Data Security for Debt Portfolios: Meeting India’s DPDPA & Saudi Arabia’s SAMA Requirements

In today’s data-driven economy, financial institutions and debt collection agencies handle an enormous volume of sensitive borrower information every single day. From personal identification details to loan repayment histories, the accuracy, confidentiality, and security of this data directly influence the trust between consumers, lenders, and collection partners.

As digital platforms transform the way debt portfolios are managed, the threat landscape has expanded dramatically. Cybercriminals now target financial data more aggressively, exploiting weak data handling practices or outdated systems. To address these risks, regulators across the world are enforcing strict compliance frameworks that prioritize privacy and cybersecurity.

Data Security for Debt Portfolios: DPDPA & SAMA Rules

In India, the Digital Personal Data Protection Act (DPDPA), 2023, has redefined how organizations handle personal data. Similarly, in Saudi Arabia, the Saudi Arabian Monetary Authority (SAMA) has set stringent standards through its Cybersecurity Framework to protect financial information and strengthen resilience against data breaches.

For debt collection agencies and lenders operating across both markets, understanding and complying with these laws is essential not only to avoid penalties but also to build sustainable, compliant, and transparent operations.

Why Data Security is Crucial in Debt Management

Debt portfolios contain the most sensitive form of financial data — names, contact details, repayment patterns, income sources, and sometimes even legal identifiers. When such data is compromised, the impact extends beyond financial losses. It erodes consumer confidence, damages brand reputation, and can lead to regulatory action.

The modern collection ecosystem, which relies heavily on cloud-based CRMs, predictive analytics, and automated communication tools, increases exposure points. A single unsecured system or negligent handling by a third-party vendor can result in massive data leaks.

Moreover, as debt recovery increasingly involves cross-border collaboration, agencies must also comply with multiple national laws simultaneously — making it crucial to have a clear understanding of data protection obligations in every jurisdiction they operate.

India’s DPDPA: A New Era for Data Protection

The Digital Personal Data Protection Act (DPDPA), 2023, is India’s first comprehensive privacy law and marks a significant step in aligning with global data protection standards such as the EU’s GDPR. The Act applies to any entity that processes digital personal data within India or outside India if it deals with Indian citizens.

For debt collection agencies, this means every borrower’s information — from contact details to payment histories — must be handled transparently, with accountability and consent.

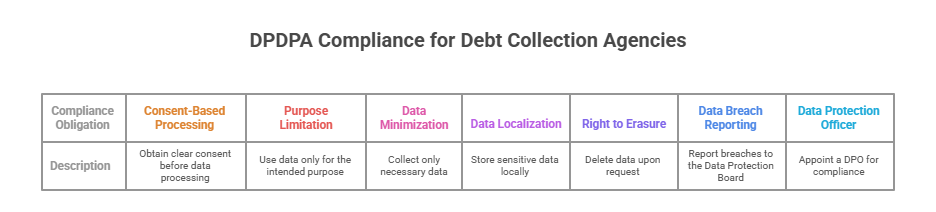

Key Compliance Obligations under DPDPA

- Consent-Based Processing: Personal data must be collected and processed only after obtaining clear and informed consent from the borrower.

- Purpose Limitation: Data must only be used for the specific purpose it was collected — in this case, debt collection or recovery.

- Data Minimization: Agencies must ensure they collect only the minimum amount of data required for legitimate operations.

- Data Localization: While the DPDPA doesn’t strictly prohibit cross-border transfers, sensitive financial data is best stored on local servers to ensure regulatory alignment.

- Right to Erasure: Borrowers can request deletion of their data once the loan is settled or when the data is no longer needed.

- Data Breach Reporting: Any data breach must be promptly reported to the Data Protection Board of India.

- Appointment of a Data Protection Officer (DPO): Every significant data fiduciary must appoint a DPO to manage compliance, respond to user grievances, and oversee data protection audits.

In practice, this means debt collection firms need to upgrade their IT infrastructure, adopt encryption-based storage, and automate consent management to ensure compliance at every stage of the collection cycle.

Saudi Arabia’s SAMA Cybersecurity Framework: Strengthening Financial Resilience

The Saudi Arabian Monetary Authority (SAMA) has established one of the most advanced cybersecurity frameworks in the Middle East. It serves as a regulatory blueprint for banks, fintech firms, insurance companies, and debt collection agencies operating within the Kingdom.

SAMA’s framework focuses not only on preventing data breaches but also on creating a culture of continuous security improvement across the financial ecosystem.

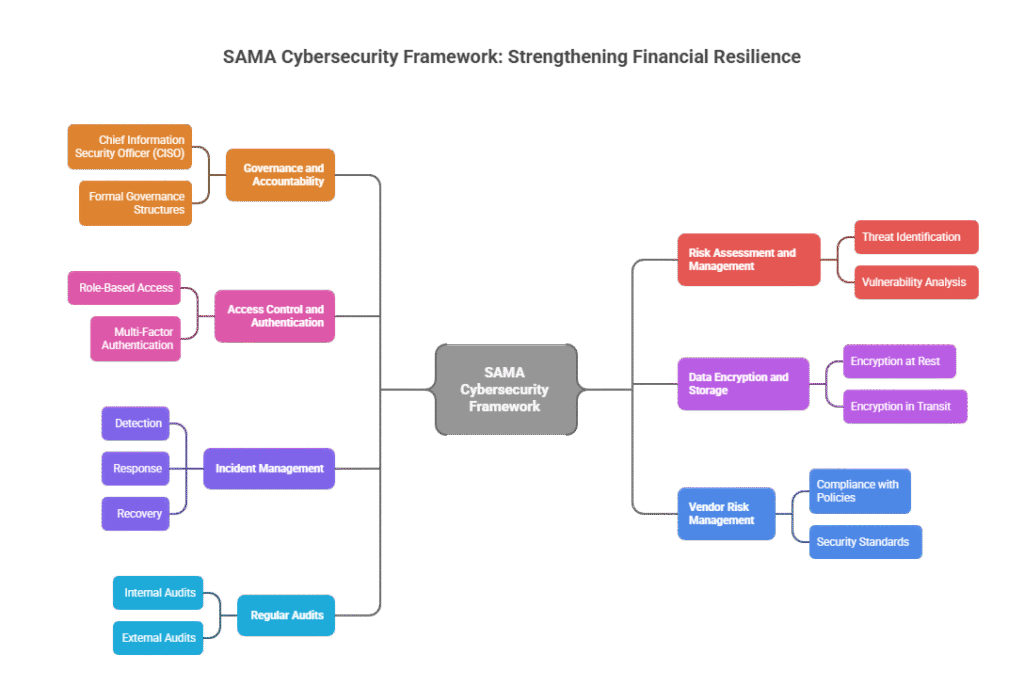

Core Principles of the SAMA Cybersecurity Framework

- Governance and Accountability: Financial institutions must establish formal cybersecurity governance structures, including the appointment of a Chief Information Security Officer (CISO).

- Risk Assessment and Management: Continuous risk assessments must be carried out to identify threats, vulnerabilities, and potential data exposure points.

- Access Control and Authentication: Data access should be strictly role-based, and all users should be verified using multi-factor authentication.

- Data Encryption and Storage: Sensitive data, such as financial and personally identifiable information (PII), must be encrypted both at rest and during transmission.

- Incident Management: Organizations must develop a detailed incident response plan to detect, respond to, and recover from cybersecurity events.

- Vendor Risk Management: External service providers must also comply with SAMA’s security policies.

- Regular Audits: Frequent internal and external audits are mandatory to validate cybersecurity readiness.

By complying with these standards, collection agencies can demonstrate strong governance, data integrity, and operational transparency, enhancing their credibility in Saudi Arabia’s tightly regulated financial environment.

Aligning DPDPA and SAMA: A Dual Compliance Approach

Agencies that operate across India and Saudi Arabia must align their compliance frameworks to satisfy both data protection and cybersecurity requirements. Though each regulation differs in terminology and enforcement, both share a common foundation — data accountability, consent, security, and breach preparedness.

| Compliance Area | India’s DPDPA | Saudi Arabia’s SAMA Framework |

|---|---|---|

| Objective | Personal data privacy | Cybersecurity and information protection |

| Regulatory Authority | Ministry of Electronics & IT | Saudi Central Bank (SAMA) |

| Consent Management | Explicit and informed | Implied through governance policies |

| Data Localization | Strongly encouraged | Mandatory for financial data |

| Breach Notification | To Data Protection Board | Immediate reporting to SAMA |

| Data Officer Role | Data Protection Officer | Chief Information Security Officer |

| Penalties | Up to ₹250 crore | Severe fines or license suspension |

A harmonized data protection strategy ensures compliance across borders and simplifies operations for multinational agencies. The key is to centralize governance, automate reporting, and maintain strong documentation of compliance activities.

Implementing Robust Data Security Practices

1. Encryption at Every Layer

Implement encryption for data storage, transmission, and backups. Use AES-256 encryption for data at rest and TLS 1.3 for data in transit to safeguard borrower records.

2. Role-Based Access Control (RBAC)

Restrict access to sensitive information based on roles and responsibilities. Agents should only view data relevant to their assigned accounts.

3. Multi-Factor Authentication (MFA)

All systems, including CRM tools and email platforms, should implement MFA to reduce the risk of unauthorized logins.

4. Periodic Security Audits

Conduct both internal and third-party cybersecurity audits every quarter. These helps identify vulnerabilities and ensure compliance with DPDPA and SAMA standards.

5. Cloud Compliance

If debt portfolios are stored on cloud systems, ensure the cloud provider is ISO 27001 certified and offers region-specific data storage in India or Saudi Arabia.

6. Data Retention and Erasure

Set clear data retention timelines and erase borrower data permanently after settlement using cryptographic erasure or secure wiping protocols.

7. Continuous Employee Training

Regularly train employees on phishing awareness, secure handling of borrower information, and the consequences of non-compliance.

8. Incident Response Preparedness

Have a detailed incident response plan ready. Define how to identify, contain, and report data breaches within required timelines.

Cross-Border Data Transfers: Challenges and Solutions

Debt collection often involves clients and consumers across multiple geographies. However, cross-border data transfer is one of the most sensitive areas of compliance. Both DPDPA and SAMA require agencies to take extra precautions before moving data outside national borders.

Key Challenges

- Regulatory conflicts between data privacy laws in India and Saudi Arabia.

- Vendor compliance risks when using offshore data processors.

- Legal complexities in establishing consent for international transfers.

Best Practices

- Data anonymization should be used when sharing borrower data across jurisdictions.

- Sign Data Processing Agreements (DPAs) with all third parties.

- Store data on servers located in compliant regions and use VPNs and end-to-end encryption for transfers.

- Maintain audit trails of every cross-border transaction for regulatory review.

Leveraging Technology for Compliance

Technology plays a decisive role in ensuring ongoing compliance with data protection frameworks. Modern debt management systems now integrate privacy-by-design principles, embedding compliance controls into daily operations.

Automated Compliance Monitoring

Software platforms can track borrower consent, restrict unauthorized access, and automatically flag non-compliant actions — minimizing manual oversight errors.

AI-Driven Risk Analysis

Artificial intelligence can detect irregular patterns, predict vulnerabilities, and instantly alert administrators to potential threats before they escalate.

Blockchain for Immutable Records

Blockchain ensures data transparency by creating immutable, timestamped records of every transaction or update made to a debt portfolio, guaranteeing accountability and authenticity.

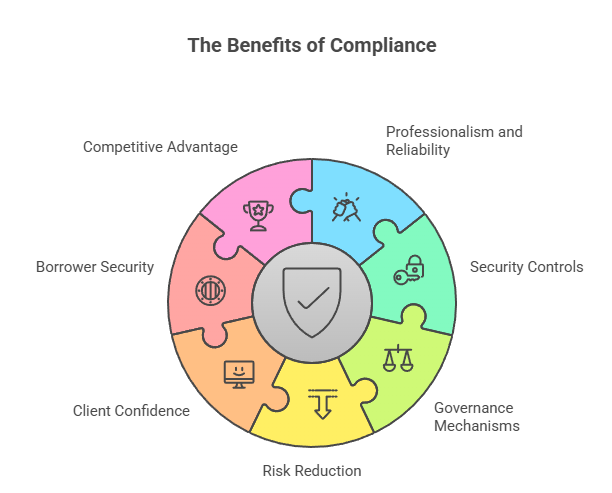

How Compliance Enhances Business Credibility

Strong compliance is a clear indicator of professionalism and reliability. Clients, especially large lenders and financial institutions, prefer to work with agencies that maintain stringent security controls and clear governance mechanisms.

By aligning with DPDPA and SAMA requirements:

- Agencies reduce operational and legal risk.

- Clients gain confidence in data integrity and protection.

- Borrowers feel secure sharing personal financial details.

- The organization earns a competitive advantage in regulated markets.

Compliance is not merely about avoiding fines — it’s about demonstrating ethical responsibility and long-term commitment to data stewardship.

A Forward-Looking Data Security Strategy

The global financial sector is moving toward a future where data privacy and cybersecurity are central to business success. Agencies that treat compliance as a continuous journey rather than a one-time effort will lead in both reputation and client retention.

Debt collection companies should focus on:

- Embedding data privacy principles into business strategy.

- Building cross-functional teams that merge IT, legal, and operations expertise.

- Partnering with technology vendors that offer compliance automation.

- Regularly updating data policies to match new legal developments in both India and Saudi Arabia.

When organizations proactively safeguard borrower information, they not only protect themselves from legal risks but also build lasting trust — the most valuable currency in the world of finance.