The ESG Factor in Corporate Lending: Why Sustainable Debt Is Gaining Traction

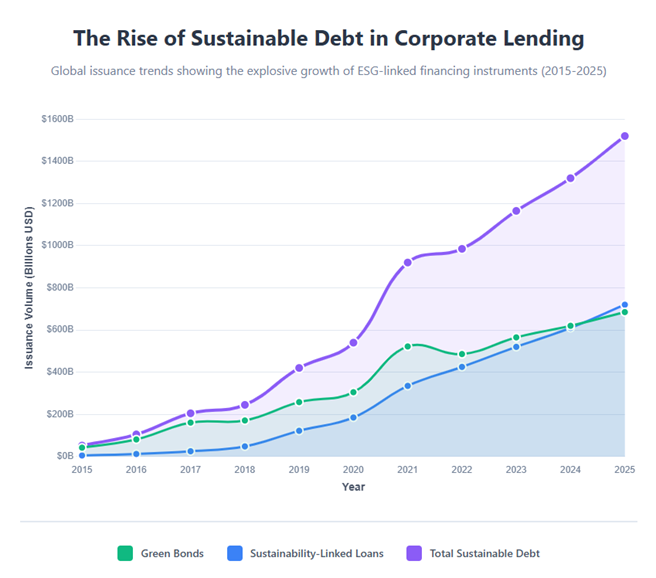

The global lending ecosystem is undergoing a powerful transformation. Corporate borrowing, once evaluated purely on financial risk and return, is now being reshaped by a new decision-making lens—Environmental, Social, and Governance (ESG) performance. Today, lenders, investors, and regulators are increasingly linking access to capital with sustainability outcomes. This shift has given rise to one of the fastest-growing segments in financial markets: sustainable debt.

From green bonds financing renewable energy projects to sustainability-linked loans tied to ESG performance targets, sustainable debt instruments are no longer a niche product. They are becoming central to how corporations raise capital and manage long-term risk. This article explores why ESG-linked lending is gaining traction, how green bonds and sustainability-linked loans work, and how both issuers and investors are embedding ESG metrics into modern credit portfolios.

The Rise of ESG in Corporate Finance

Over the last decade, ESG has evolved from a reputational consideration into a critical financial metric. Climate change risks, supply-chain transparency, labor standards, cybersecurity governance, and regulatory compliance are now seen as material factors influencing a company’s long-term profitability and creditworthiness.

Three powerful forces are fueling this transformation:

- Regulatory pressure: Governments and financial regulators are mandating greater climate and ESG disclosures.

- Investor demand: Institutional investors now allocate trillions of dollars specifically to ESG-compliant assets.

- Corporate strategy shifts: Businesses increasingly recognize sustainability as a driver of resilience and competitive advantage.

As a result, traditional debt instruments are being redesigned to reward sustainable behaviour and penalize poor ESG performance.

What Is Sustainable Debt?

Sustainable debt refers to borrowing instruments where proceeds are used for environmental or social projects or where the financial terms are linked directly to ESG performance. Unlike conventional lending, these instruments incorporate sustainability into their structure.

The two most dominant categories are:

- Green bonds and social bonds

- Sustainability-linked loans (SLLs)

Each plays a distinct role in reshaping how corporate credit markets function.

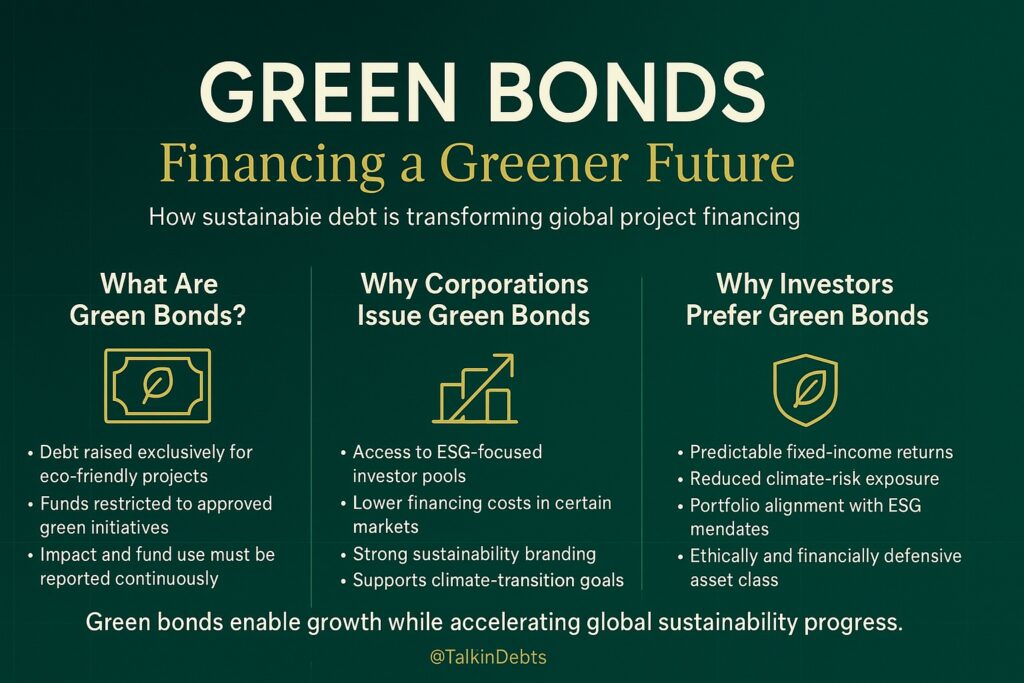

Green Bonds: Financing a Greener Future

What Are Green Bonds?

Green bonds are debt securities issued by corporations, governments, or financial institutions to finance projects that deliver clear environmental benefits. These projects typically include:

- Renewable energy installations

- Energy-efficient buildings

- Clean transportation

- Water conservation systems

- Pollution prevention and waste management

Unlike regular bonds, the use of proceeds from green bonds is strictly restricted to eligible green projects, and issuers must provide continuous reporting on how funds are used.

Why Corporations Are Issuing Green Bonds

Green bonds offer multiple advantages to issuers:

- Access to a wider investor base, especially ESG-focused funds

- Lower cost of capital in some markets due to strong demand

- Enhanced brand value and sustainability credentials

- Alignment with long-term climate commitments

For capital-intensive industries such as infrastructure, energy, manufacturing, and real estate, green bonds provide an ideal mechanism to finance sustainable transformation without overleveraging balance sheets.

Why Investors Prefer Green Bonds

From the investor standpoint, green bonds offer:

- Predictable fixed-income returns

- Reduced long-term risk exposure from climate volatility

- Portfolio diversification aligned with sustainability objectives

- Compliance with ESG fund mandates

As global climate risks intensify, investors increasingly view green bonds as both ethically aligned and financially defensive assets.

Sustainability-Linked Loans: Performance-Based Financing

How Sustainability-Linked Loans Work

Unlike green bonds, sustainability-linked loans (SLLs) do not restrict how the borrower uses the funds. Instead, the loan’s interest rate is directly tied to the borrower’s ability to meet predefined ESG performance targets known as Key Performance Indicators (KPIs).

These KPIs may include:

- Reduction in carbon emissions

- Increase in renewable energy usage

- Workplace safety improvement

- Gender diversity in leadership

- Supply-chain transparency benchmarks

If the borrower hits the targets, the interest rate decreases. If they fail, the rate increases—creating direct financial accountability for ESG outcomes.

Why Companies Are Choosing SLLs

Corporations favor sustainability-linked loans because they:

- Preserve capital usage flexibility

- Integrate ESG into core business performance

- Improve lender relationships

- Enhance credit profiles over time

SLLs are particularly popular among sectors transitioning toward sustainability, such as logistics, chemicals, manufacturing, aviation, and energy.

Why Lenders Are Promoting ESG-Linked Loans

From a lender’s perspective, SLLs help:

- Reduce long-term credit risk

- Align loan portfolios with regulatory expectations

- Meet internal sustainability goals

- Attract ESG-focused institutional funding

Banks increasingly view ESG performance as a forward-looking risk indicator rather than a mere reputational factor.

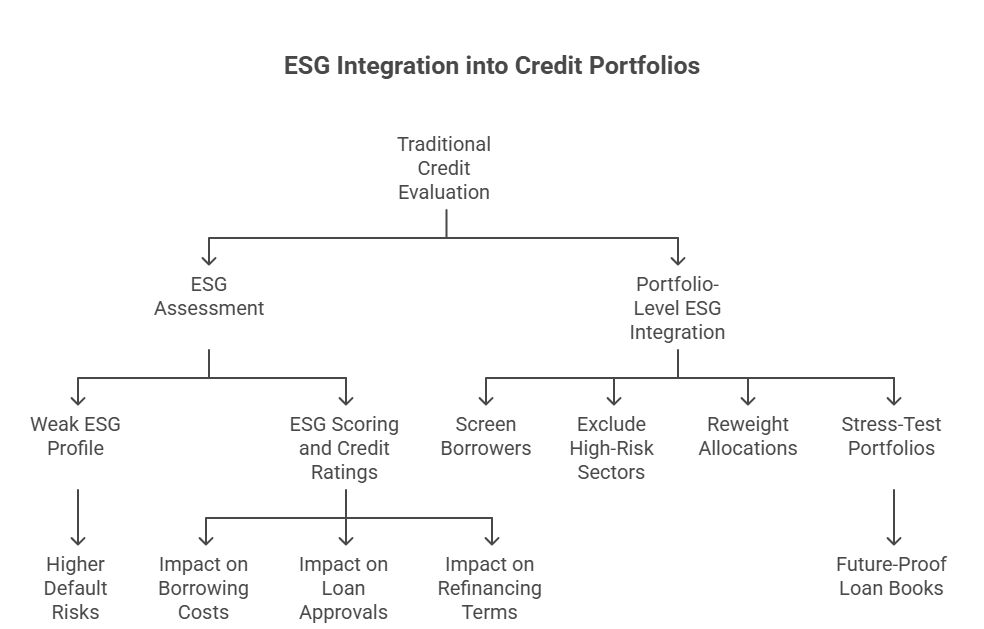

How ESG Metrics Are Being Integrated into Credit Portfolios

ESG as a Credit Risk Indicator

Traditional credit evaluations focus on:

- Cash flow stability

- Profit margins

- Debt service coverage

- Industry risk

Today, these are being supplemented with ESG assessments such as:

- Carbon intensity

- Human rights compliance

- Governance transparency

- Cybersecurity risk

- Supply-chain ethics

Companies with weak ESG profiles often face higher default risks due to regulatory fines, operational disruptions, reputational damage, and litigation exposure.

ESG Scoring and Credit Ratings

Rating agencies and data firms now incorporate ESG factors into:

- Credit rating outlooks

- Default probability models

- Pricing of debt instruments

- Capital adequacy frameworks

This integration means ESG is no longer “non-financial” information—it directly affects borrowing costs, loan approvals, and refinancing terms.

Portfolio-Level ESG Integration

Asset managers and institutional lenders now:

- Screen borrowers based on ESG thresholds

- Exclude high-risk sectors with poor sustainability compliance

- Reweight allocations toward ESG-aligned issuers

- Stress-test portfolios against climate transition risk

As ESG-linked regulations tighten worldwide, lenders are proactively future-proofing their loan books.

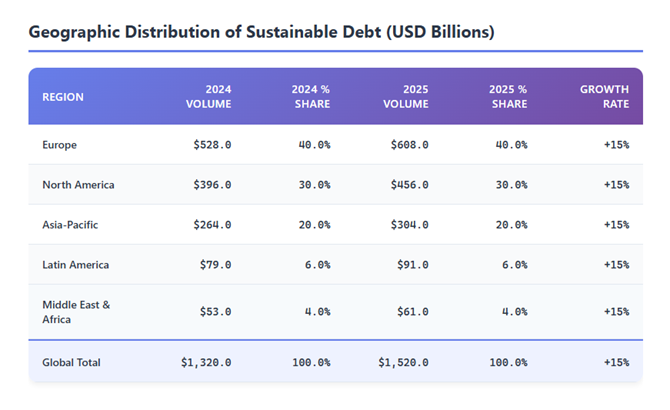

Why Sustainable Debt Is Growing So Rapidly

The explosive growth of sustainable debt is not accidental. Several structural trends are reinforcing its momentum.

1. Regulatory Mandates and Climate Policy

Governments across major economies are pushing net-zero commitments into law. This automatically raises the cost of capital for carbon-heavy enterprises while lowering it for clean-transition businesses.

Financial institutions must align with:

- Climate risk stress testing

- ESG disclosure standards

- Green taxonomy classification systems

- Sustainable finance reporting mandates

These requirements strongly Favor ESG-linked lending.

2. Institutional Investor Pressure

Pension funds, sovereign wealth funds, and asset managers are under pressure from stakeholders to invest responsibly. As a result:

- ESG portfolios are expanding faster than traditional funds

- Capital is shifting toward green and sustainable debt

- Borrowers without ESG integration are facing shrinking funding pools

3. Cost of Capital Advantage

In many markets, sustainable debt instruments now offer:

- Preferential interest rates

- Higher demand in bond auctions

- Lower refinancing risk

- Greater funding stability during market stress

This creates a clear financial incentive for companies to transform their borrowing structures.

4. Reputation, Branding, and Market Trust

Corporate reputation now directly affects valuation, customer loyalty, and talent retention. Sustainable financing acts as:

- A public declaration of ethical commitment

- A signal of long-term strategic vision

- A shield against ESG-related controversies

For listed companies, especially, ESG-linked borrowing influences shareholder confidence and analyst ratings.

Challenges and Criticisms of ESG-Linked Lending

Despite its rapid adoption, sustainable debt is not without challenges.

Greenwashing Risks

A major concern is greenwashing, where companies:

- Overstate ESG achievements

- Use vague sustainability claims

- Set weak, non-material KPIs

- Avoid independent verification

This undermines market trust and exposes lenders to reputational risk.

Lack of Global Standardization

Different countries follow different ESG reporting frameworks, making:

- KPI comparison difficult

- Cross-border ESG verification is complex

- Investor due diligence is more expensive

While global harmonization efforts are underway, full standardization is still evolving.

Data Quality and Reporting Gaps

Many companies—especially in emerging markets—still lack:

- Robust ESG data tracking systems

- Verified emissions reporting

- Independent sustainability audits

This slows down ESG-linked credit expansion in certain regions.

The Future of Corporate Lending Is ESG-Driven

Sustainable debt is no longer an optional financial innovation—it is becoming the default structure for future corporate borrowing. As regulatory pressure increases, investor expectations deepen, and climate risks reshape capital markets, ESG-linked finance will move from “value-add” to “value-essential.”

Key transformations expected over the next decade include:

- ESG metrics are becoming mandatory in all large corporate loans

- Carbon intensity is formally priced into credit risk models

- Default risk increasingly linked to sustainability failure

- Green bond issuance is surpassing traditional corporate bonds in select sectors

- AI-driven ESG risk scoring replacing manual sustainability audits

Corporations that integrate ESG into their core financial strategy will gain privileged access to capital. Those that resist the transition will face higher borrowing costs, shrinking liquidity access, and rising investor scepticism.

Why Sustainable Debt Is Reshaping Capital Allocation

Sustainable debt is fundamentally altering where global capital flows. Instead of prioritizing sheer profitability alone, markets are now rewarding:

- Long-term environmental risk management

- Ethical operational practices

- Transparent governance systems

- Social impact scalability

Capital is being redirected from extractive, high-risk industries toward cleaner, more responsible enterprises. This is not just a sustainability shift—it is a structural realignment of global finance.

Final Thought

The ESG factor has transformed corporate lending from a purely financial activity into a strategic sustainability lever. Green bonds and sustainability-linked loans now influence not just how companies borrow, but how they operate, innovate, and compete.

As environmental risks escalate and regulatory scrutiny tightens, sustainable debt will become the most credible form of corporate financing. Companies that align early with ESG-driven credit structures will shape the next era of resilient, responsible, and profitable global business.