EU Green Debt Directive: How Commercial Energy Defaults Create New Lead Sources

October 2025

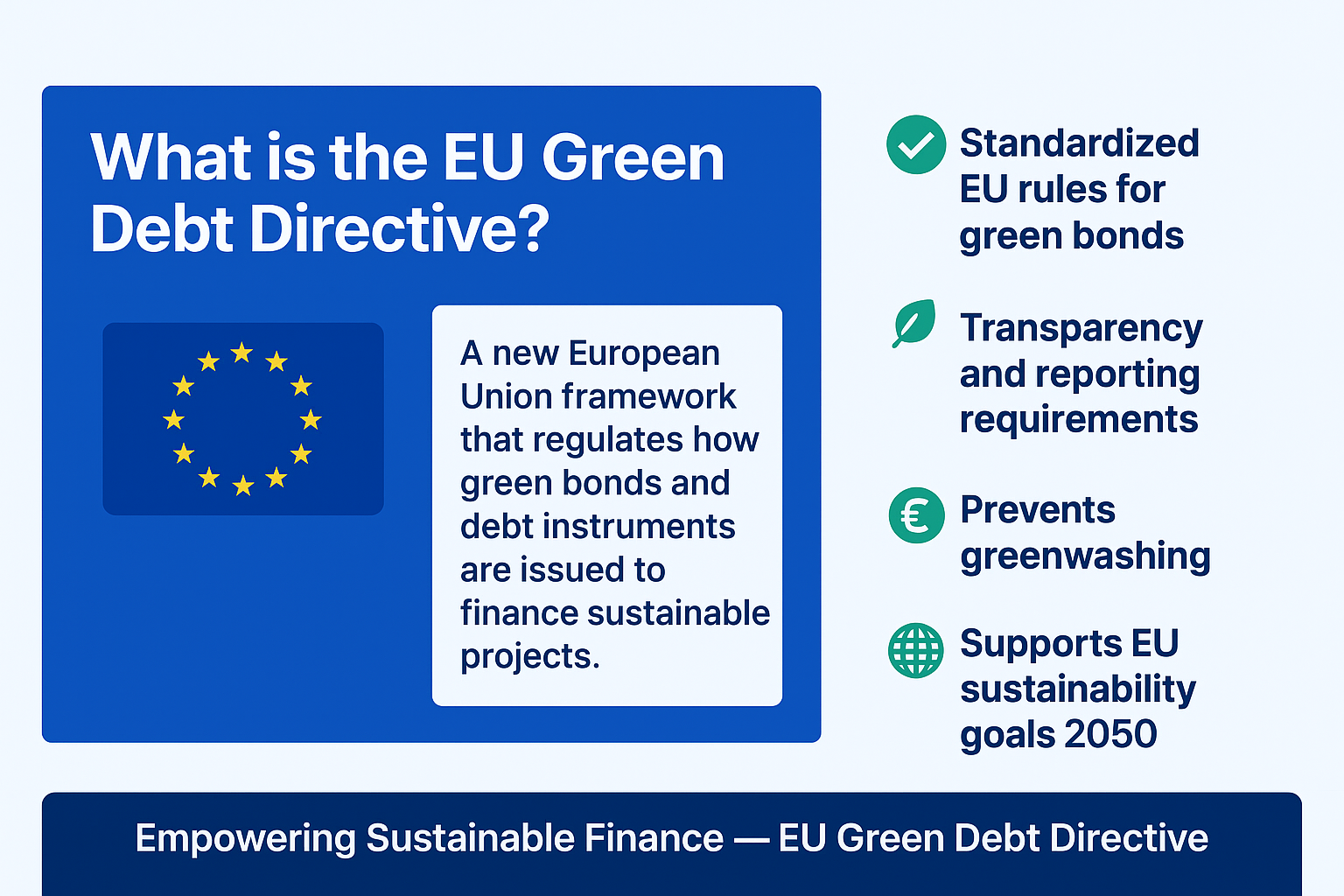

The European Union’s ambitious Green Debt Directive, designed to enforce sustainability in corporate finance, has sparked an unforeseen ripple effect across industries. As companies scramble to comply with stricter environmental debt disclosure standards, a new category of commercial energy defaults is quietly emerging — creating unexpected lead sources for debt recovery and financial services firms.

Green Debt Meets Real-World Pressures

The EU Green Debt Directive, implemented under the 2024 Sustainable Finance Action Plan, mandates companies to disclose and reconcile the carbon costs embedded in their borrowing. This move was intended to accelerate the green transition and force accountability in industries with heavy emissions.

However, while the Directive aligns with the EU’s broader Net-Zero 2050 roadmap, it has exposed a deep financial strain among mid-tier manufacturers, logistics providers, and energy-intensive suppliers.

According to data from Eurostat’s Q3 2025 report, more than 27% of mid-market enterprises in Europe reported difficulty maintaining compliance due to carbon penalty arrears, escalating operating costs, and rising green loan obligations.

Commercial Energy Defaults on the Rise

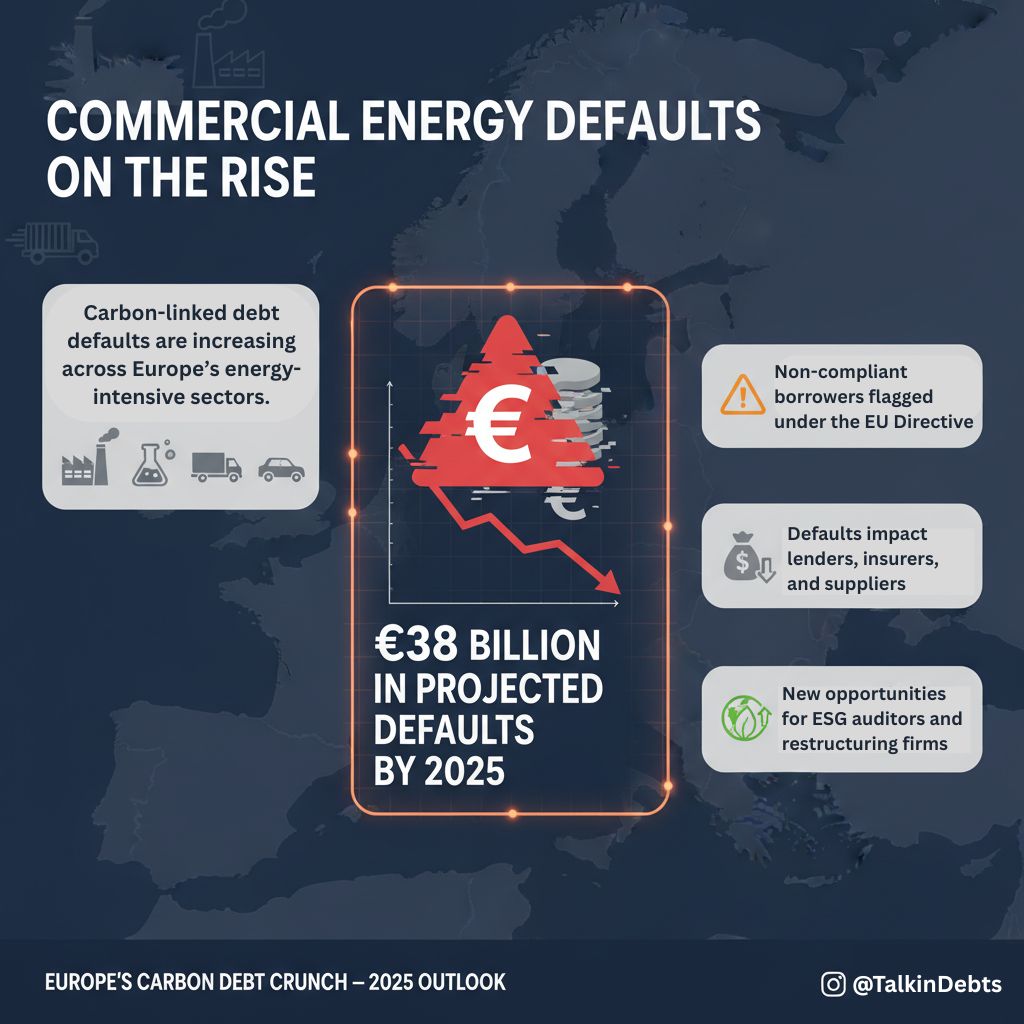

Energy-intensive industries such as steel, chemicals, logistics, and automotive supply chains are now facing increased scrutiny over their carbon-linked debt. Firms that fail to meet carbon reporting standards or default on green performance bonds are now being flagged under the Directive as “non-compliant borrowers.”

These defaults are not merely regulatory — they are financial events that ripple through credit markets, affecting lenders, insurers, and suppliers alike.

Analysts from Deutsche Finance Weekly estimate that commercial energy defaults across Europe could exceed €38 billion by the end of 2025 — an all-time high for green-linked lending.

This shift has opened up a new lead generation landscape for debt collection agencies, ESG auditors, and financial restructuring consultants.

How Defaults Become Data-Driven Opportunities

Under the Directive, every carbon-linked loan default must be disclosed in the EU’s centralized Green Debt Registry (GDR). This registry provides a transparent, open-access database of corporate sustainability-linked financial activities — including those in arrears.

For debt recovery firms and credit intelligence agencies, the GDR represents a goldmine of actionable data. Each defaulted entry reveals:

- Company name and registration details

- Industry classification and carbon rating

- Amount and nature of the defaulted obligation

- Location and prior sustainability score

This structured transparency is now being leveraged by B2B data analytics companies, AI-driven lead scoring systems, and business development teams within the financial services and debt recovery ecosystem.

In essence, carbon defaults are turning into qualified sales leads for financial remediation and sustainability compliance support.

Sectors Most Affected by Green Debt Pressure

- Manufacturing:

The manufacturing sector — especially those dealing in metals, plastics, and electronics — faces mounting carbon tariff penalties. EU regulators have increased oversight on embedded emissions in raw materials, forcing companies to pay additional green levies. - Logistics and Supply Chain:

Transport firms are hit hard by both fuel transition costs and emissions reporting obligations. Delayed compliance with Scope 3 emissions data has resulted in record numbers of penalty-driven defaults. - Agriculture and Food Processing:

The agri-sector faces difficulties transitioning from fossil-fueled equipment and fertilizers. Carbon intensity scores directly impact loan interest rates and default risks under new ESG-linked credit terms. - Energy and Utilities:

While renewables continue to expand, legacy energy producers are being penalized for missed emission targets. These companies now account for nearly 40% of the EU’s registered carbon arrears.

Financial Institutions Recalibrate Risk Models

Banks and institutional lenders have had to rewrite their credit risk frameworks to align with the Directive. Traditional collateral assessments now include carbon performance ratios, meaning a company’s sustainability score can directly influence loan approval or default recovery strategy.

However, the transition hasn’t been smooth. Many mid-sized banks with significant SME exposure are now reporting higher non-performing asset ratios, particularly in Italy, Spain, and Eastern Europe, where compliance costs are outpacing capital availability.

As a result, private equity and debt restructuring firms have begun targeting distressed green portfolios — converting compliance stress into profitable recovery operations.

Carbon Arrears: The New Form of Debt

The term “carbon arrears” has entered Europe’s financial lexicon to describe unpaid or underreported carbon obligations that accumulate as part of an enterprise’s debt structure.

These arrears are not only regulatory but also commercially recoverable, meaning they can be traded, bought, or recovered through specialized debt channels.

This evolution marks the emergence of a parallel debt economy — one rooted not in unpaid invoices or loans, but in unmet sustainability commitments.

Industry insiders are already calling this the “next wave” of green financial intelligence, where sustainability metrics merge with credit analytics to shape recovery strategies and lead generation models.

AI and Automation Drive Lead Extraction

Modern AI-driven debt intelligence platforms are now integrating carbon compliance data into their predictive models. By analyzing default trends in carbon-linked sectors, these systems can automatically identify high-potential recovery opportunities.

For instance, a logistics company flagged for repeated carbon reporting failures becomes a lead not just for recovery, but for consulting firms offering ESG data solutions or for alternative finance providers offering restructuring options.

In short, automation is turning sustainability non-compliance into market intelligence.

Policy Implications and Business Ethics

While the Directive aims to promote environmental responsibility, it also exposes a gray area: the commercialization of carbon failure.

Critics argue that turning green debt defaults into business leads risks monetizing environmental non-compliance, creating incentives that run counter to sustainability’s spirit.

However, policymakers defend the system, stating that transparent market correction is essential to ensuring accountability.

According to the EU Commissioner for Financial Stability, transparency “does not punish failure — it prevents concealment,” helping investors and creditors make informed decisions.

The European Central Bank (ECB) has also confirmed that data-driven monitoring of green defaults will continue as a core part of its Monetary Policy Greenization Program.

Emerging Markets: Expansion Beyond the EU

The EU’s regulatory success is already inspiring similar frameworks in the UK, Canada, and Singapore, where carbon-linked credit standards are being explored.

For global debt recovery firms and ESG consultants, this means an expanding pool of cross-border default data.

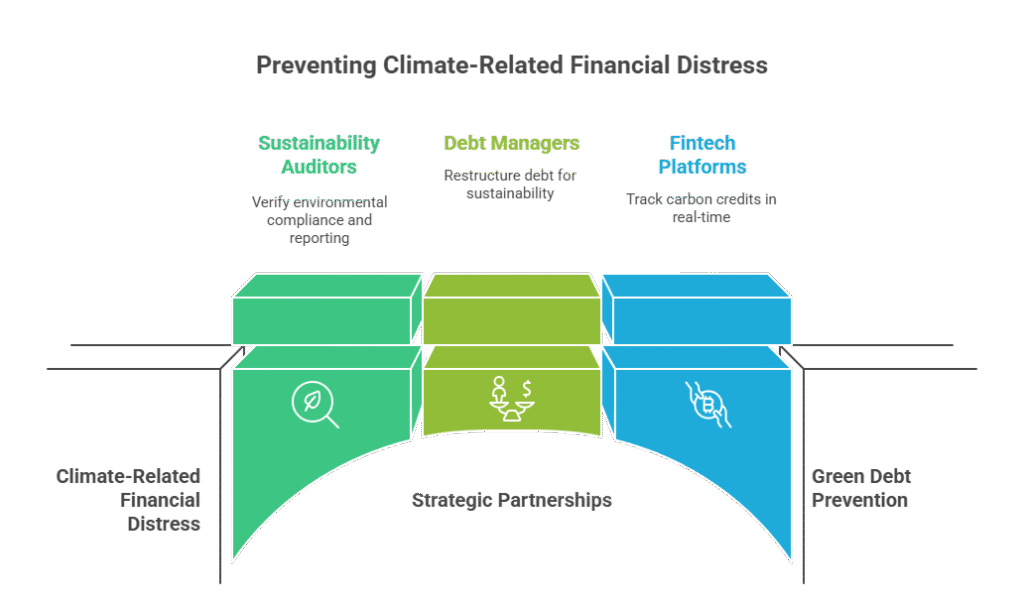

Lead generation is no longer limited to traditional corporate insolvencies — it now includes climate-related financial distress, widening the prospect base for firms specializing in compliance recovery services.

Corporate Response: Prevention Through Partnership

To avoid being flagged in the GDR, many European corporations are now forming strategic partnerships with sustainability auditors, debt managers, and fintech platforms offering real-time carbon credit tracking.

By integrating compliance reporting with financial risk dashboards, companies can monitor carbon-linked debt exposure before it escalates into default.

The European Manufacturing Confederation (EMC) reports that over 42% of its members have entered such partnerships in the last year — signaling a proactive shift toward green debt prevention.

The Road Ahead

The EU Green Debt Directive marks a turning point in how financial responsibility and environmental sustainability intersect.

It has redefined debt itself — expanding it beyond currency into carbon obligations that carry real market consequences.

For businesses, the challenge is steep: balance compliance with profitability.

For financial services, however, the opportunity is unprecedented — to harness structured transparency and transform regulatory data into viable lead streams.

As Europe marches toward its 2050 net-zero target, one truth is becoming clear:

In the new financial ecosystem, every carbon lapse is a lead, and every default — an opening for innovation.