Debt Outsourcing in 2025: Why Banks and Fintechs Are Partnering with Specialized Recovery Agencies

In 2025, debt outsourcing has shifted from a tactical back-office decision to a core strategic move for banks and fintechs. Rising delinquency levels, sustained operational cost pressures, increasing regulatory complexity, and changing borrower behaviour are forcing lenders to rethink how recovery operations are structured. Rather than expanding internal collection teams, financial institutions are increasingly partnering with specialized recovery agencies to improve efficiency, compliance, and recovery performance.

This trend reflects a broader transformation in credit risk management, where recoveries are no longer viewed as a last-stage function but as an integrated component of financial stability and customer lifecycle management.

The Credit Landscape in 2025 Is Driving Outsourcing Decisions

High interest rates, inflationary pressures, and tighter household budgets continue to shape borrower repayment behaviour in 2025. Delinquencies across credit cards, personal loans, BNPL products, and SME facilities have become more frequent and more complex to resolve. At the same time, lenders are under pressure to manage non-performing assets without escalating costs or regulatory exposure.

Banks are dealing with legacy portfolios and rigid operating structures, while fintechs face rapid portfolio growth and thin margins. In both cases, internal recovery teams struggle to scale quickly, adapt to regulatory changes, and deliver consistent outcomes. Debt outsourcing has emerged as a practical and scalable response to these challenges.

Cost Efficiency Is a Primary Driver of Debt Outsourcing

Operating an in-house collections function involves high fixed costs, including staffing, training, compliance management, technology infrastructure, and supervisory oversight. These costs remain largely unchanged regardless of delinquency volumes, creating inefficiencies during periods of volatility.

Outsourcing debt recovery allows lenders to convert fixed costs into variable, performance-linked expenses. Specialized recovery agencies operate at scale, enabling them to deliver recoveries more efficiently while aligning costs directly with results. This model is particularly attractive in 2025, as lenders seek to protect margins amid economic uncertainty.

For fintechs, outsourcing avoids premature investment in large operational teams. For banks, it supports cost rationalisation without compromising recovery outcomes.

Regulatory Complexity Has Increased the Need for Specialist Partners

Debt recovery regulations have become more detailed and more strictly enforced. Consumer protection laws, conduct obligations, data privacy requirements, and communication standards vary across regions and are frequently updated. Non-compliance can result in fines, legal action, and reputational damage.

Specialized recovery agencies invest continuously in regulatory expertise, compliance frameworks, and staff training. Their core business depends on maintaining alignment with evolving legal requirements. By outsourcing, banks and fintechs reduce regulatory risk while ensuring recoveries are conducted in a compliant and ethical manner.

In 2025, regulators also expect lenders to demonstrate active oversight of third-party partners. Mature outsourcing arrangements now include structured governance models, regular audits, detailed reporting, and clear accountability.

Digital Collections Capabilities Are Reshaping Recovery Outcomes

Borrowers increasingly expect digital-first engagement throughout the recovery process. Traditional phone-based approaches alone are no longer sufficient. Consumers want flexible communication channels, transparency, and the ability to resolve obligations without friction.

Specialized recovery agencies have invested heavily in digital collections platforms that enable automated outreach, self-service payment options, and real-time performance tracking. These capabilities allow recoveries to be conducted more efficiently while improving borrower responsiveness.

By outsourcing, lenders gain immediate access to advanced digital infrastructure without long development cycles or high capital expenditure. This is a key reason why debt outsourcing continues to accelerate in 2025.

Data-Driven Recovery Strategies Improve Performance

Modern debt outsourcing is driven by data analytics rather than volume-based contact strategies. Recovery agencies use segmentation models to assess payment capacity, behavioural signals, and risk profiles. This enables tailored treatment strategies that maximise recoveries while minimising customer friction.

Accounts can be prioritised based on the likelihood of cure, balance size, and historical behaviour. This targeted approach leads to higher recovery rates, shorter resolution timelines, and better portfolio insights for lenders.

For banks and fintechs, outsourcing also provides access to advanced analytics that support broader credit risk and portfolio management decisions.

Fintechs Are Accelerating the Shift Toward Outsourcing

Fintech lenders have been early adopters of debt outsourcing due to their rapid growth and digital operating models. Scaling internal recovery operations in parallel with customer acquisition is often impractical and costly. Outsourcing allows fintechs to maintain focus on product innovation while ensuring recoveries are handled by experienced, compliant partners.

In addition, partnering with established recovery agencies strengthens fintech credibility with regulators, investors, and funding partners. In 2025, outsourcing is increasingly embedded into fintech operating models from early growth stages rather than being introduced reactively.

Banks Are Moving Toward Hybrid Recovery Models

Traditional banks are re-evaluating fully in-house recovery structures. Many legacy systems lack flexibility and struggle to integrate digital engagement and advanced analytics. As a result, banks are adopting hybrid models that combine internal oversight with outsourced execution.

Common approaches include outsourcing early-stage delinquencies, non-core portfolios, or specialised recovery segments while retaining sensitive or high-risk cases internally. This balance allows banks to improve efficiency while maintaining strategic control and regulatory accountability.

Customer Experience Has Become Central to Recovery Strategy

Recovery practices now directly influence brand perception and customer retention. Poor recovery experiences can lead to complaints, regulatory scrutiny, and long-term reputational harm. In competitive lending markets, customer experience is a critical differentiator.

Specialized recovery agencies in 2025 emphasise respectful engagement, transparent communication, and sustainable repayment solutions. Structured hardship programs and flexible payment arrangements improve cooperation and long-term recovery outcomes.

For lenders, outsourcing supports consistent recovery standards aligned with customer-centric values.

Scalability and Resilience During Economic Volatility

Economic conditions in 2025 remain unpredictable. Delinquency volumes can increase rapidly due to changes in interest rates, employment levels, or sector-specific disruptions. Internal teams often lack the flexibility to scale efficiently during such periods.

Outsourcing provides operational resilience. Recovery agencies can absorb volume fluctuations without compromising service quality or compliance. This scalability helps lenders protect cash flow and balance sheet stability during economic stress.

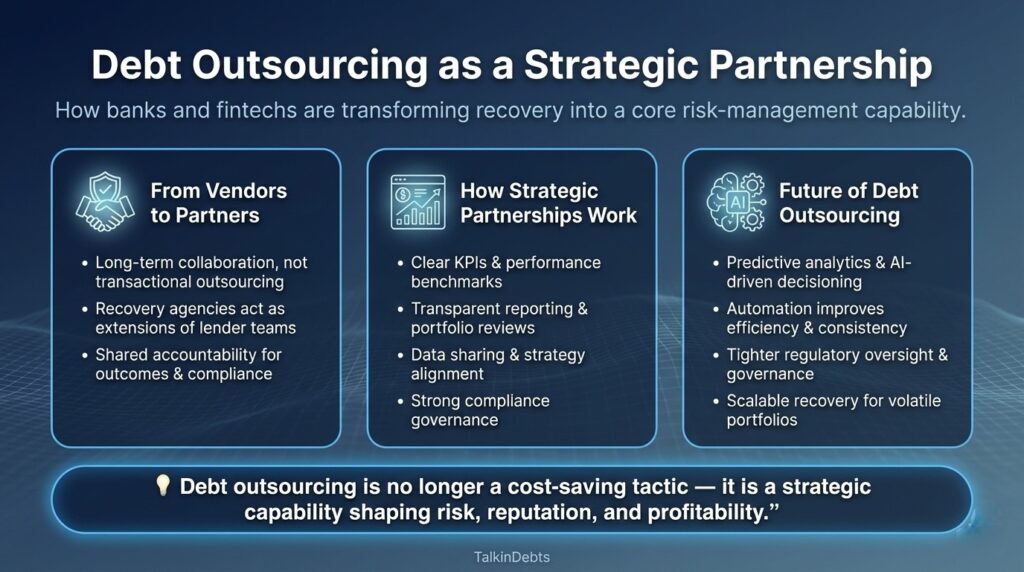

Debt Outsourcing as a Strategic Partnership

The most effective debt outsourcing arrangements in 2025 are built on long-term partnerships rather than transactional vendor relationships. Lenders work closely with recovery agencies on strategy, data sharing, performance optimisation, and compliance governance.

Clear KPIs, transparent reporting, and regular portfolio reviews ensure alignment between lenders and their outsourcing partners. These partnerships position recovery agencies as extensions of the lender’s risk and operations teams.

The Future Outlook for Debt Outsourcing

Debt outsourcing will continue to evolve beyond 2025 as technology advances and regulatory expectations increase. Automation, predictive analytics, and AI-driven decisioning will further enhance recovery efficiency. At the same time, governance and oversight requirements will become more rigorous.

Banks and fintechs that treat debt outsourcing as a strategic capability rather than a cost-cutting exercise will be better equipped to manage credit risk, protect customer relationships, and maintain long-term financial stability.

Final Perspective

Debt outsourcing in 2025 reflects a fundamental shift in how financial institutions manage recovery operations. Cost pressures, regulatory demands, digital expectations, and portfolio volatility have made traditional in-house models increasingly unsustainable.

By partnering with specialized recovery agencies, banks and fintechs gain access to expertise, scalability, and advanced technology while maintaining compliance and customer trust. In a credit environment where recovery performance directly impacts profitability and reputation, debt outsourcing has become a strategic advantage rather than a last resort.