Global Credit Risk Shifts: What Rising Corporate & Consumer Debt Means for Financial Institutions

The global credit environment is undergoing a structural shift. Rising interest rates, prolonged inflationary pressure, geopolitical instability, and tighter liquidity conditions are converging to reshape credit risk across major economies. For financial institutions, the challenge is no longer limited to managing cyclical downturns — it is about adapting to a fundamentally altered risk landscape where both corporate and consumer debt vulnerabilities are increasing simultaneously.

From the United States and the European Union to the rapidly expanding GCC markets, lenders, banks, and credit bureaus are facing a recalibration moment. Credit growth has not slowed, but repayment capacity has weakened. Balance sheets appear resilient on the surface, yet early warning signals across multiple sectors suggest mounting stress beneath.

This shift demands sharper risk intelligence, stronger portfolio monitoring, and a more proactive approach to credit decisioning.

The Global Debt Build-Up: A Structural Risk, Not a Temporary Spike

Global debt levels have reached historic highs. Corporate borrowing surged during years of low interest rates, while consumer debt expanded rapidly through credit cards, BNPL products, auto loans, and unsecured personal lending. What has changed is the cost of servicing that debt.

As central banks across the US, EU, and GCC tightened monetary policy to control inflation, debt servicing burdens rose faster than income growth. This has created a lag effect — one where defaults do not spike immediately, but risk accumulates quietly across portfolios.

Financial institutions are now managing exposure in an environment where:

- Cash flow coverage ratios are deteriorating

- Refinancing windows are narrowing

- Delinquencies are rising unevenly across sectors and regions

This is not a synchronized crisis, but a fragmented one — making risk assessment more complex than in previous cycles.

United States: Consumer Stress Meets Corporate Leverage

In the US, credit risk is increasingly bifurcated between headline economic strength and underlying financial strain.

On the consumer side, revolving credit balances continue to grow, driven largely by credit cards and short-term lending. Delinquency rates among subprime and near-prime borrowers have risen steadily, particularly in younger demographics and lower-income segments. Wage growth has slowed, while essential costs such as housing, insurance, and healthcare remain elevated.

For lenders, this translates into higher roll rates from early-stage delinquencies to charge-offs — a trend that demands earlier intervention strategies.

On the corporate side, leverage remains elevated, especially among mid-market firms and private equity-backed entities. Many companies refinanced at ultra-low rates during 2020–2021. As these facilities mature, refinancing risk has become a dominant concern.

Key pressure points include:

- Commercial real estate, particularly office assets

- Retail and consumer discretionary sectors

- Highly leveraged sponsor-backed businesses

Banks are responding with tighter underwriting standards, but legacy exposure remains a material risk.

European Union: Fragmented Risk Across Economies

The EU presents a more fragmented credit risk picture. While some economies have shown resilience, others are facing persistent stress driven by energy costs, weak growth, and regulatory tightening.

Consumer debt risks vary widely across member states. Southern European economies continue to grapple with high household debt relative to income, while Northern markets face pressure from rising mortgage costs as variable-rate loans reset.

Corporate credit risk in Europe is heavily influenced by:

- Energy-intensive industries

- Export-dependent manufacturers

- SMEs reliant on bank financing

Unlike the US, where capital markets play a larger role, European firms are more bank-dependent. This increases systemic exposure for lenders, especially in markets where non-performing loan ratios are already elevated.

For EU-based financial institutions, the challenge lies in balancing regulatory compliance with proactive risk management, particularly as stress-testing assumptions struggle to keep pace with real-world volatility.

GCC Markets: Rapid Growth Meets Credit Maturity Risk

The GCC region has experienced strong economic momentum, supported by diversification initiatives, infrastructure spending, and financial sector expansion. However, rapid credit growth has introduced its own set of risks.

Consumer lending has expanded aggressively across personal loans, auto finance, and credit cards. While default rates remain relatively low, early-stage delinquency trends suggest rising sensitivity to income shocks, particularly among expatriate populations.

On the corporate side, leverage is increasing across construction, real estate, and mid-sized enterprises aligned with government-led projects. While sovereign backing provides stability, execution risk and payment delays can strain cash flows.

GCC lenders face a unique challenge:

- Managing fast-growing loan books

- Enhancing credit bureau data accuracy

- Strengthening early-warning systems in a region with evolving regulatory frameworks

Institutions that rely solely on historical default data risk underestimating future stress.

Credit Bureaus and Data Providers: Rising Importance in Risk Intelligence

As credit risk becomes more complex, the role of credit bureaus and data providers is expanding beyond traditional reporting.

Modern risk management requires:

- Real-time or near-real-time credit signals

- Behavioral analytics across products

- Cross-border data integration

In markets where consumers and corporates engage with multiple lenders, fragmented data creates blind spots. Financial institutions increasingly depend on enriched bureau insights to identify early signs of distress, such as utilization spikes, payment pattern changes, and exposure concentration.

For credit bureaus, the opportunity lies in evolving from static data repositories to predictive risk intelligence platforms — supporting lenders with actionable insights rather than retrospective reporting.

What This Means for Banks and Lenders

The current credit cycle is testing traditional risk models. Institutions that rely on backward-looking indicators are finding themselves reactive rather than proactive.

Key strategic implications include:

- Greater emphasis on early-stage delinquency management

- Portfolio segmentation based on vulnerability, not just credit score

- Dynamic limit management and pricing adjustments

- Closer integration between credit, collections, and analytics teams

Risk appetite frameworks must also evolve. Growth-driven strategies without granular risk visibility are increasingly unsustainable in a high-cost-of-credit environment.

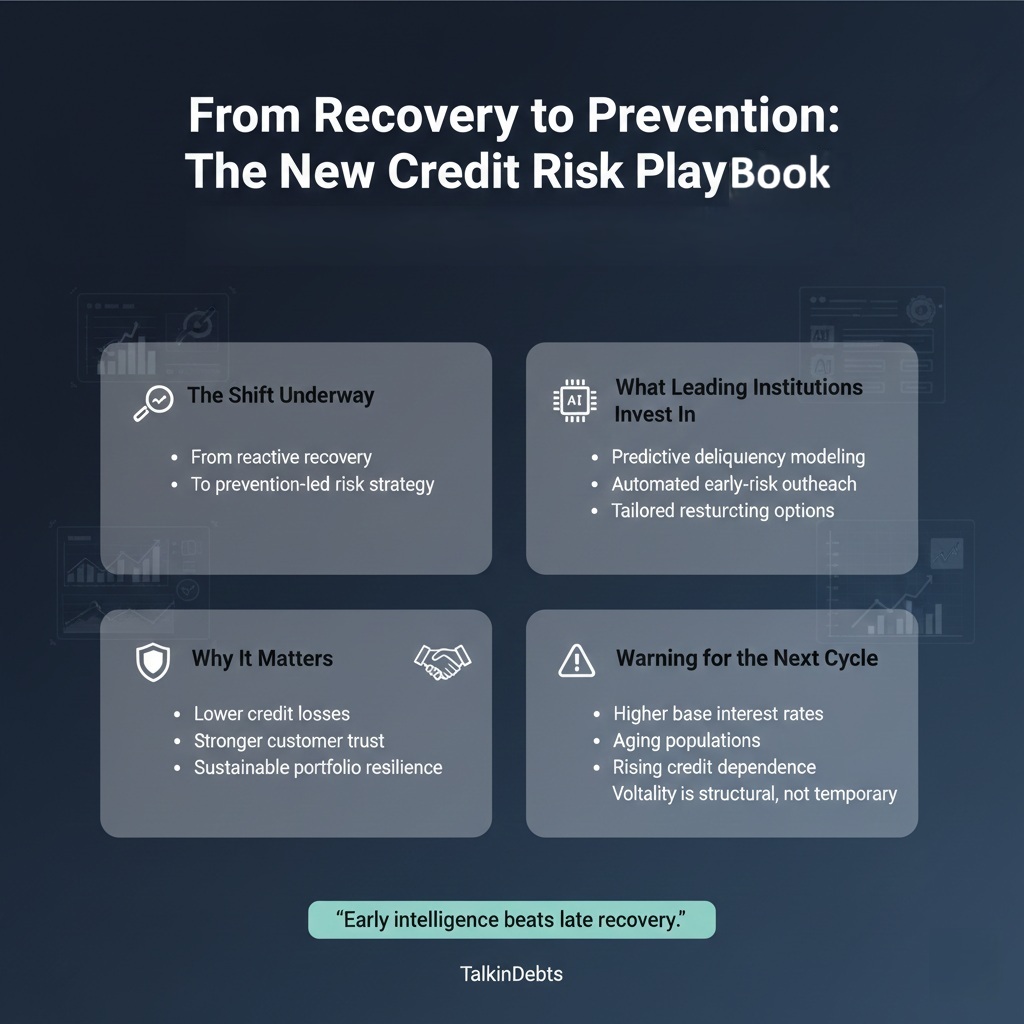

The Shift from Recovery to Prevention

One of the most important changes underway is the shift from recovery-focused risk management to prevention-led strategies.

Rather than reacting after a default occurs, leading institutions are investing in:

- Predictive modeling to identify stress before delinquency

- Automated outreach triggered by behavioral risk signals

- Tailored restructuring options for at-risk borrowers

This approach not only reduces credit losses but also strengthens long-term customer relationships — a critical advantage in competitive financial markets.

A Warning for the Next Credit Cycle

The current environment should be viewed as a warning, not an anomaly. Structural factors such as aging populations, higher base interest rates, and increased reliance on credit for consumption suggest that volatility will remain a defining feature of future credit cycles.

Financial institutions that adapt now — by strengthening data capabilities, refining risk frameworks, and embedding early intervention into their operating models — will be better positioned to navigate the next phase of global credit stress.

Those who delay risk recalibration may find that by the time defaults rise sharply, the opportunity to act has already passed.

Final Thought

Global credit risk is no longer confined to one region, one sector, or one borrower class. The convergence of rising corporate leverage and consumer debt stress represents a pivotal moment for financial institutions.

In this environment, resilience is not built through caution alone, but through intelligence, agility, and foresight. The institutions that recognize this shift early will not only protect their balance sheets — they will define the next standard of credit risk management.