Debt Collection Harassment Laws 2025: Avoiding Landmines in the US, UK & Saudi Arabia

In 2025, global debt collection laws will have become more stringent than ever. Regulators across the United States, the United Kingdom, and Saudi Arabia are cracking down on harassment, unethical collection practices, and privacy breaches. From multimillion-dollar fines to revoked licenses, agencies are learning that compliance is not optional—it’s survival.

This article explores the latest debt collection harassment laws in 2025, landmark case studies, and ready-to-use scripts to ensure your communication stays compliant while protecting your reputation and bottom line.

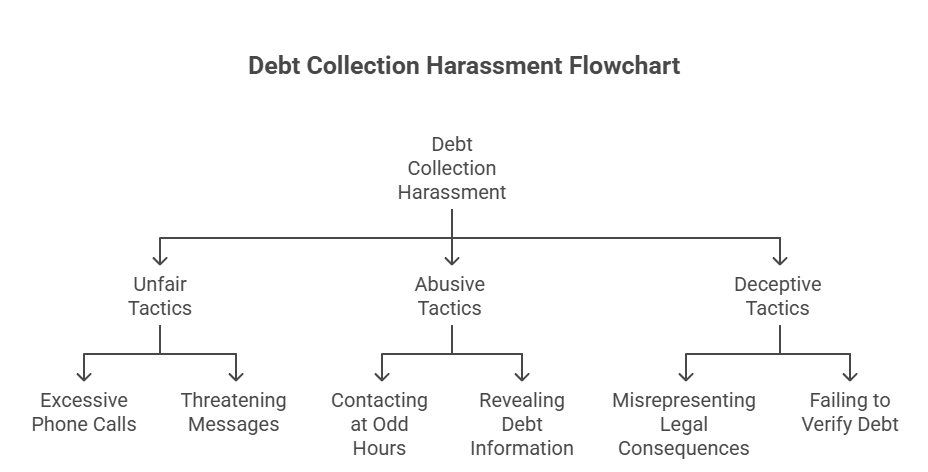

Understanding Debt Collection Harassment

Debt collection harassment occurs when collectors use unfair, abusive, or deceptive tactics to recover money. Common violations include:

- Excessive phone calls or threatening messages

- Contacting consumers at odd hours

- Revealing debt information to third parties

- Misrepresenting legal consequences

- Failing to verify debt ownership

While the definition varies across jurisdictions, the underlying principle is universal—respect consumer rights while collecting debt.

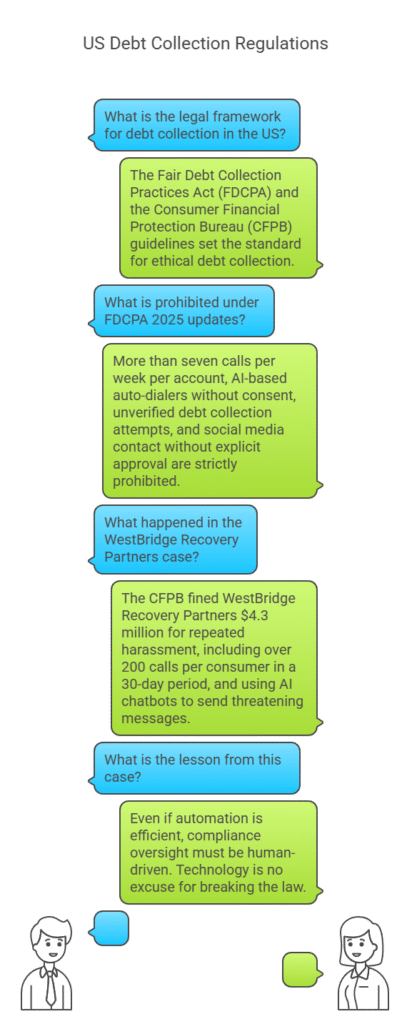

United States: CFPB & FDCPA Crack Down Hard

1. Legal Framework

In the U.S., the Fair Debt Collection Practices Act (FDCPA) and the Consumer Financial Protection Bureau (CFPB) guidelines set the standard for ethical debt collection.

Under FDCPA 2025 updates, the following are strictly prohibited:

- More than seven calls per week per account

- AI-based auto-dialers without consent

- Unverified debt collection attempts

- Social media contact without explicit approval

2. Recent Case Study: Major Fine in 2025

In April 2025, the CFPB fined WestBridge Recovery Partners $4.3 million for repeated harassment, including over 200 calls per consumer in a 30-day period. The company also used AI chatbots to send threatening messages.

Lesson:

Even if automation is efficient, compliance oversight must be human-driven. Technology is no excuse for breaking the law.

3. Compliance Script Example (U.S.)

“Good morning, [Customer Name]. This is [Agent Name] calling from [Company Name] regarding your account ending in [Last 4 Digits]. This call is for information purposes only. If this is a convenient time, I can provide details about repayment options.”

✅ Avoids coercion

✅ Offers choice

✅ Establishes transparency

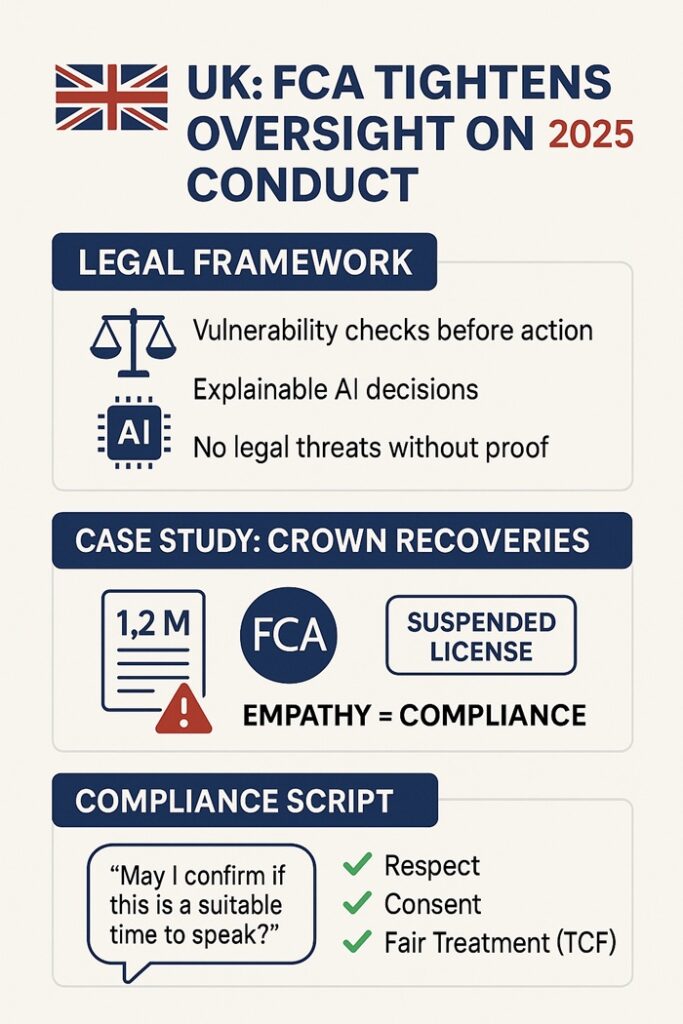

United Kingdom: FCA Tightens Oversight on Conduct

1. Legal Framework

The Financial Conduct Authority (FCA) regulates debt collection under the Consumer Credit Sourcebook (CONC). In 2025, the FCA enhanced its focus on mental health awareness, AI transparency, and consumer well-being.

Key 2025 updates include:

- Collectors must perform vulnerability assessments before pursuing action.

- AI systems must provide explainable decisions when scoring or prioritizing accounts.

- Threatening legal action without verified evidence is grounds for license suspension.

2. Case Study: FCA Action Against Crown Recoveries (2025)

In February 2025, the FCA penalized Crown Recoveries Ltd. £1.2 million for ignoring mental health disclosures and continuing to pressure customers identified as vulnerable.

The agency’s license was suspended for three months pending retraining of staff.

Lesson:

Empathy isn’t optional—it’s part of compliance.

3. Compliance Script Example (UK)

“Hello [Customer Name], I’m contacting you regarding your outstanding account with [Company]. Before we continue, may I confirm if this is a suitable time to speak? If you’d prefer, I can share information in writing.”

✅ Demonstrates respect

✅ Seeks consent before discussing sensitive information

✅ Aligns with FCA’s Treating Customers Fairly (TCF) principle

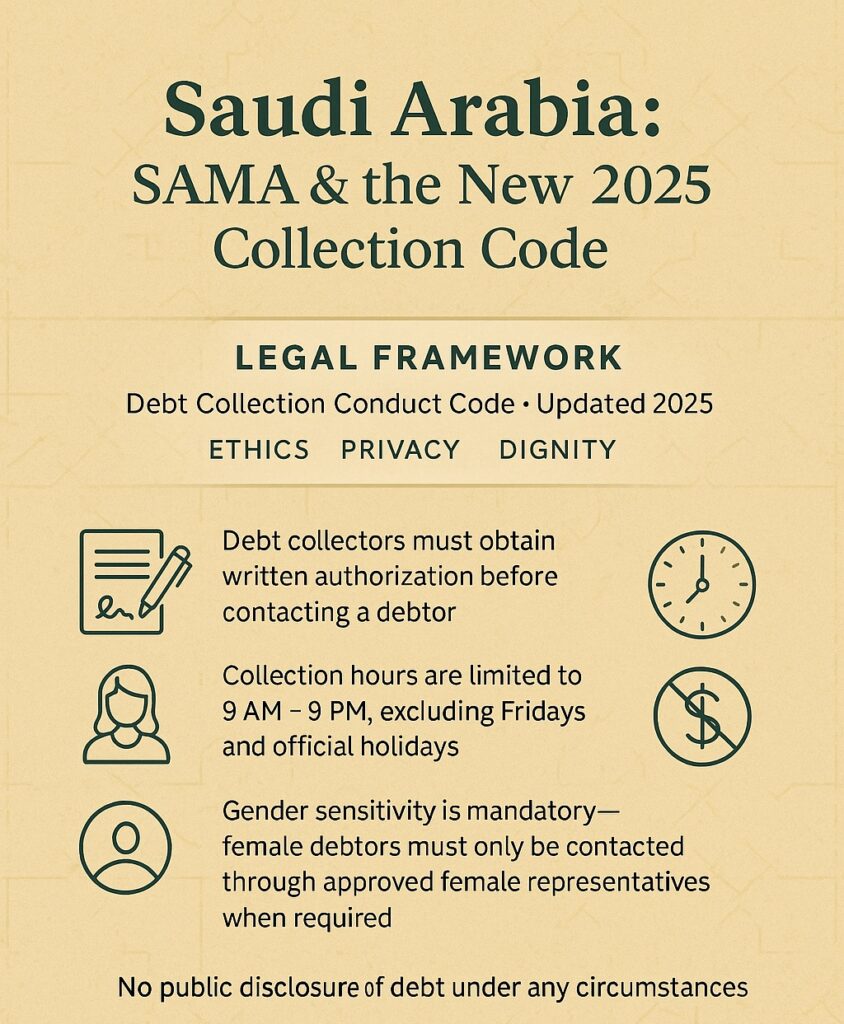

Saudi Arabia: SAMA & the New 2025 Collection Code

1. Legal Framework

The Saudi Central Bank (SAMA) enforces the Debt Collection Conduct Code, which was significantly updated in 2025.

This framework emphasizes Islamic finance ethics, privacy, and dignified engagement.

Key 2025 Provisions:

- Debt collectors must obtain written authorization before contacting a debtor.

- Collection hours are limited to 9 AM – 9 PM, excluding Fridays and official holidays.

- Gender sensitivity is mandatory—female debtors must only be contacted through approved female representatives when required.

- No public disclosure of debt under any circumstances.

2. Case Study: SAMA Suspends Al-Noor Collections (2025)

In June 2025, Al-Noor Collections, a Riyadh-based agency, faced suspension for verbal intimidation and unauthorized home visits. The agency was fined SAR 2.5 million and required to publish a public apology.

Lesson:

Cultural and ethical sensitivity is central to compliance in Saudi Arabia.

3. Compliance Script Example (Saudi Arabia)

“Assalamu Alaikum [Customer Name]. This is [Agent Name] calling from [Agency Name], authorized by [Bank/Company]. I’m reaching out regarding your account, and I’d like to confirm if this is a convenient time to discuss possible repayment solutions.”

✅ Respectful tone

✅ Culturally appropriate greeting

✅ Avoids pressure

Comparative Snapshot: Debt Collection Harassment Laws 2025

| Region | Main Regulator | Key Law/Code | Penalty for Harassment | Core Principle |

|---|---|---|---|---|

| United States | CFPB | FDCPA (2025 Revision) | Up to $10,000 per violation | Transparency & Consent |

| United Kingdom | FCA | CONC (2025) | Fines + License Suspension | Vulnerability Awareness |

| Saudi Arabia | SAMA | Debt Collection Conduct Code (2025) | SAR 2.5M + Suspension | Dignity & Privacy |

Common Red Flags That Trigger Investigations

- Excessive Call Frequency

More than 7 calls per week per account (U.S.) or repeated unanswered calls (U.K./Saudi). - Aggressive Language

Using threats like “final warning” or “legal action tomorrow” can violate regulations. - Unverified Debt Claims

Contacting debtors without confirming ownership or amount is illegal in all three regions. - Ignoring Vulnerable Consumers

Mental health or financial distress must be handled with extra care. - Improper Data Handling

Sharing personal debt details via email or with third parties breaches privacy laws.

Best Practices for Compliance in 2025

1. Train Your Team Quarterly

Ongoing compliance training helps staff stay current with changing rules and cultural nuances.

2. Use AI with Human Oversight

AI-driven tools can flag harassment risks, but final communication must always be human-reviewed.

3. Record All Interactions

Maintain secure records of all calls, emails, and payment discussions for legal defense and transparency.

4. Offer Written Communication Options

Consumers have the right to request written communication instead of calls. Always honor this request.

5. Establish a Complaint Resolution Desk

Having a dedicated compliance officer or desk reduces escalation and builds trust with regulators.

Scripts for Compliant Communication

Here are examples for different scenarios across regions:

Payment Reminder Script:

“This is a courtesy reminder regarding your account with [Company]. If you’ve already made a payment, please disregard this message. Otherwise, you can reach us at [Contact Details] to discuss your options.”

Dispute Handling Script:

“Thank you for bringing this to our attention. We’ll verify the details and pause collection activity until the issue is resolved.”

Follow-Up Script (Post Reminder):

“We haven’t heard back regarding your previous correspondence. If you’re facing financial difficulties, we can discuss flexible repayment options.”

✅ non-threatening

✅ Empathetic

✅ Compliant

2025 Outlook: The Future of Ethical Debt Collection

As governments and regulators continue to refine consumer protection frameworks, the next phase of compliance will focus on AI explainability, emotional intelligence training, and data privacy.

Firms that embed ethical communication into their culture will not only avoid fines but also build long-term consumer trust—a vital advantage in the tightening global credit environment.

Final Word

Debt collection in 2025 is no longer just about recovery—it’s about responsibility.

Whether in the U.S., U.K., or Saudi Arabia, agencies that lead with respect, empathy, and compliance will stay ahead. The rest risk becoming tomorrow’s headlines.