Spain’s “Right to Disconnect” Law Disrupts Collections Staffing: Night Shift Bans

Spain’s newly implemented “Right to Disconnect” law, designed to protect employees’ personal time and promote mental well-being, is causing a significant shake-up in the collections industry. The legislation prevents employers from expecting workers to respond to emails, phone calls, or other work-related communications outside their designated working hours. While the law has been hailed as a progressive step for employee rights, it is creating operational challenges for industries that rely on flexible and extended working hours, particularly collections agencies.

Spain’s Right to Disconnect Law Disrupts Collections: A New Legal Landscape for Employees

The “Right to Disconnect” law is part of Spain’s broader labor reforms aimed at improving employee work-life balance and reducing burnout. Employees now have a legal right to ignore work communications during off-hours, except in cases of genuine emergencies. Employers are required to implement clear policies detailing acceptable after-hours communication and establish a workplace culture that respects employees’ personal time.

Failure to comply with the law can result in fines ranging from €1,000 to €10,000 per employee, making compliance a critical issue for businesses. For industries like debt collection, which have historically relied on late-night shifts to reach clients and debtors across different time zones, this legislation represents a fundamental shift in operational norms.

Industry experts note that the law could influence not only how companies schedule shifts but also how they manage client expectations. “Collections agencies have to rethink their business models entirely,” said Luis Fernandez, a labor compliance consultant in Madrid. “You cannot maintain the same night-shift operations domestically without violating the law, so alternatives are necessary.”

Operational Impact on the Collections Industry

Debt collection is a highly time-sensitive industry, requiring agencies to reach clients at convenient hours. Traditionally, this has meant scheduling employees for night and early-morning shifts. Now, with the “Right to Disconnect” law in place, Spanish agencies are finding it increasingly difficult to maintain coverage for clients located in different time zones.

The immediate impact has been felt in staffing shortages and operational delays. Agencies report that domestic employees are unwilling or unable to work beyond regulated hours, creating gaps in collections outreach. These gaps risk delayed payments, reduced client satisfaction, and ultimately, revenue loss for agencies.

“It’s a challenge we never anticipated,” said Maria Gonzalez, operations manager at a mid-sized Spanish collections agency. “We have clients across Europe who are only reachable during hours outside Spain’s standard working times. Without a workaround, we simply cannot maintain our service levels.”

Outsourcing as a Strategic Response

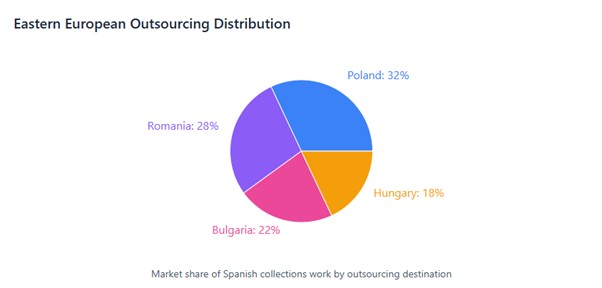

In response to these challenges, many Spanish agencies are increasingly turning to outsourcing hubs in Eastern Europe. Countries such as Poland, Romania, Bulgaria, and Hungary have become preferred destinations due to their skilled labor, multilingual capabilities, lower operational costs, and favorable time zone alignment with Western Europe.

Outsourcing allows agencies to maintain night and early-morning coverage without violating Spain’s labor regulations. Professionals in Eastern Europe can reach clients during hours that Spanish employees are legally protected from working, ensuring uninterrupted operations and compliance.

“The shift to Eastern Europe is not just about cost savings,” said Fernandez. “It’s about operational continuity. These teams are highly skilled, understand Western European business practices, and can deliver services seamlessly, filling the gaps created by the new Spanish law.”

Advantages of Eastern European Outsourcing

Several factors make Eastern Europe an attractive outsourcing destination for collections agencies:

- Skilled Workforce: Eastern European countries have strong educational systems producing graduates in finance, law, communication, and customer service. Multilingual professionals capable of handling international clients are widely available.

- Cost Efficiency: Labor costs in Eastern Europe are significantly lower than in Spain, enabling agencies to maintain high-quality operations at a reduced expense.

- Time Zone Alignment: Countries such as Poland and Romania are just one hour ahead of Spain, allowing teams to cover night and early-morning shifts efficiently.

- Cultural Compatibility: Many Eastern European professionals are familiar with Western European business norms, which facilitates communication and integration with Spanish operations.

- Scalability: Agencies can scale their operations up or down depending on demand without the constraints of local labor regulations.

By leveraging these advantages, Spanish collections agencies are able to continue their operations effectively while remaining fully compliant with labor laws.

Challenges and Risks

Outsourcing, however, is not without challenges. Agencies must ensure that partners comply with data protection laws, particularly the EU’s General Data Protection Regulation (GDPR), to safeguard sensitive client information. Failure to comply with data privacy standards could result in significant penalties and damage to reputation.

Additionally, maintaining service quality across multiple locations requires robust training, monitoring, and quality assurance processes. Cultural differences, language nuances, and operational practices must be managed to ensure that outsourced teams deliver the same level of performance as in-house staff.

“Remote teams are highly effective, but you need strong oversight,” said Gonzalez. “Training, regular audits, and standardized processes are critical to maintain consistency.”

Broader Labor Market Implications

The law’s effects extend beyond collection agencies. Spanish employees benefit from improved work-life balance, reduced burnout, and greater mental well-being. However, some higher-paying night-shift opportunities may diminish as operations move abroad.

For Eastern European economies, the shift presents opportunities. Increased demand for skilled collections professionals boosts employment, raises wages in certain sectors, and attracts foreign business partnerships, strengthening local economies.

“The labor market is adjusting on both ends,” said Fernandez. “Spain gains healthier, more satisfied employees, while Eastern Europe gains jobs and economic growth. The challenge is balancing operational needs with these shifts.”

Industry Innovation and Adaptation

To navigate these changes, Spanish agencies are adopting hybrid workforce models that combine domestic day-shift teams with outsourced night coverage. Automation and AI-driven collections tools are increasingly integrated to optimize operations and reduce reliance on human intervention. Predictive analytics platforms help agencies target clients efficiently, minimizing wasted effort and ensuring regulatory compliance.

The law has also encouraged agencies to rethink internal policies and invest in employee training programs. By promoting a culture of compliance and respect for personal time, companies can retain talent while meeting operational goals.

Looking Ahead

Spain’s “Right to Disconnect” law represents a turning point for the collections industry, pushing agencies to innovate and adopt new staffing strategies. Outsourcing to Eastern Europe has emerged as a key solution, allowing agencies to maintain operational continuity without compromising legal compliance.

While challenges remain, including data protection, quality assurance, and cross-cultural integration, the law is driving a transformation in how collections operations are managed. Agencies that effectively combine outsourcing, technology, and strategic workforce planning are poised to thrive in the new regulatory environment, balancing operational efficiency with employee well-being.

The law exemplifies Spain’s commitment to labor rights, signaling a broader trend in Europe toward improved work-life balance. For collections agencies, adaptation is no longer optional; it is essential for sustainable operations in a landscape that increasingly prioritizes compliance, innovation, and employee welfare.