Cross-Border Debt Trading: The Rise of Secondary Loan Markets

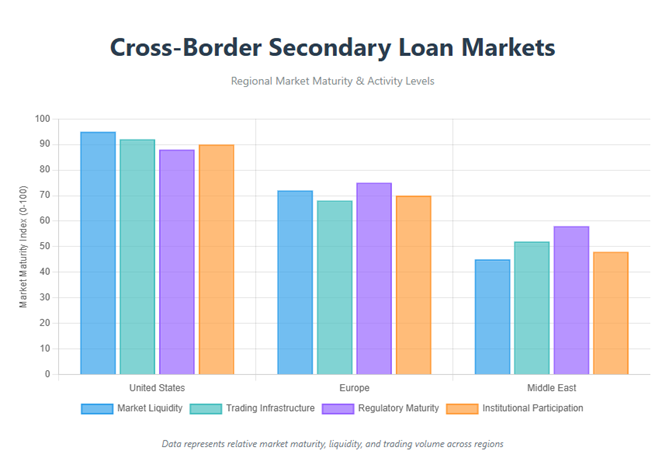

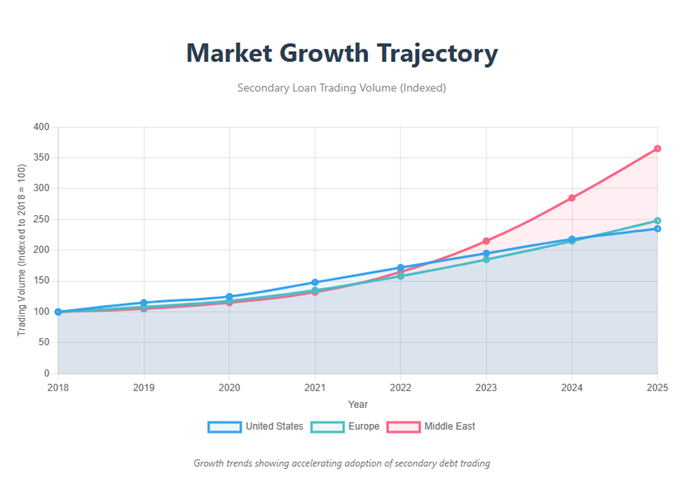

The global financial system is undergoing a structural shift. Once dominated by traditional bank lending and domestic credit markets, debt capital is now increasingly fluid, borderless, and traded much like equity. At the center of this transformation lies cross-border debt trading—particularly the explosive growth of secondary loan markets spanning the United States, Europe, and the Middle East.

Driven by rising interest rates, tighter bank regulations, institutional appetite for yield, and digital trading infrastructure, secondary debt markets have evolved into a sophisticated ecosystem encompassing private debt, venture debt, distressed loans, and syndicated credit instruments. What was once an opaque, relationship-driven activity is now becoming a mainstream asset class for global investors.

This article explores how secondary loan markets are expanding across major financial regions, why cross-border debt trading is accelerating, and what this means for lenders, investors, fintech platforms, and regulators.

Understanding Secondary Loan Markets in a Global Context

Secondary loan markets allow existing debt instruments—rather than newly originated loans—to be bought and sold between investors. These include leveraged loans, private credit facilities, venture debt, infrastructure loans, and non-performing or stressed assets.

Unlike primary markets, secondary markets provide liquidity, price discovery, and risk transfer, enabling lenders to rebalance portfolios and investors to gain exposure to yield-generating assets without originating loans directly.

Cross-border secondary debt trading takes this one step further. Loans originated in one jurisdiction are increasingly being sold to buyers in another, facilitated by global funds, multi-currency settlement systems, and standardized documentation.

This globalization of debt trading is reshaping how capital flows across economies.

The United States: The World’s Most Liquid Secondary Loan Market

The US remains the epicenter of secondary loan trading. Its leveraged loan market, private credit ecosystem, and distressed debt sector are the most developed globally.

Several factors underpin US dominance:

- A mature syndicated loan market with standardized legal frameworks

- Deep participation from CLO managers, hedge funds, and pension funds

- Robust trading platforms and dealer networks

- High levels of corporate leverage are fueling the ongoing loan supply

Private credit funds in the US have expanded rapidly as banks retreat from middle-market lending. These loans—often floating-rate and covenant-light—are now actively traded in secondary markets, allowing investors to manage duration, credit risk, and exposure.

Venture debt has also become a key secondary asset, particularly as technology firms delay IPOs. Early lenders increasingly sell portions of venture debt portfolios to institutional buyers seeking higher yields without equity dilution risk.

The US model is increasingly being replicated abroad.

Europe: Fragmentation Giving Way to Integration

Europe’s secondary loan market has historically lagged behind the US due to regulatory complexity, language barriers, and legal fragmentation. However, this is changing rapidly.

Key drivers of European market growth include:

- Expansion of pan-European private credit funds

- Regulatory harmonization under EU financial frameworks

- Increased issuance of unitranche and direct lending facilities

- Growing distressed debt opportunities following economic slowdowns

London remains the central hub for European secondary debt trading, acting as a bridge between US capital and continental borrowers. European leveraged loans, particularly in sectors like infrastructure, energy, and industrials, are now actively traded by global funds.

Cross-border trading within Europe itself is rising, with investors acquiring loan exposure across Germany, France, Spain, Italy, and the Nordics. Non-performing loan (NPL) portfolios—once the domain of domestic banks—are increasingly sold to international asset managers.

Europe’s evolution signals a move toward a more liquid, interconnected credit market.

The Middle East: From Relationship Lending to Tradable Debt

The Middle East is emerging as the fastest-growing frontier for cross-border debt trading. Historically dominated by relationship-based bank lending and sovereign financing, the region is now embracing structured credit markets.

Several developments are accelerating this transition:

- Expansion of GCC sovereign wealth funds into private debt

- Growth of regional private credit and venture debt platforms

- Increased project finance and infrastructure lending

- Regulatory modernization in the UAE and Saudi Arabia

The UAE, in particular, is positioning itself as a regional hub for debt capital markets. Dubai and Abu Dhabi are attracting global asset managers seeking exposure to Middle Eastern credit, often through secondary acquisitions rather than direct origination.

Syndicated loans linked to energy, logistics, real estate, and technology are now being actively traded between regional banks and international investors. Venture debt is also gaining traction as startups in the GCC seek non-dilutive financing.

Cross-border debt trading allows Middle Eastern lenders to recycle capital while enabling foreign investors to tap into high-growth regional credit opportunities.

The Rise of Private Debt as a Global Asset Class

Private debt sits at the core of secondary loan market expansion. As banks face capital constraints and regulatory pressures, private lenders are filling the gap—particularly in mid-market, venture-backed, and special-situation lending.

Private debt offers:

- Higher yields compared to public bonds

- Floating-rate protection in high-interest environments

- Customized risk-return profiles

- Strong collateral and covenants in select markets

Secondary trading of private debt is no longer niche. Institutional investors increasingly buy and sell loan participations, portfolio strips, and single-name exposures across borders.

This has led to the emergence of specialized secondary private credit funds, whose sole mandate is acquiring existing debt positions globally.

Liquidity, once the main drawback of private debt, is improving steadily.

Venture Debt and Cross-Border Capital Flows

Venture debt has evolved beyond Silicon Valley. As startups expand globally, venture lenders are extending credit across Europe and the Middle East, often in collaboration with US-based funds.

Secondary markets are becoming critical for venture debt because:

- Exit timelines are longer due to delayed IPOs

- Lenders seek portfolio rebalancing

- Investors want exposure without early-stage equity risk

Cross-border venture debt trading allows global funds to access innovation ecosystems in multiple regions while managing concentration risk.

This trend is particularly visible in fintech, healthtech, climate tech, and enterprise SaaS sectors.

Technology’s Role in Scaling Secondary Loan Markets

Digital infrastructure is accelerating the globalization of debt trading. Advanced platforms now enable:

- Loan portfolio analytics and pricing

- Digital settlement and documentation

- Cross-border compliance and KYC

- Real-time market transparency

Fintech-driven loan marketplaces are reducing friction in secondary transactions, allowing smaller institutions and family offices to participate alongside large funds.

Artificial intelligence and data analytics are also improving credit risk assessment, making cross-border debt trading more efficient and scalable.

Technology is turning debt into a tradable, data-driven asset class.

Risk, Regulation, and Transparency Challenges

Despite rapid growth, cross-border secondary loan markets face challenges.

Regulatory differences across jurisdictions can complicate enforcement, taxation, and reporting. Legal frameworks for loan transfers vary significantly between the US, Europe, and the Middle East.

Other risks include:

- Currency volatility

- Political and regulatory uncertainty

- Limited transparency in private transactions

- Valuation complexity in illiquid assets

However, increased institutional participation is pushing the market toward higher standards of disclosure, documentation, and governance.

Regulators are also adapting, recognizing that private credit and secondary trading play a critical role in financial stability.

What This Means for Global Investors and Lenders

The rise of cross-border debt trading fundamentally changes how capital is allocated.

For lenders, secondary markets offer balance-sheet flexibility and risk management tools. For investors, they unlock diversified yield opportunities beyond traditional bonds and equities.

For emerging markets and regions like the Middle East, secondary loan markets attract foreign capital while strengthening local financial ecosystems.

Debt is no longer static. It is dynamic, global, and increasingly liquid.

The Future of Cross-Border Secondary Loan Markets

Looking ahead, several trends are likely to define the next phase:

- Continued growth of private credit and alternative lending

- Greater integration between the US, European, and Middle Eastern markets

- Expansion of digital debt trading platforms

- Increased institutionalization and standardization

- Stronger focus on ESG-linked debt instruments

As global economic cycles become more volatile, the ability to trade, price, and manage debt across borders will become a core financial capability.

Secondary loan markets are no longer a niche corner of finance. They are becoming a central pillar of the global capital markets ecosystem.