Top SaaS Tools for Debt Recovery Agencies in 2025

In 2025, debt recovery agencies are undergoing a major digital transformation. The traditional approach of manual follow-ups and fragmented spreadsheets is rapidly being replaced by advanced SaaS (Software as a Service) tools designed to automate, analyze, and optimize the entire collection process. From skip tracing to payment tracking, the right SaaS solutions can significantly improve recovery rates, reduce compliance risks, and enhance client satisfaction.

Top SaaS tools revolutionizing debt recovery in 2025

This article explores the top SaaS tools revolutionizing debt recovery in 2025, their features, and how they empower agencies to stay competitive in an increasingly data-driven industry.

1. DebtCol Cloud: The All-in-One Debt Collection Platform

DebtCol Cloud continues to dominate the debt recovery market with its robust automation and AI-driven features. Designed for collection agencies of all sizes, it provides a centralized platform to manage debtor communications, track payments, and generate performance reports.

Key Features

- AI-assisted debtor segmentation and predictive recovery scoring

- Multi-channel communication (SMS, email, WhatsApp, voice)

- Real-time compliance monitoring for regional laws

- Built-in payment gateway and automated reminders

Why It Stands Out

DebtCol Cloud’s biggest advantage lies in its data intelligence engine, which helps collection teams prioritize high-probability recoveries. With predictive analytics, agencies can focus resources where recovery chances are highest, resulting in a measurable boost in success rates.

2. CollectAI: Smarter Digital Payment Recovery

CollectAI has become a favorite among agencies aiming for digital-first recovery strategies. The tool blends automation with personalized communication powered by AI.

Key Features

- Smart payment reminders using behavioral analytics

- Dynamic payment plans for better debtor engagement

- Cloud-based dashboard with real-time insights

- Integration with major ERP and CRM systems

Why It Stands Out

CollectAI leverages machine learning to predict the best communication time and channel for each debtor, improving repayment rates and reducing collection costs. It also ensures GDPR compliance, making it a trusted choice across Europe and beyond.

3. TCN Cloud Contact Center: Streamlined Debtor Communication

Debt recovery success relies heavily on effective communication. TCN Cloud Contact Center is a powerful SaaS solution tailored for call-based debt collection operations.

Key Features

- Predictive dialer and call recording

- Voice analytics for compliance and tone detection

- Real-time agent monitoring and performance reports

- CRM integration and automated follow-ups

Why It Stands Out

Its AI-powered voice analytics can detect stress, aggression, or hesitation during calls, giving collection managers actionable insights into debtor sentiment. This not only enhances recovery but also ensures that agents follow compliance standards.

4. Gaviti: Automated Accounts Receivable Software

For agencies managing commercial debt, Gaviti provides an automated accounts receivable system that minimizes delays and disputes.

Key Features

- Automated invoice follow-ups and payment reminders

- Custom workflows for different client types

- Cloud-based collaboration between finance teams

- Smart aging reports and performance dashboards

Why It Stands Out

Gaviti’s automation significantly reduces manual effort in following up on overdue invoices. It also offers deep analytics on payment patterns, helping agencies identify risky clients early and improve overall cash flow management.

5. TrueAccord: AI-Driven Customer-Centric Collections

TrueAccord is redefining debt recovery with its customer-focused approach. Instead of relying solely on pressure-based tactics, it uses empathy-driven communication to encourage repayment.

Key Features

- AI-generated personalized repayment messages

- Omnichannel engagement (email, text, web portal)

- Real-time compliance and audit trail

- Scalable cloud infrastructure for large agencies

Why It Stands Out

TrueAccord’s strength lies in its behavioral science-based design, which adapts communication tone and strategy based on debtor behavior. This leads to higher engagement and lower dispute rates, improving brand reputation for agencies.

6. Katabat: End-to-End Debt Management Automation

Katabat, now part of Exela Technologies, offers a complete suite for debt management automation. It’s built for agencies that need an enterprise-grade solution to handle high-volume recoveries.

Key Features

- Centralized case management and workflow automation

- Integration with third-party legal and credit bureaus

- Real-time dashboards and forecasting tools

- Cloud security and data privacy controls

Why It Stands Out

Katabat provides a unified view of the entire recovery lifecycle, from first contact to final settlement. Its advanced analytics empower agencies to make data-driven decisions and measure recovery performance in real time.

7. Simplicity Collection Software: Designed for Agencies

Simplicity continues to be one of the most widely used SaaS solutions for small to mid-sized debt collection agencies. It’s easy to deploy, scalable, and cost-effective.

Key Features

- Client and debtor portals with secure access

- Automated payment scheduling and reporting

- Cloud-hosted with zero installation requirements

- User-friendly interface for remote teams

Why It Stands Out

Simplicity is ideal for agencies that want a plug-and-play solution without technical complexity. Its transparent pricing and quick onboarding make it a favorite among independent collectors and startups entering the debt recovery market.

8. Experian Debt Analytics: Data Power Meets Recovery Precision

Experian’s Debt Analytics suite combines the company’s massive data resources with machine learning models to enhance debt collection strategy.

Key Features

- Predictive recovery models using credit behavior data

- Portfolio segmentation and strategy optimization

- Customizable dashboards for recovery forecasting

- Integration with CRM and accounting platforms

Why It Stands Out

Experian’s access to rich credit bureau data gives agencies a unique advantage. It helps predict recovery likelihood, tailor negotiation approaches, and identify potential re-default risks — all while staying fully compliant.

9. Collect! Cloud: Flexible Collection Management

Collect! is a highly customizable SaaS tool that caters to agencies needing flexible configuration and workflow control.

Key Features

- Full-cycle debt recovery management

- Built-in letter and email templates

- Cloud database and reporting tools

- Secure API integrations for data exchange

Why It Stands Out

Collect! stands out for its flexibility and scalability. Agencies can modify workflows, reports, and templates to match unique client or industry needs, ensuring operational consistency and efficiency.

10. Lariat Data Systems: Comprehensive Skip Tracing and Reporting

Debt recovery often starts with finding the right debtor, and Lariat Data Systems excels in that space.

Key Features

- Advanced skip tracing integration

- Batch data processing and debtor profiling

- Geolocation insights and address validation

- Centralized case records and analytics

Why It Stands Out

Lariat enables agencies to locate and verify debtor details faster, improving contact rates and reducing wasted efforts on invalid data. It’s particularly useful for agencies handling complex, multi-state debt portfolios.

11. Zoho CRM for Collections: Affordable and Integrative

While not exclusive to collections, Zoho CRM remains one of the most cost-effective SaaS tools for managing client relationships and debt recovery pipelines.

Key Features

- Task automation and reminder workflows

- Multi-channel communication integration

- Cloud analytics and performance tracking

- Integration with accounting tools like QuickBooks and Xero

Why It Stands Out

For smaller agencies or startups, Zoho CRM provides a budget-friendly entry point into automated debt management. Its scalability and integration ecosystem make it a reliable foundation for long-term growth.

12. Payrix: Payment Gateway for Modern Agencies

Payrix specializes in providing secure and customizable payment solutions integrated with collection platforms.

Key Features

- Online payment portals and scheduling

- Automated receipts and settlement reports

- PCI DSS compliance and fraud prevention

- API integration for real-time reconciliation

Why It Stands Out

Payrix makes debt payments seamless and trustworthy for both agencies and debtors. Its focus on security and automation helps agencies streamline payment collection while maintaining compliance.

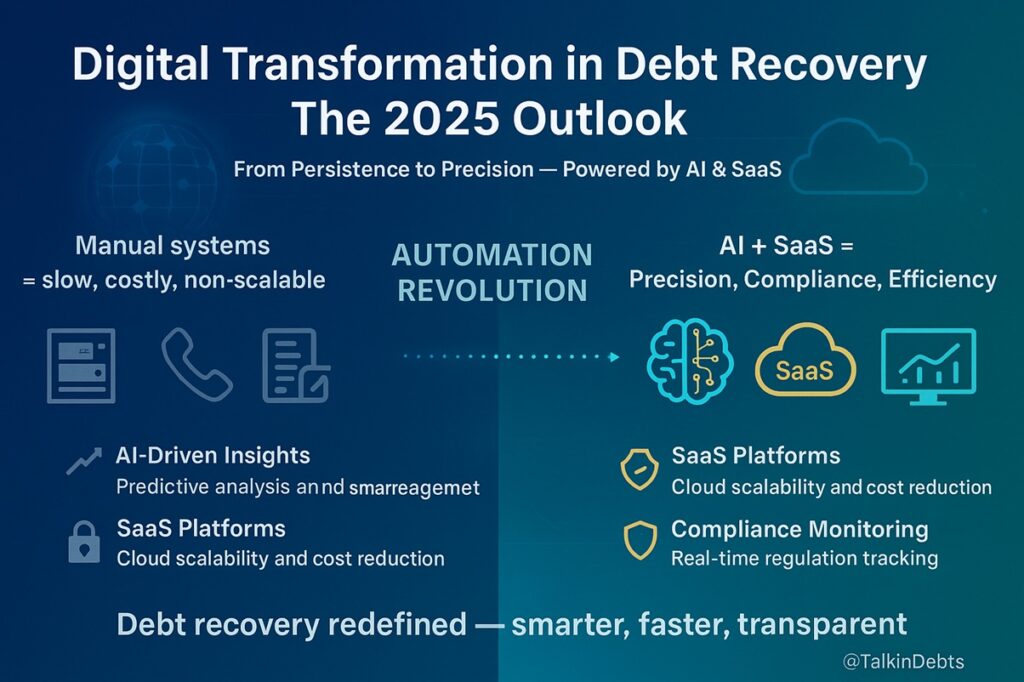

Digital Transformation in Debt Recovery: The 2025 Outlook

As 2025 progresses, debt recovery is no longer just about persistence — it’s about precision. Agencies that embrace SaaS automation and data analytics are outperforming those that rely on outdated manual systems. AI-driven insights, real-time compliance monitoring, and personalized debtor engagement are setting new benchmarks in efficiency and transparency.

Cloud-based SaaS tools not only reduce operational costs but also enable remote collaboration, scalability, and compliance adaptability — essential in a rapidly evolving regulatory landscape.

Final Takeaway

The debt recovery industry is entering an era where technology defines success. SaaS tools empower agencies to recover smarter, not harder — through automation, analytics, and strategic engagement.

Whether you’re managing consumer collections or commercial portfolios, investing in the right SaaS solutions in 2025 can transform your agency into a high-performance, data-driven recovery powerhouse.