India’s Credit Card Debt Crosses ₹2 Lakh Crore – Are Consumers Overspending?

New Delhi, July 11, 2025 – In a startling revelation that has stirred financial circles across the country, India’s outstanding credit card debt has officially crossed the ₹2 lakh crore mark for the first time in history. The figure, released by the Reserve Bank of India (RBI) in its latest monthly bulletin, marks a 30% year-on-year surge and raises significant questions about whether Indian consumers increasingly rely on plastic money to maintain their lifestyles or merely struggle to stay afloat.

With the country still grappling with high inflation and slow wage growth, this explosive rise in unsecured credit raises alarm bells about the financial health of households and the sustainability of consumption-led growth in Asia’s third-largest economy.

Alarming Growth in India’s Consumer Credit

The RBI data indicates that as of June 2025, the total outstanding credit card debt stood at ₹2.03 lakh crore, a sharp increase from ₹1.56 lakh crore recorded during the same period last year. In comparison, this debt was just ₹94,000 crore in 2020, signifying that the volume has more than doubled in less than five years.

According to analysts, this surge has been driven by a combination of increased consumer spending, aggressive marketing by credit card issuers, higher credit limits, and the rapid digitalization of financial services post-pandemic.

“Credit card usage has risen not just in metros but also in Tier 2 and Tier 3 cities,” said Suman Joshi, a senior economist at Axis Securities. “This is partially due to aspirational spending, but also due to economic distress. People are turning to credit cards to bridge cash flow gaps in their monthly expenses.”

Lifestyle Inflation or Survival Strategy?

The rise in debt has prompted a critical question: Are Indian consumers overspending, or is credit card use now a survival strategy?

A 2024 consumer sentiment survey by Local Circles revealed that 41% of respondents had used credit cards in the past six months to pay for essentials such as groceries, utility bills, and education fees. Nearly 28% admitted they were unable to pay off the full balance each month, leading to interest charges upwards of 36% per annum.

“With inflation pushing up the cost of living, many middle-class families are relying on credit just to get through the month,” said Rajeev Arora, founder of Fin Assist, a personal finance advisory platform. “The credit card is no longer a luxury tool—it has become a fallback in times of financial stress.”

The consumer price index (CPI) inflation for June 2025 stood at 6.1%, remaining above the RBI’s comfort zone of 4% for the tenth straight month. This has significantly dented purchasing power and added pressure on household budgets.

Rising Defaults and Delinquencies

Perhaps more concerning is the parallel rise in credit card delinquencies. According to data from CRIF High Mark, the 90-day delinquency rate for credit cards has increased from 1.8% in Q1 FY24 to 2.5% in Q1 FY25.

“This is a clear red flag,” said Prashant Mehta, VP of Risk Analytics at a leading private sector bank. “We are now witnessing early signs of stress in repayment behaviour. Unlike home loans or auto loans, credit card debt is unsecured and expensive, making it the first to slip when finances are tight.”

Banks have already begun tightening underwriting norms. Some lenders are reviewing credit limits and pulling back pre-approved offers for borrowers who show signs of financial stress.

In April 2025, the RBI also directed banks to improve transparency in the computation of annual percentage rates (APR) and to ensure that customers understand the risks of rolling over credit card balances.

Surge in Credit Card Issuance

Despite these risks, credit card issuances are booming. As per RBI data, the total number of credit cards in circulation in India has surpassed 120 million as of May 2025, compared to 90 million in 2022.

Leading issuers such as HDFC Bank, ICICI Bank, SBI Card, and Axis Bank have reported record growth in card acquisitions. The fintech boom has also contributed, with startups like Slice, One Card, and Uni offering innovative “buy now, pay later” (BNPL) solutions bundled with credit cards.

“Credit cards are being positioned as lifestyle enablers. From cashback and airport lounge access to EMI conversion features—issuers are doing everything to attract the millennial and Gen Z segment,” said Namrata Shah, a digital payments consultant.

However, critics argue that the ease of access to credit is masking the long-term burden that many first-time users may not fully comprehend.

Economic Implications: A Double-Edged Sword

While rising credit card usage indicates strong consumer demand—traditionally a positive sign for the economy—it also signals growing dependence on debt-fuelled consumption. Experts caution that this trend could be unsustainable, especially if job growth remains uneven and wage increases fail to keep pace with inflation.

“Consumer spending drives nearly 60% of India’s GDP. So, in the short term, this credit-fuelled consumption is supporting economic growth,” explained Dr. Shalini Desai, macroeconomist. “But if this translates into rising defaults, it could lead to a broader credit crisis.”

The situation is reminiscent of the U.S. subprime credit boom before the 2008 financial crisis, albeit on a smaller scale.

India’s household debt-to-GDP ratio has steadily climbed to 40% in 2025, up from 32% in 2019, according to the Bank for International Settlements. A major portion of this debt is now in the form of unsecured consumer credit, including personal loans and credit card dues.

The Debt Trap Phenomenon

For consumers, the psychological toll of revolving debt is another concern. Many cardholders report falling into the “minimum payment trap,” where only the minimum due is paid each month, leaving the bulk of the balance to accumulate interest.

Sakshi Jain, a 29-year-old marketing executive in Mumbai, shared her experience. “I initially used my credit card to cover a hospital emergency. But with rent, groceries, and EMIs, I couldn’t clear the full amount. Within eight months, my ₹50,000 balance ballooned to ₹75,000. It’s a nightmare.”

Financial counsellors warn that such cases are becoming increasingly common, especially among younger earners who lack basic financial literacy.

What Can Be Done?

As credit card debt escalates, experts are calling for urgent policy interventions and public awareness campaigns.

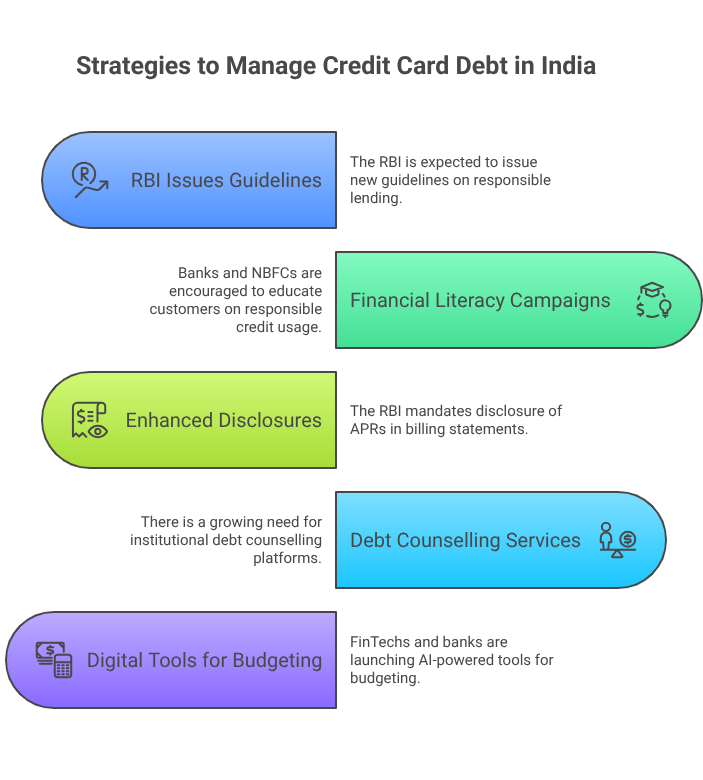

- Stricter Regulation: The RBI is expected to issue fresh guidelines later this year on responsible lending, particularly aimed at fintech lenders and co-branded card issuers.

- Financial Literacy Campaigns: Banks and NBFCs are being encouraged to invest in educating customers on responsible credit usage, interest calculations, and the dangers of rolling over balances.

- Enhanced Disclosures: The RBI’s April directive mandating disclosure of APRs in billing statements is a welcome step, but enforcement and standardization remain key.

- Debt Counselling Services: There is a growing need for institutional debt counselling platforms, particularly for young professionals and low-income households.

- Digital Tools for Budgeting: FinTechs and banks alike are launching AI-powered tools that help users track spending, set repayment goals, and get alerts when they’re nearing their credit limits.

Conclusion: A Wake-Up Call

India crossing the ₹2 lakh crore threshold in credit card debt should not be viewed merely as a statistic—it is a loud wake-up call. The convergence of rising living costs, easy credit, and lagging financial education is pushing millions into a precarious financial situation.

While credit cards offer undeniable convenience and financial flexibility, unchecked usage, especially during economic uncertainty, can have long-term consequences. With delinquencies on the rise and more households juggling multiple debts, the time for reactive policies is over.

Stakeholders—from regulators and banks to consumers themselves—must now adopt a more cautious and informed approach to credit. As the festive season nears and spending typically spikes, the question looms larger than ever: Is India on the verge of a credit bubble?

Only time and data will tell.