GDPR Penalty Shock: €11M Fine for German Lender Over SaaS Vendor Data Leak

In a striking reminder of Europe’s tough stance on data privacy, a leading German financial institution has been fined €11 million after a third-party SaaS vendor’s data breach exposed sensitive customer information. Regulators ruled that the bank failed to implement “adequate safeguards and vendor oversight,” marking one of the most significant GDPR enforcement actions of 2025.

The decision, announced by the Federal Commissioner for Data Protection and Freedom of Information (BfDI), underscores the growing risks businesses face from outsourced software services and highlights the increasing scrutiny over third-party data processors under the General Data Protection Regulation (GDPR).

The Incident: How a SaaS Vendor Triggered a Data Disaster

The fine stems from a data leak in early 2024 involving a cloud-based loan management platform used by the lender. According to the BfDI report, the SaaS vendor suffered a misconfigured database incident that left over 200,000 customer records exposed on the open web for nearly three weeks before being detected.

The leaked data reportedly included loan details, repayment histories, contact information, and partial identification data, though no full credit card or banking credentials were compromised. Despite the SaaS provider being directly responsible for the misconfiguration, regulators determined that the bank bore ultimate responsibility under the GDPR for ensuring adequate technical and organizational safeguards.

“Data controllers cannot outsource their accountability,” said BfDI spokesperson Klara Heinemann during a press briefing. “When you rely on vendors to process personal data, you must ensure compliance at every level — from configuration to monitoring.”

The Regulator’s Verdict: Accountability Can’t Be Delegated

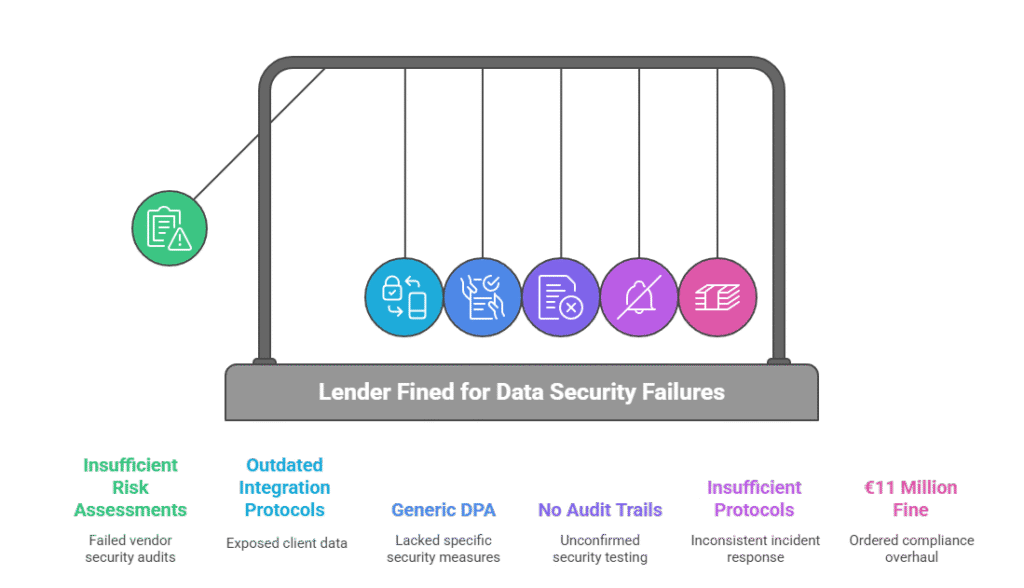

Investigators concluded that the lender failed to conduct sufficient risk assessments or ongoing audits of the SaaS vendor’s data security practices. Despite repeated internal warnings about third-party risks, the bank allegedly continued using outdated integration protocols that exposed client data to potential unauthorized access.

The BfDI cited Articles 5, 24, and 32 of the GDPR, which require data controllers to ensure the integrity and security of personal data — even when processed by external service providers.

The regulator’s 97-page decision noted that:

- The lender’s Data Processing Agreement (DPA) with the SaaS vendor was “generic and outdated.”

- There were no formal audit trails confirming regular security testing.

- Incident response protocols were “insufficiently defined and inconsistently applied.”

As a result, the BfDI imposed an €11 million administrative fine, one of the largest in Germany this year, and ordered the bank to overhaul its vendor compliance framework within 90 days.

Company’s Response: “A Shared Responsibility, But a Lesson Learned”

The German lender — which has not been publicly named due to ongoing legal proceedings — issued a statement acknowledging the breach and accepting “shared accountability.”

“While the root cause of the incident lies with an external software vendor, we recognize that ultimate data responsibility rests with us,” the statement read. “We have since suspended all operations with the affected provider and introduced enhanced vendor risk controls.”

The bank added that no fraudulent activity had been reported as a result of the exposure and that all affected customers were notified within 72 hours, in line with GDPR breach notification requirements.

However, privacy advocates argue that this case highlights the systemic underestimation of vendor risks in the financial sector, where cloud-based platforms have become deeply embedded in loan servicing, digital payments, and credit management.

Third-Party Risks Under GDPR: The Hidden Weak Link

Experts say this case illustrates a growing compliance blind spot — third-party SaaS providers that process or store personal data on behalf of financial institutions.

“Many organizations assume that if a vendor is certified or claims GDPR compliance, their job is done,” said Dr. Lukas Brandt, a cybersecurity and privacy law specialist at the University of Bonn. “But under GDPR, the data controller remains accountable for ensuring that processors meet strict technical and organizational standards. This case is a wake-up call.”

He added that regulators across Europe are now focusing on supply-chain vulnerabilities — especially following several recent breaches involving cloud services, HR software, and digital marketing platforms.

Indeed, the European Data Protection Board (EDPB) recently urged businesses to strengthen vendor risk management frameworks, conduct regular audits, and ensure data minimization in all external integrations.

Industry Reaction: Shockwaves Across the Financial Sector

The €11 million fine has sent shockwaves through Germany’s banking and fintech sectors, where many institutions rely heavily on third-party SaaS vendors for automation, analytics, and customer engagement tools.

Industry observers warn that this case could trigger a wave of proactive compliance reviews across Europe. The German Banking Association (BdB) has called for clearer regulatory guidance on shared accountability between data controllers and processors.

“This decision raises an important question: How far does a bank’s oversight extend into the technical operations of its SaaS provider?” said Anke Müller, BdB’s head of compliance. “Without clear boundaries, financial institutions could face disproportionate liabilities.”

Meanwhile, several cybersecurity firms have reported a surge in inquiries from lenders seeking data protection impact assessments (DPIAs) and vendor security audits to avoid similar penalties.

GDPR Enforcement Trends in 2025: The Year of Vendor Liability

The case fits a broader pattern of tougher enforcement actions under GDPR, especially regarding third-party service providers. So far in 2025, European regulators have issued over €200 million in cumulative fines, with a notable uptick in penalties related to data processors and cloud misconfigurations.

Recent examples include:

- A €14.5M fine for a French telecom provider whose marketing vendor exposed customer emails.

- A €9.3M penalty for a Spanish insurance firm over insecure CRM integrations.

- A €7.1M fine against a Dutch e-commerce platform for using analytics software without valid data processing contracts.

Experts say the trend signals a maturing regulatory environment where vendor accountability is no longer an afterthought.

“GDPR enforcement has evolved,” said Sophie Lang, partner at EU law firm Data Shield Legal. “In the early years, regulators focused on consent and transparency. Now, the focus has shifted to operational compliance, especially where sensitive financial data and third-party cloud systems are involved.”

What Businesses Can Learn: Strengthening Vendor Governance

While the €11 million penalty is a cautionary tale for financial institutions, its lessons apply broadly across industries. Compliance professionals recommend a multi-layered vendor management approach to minimize risks and demonstrate due diligence to regulators.

Key best practices include:

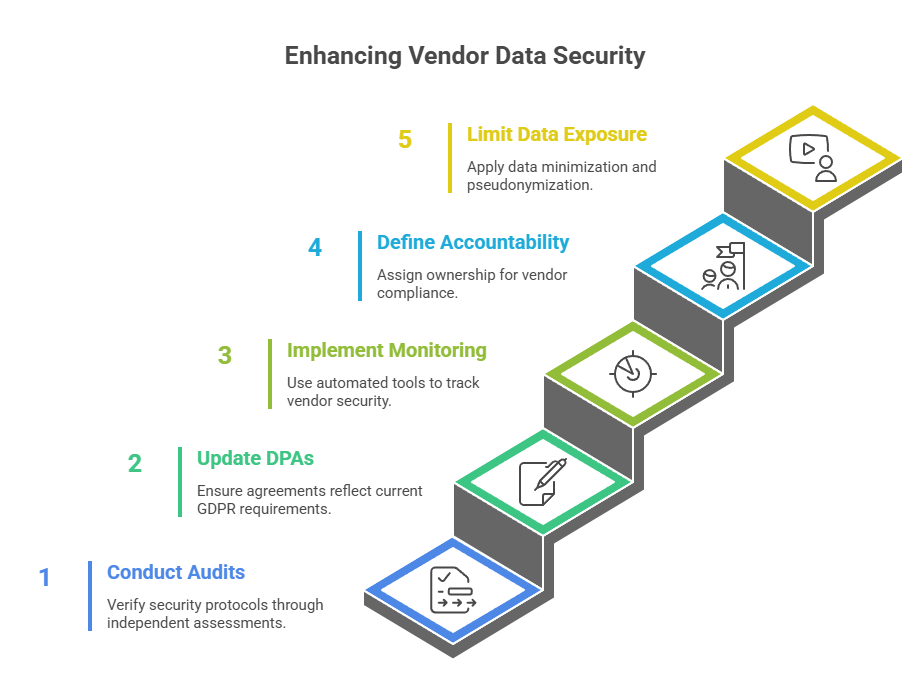

- Conduct regular third-party audits – Verify security protocols, encryption standards, and access controls through independent assessments.

- Update Data Processing Agreements (DPAs) – Ensure clauses reflect current GDPR requirements, including breach notification obligations and sub-processor approvals.

- Implement continuous monitoring – Use automated tools to track vendor security posture and detect anomalies.

- Define clear accountability frameworks – Assign ownership for vendor compliance within internal data governance teams.

- Limit data exposure – Apply data minimization and pseudonymization where possible to reduce breach impact.

As data ecosystems grow more complex, regulators expect businesses to anticipate and mitigate third-party risks rather than react after a breach.

Analysts’ Take: A Turning Point for Financial Data Oversight

Industry analysts view this ruling as a turning point for data governance in the financial sector. With increasing digital transformation, banks and lenders are integrating AI-driven SaaS tools for loan processing, collections, and credit scoring — often at the expense of full visibility into how customer data is stored and protected.

“This is a wake-up call for every compliance officer in Europe,” said Ralph Keller, Chief Analyst at FinData Insights. “Vendor oversight can no longer be a checkbox exercise. Regulators expect concrete proof of monitoring, testing, and accountability.”

He warned that similar enforcement actions could follow in other EU member states, particularly in sectors such as insurance, healthcare, and fintech, where sensitive personal data flows through complex vendor networks.

A €11 Million Lesson in Accountability

The €11 million GDPR fine against the German lender underscores a critical reality — outsourcing does not outsource responsibility. As more organizations embrace cloud-based SaaS solutions to streamline operations, data protection must evolve alongside technology.

For European businesses, the message is clear:

- Vendor compliance is your compliance.

- Misconfigurations can become multimillion-euro mistakes.

- And under GDPR, accountability stops at the top.

With regulators tightening their grip on third-party data management, companies across all industries must revisit how they select, monitor, and secure their SaaS partners — before the next enforcement headline strikes.