UAE Public Debt Clock: Stable or Rising Behind the Scenes?

New Trends Emerge in 2025 as the Gulf Powerhouse Faces Economic Crossroads

Abu Dhabi

The UAE public debt clock continues ticking in real time, broadcasting to the world a national debt that remains, on paper, under control. But a growing number of economists and analysts are voicing concern: Is the rising needle on the clock a warning of deeper fiscal vulnerabilities?

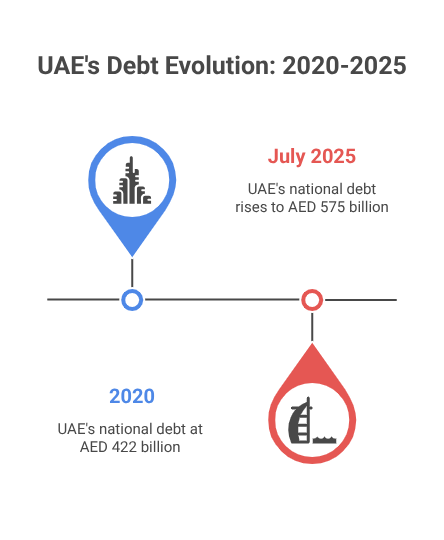

As of July 2025, the UAE’s national debt stands at AED 575 billion (USD 156 billion)—up from AED 422 billion just five years ago. While this still represents a relatively modest 36% of GDP, the recent uptick has led to widespread debate over whether the UAE’s debt strategy is entering a new, riskier phase.

Debt Transparency in the Spotlight

The unveiling of the UAE public debt clock in early 2024 was heralded as a bold move toward financial transparency. Updated in real time and modelled on similar tools in the U.S. and EU, the clock visualizes the UAE’s debt burden in a digital format accessible to the public, economists, and global investors.

Officials claimed the clock was meant to showcase the country’s low debt-to-GDP ratio compared to global peers. Yet, ironically, it has also provided a stark view of its upward trajectory, which has accelerated since 2021 due to increased federal spending, oil market volatility, and large-scale economic diversification projects.

Drivers Behind the Debt Growth

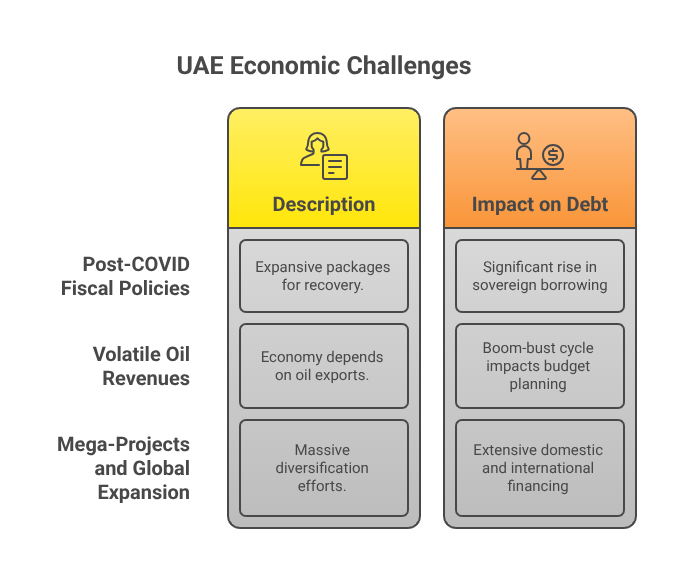

1. Post-COVID Fiscal Policies

The UAE introduced expansive fiscal packages in 2020 and 2021 to stimulate recovery from the COVID-19 pandemic. This included infrastructure investments, small business bailouts, and tourism revival strategies. While effective in cushioning the downturn, these measures came with a significant rise in sovereign borrowing.

Federal debt alone jumped by over 40% from 2020 to 2024, largely due to bond issuances and international loans. Dubai, known for its reliance on external borrowing to fund its growth, accounted for a sizeable share.

2. Volatile Oil Revenues

Despite ambitious plans to diversify, the UAE economy still depends heavily on oil exports, particularly in Abu Dhabi. While Brent crude traded as high as $94 per barrel in Q1 2025, it dropped below $80 by mid-year, cutting into fiscal revenues.

Analysts warn that the boom-bust oil cycle continues to impact long-term budget planning. “The UAE has improved its buffers, but oil volatility remains a structural challenge,” said Miryam Al-Rashed, a senior analyst at the Middle East Economic Forum.

3. Mega-Projects and Global Expansion

From the Dubai Urban Master Plan 2040 to Etihad Rail, NEOM partnerships, and green energy investments, the country’s diversification efforts are massive in scale—and cost. Funding these initiatives has required extensive domestic and international financing, increasing the overall debt load.

A Regional Comparison: Where the UAE Stands

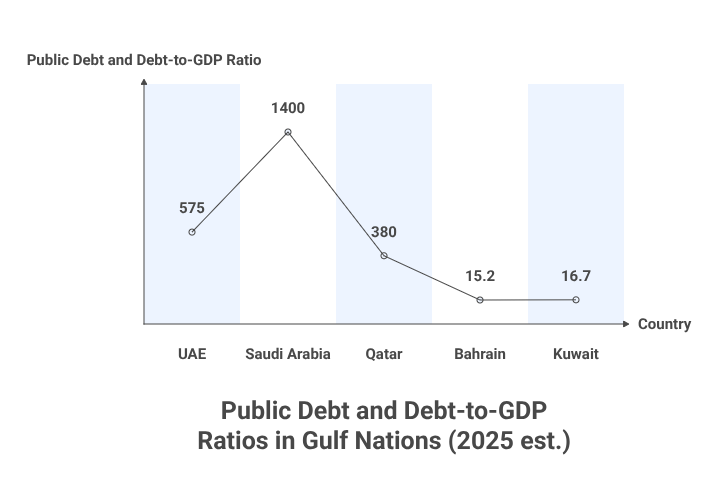

Compared to other Gulf nations, the UAE’s debt level is moderate:

| Country | Public Debt (2025 est.) | Debt-to-GDP Ratio |

|---|---|---|

| UAE | AED 575 billion | 36% |

| Saudi Arabia | SAR 1.4 trillion | 38% |

| Qatar | QAR 380 billion | 45% |

| Bahrain | BHD 15.2 billion | 118% |

| Kuwait | KWD 16.7 billion | 11% |

(Source: IMF Regional Fiscal Outlook, Q2 2025)

What makes the UAE stand out is its economic ambition paired with relatively low debt—a position that could change rapidly if external shocks continue or global interest rates rise.

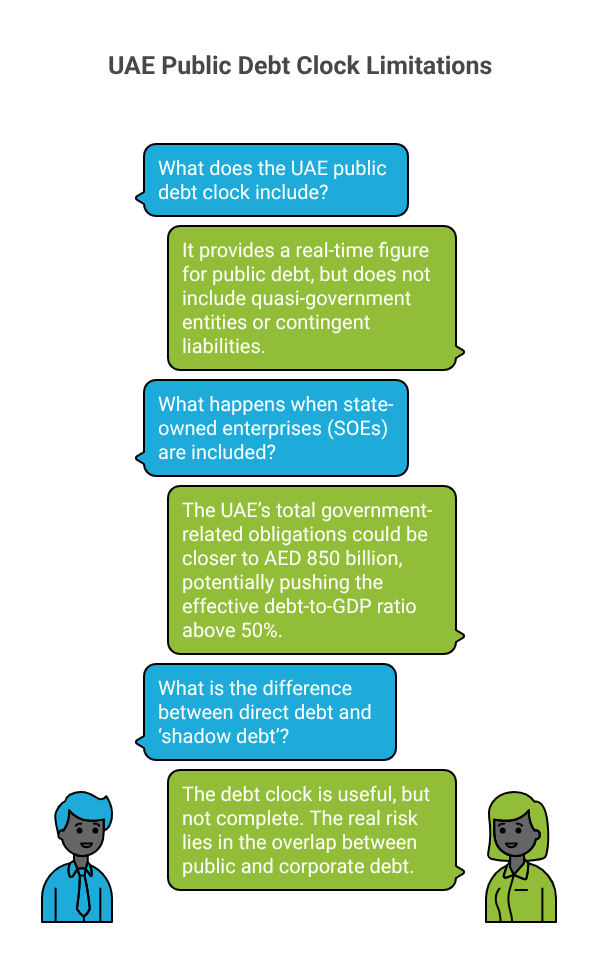

Debt Clock vs. Reality: What the Numbers Don’t Show

While the UAE public debt clock provides a real-time figure, it does not include quasi-government entities or contingent liabilities. This means debt held by major state-owned firms—such as Emirates Airline, Dubai World, or ADNOC—is not reflected.

According to independent estimates, when SOEs are included, the UAE’s total government-related obligations could be closer to AED 850 billion, potentially pushing the effective debt-to-GDP ratio above 50%.

“There is a difference between direct debt and what’s called ‘shadow debt’,” explained Dr. Saeed Al Nuaimi, an economic advisor in Sharjah. “The debt clock is useful, but not complete. The real risk lies in the overlap between public and corporate debt.”

Credit Ratings and Investor Confidence

Despite rising debt, the UAE continues to enjoy strong credit ratings. In May 2025, Fitch reaffirmed the country’s AA- rating, citing a stable economic outlook and robust foreign reserves exceeding USD 420 billion.

Bond yields remain attractive, and foreign investment inflows are solid, particularly into real estate, logistics, and AI sectors. But experts warn that global credit tightening could change sentiment quickly.

“The UAE is still seen as a low-risk borrower, but investor confidence is fragile,” said Jerome Collins, MENA economist at Nomura. “Any missteps in fiscal discipline or transparency could trigger a market correction.”

Fiscal Reform Measures Underway

To counter rising debt pressure, the government has introduced several initiatives:

- UAE Federal Debt Law: Enacted in 2022, this created a consolidated framework for bond issuance and public borrowing.

- Corporate Tax Implementation: A 9% corporate tax took effect in June 2023, aimed at boosting non-oil revenues.

- Public-Private Partnerships (PPPs): Increasing reliance on PPP models to reduce direct government spending on infrastructure.

Officials argue that these reforms will strengthen debt sustainability, with a goal to keep the national debt-to-GDP ratio under 40% through 2030.

Public Sentiment: Cautious but Supportive

A 2025 survey by Gulf Polling Insights found that 67% of UAE residents are aware of the debt clock, and 52% support continued government borrowing, provided it funds healthcare, infrastructure, and green innovation.

However, 31% expressed concern over rising national debt, citing fears of future taxation or subsidy cuts.

The Road Ahead: Manageable or mounting?

The central question now: Is the UAE’s public debt sustainable in the long run?

The answer hinges on four key factors:

- Oil Price Trends – Sustained low oil prices could widen the fiscal deficit.

- Global Interest Rates – Higher rates make borrowing costlier and repayment tougher.

- Geopolitical Stability – Regional tensions could impact investor appetite.

- Execution of Reform Plans – Will corporate tax and diversification truly offset debt pressures?

While the UAE public debt clock remains a symbol of transparency, it’s also becoming a barometer of financial stress. If the current debt trajectory continues without a corresponding surge in non-oil revenues, the nation could face increasing fiscal headwinds.

Time to Watch the Clock Closely

As the UAE enters the second half of 2025, the focus is shifting from debt numbers to debt strategy. The government’s ability to balance investment with fiscal prudence will define the next decade of growth.

For now, the UAE public debt clock remains a digital warning—quiet, constant, and counting.