FTC’s “Junk Fee” Crackdown Forces US Agencies to Restructure Outsourcing Contracts

Impact: New compliance costs for offshore partners handling payment processing

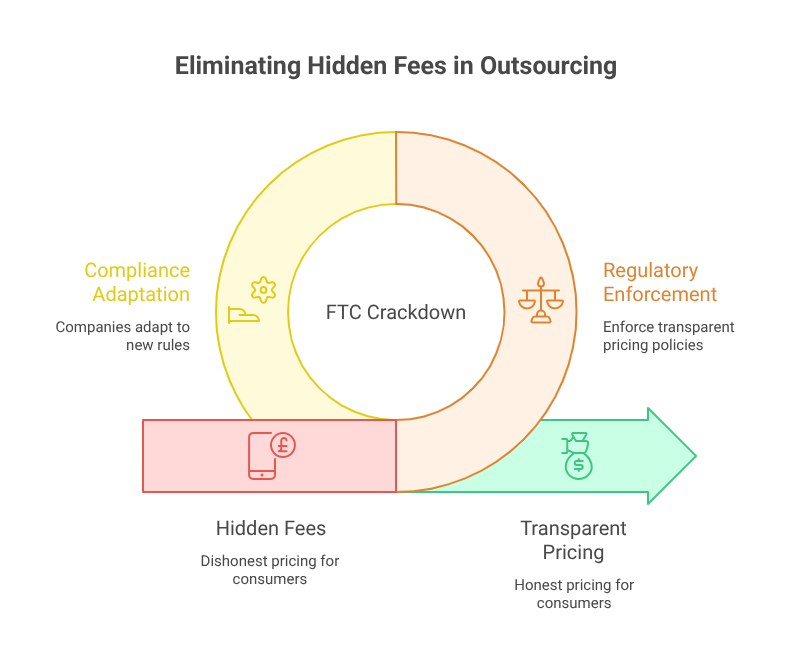

Washington, D.C: The Federal Trade Commission (FTC) has intensified its fight against “junk fees”—hidden or deceptive charges imposed on consumers—by introducing sweeping enforcement rules that directly impact U.S. companies outsourcing payment processing to offshore partners. The move is expected to reshape outsourcing contracts, increase compliance costs, and push multinational firms to tighten oversight on third-party vendors.

The crackdown comes as part of the Biden administration’s broader agenda to protect consumers from unfair financial practices, with particular scrutiny on travel, hospitality, ticketing platforms, banking services, and debt collection agencies.

What Are “Junk Fees”?

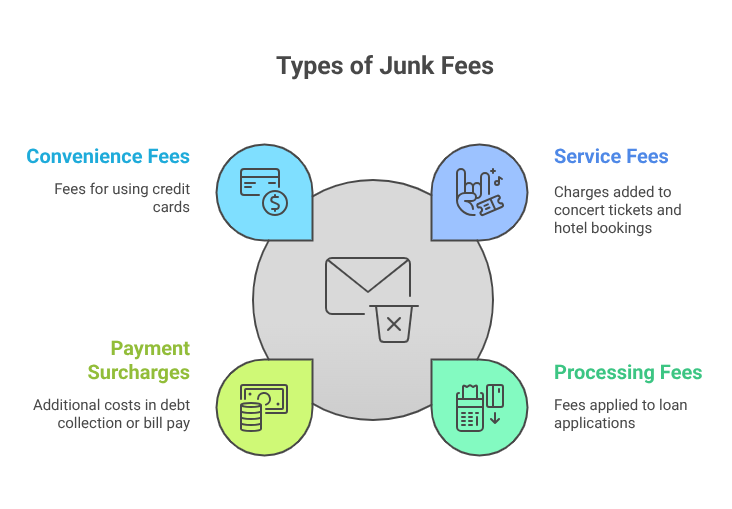

The FTC defines “junk fees” as hidden charges or misleading add-ons that consumers only discover at checkout. These can include:

- Service fees on concert tickets and hotel bookings

- Processing fees on loan applications

- Payment surcharges in debt collection or bill pay services

- Convenience fees for credit card usage

While companies often justify these as standard operational costs, the FTC argues that consumers deserve transparent, upfront pricing without last-minute surprises.

Outsourcing in the Crosshairs

For decades, U.S. companies have relied on offshore outsourcing hubs in countries like India, the Philippines, and Mexico for payment processing, customer service, and collections. These offshore partners handle millions of transactions daily—ranging from utility payments to loan instalments.

With the FTC’s new crackdown, outsourcing contracts will now need to include explicit compliance clauses requiring:

- Full disclosure of all fees upfront

- Transparent breakdown of charges in invoices and customer communications

- Regular audits of partner practices

- Data-sharing agreements to ensure consumer disputes are resolved within U.S. jurisdiction

Failure to comply could expose U.S. companies—and their offshore vendors—to hefty fines and contract suspensions.

Rising Compliance Costs

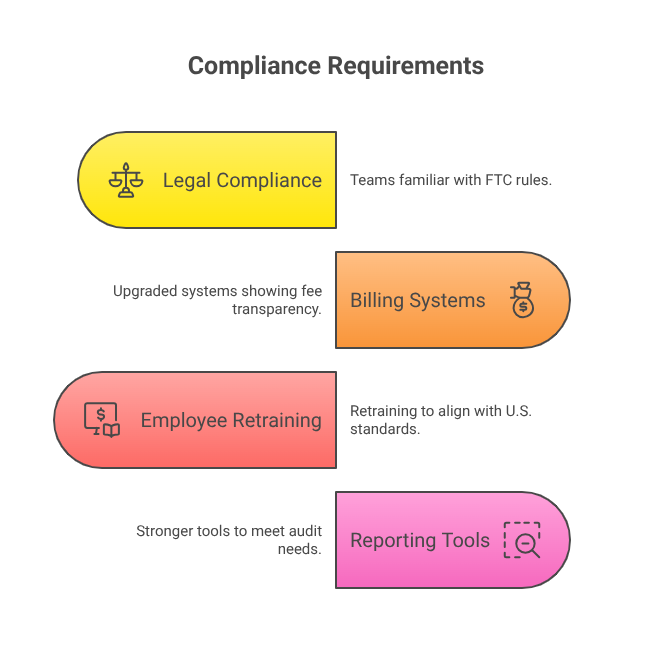

Industry analysts estimate that the new compliance framework could add 10–15% more to outsourcing costs for U.S. firms. Offshore partners will need to invest in:

- Legal compliance teams familiar with FTC rules

- Upgraded billing systems that show fee transparency

- Employee retraining to align with U.S. consumer protection standards

- Stronger reporting tools to meet audit requirements

For large BPO (Business Process Outsourcing) players like Infosys, Genpact, Concentrix, and Teleperformance, the cost burden could be absorbed across global operations. However, mid-sized outsourcing vendors may struggle to implement compliance without passing costs back to U.S. clients.

Industry Reactions

The Business Outsourcing Association of America (BOAA) has already issued a statement urging the FTC to provide “clearer implementation guidelines” to avoid operational disruptions.

“While consumer transparency is critical, we must ensure the new compliance requirements do not create unintended burdens on cross-border trade. Many U.S. companies depend on outsourcing partners to keep costs manageable,” said Ellen Rogers, BOAA President.

Meanwhile, offshore outsourcing hubs like Bangalore, Manila, and Monterrey are scrambling to update legal frameworks and compliance training. Indian IT lobby group NASSCOM has flagged the risk of contract renegotiations and possible job cuts if U.S. firms scale back outsourcing.

Case Study: The Ticketing Industry

Ticketing platforms have long been accused of tacking on excessive fees at checkout. Under the FTC’s new rules, companies outsourcing ticket payment processing to India or the Philippines will need to provide real-time, transparent breakdowns of service fees.

This means:

- Vendors must integrate with U.S. pricing systems in real time

- Invoices must display base price + exact service fee before final checkout

- Hidden fees post-purchase are strictly banned

Failure to comply could mean fines exceeding $50,000 per violation.

Debt Collection and Payment Agencies Under Pressure

Another sector heavily impacted is debt collection and consumer loan servicing. Many U.S. debt collectors outsource payment handling to overseas partners. Under the new FTC mandate, these agencies can no longer tack on “processing fees” or “convenience charges” unless they are fully disclosed upfront.

For debt collection agencies, this means:

- Rewriting consumer notices with transparent fee structures

- Updating call centre scripts used by offshore agents

- Submitting compliance reports quarterly to U.S. regulators

Legal experts warn that non-compliant agencies risk lawsuits not just from the FTC but also from state attorneys general.

Financial Impact on Consumers

Consumer advocacy groups estimate that U.S. households pay over $65 billion annually in junk fees across sectors. The FTC believes its new rules could save the average family $150–200 per year by eliminating unfair charges.

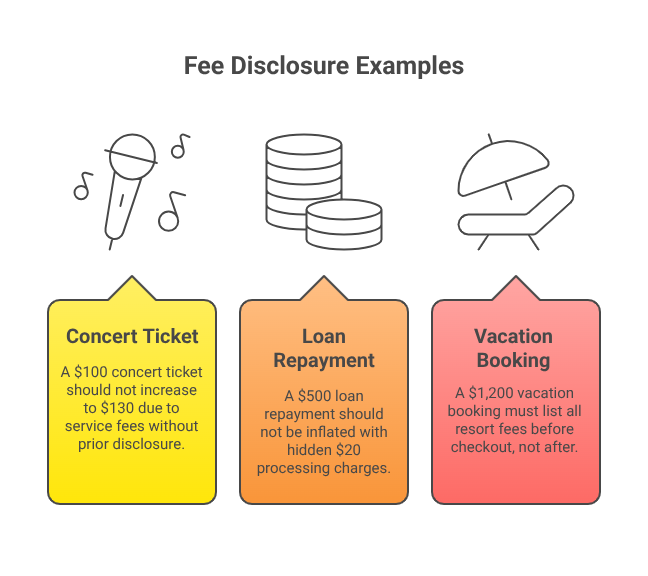

For instance:

- A $100 concert ticket could no longer balloon to $130 after service fees without upfront disclosure.

- A $500 loan repayment could not be inflated with hidden $20 “processing charges.”

- A $1,200 vacation booking must list all resort fees before checkout—not after.

This consumer-first transparency is being hailed as a “win for fairness” by advocacy groups.

Contract Restructuring Already Underway

Several Fortune 500 companies have already begun renegotiating contracts with their outsourcing partners. Industry insiders confirm that new clauses include penalty provisions if offshore vendors fail FTC compliance.

For example:

- A U.S. bank outsourcing to Manila has inserted a “compliance breach clause” imposing a $2 million penalty for violations.

- A retail giant has ordered its Bangalore vendor to upgrade billing software to meet transparency standards before Q4 2025.

- A healthcare provider is considering bringing some payment operations back in-house due to high compliance risks.

Global Ripple Effect

The FTC’s crackdown is not limited to the U.S. market. European regulators are closely monitoring the move, with the EU Commission hinting at similar rules under its ongoing Digital Consumer Rights Initiative.

If the EU follows suit, outsourcing partners worldwide may face dual compliance burdens—U.S. FTC rules and EU transparency laws—making offshore payment processing significantly more expensive.

What’s Next?

The FTC has announced that enforcement will begin in January 2026, giving companies and outsourcing partners less than six months to comply. Industry experts warn that:

- Small outsourcing firms may lose contracts if they are unable to afford compliance upgrades.

- Large U.S. firms may shift critical payment functions back onshore.

- Consumers will see clearer billing statements, but companies may increase base prices to offset compliance costs.

Final Outlook

The FTC’s junk fee crackdown represents a turning point in how U.S. companies manage offshore outsourcing. What was once a cost-saving practice may now turn into a compliance-heavy operation with legal risks attached.

For consumers, the outcome is straightforward—fewer hidden fees and more honest pricing. For U.S. companies and their offshore partners, however, the road ahead will be costlier and more complex.

As global outsourcing giants adapt to this regulatory wave, one thing is clear: the era of hidden fees is coming to an end.