Fintech vs. Traditional Lending: Who’s Winning the SME Debt Market?

Small and medium enterprises (SMEs) form the backbone of every major economy, yet they continue to struggle with access to timely and affordable credit. For decades, traditional lenders dominated the SME debt landscape with strict eligibility criteria and lengthy approval cycles. But today, fintech platforms are rapidly reshaping B2B financing by introducing smarter credit scoring models, seamless digital onboarding, and faster disbursements. This shift has sparked a critical debate: Fintech vs.

Traditional Lending: Who is truly winning the SME debt market?

The rise of fintech isn’t just a trend; it represents a structural transformation in how businesses borrow, grow, and sustain operations. With SMEs increasingly seeking agility, convenience, and data-driven credit assessments, fintech lenders are positioning themselves as the preferred choice for business borrowers. At the same time, traditional lenders are adapting, upgrading, and reinventing their models to retain market share. The competition is intense—yet it is also driving innovation that benefits millions of small businesses.

Why SME Debt Markets Became a Battleground

SMEs often face cash flow gaps, working capital shortages, delayed payments, and seasonal revenue fluctuations. While banks historically served these needs, their rigid processes left a significant credit gap. Many SMEs lacked collateral, financial documentation, and formal credit history—leading to automatic rejection despite healthy business performance.

Fintech platforms identified this gap and built lending systems that prioritize speed, automation, and alternative data, giving SMEs a new pathway to secure financing. As a result, the SME debt market has become a major battleground, with both traditional lenders and fintech companies fighting for relevance and dominance.

Fintech’s Disruption: Faster, Smarter, More Accessible

Fintech lenders fundamentally redesigned the borrowing experience. Instead of long queues, paperwork, and weeks of waiting, SMEs now get financing decisions in minutes and disbursement in hours or days. This shift is powered by several innovations:

1. Alternative Credit Scoring Changed the SME Game

Traditional lenders rely heavily on income statements, collateral, bank balance sheets, and past repayment history. Many SMEs—especially new businesses—struggle to meet these expectations.

Fintech platforms, however, evaluate borrowers using real-time business data, including:

- GST filings

- POS transactions

- Inventory turnover

- Transaction-level payment history

- Supplier invoices

- E-commerce sales analytics

- Utility bills

- Mobile usage patterns

This approach gives fintech lenders a detailed and dynamic understanding of a company’s health, enabling them to approve borrowers previously overlooked by banks. Alternative credit scoring reduces bias, increases financial inclusion, and supports SMEs that rely on just-in-time cash flow.

2. Digital Onboarding Simplified B2B Lending

Traditional lenders often require in-person visits, physical KYC, and lengthy manual verification. Fintech platforms replaced this with fully digital onboarding, including:

- Online KYC

- eSignatures

- Automated underwriting

- Data-based verification

- Instant document uploads

- Real-time credit approval engines

This level of convenience removes frustration from the borrowing journey and significantly reduces the cost of customer acquisition.

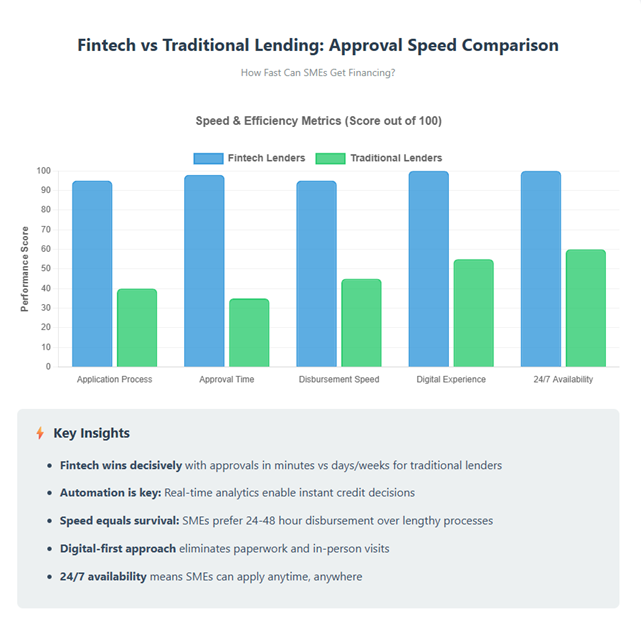

3. Speed: The Ultimate Competitive Advantage

In the SME world, speed determines survival. Fintech lenders use automation and real-time analytics to deliver:

- Approvals within minutes

- Disbursement within 24–48 hours

- 24/7 application availability

- Automated credit checks

- Instant risk scoring

Traditional banks, constrained by manual processes and compliance checks, often take days or weeks—something SMEs cannot afford during urgent financial needs.

4. Tailored Products for Every Business

Fintech platforms offer more flexible products, including:

- Invoice-based financing

- Revenue-based financing

- Merchant cash advances

- Micro-loans

- Short-term credit lines

- Supply chain financing

These products match the real-world needs of SMEs far more closely than traditional term loans. Customization allows businesses of all sizes—from micro retailers to growing exporters—to access funding that fits their operations.

5. Transparent Pricing and Better User Experience

Fintech lenders typically provide:

- Simplified dashboards

- Transparent interest rates

- Real-time EMI tracking

- Automatic repayment schedules

- Clear fee disclosures

A frictionless digital experience builds trust and encourages repeat borrowing.

Traditional Lenders Still Have Strong Advantages

Even with the rise of fintech, traditional lenders are not out of the race. In fact, they hold several powerful advantages that continue to attract SMEs.

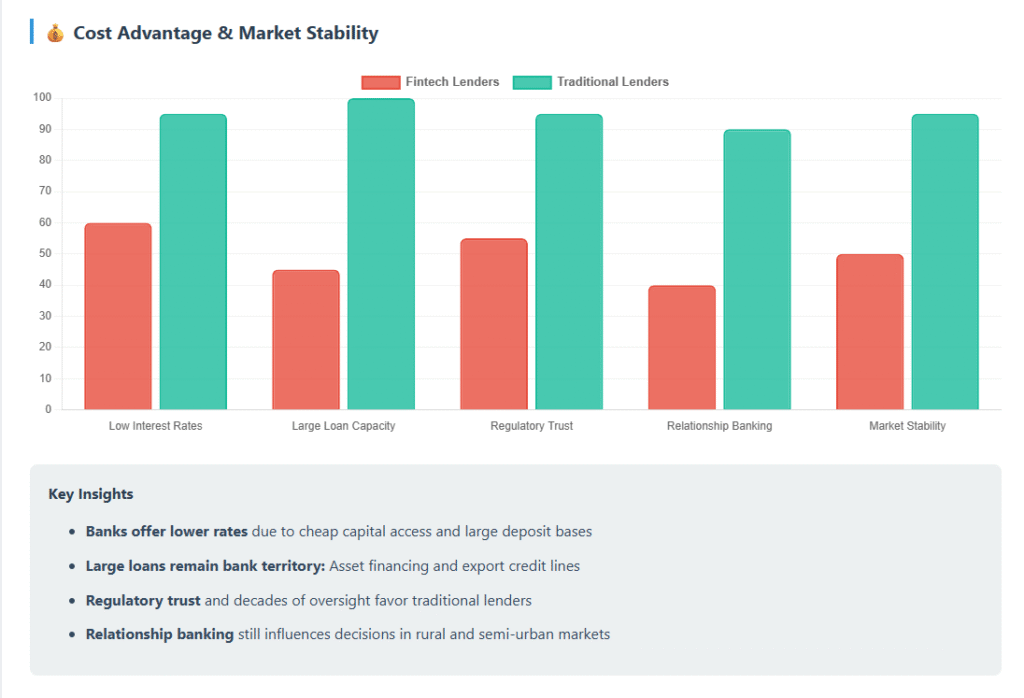

1. Lower Interest Rates and Better Pricing

Banks usually offer lower interest rates because of:

- Cheap access to capital

- Government-backed credit guarantee schemes

- Established risk management frameworks

- Large deposit bases

For SMEs with strong documentation and collateral, banks continue to be the preferred choice due to affordability.

2. Deep Customer Relationships

Traditional lenders have decades-long relationships with businesses, built through:

- Regional branches

- Personal bankers

- Local market understanding

- Customized financial advice

This relational trust still influences SME lending decisions, especially in rural and semi-urban markets.

3. Large Loan Amounts and Structured Debt Solutions

While fintech excels in short-term and small-ticket loans, banks dominate:

- Large working capital loans

- Term loans

- Asset financing

- Export/import credit lines

- Overdrafts

- Secured business loans

These are areas where fintech has limited reach, ensuring that banks continue to remain crucial players.

4. Regulatory Trust and Stability

Many SMEs still perceive banks as more reliable, given their regulatory oversight and longevity. Fintech lenders—many of which are startups—may face trust challenges during economic uncertainty.

The Hybrid Model: Collaboration Over Competition

The most powerful trend emerging today is the bank–fintech partnership ecosystem. Instead of fighting for dominance, many banks now collaborate with fintech companies to enhance efficiency and reach.

These partnerships combine the strengths of both worlds:

- Fintech’s technology + Bank’s capital base

- Fintech’s speed + Bank’s stability

- Fintech’s data analytics + Bank’s risk management

This hybrid model is redefining the SME lending market and enabling lenders to serve more businesses at lower costs.

Who Is Winning the SME Debt Market Right Now?

The answer depends on the borrower, the loan type, and the speed required.

Fintech is winning when SMEs need:

- Immediate working capital

- Small-ticket or short-term loans

- Alternative credit scoring

- Fast onboarding

- Digital-first convenience

- Supply chain financing

- Flexible repayment models

Fintech lenders dominate these segments because they match modern business needs.

Traditional lenders are winning when SMEs need:

- Large loan amounts

- Long-tenure loans

- Asset-backed financing

- Lower borrowing costs

- Complex structured debt

- Government-backed schemes

Banks remain the leader in high-value and secured lending.

The Real Winner: SMEs and the Future of B2B Financing

Regardless of who wins between fintech and traditional lenders, the real winner is the SME sector. Competition forces both sides to innovate, reduce processing time, and offer more inclusive products. The combination of digital infrastructure, mobile-first banking, and advanced credit algorithms is unlocking new possibilities for millions of businesses.

Looking ahead, the SME debt market will likely shift toward embedded finance, where lenders integrate credit services directly into platforms SMEs already use—such as accounting software, payment terminals, and e-commerce systems. This model will make borrowing faster, easier, and more personalized than ever before.

Key Drivers That Will Shape the Future

- AI-driven underwriting

- Open banking and data-sharing ecosystems

- Blockchain-based lending and invoice verification

- Faster cross-border settlement systems

- Real-time credit visibility for SMEs

- Stronger regulatory oversight for fintechs

- Bank–fintech co-lending models

These advancements will deepen financial inclusion and transform how SMEs access working capital.

Final Thoughts

Fintech has clearly disrupted the SME debt market with innovation, speed, and digital onboarding. But traditional lenders continue to hold strong because of scale, stability, and lower costs. This evolving competition is pushing both sides to deliver better services, smarter credit models, and more accessible financing for businesses.

The future of SME lending will not be about choosing fintech over traditional lenders—it will be about creating a connected financial ecosystem where technology, data, and capital work together to empower every small and medium enterprise. As this transformation accelerates, SMEs will benefit from unprecedented access to credit, enabling them to grow, compete, and shape the next era of economic development.