The Camel Mortgage Bubble: Bedouin Tradition Meets Modern Debt (Agricultural loan defaults)

GCC Region: Across the Arabian Peninsula, a silent financial crisis is brewing. It doesn’t originate from oil, real estate, or global trade, but from camels. These animals, long revered as the lifeline of Bedouin culture, have now become the centrepiece of a dangerous and growing debt bubble that’s threatening the agricultural backbone of the Gulf region.

Camel Mortgage Debt: Tradition Turned Collateral

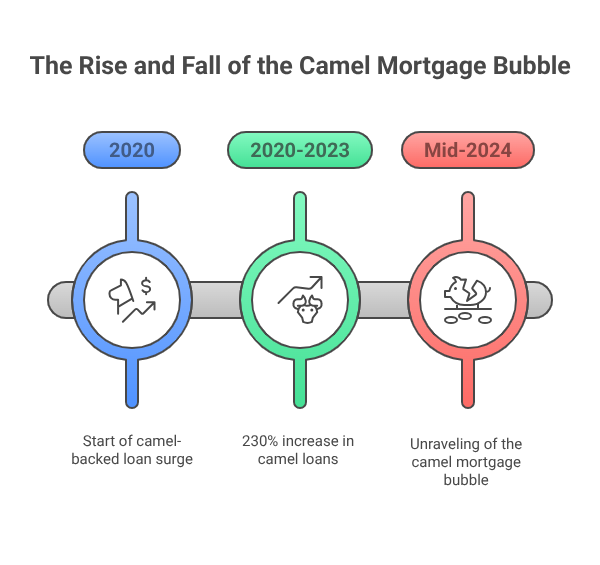

In many parts of Saudi Arabia, the UAE, and Oman, camels have historically represented wealth, mobility, and cultural status. But over the last five years, a new financial phenomenon has emerged: camels being mortgaged as collateral for agricultural loans.

With an estimated 1.2 million camels across the GCC, many valued between AED 30,000 to AED 1 million depending on breed, age, and pedigree, they became an appealing form of rural asset securitization. Financial institutions eager to expand their footprint in underserved desert regions embraced this unconventional model. From 2020 to 2023, camel-backed loans increased by over 230%, with over AED 6.8 billion ($1.85 billion) disbursed across 38,000 loans.

This fusion of cultural asset and modern debt instrument seemed to offer a bridge between tradition and progress. But by mid-2024, it began to unravel.

A Sudden Price Crash

What lenders failed to account for was volatility. Camel values—especially for non-racing and non-milking breeds—collapsed between Q3 2023 and Q1 2025 by over 45%, triggered by oversupply, rising feed costs, veterinary shortages, and declining market demand.

Data from the GCC Agricultural Lending Council shows the average camel’s value dropped from AED 92,000 in 2023 to just AED 50,800 in early 2025. This devaluation rendered thousands of camel-mortgaged loans undercollateralized almost overnight.

As a result, default rates surged. In the first quarter of 2025 alone, over 11,400 camel-backed loans fell into delinquency, marking a 62% increase from the same period in 2024.

Debt Collection Meets Desert Reality

The crisis has put lenders in an unfamiliar position: thousands of camels are now being repossessed. But what looked manageable on paper has proven chaotic on the ground. Camels are living assets requiring constant care, space, and specialized handling. Banks, unprepared for livestock management, are struggling with logistics, costs, and welfare concerns.

One of the region’s largest commercial banks reportedly holds ownership of over 4,800 camels—many housed in temporary desert holding pens. Daily maintenance is estimated at AED 40 per camel, pushing monthly operational costs beyond AED 5.7 million.

Several lenders have resorted to mass auctions to liquidate their camel holdings. However, oversupply and buyer fatigue have led to a freefall in auction prices. Pedigree camels once valued at over AED 300,000 are now selling for as little as AED 90,000.

Economic Impact on Agricultural Sustainability

The ripple effects are stark. Camel milk farms, date growers, and desert transport operators—many of whom had leveraged camel mortgages to fund expansion—are now facing insolvency. According to figures from the GCC Rural Finance Observatory, over 6,700 small agricultural enterprises in the UAE and Saudi Arabia have halted operations since the beginning of the year due to loan distress.

This sudden contraction in rural economies is contributing to a 17% year-on-year decline in camel milk production, and a 24% drop in employment across agricultural sectors that depend on camel Labor or transport. In Oman’s Al Dhahirah region alone, over 1,900 seasonal jobs were lost in Q2 2025.

Cultural Disruption and Credit Shame

Beyond economics, the collapse of camel-backed debt has ignited a deep social reckoning. In traditionally close-knit tribal regions, defaults are not merely financial—they are perceived as public shame.

Loan default registries, now digital and centralized, have flagged thousands of rural borrowers, limiting their future access to government subsidies and credit. Many have found themselves cut off from formal banking and forced back into informal borrowing networks, often at double-digit interest rates.

Adding to the pressure, some financial institutions have adopted aggressive AI-based collection tactics. Automated WhatsApp reminders, SMS threats, and voice bots have reached remote herders, many of whom lack the financial literacy to understand repayment options or restructuring terms.

This digital debt collection push, though efficient, has alienated entire communities and sparked calls for more humane and culturally aware financial practices.

Regulatory Alarm Bells

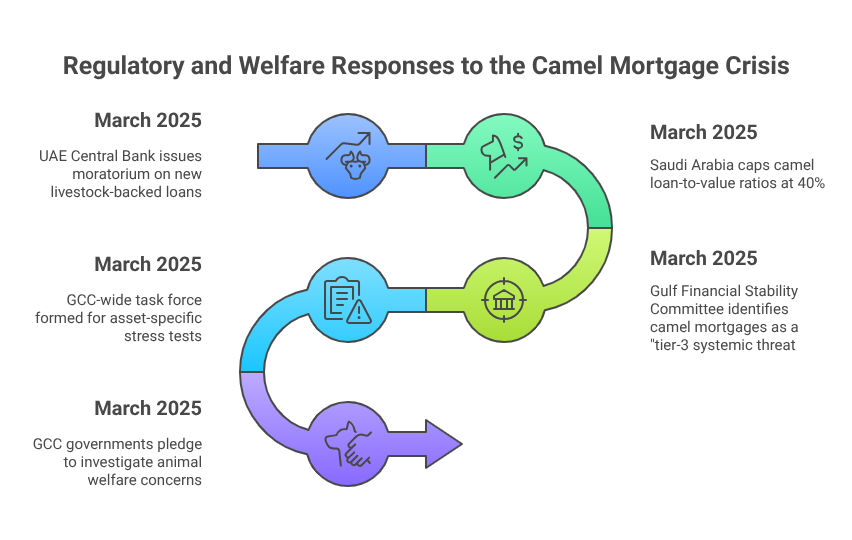

Authorities have begun to act—but slowly. In March 2025, the UAE Central Bank issued a moratorium on issuing new livestock-backed loans. Saudi Arabia followed with a cap on camel loan-to-value (LTV) ratios, limiting financing to 40% of appraised value, down from 70% in previous years.

Meanwhile, the Gulf Financial Stability Committee (GFSC) released an advisory identifying camel mortgages as a “tier-3 systemic threat,” recommending that member nations de-risk agricultural lending portfolios.

A GCC-wide task force is also being formed to explore asset-specific stress tests, particularly for livestock and perishable goods. These moves aim to avert similar collapses tied to other traditional assets like falcons, date palm groves, and desert horses.

Animal Welfare Concerns Escalate

As repossession accelerates, so do fears over animal welfare. Activists and NGOs warn that many camels are being housed in overcrowded, unsanitary conditions without adequate veterinary support.

With over 17,000 repossessed camels estimated to be in bank custody across the region, daily care logistics have become unsustainable. Reports of neglect, disease outbreaks, and unregulated mass culling are beginning to surface, prompting calls for intervention from international animal welfare bodies.

GCC governments have pledged to investigate and may consider emergency funding for temporary camel shelters run by NGOs and state-backed agricultural boards.

Fintech’s Role in the Bubble

Much of the camel mortgage bubble’s growth was fuelled by regional fintech platforms that targeted rural populations with sleek, mobile-first lending apps. These platforms promised 24-hour approvals and minimal documentation, luring thousands of borrowers without providing adequate risk disclosures or market education.

Between 2021 and 2024, over 52% of camel-backed loans were issued via app-based lending interfaces. Many users signed contracts without legal reviews, misjudged floating interest rates, or misunderstood penalties.

This overreliance on automation and lack of due diligence has drawn the attention of digital finance regulators. Several platforms are now under review, with proposed legislation expected to mandate livestock risk training, credit counselling, and tighter identity checks for future borrowers.

The Numbers Behind the Bubble

- Total Camel-Backed Loans Issued (2020–2024): AED 6.8 billion

- Average Loan Size: AED 178,000

- Estimated Repossessed Camels (as of Q2 2025): 17,000+

- Default Rate Increase (Q1 2025 vs. Q1 2024): 62%

- Average Market Value Decline per Camel: -45%

- Agricultural Business Closures (2025 YTD): 6,700+

- Monthly Camel Maintenance Cost (Repossession Centres): AED 5.7 million

These figures underscore the sheer scale of the issue and the systemic exposure built into rural credit systems.

Searching for a Sustainable Model

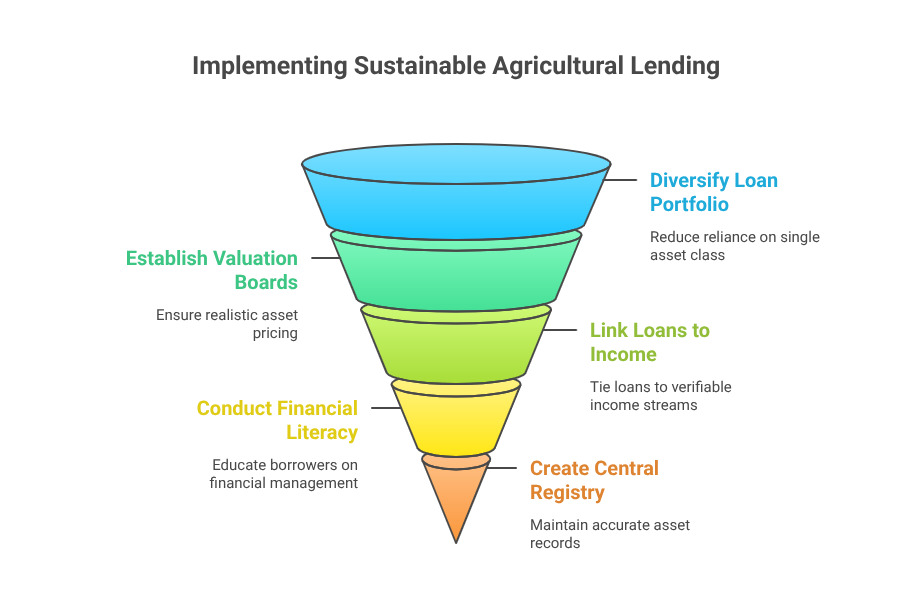

Experts argue that the future of agricultural lending in the region must include safeguards against asset-class overconcentration. Proposed reforms include:

- Creating livestock valuation boards to ensure standardized and realistic pricing

- Linking camel-backed loans to verifiable income streams (milk, breeding services, tourism)

- Mandating financial literacy sessions before loan disbursement

- Launching a centralized camel registry with verified appraisals

In addition, analysts are urging governments to promote diversified rural funding—not just livestock-based—but also green tech, irrigation infrastructure, and desert farming automation.

The Future of Camel Financing

What began as a modern tool for rural development has mutated into a complex financial and cultural crisis. The camel mortgage bubble is more than a cautionary tale—it’s a case study in how rapid financial innovation, if not grounded in economic reality and cultural context, can destabilize communities and economies alike.

As camels sit in bank yards instead of desert dunes, and herders count debt notices instead of herd size, the region must decide whether tradition and finance can truly coexist, or whether a new approach to rural credit must be born from the ashes of this bubble.

As camels sit in bank yards instead of desert dunes, and herders count debt notices instead of herd size, the region must decide whether tradition and finance can truly coexist, or whether a new approach to rural credit must be born from the ashes of this bubble.