Debt Recovery 4.0: How AI and Automation Are Transforming Collections

The global debt recovery industry is undergoing a revolution. Traditional collection methods—manual calls, paper notices, and generic recovery strategies—are being replaced by intelligent, data-driven, and automated systems. Welcome to Debt Recovery 4.0, where artificial intelligence (AI), machine learning (ML), and automation are reshaping how lenders, banks, and collection agencies recover debt while improving the customer experience.

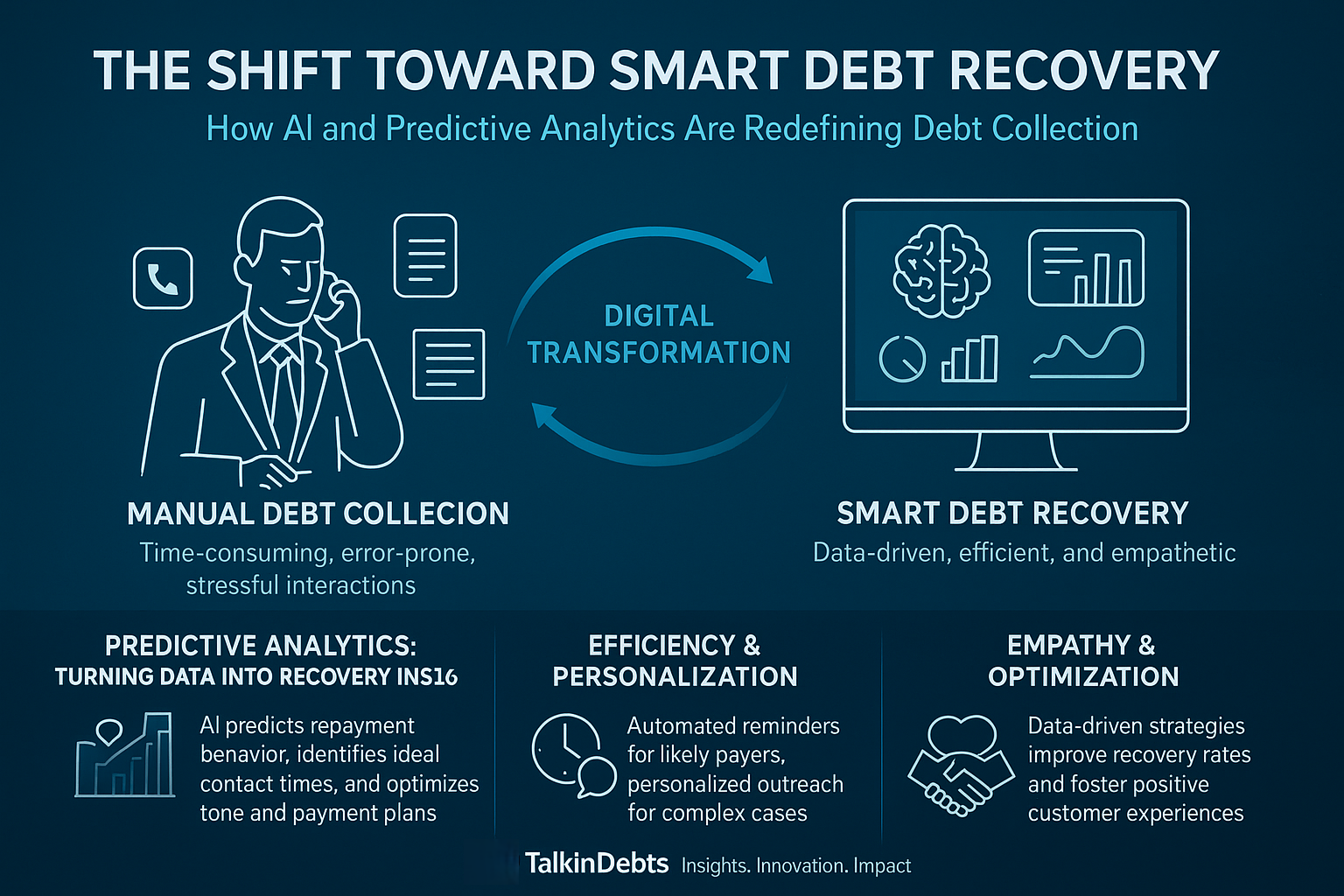

The Shift Toward Smart Debt Recovery

In the past, debt collection relied heavily on human agents managing vast lists of overdue accounts. The process was time-consuming, prone to human error, and often created negative customer interactions. With the rise of digital ecosystems and data intelligence, the collection process has evolved dramatically.

AI now allows agencies to analyze borrower behavior, predict repayment likelihood, and personalize communication strategies. This shift reduces costs, increases recovery rates, and promotes a more empathetic approach to debt resolution.

1. Predictive Analytics: Turning Data into Recovery Insights

Predictive analytics is one of the most powerful tools in modern debt collection. Using historical repayment data, financial profiles, and behavioral signals, AI models can predict:

- Which customers are most likely to pay on time

- The ideal time and channel to contact them

- The most effective tone and payment plan for engagement

For example, an AI model can analyze thousands of accounts and segment them based on repayment probability. High-probability debtors can be sent automated reminders, while complex cases can be prioritized for human agents. This data-driven targeting ensures resources are used where they’re most effective—improving overall recovery rates.

2. Automation: Streamlining the Collection Workflow

Automation is the backbone of Debt Recovery 4.0. Routine tasks—sending reminders, verifying payment receipts, updating ledgers—are now managed by intelligent automation platforms.

Automated workflows ensure that no account falls through the cracks. They also improve efficiency by handling repetitive tasks 24/7 without fatigue. For instance:

- Automated payment reminders via SMS, email, or WhatsApp

- Auto-generated repayment plans based on borrower affordability

- Real-time account updates to reduce administrative lag

This not only speeds up debt resolution but also enhances compliance by maintaining a consistent and documented communication trail.

3. AI-Powered Chatbots: Human-Like Interactions, Real Results

Customer engagement in debt recovery has always been delicate. AI-powered chatbots have emerged as a game-changer by delivering empathetic, conversational, and non-intrusive communication.

Modern chatbots are capable of understanding tone, emotion, and intent through natural language processing (NLP). They can negotiate repayment terms, offer settlement options, and guide customers through digital payment portals—all without human intervention.

For borrowers, this creates a stress-free experience where they can interact privately at their convenience. For agencies, it reduces inbound call volumes and boosts operational efficiency.

4. Machine Learning in Action: Smarter Decision-Making

Machine learning models continuously learn from outcomes. Every successful or failed collection interaction feeds new data back into the system, refining the accuracy of predictions. Over time, ML algorithms improve at identifying patterns that humans might miss—such as subtle correlations between payment delays and external factors like economic trends or regional conditions.

This level of insight helps agencies adopt a dynamic collection strategy that adapts to changing borrower behavior and market conditions. Instead of static scripts, recovery teams can now make real-time data-backed decisions.

5. Sentiment Analysis: Measuring Borrower Emotions

Debt collection is not just about money—it’s about relationships. Sentiment analysis uses AI to interpret the emotional tone of borrower responses across emails, chats, and voice calls. This helps agencies understand how customers feel about repayment efforts.

If a borrower’s tone shows frustration or anxiety, the AI system can flag the case for a more personalized approach by a human agent. This creates a more empathetic recovery environment, improving the chances of successful repayment and preserving the lender’s brand image.

6. Omnichannel Engagement: Meeting Customers Where They Are

The modern borrower expects convenience. AI and automation enable omnichannel collection strategies, reaching customers across their preferred platforms—email, SMS, phone, mobile apps, or even social media.

Each channel is synchronized, meaning communication is consistent and context-aware. For instance, if a customer interacts with a chatbot via WhatsApp and later calls the agency, the agent already has a complete record of the conversation. This seamless experience builds trust and increases cooperation.

7. Compliance and Risk Mitigation Through AI

Debt collection is a highly regulated industry, and compliance is critical. AI systems can help enforce regulatory compliance and ethical collection practices through automated monitoring.

AI tools can scan communication logs, detect policy breaches, and flag potential risks before they escalate. They can even ensure that all interactions align with data privacy laws such as GDPR, PCI-DSS, or CCPA. This not only protects customers but also shields agencies from legal exposure.

8. The Integration of Robotic Process Automation (RPA)

RPA complements AI by handling rule-based back-office operations that require precision and speed. In the debt recovery context, RPA bots can:

- Update customer records

- Process payments and reconcile accounts

- Generate compliance reports

- Transfer data between systems without human input

When integrated with AI, RPA creates a fully automated debt recovery ecosystem—reducing costs, errors, and turnaround times.

9. Personalized Debt Resolution: The Human-AI Partnership

While AI drives efficiency, the human touch remains essential in collections. Debt Recovery 4.0 promotes a human-AI collaboration, where technology supports agents instead of replacing them.

AI systems can provide real-time insights to collection agents during calls, such as suggesting repayment options or detecting signs of distress in a borrower’s voice. Agents can then respond with empathy, offering tailored solutions. This data-supported personalization strengthens relationships and increases recovery success.

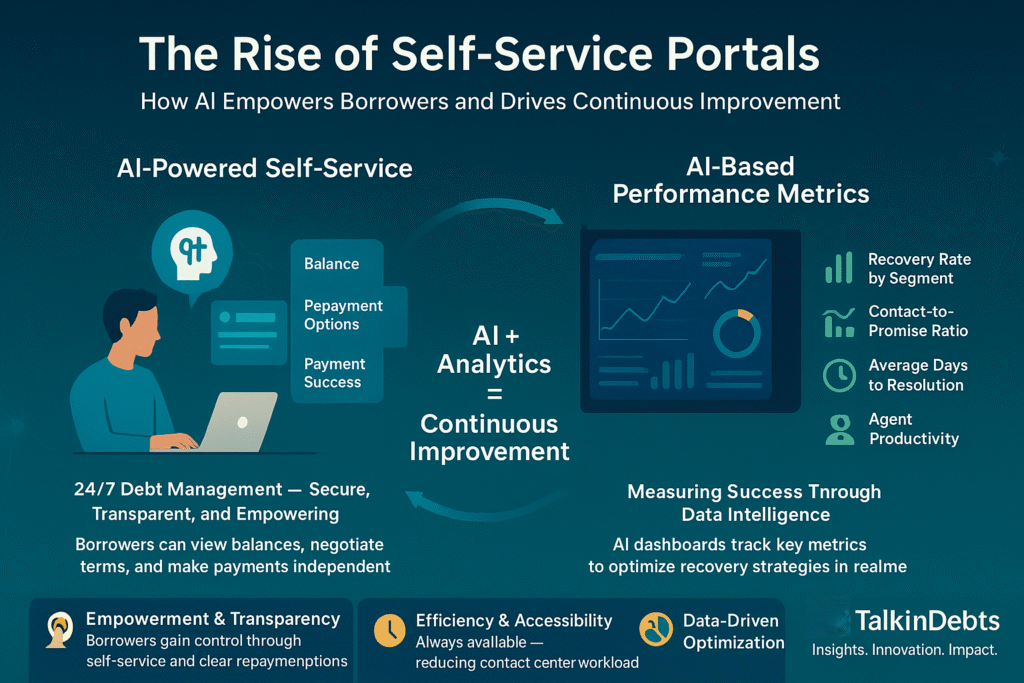

10. The Rise of Self-Service Portals

AI-driven self-service portals empower customers to manage their debts independently. Borrowers can log in, view balances, negotiate repayment terms, and make payments securely—without speaking to an agent.

These portals are available 24/7, providing flexibility while maintaining transparency. By giving control back to the borrower, agencies can reduce pressure on their contact centres and enhance overall satisfaction.

11. Measuring Success: AI-Based Performance Metrics

AI doesn’t just improve recovery—it also measures it. Intelligent dashboards track performance indicators like:

- Recovery rate by segment

- Contact-to-promise ratio

- Average days to resolution

- Agent productivity metrics

By analyzing these KPIs, agencies can continuously optimize their strategies. The result is a cycle of continuous improvement driven by real-time data.

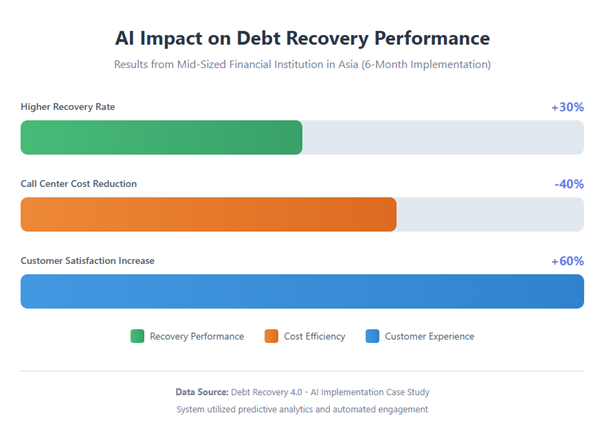

12. Case Study: AI Impact in Real-World Collections

A mid-sized financial institution in Asia implemented an AI-based debt recovery platform that combined predictive analytics and automated engagement. Within six months, they achieved:

- 30% higher recovery rates

- 40% reduction in call center costs

- 60% increase in customer satisfaction scores

The system analyzed repayment behavior, predicted delinquency risk, and personalized communication strategies. The outcome proved that smart automation can drive both financial and reputational gains.

Future of Debt Recovery: Autonomous Collections

As technology advances, the future points toward autonomous debt recovery systems—AI ecosystems capable of managing end-to-end recovery with minimal human input. Integration with digital banking APIs, blockchain-based payment verification, and advanced emotion AI will further enhance transparency, security, and engagement.

In the near future, lenders may rely on fully intelligent platforms that not only recover debt but also predict default before it occurs, transforming debt collection from a reactive to a proactive process.

The New Era of Intelligent Debt Recovery

Debt Recovery 4.0 is not just an evolution—it’s a revolution. AI, machine learning, and automation have redefined what’s possible in collections. They enable lenders and agencies to recover more debt, reduce costs, and build trust through data-driven, empathetic engagement.

By leveraging predictive insights, automated workflows, and personalized communication, organizations can move from reactive debt chasing to proactive debt management. The focus is shifting from confrontation to collaboration—helping borrowers stay informed, compliant, and empowered.

As technology continues to evolve, the agencies that adopt these intelligent tools today will lead tomorrow’s financial landscape, setting new standards in transparency, efficiency, and customer experience.