AI-Powered Debt Analytics Tools Gain Adoption Among Global Lenders as Credit Risk Pressures Intensify in 2025

Global lenders are accelerating their shift toward AI-powered debt analytics tools, driven by rising borrower risk, tightening regulatory environments, and the need for more accurate credit decisioning. In 2025, financial institutions, fintech innovators, and credit bureaus are partnering at a record pace to deploy real-time debt monitoring technologies that improve prediction accuracy, reduce loan defaults, and transform risk management processes across markets.

As consumer and corporate debts climb worldwide, banks face heightened exposure to delinquency and insolvency. This year’s lending environment reflects a new reality: traditional credit assessment models are no longer sufficient. Institutions need deeper visibility into borrower behavior, market volatility, and early-warning indicators. AI-driven analytics platforms—once considered a technological luxury—have now become essential infrastructure for risk teams, compliance departments, and underwriting divisions.

The adoption surge is particularly strong among lenders operating in emerging markets, global fintech companies offering unsecured lending, and asset managers handling high-risk portfolios. These organizations increasingly rely on machine learning, natural language processing, and behavioral scoring algorithms to forecast borrower outcomes with unprecedented accuracy.

Global Lenders Turn to AI for Predictive Risk Assessment

The pressure on banks to maintain loan quality has intensified. As household debt ratios rise in the U.S., Europe, Asia, and the Middle East, lenders are relying on predictive analytics to detect early signs of financial distress. AI systems can now analyze thousands of variables—from spending patterns and repayment habits to macroeconomic signals and sector-specific stress levels.

Machine learning models help lenders classify risk more precisely by continuously learning from new repayment data. This allows credit teams to move beyond static scoring methods and adopt adaptive systems capable of identifying risks before they materialize.

In markets facing economic uncertainty, AI-powered debt analytics are enabling lenders to build greater resilience. Real-time insights allow financial institutions to adjust credit limits, restructure loan offers, or implement targeted collection strategies. The shift to proactive risk management represents one of the most significant transformations in modern lending.

SaaS Debt-Monitoring Tools Reshape the Risk Management Landscape

A growing portion of the industry’s AI transformation is driven by SaaS-based debt-monitoring platforms. These cloud-native systems offer lenders scalable and cost-efficient solutions without requiring heavy infrastructure investment. The rapid onboarding capabilities of SaaS platforms have made them particularly appealing to mid-sized banks, microfinance institutions, and digital lenders looking to modernize their systems quickly.

Key features of emerging SaaS debt analytics platforms include:

- Real-time borrower monitoring

- Automated risk scoring and alerts

- Portfolio stress-testing engines

- Predictive delinquency modeling

- AI-driven collections optimization

- RegTech compliance integrations

These tools are reducing operational costs by automating manual credit checks, enhancing accuracy in underwriting decisions, and accelerating the identification of non-performing loans (NPLs).

Fintechs leading the SaaS debt analytics revolution include start-ups specializing in behavioral risk modeling, open banking integration, and cross-sector credit intelligence. Their platforms aggregate multiple data streams—from telecom usage to utility bills—to produce more comprehensive borrower profiles. This multidimensional approach is helping lenders expand credit access while managing risk more effectively.

AI Partnerships Between Banks and Tech Providers Rise Globally

The global rise in AI adoption is fueling a wave of strategic partnerships between banks and technology companies. Institutions that once relied exclusively on in-house risk systems now seek collaboration with AI-focused SaaS firms, recognizing the competitive advantage of real-time analytics.

In Europe, major banks are partnering with AI vendors to strengthen credit risk and compliance tracking. In the U.S., digital-first lenders are using advanced modeling tools to improve approval speeds while minimizing fraud exposure. Meanwhile, Asian and Middle Eastern financial institutions are signing multi-year agreements with international AI providers to support large-scale digital transformation projects.

These partnerships often focus on:

- Integrating AI analytics into core banking systems

- Automating underwriting workflows

- Enhancing debt recovery strategies

- Building early-warning risk dashboards

- Improving corporate lending assessments

For global lenders facing increasing regulatory scrutiny, AI partnerships also support compliance efforts by providing transparent audit trails and consistent scoring methodologies that meet supervisory expectations.

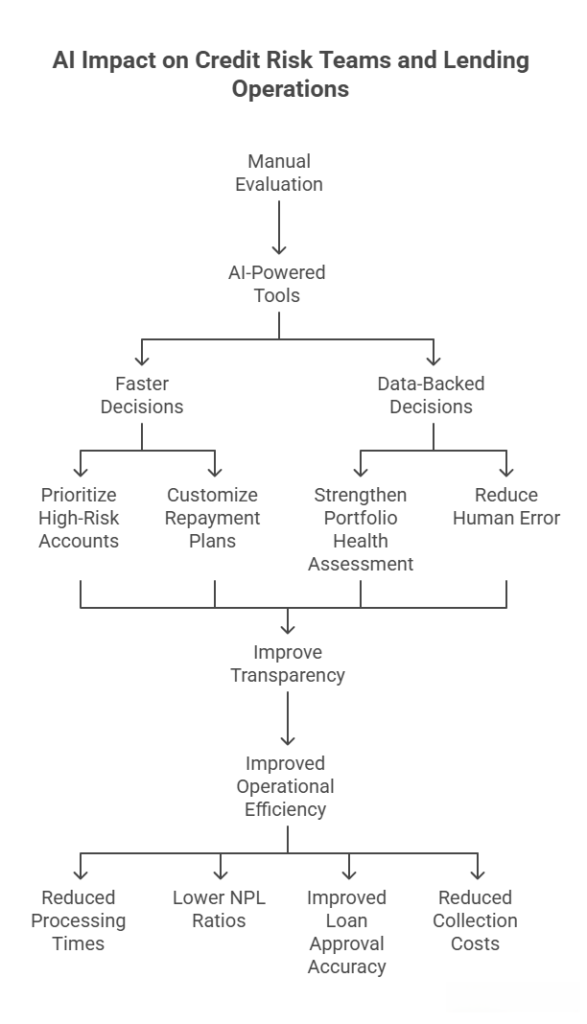

Impact on Credit Risk Teams and Lending Operations

The shift toward AI-powered tools is transforming the roles of credit analysts, underwriters, and risk teams. Instead of spending hours manually evaluating borrower files, analysts now rely on automated risk insights to make faster, data-backed decisions.

AI systems allow credit teams to:

- Prioritize high-risk accounts earlier

- Customize repayment plans using behavioral insights

- Strengthen portfolio health assessment

- Reduce human error through standardized evaluation criteria

- Improve transparency in lending decisions

The result is a measurable improvement in operational efficiency. Banks adopting AI-driven debt analytics have reported reduced processing times, lower NPL ratios, and improved loan approval accuracy. Furthermore, AI-enabled early detection tools reduce collection costs by identifying distressed borrowers before they default.

AI Tools Improve Debt Recovery and Collections Performance

Debt recovery strategies are also undergoing a major transformation. AI-driven collection systems use machine learning to determine the most effective communication channels, timings, and repayment negotiation methods for each borrower.

These tools analyze behavioral and transactional data to categorize borrowers into micro-segments—allowing lenders to apply personalized recovery strategies that significantly improve repayment outcomes.

AI-powered automated outreach systems reduce operational strain on call centers and improve customer experience. Meanwhile, predictive analytics help lenders allocate resources more effectively across recovery teams, increasing efficiency and long-term recovery rates.

Open Banking Accelerates AI Adoption Across the Lending Industry

The expansion of open banking frameworks in 2025 is fueling deeper data connectivity between banks, fintech apps, and third-party providers. With borrower consent, lenders can now access real-time income data, expense patterns, and financial obligations, enabling more accurate risk assessments.

AI-powered debt analytics tools leverage this data to generate dynamic credit profiles that reflect a borrower’s current financial reality rather than outdated credit reports. As a result, lenders can make more inclusive decisions while reducing exposure to high-risk accounts.

This has been especially transformative for the unsecured lending market, where traditional credit reports often fail to capture a borrower’s complete financial behavior.

Corporate Lending and SME Financing Benefit from AI Insights

Corporate lenders are increasingly integrating AI tools to evaluate business creditworthiness and detect early signs of financial instability among small and medium enterprises (SMEs). Predictive analytics can identify supply chain disruptions, revenue volatility, and liquidity risks at earlier stages, allowing lenders to intervene before a business becomes distressed.

AI-assisted stress-testing tools model various macroeconomic scenarios, helping lenders understand how different industries will respond to changing market conditions. This capability has become essential as businesses navigate inflationary pressures, currency fluctuations, and global trade uncertainties.

For SME lenders, AI-based debt monitoring offers significant advantages:

- More accurate forecasting of business cash flows

- Reduced risk of SME loan defaults

- Better structuring of repayment plans

- Increased ability to serve new-to-credit businesses

With SMEs forming the backbone of many economies, AI-powered risk management tools are strengthening the resilience of corporate lending portfolios worldwide.

Regulators Push for Responsible Use of AI in Lending

As AI becomes more embedded in lending systems, regulators are increasing oversight to ensure fairness, transparency, and data security. Supervisory bodies across the EU, UK, U.S., and Asia have introduced guidelines requiring lenders to ensure that AI models do not discriminate, produce biased outcomes, or lack explainability.

Lenders must now maintain audit trails, model documentation, and transparent scoring logic. Many AI SaaS providers have responded by integrating compliance modules, bias-detection tools, and explainability dashboards into their platforms.

The move toward regulated AI enhances consumer trust and strengthens the long-term sustainability of AI adoption in the lending ecosystem.

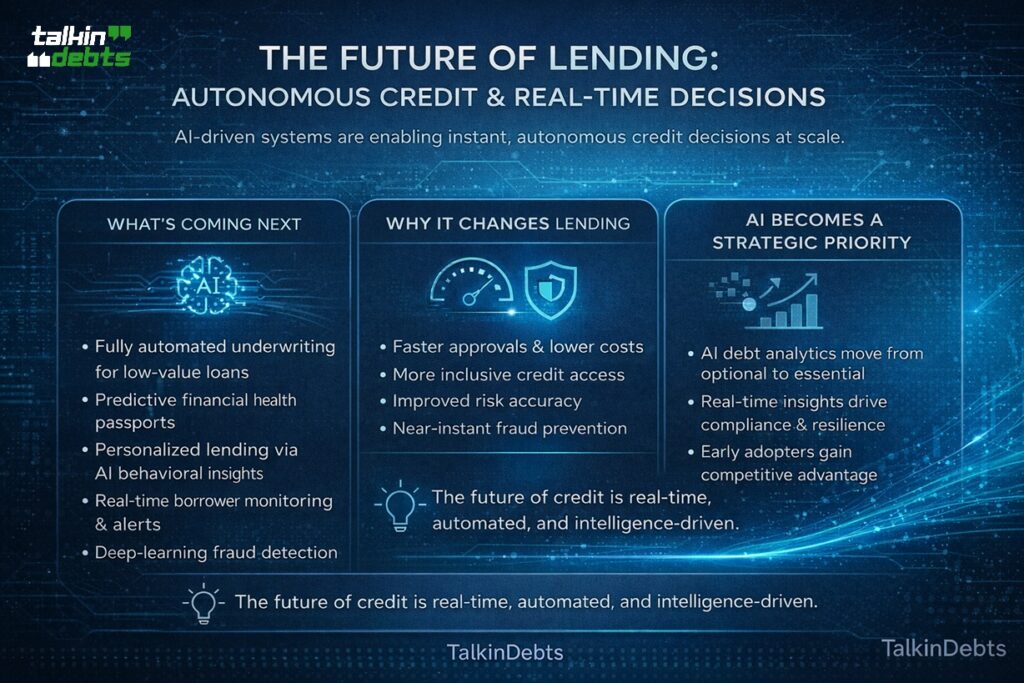

The Future: Autonomous Credit Systems and Real-Time Lending Decisions

Looking ahead, AI-driven debt analytics will play a crucial role in the evolution of autonomous credit systems—lending frameworks capable of making independent, real-time decisions based on dynamic borrower data.

Future innovations expected in the next few years include:

- Fully automated underwriting for low-value loans

- Predictive financial health passports

- Personalized lending products based on AI behavioral insights

- Autonomous credit monitoring with real-time borrower alerts

- Deep-learning systems that detect fraud with near-perfect accuracy

These advancements will create a more efficient, inclusive, and risk-aware lending environment. Financial institutions adopting early will gain a decisive competitive edge as global lending becomes increasingly data-driven.

AI Adoption Becomes a Strategic Priority for Lenders

By 2025, AI-powered debt analytics tools will no longer be niche technologies—they are strategic assets. As global debt levels rise and risk environments grow more complex, lenders across regions recognize the urgency of adopting intelligent systems that enhance accuracy, efficiency, and regulatory compliance.

The shift signals a new era in lending: one where real-time insights, machine learning, and automated decisioning become the foundation of modern credit ecosystems. Institutions investing in AI partnerships and SaaS debt-monitoring tools today will be better positioned to navigate economic uncertainty and maintain resilient portfolios in the years ahead.