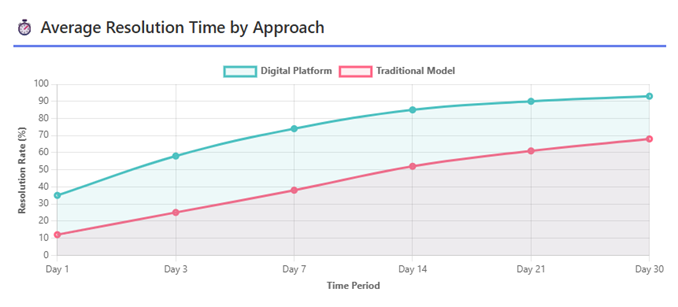

Legacy debt resolution models rely heavily on human intervention. Manual account reviews, outbound calling campaigns, spreadsheet-based tracking, and disconnected communication systems increase cost per account while limiting scalability. As delinquency volumes grow, these models struggle to deliver consistent results without expanding headcount.

From a B2B perspective, the inefficiencies are clear. Early-stage delinquent accounts often carry low balances but require disproportionate effort. Agents spend time chasing customers who may simply need reminders, clarity, or flexible options rather than direct negotiation. This approach inflates operational costs and reduces overall recovery efficiency.

At the same time, customers increasingly expect digital convenience. Phone-only engagement feels outdated, intrusive, and misaligned with how modern businesses and individuals manage their financial obligations. These pressures are accelerating the shift toward digital debt resolution ecosystems.

Digital Debt Resolution Platforms as the Core Infrastructure

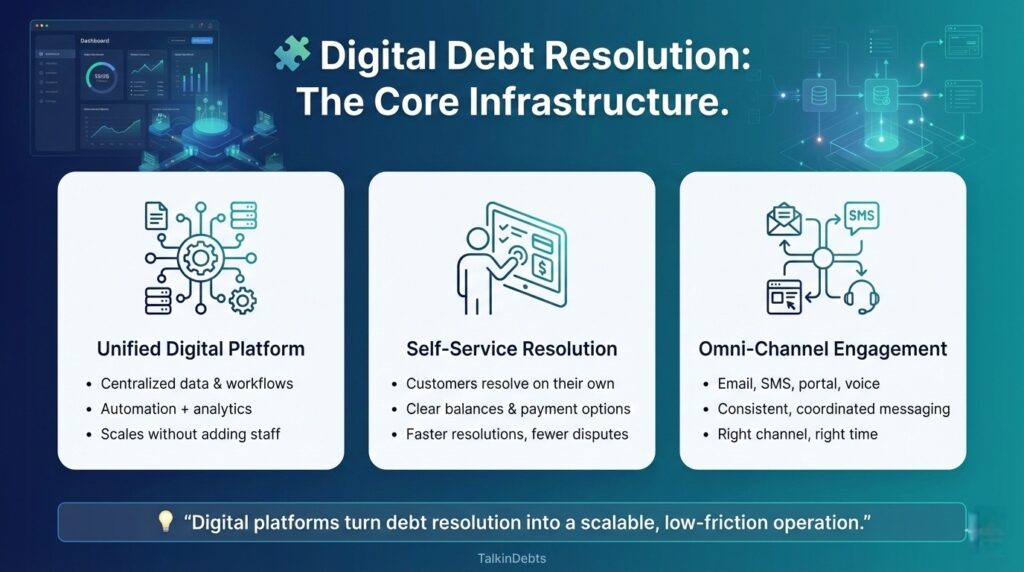

At the heart of modern debt resolution lies the digital collections platform. These platforms act as a centralized system that integrates account data, workflow automation, communication channels, payment processing, and analytics into a single operational environment.

For B2B organizations, digital platforms eliminate silos. Instead of managing multiple tools for data storage, outreach, and reporting, teams operate from one unified system. This improves visibility across portfolios and enables faster, more informed decision-making.

Automation plays a critical role. Routine actions such as payment reminders, status updates, follow-ups, and escalation triggers are handled automatically based on predefined rules. This reduces manual workload and ensures consistency across thousands or even millions of accounts.

Most importantly, digital platforms allow organizations to scale without proportional increases in staffing. As volumes rise, systems absorb the load, keeping cost-to-collect under control while maintaining performance.

Self-Service Portals: Empowering Resolution Without Friction

Self-service portals represent one of the most powerful shifts in debt resolution strategy. These portals allow customers to resolve outstanding obligations independently, without the pressure or discomfort of direct agent interaction.

A well-designed self-service portal provides customers with real-time access to their account information. They can view balances, understand charges, explore repayment options, and complete payments securely at their convenience. This transparency removes uncertainty and reduces resistance to engagement.

From the customer’s perspective, self-service restores control. Instead of reacting to outbound calls, they can proactively choose how and when to act. This leads to higher engagement rates and faster resolutions.

For B2B clients, the operational impact is significant. Self-service portals reduce inbound call volumes, shorten resolution cycles, and improve cash flow predictability. Payment plans and settlement options can be standardized and pre-approved, minimizing negotiation time while still offering flexibility.

Self-resolution also reduces disputes. When customers clearly understand their obligations and options, there is less confusion, fewer escalations, and lower administrative overhead.

Omni-Channel Engagement as a Strategic Advantage

Debt resolution no longer happens in a single channel. Customers interact across email, SMS, web portals, mobile interfaces, and voice calls. Omni-channel engagement acknowledges this reality and creates a seamless experience across all touchpoints.

An effective omni-channel strategy ensures that communication is coordinated rather than fragmented. Messages are consistent in tone, timing, and content, regardless of the channel used. Customers can move from one channel to another without losing context or repeating information.

For B2B organizations, omni-channel engagement improves efficiency and effectiveness. Digital channels handle high-volume, low-complexity interactions, while human agents step in only when needed. This layered approach reduces costs while maintaining strong recovery outcomes.

Crucially, omni-channel does not mean over-communication. Advanced platforms use engagement data to determine when, where, and how to reach customers. This reduces contact fatigue and improves response rates.

Cost Optimization Through Automation and Intelligent Segmentation

One of the most compelling benefits of digital debt resolution is cost reduction. Automation replaces repetitive manual tasks that consume agent time without adding proportional value.

Intelligent segmentation allows accounts to be grouped based on risk profile, balance size, delinquency stage, and behavioral indicators. Each segment follows a tailored resolution path designed to maximize efficiency and recovery.

Low-risk accounts may receive automated digital reminders and self-service options. Medium-risk accounts might be offered structured payment plans. High-risk or complex cases can be escalated to specialized agents. This targeted allocation of resources significantly lowers cost-to-collect.

For B2B clients managing diverse portfolios, segmentation ensures that no single strategy is applied indiscriminately. Every account receives an appropriate level of attention, improving overall portfolio performance.

Improving Customer Experience Without Compromising Recovery

A key concern for many organizations is whether a softer, digital-first approach weakens recovery outcomes. In practice, the opposite is often true.

Digital debt resolution focuses on clarity, flexibility, and respect. Customers are more likely to engage when they feel informed rather than pressured. Self-service options reduce defensiveness, while consistent omni-channel communication builds trust.

Positive resolution experiences protect brand reputation. Customers who resolve debt through a fair and transparent process are more likely to maintain long-term relationships, return for future business, or speak positively about the organization.

For B2B companies, this balance between recovery and experience is critical. Debt resolution should not be treated as a standalone function but as part of the broader customer lifecycle.

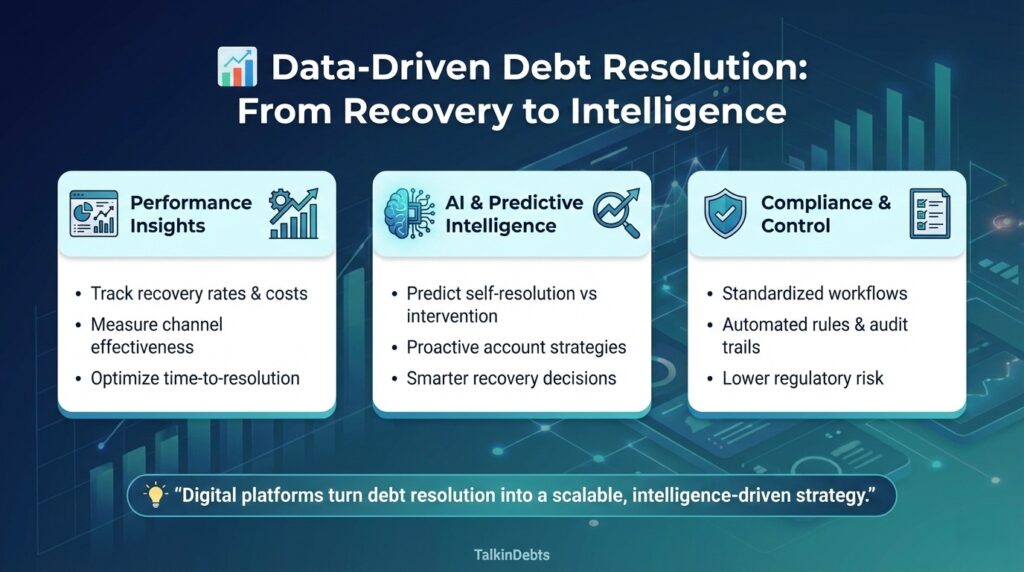

Data-Driven Optimization and Performance Insights

Digital platforms generate continuous streams of data. Every interaction provides insight into customer behavior, channel effectiveness, and resolution outcomes.

Analytics enable organizations to measure what works and what does not. Teams can track recovery rates by channel, cost per resolution, average time to close, and customer engagement patterns. These insights support continuous optimization.

Over time, predictive models can anticipate which accounts are likely to self-resolve, which require intervention, and which may need alternative strategies. This transforms debt resolution from a reactive process into a proactive, intelligence-driven operation.

Compliance, Governance, and Risk Control

Regulatory expectations around debt resolution continue to rise. Digital platforms offer built-in governance advantages by standardizing workflows and documenting every interaction.

Automated rules ensure that communication frequency, messaging standards, and escalation paths align with regulatory requirements. Centralized records create clear audit trails, reducing compliance risk and simplifying internal reviews.

For B2B organizations operating across multiple jurisdictions, this consistency is especially valuable. Digital platforms help maintain control, even as portfolios and regulations evolve.

The Long-Term Strategic Impact for B2B Organizations

Digital debt resolution is not just a tactical upgrade—it is a strategic shift. Organizations that invest in digital platforms, self-service portals, and omni-channel engagement gain a structural advantage.

They operate at lower cost, scale more efficiently, and deliver better customer experiences. They also gain deeper insight into portfolio performance and customer behavior, supporting smarter decision-making across the business.

As debt volumes grow and expectations change, digital-first debt resolution models will become the industry standard. B2B organizations that adapt early will be better positioned to manage risk, protect revenue, and sustain long-term growth.